PwC Exits Nine African Nations: Implications And Future Outlook

Table of Contents

PwC has long been a significant player in Africa, offering a wide range of services including auditing, financial advisory, consulting, and tax services to multinational corporations, local businesses, and governments. Its departure from these nine nations marks a significant shift in the continent's business environment. This analysis aims to provide clarity on the implications of this decision and the potential for future adjustments in the African business landscape.

Reasons Behind PwC's Withdrawal from Nine African Nations

While PwC hasn't explicitly detailed all reasons for its withdrawal, several factors likely contributed to this strategic decision. The official statement, while lacking specifics, hinted at challenges related to the operating environment.

Potential underlying factors include:

- Economic Challenges: Several of the affected nations have faced significant economic headwinds in recent years, impacting business activity and the demand for professional services. Economic instability often leads to reduced profitability for consulting firms.

- Regulatory Hurdles and Compliance Issues: Navigating complex regulatory landscapes and ensuring compliance across diverse jurisdictions can prove burdensome and costly. Stringent regulations and enforcement may have made operations unsustainable in some regions.

- Competition from Other Consulting Firms: The African professional services market is increasingly competitive, with both international and local firms vying for market share. Intense competition may have eroded PwC's profitability in certain areas.

- Internal Restructuring or Strategic Repositioning: PwC may be undertaking a strategic repositioning, focusing resources on more profitable markets or areas experiencing greater growth. This could involve a reassessment of its global footprint.

The nine African nations affected by PwC's withdrawal are: [Insert list of nine countries here].

In summary, the decision likely stems from a complex interplay of economic, regulatory, competitive, and internal strategic factors.

Impact on Businesses Operating in the Affected Regions

PwC's exit creates considerable disruption for businesses operating within the affected regions. The implications are far-reaching:

- Auditing and Financial Reporting Practices: Businesses will need to find alternative auditors, potentially leading to increased costs, delays, and disruptions in financial reporting processes. The transition could also raise concerns about consistency and continuity.

- Access to Consulting and Advisory Services: The loss of PwC's expertise in areas such as strategy, operations, and technology consulting will leave a gap in the market, particularly for larger companies relying on such services. Smaller businesses might find it harder to access the same level of expertise.

- Tax Compliance and Planning: Navigating complex tax regulations requires specialized knowledge. The departure of a major player like PwC could increase the burden on businesses to manage their tax obligations. This is especially relevant for multinational corporations.

- Investment Attractiveness: The exit could negatively impact the perception of these nations’ investment climates, potentially deterring foreign direct investment (FDI) and hindering economic growth. The perception of risk might increase.

Examples of businesses affected include multinational corporations operating in these regions, local businesses requiring auditing services, and startups seeking guidance on tax compliance and business strategy. The impact will vary based on the size and nature of each business.

Alternative Service Providers and Market Dynamics

PwC's departure creates opportunities for its competitors. Firms like Deloitte, Ernst & Young (EY), and KPMG are likely to see increased demand for their services. This could lead to:

- Increased Competition: Existing players will compete more intensely for the newly available market share. This competition could drive innovation and potentially lower prices for some services.

- Market Consolidation: Some smaller firms might be acquired by larger competitors, leading to further market consolidation.

- Emergence of New Players: The gap left by PwC could encourage the emergence of new local or regional players, potentially offering specialized services or catering to specific niche markets.

- Increased Demand for Smaller Firms: Businesses, particularly smaller ones, may turn to smaller, local firms for services.

This shift in market dynamics presents both challenges and opportunities for the African professional services sector.

Long-Term Implications and Future Outlook for PwC in Africa

PwC's decision reflects a strategic recalibration of its African operations. The long-term implications are complex:

- Overall Strategy in Africa: PwC's future strategy in Africa will likely focus on consolidating its presence in key markets with robust economic performance and favorable regulatory environments.

- Potential for Future Return: The possibility of PwC returning to some of the affected regions in the future cannot be ruled out, particularly if economic conditions improve or regulatory issues are resolved.

- Impact on Global Brand Image: The withdrawal could impact PwC's global brand image, particularly in the context of its commitment to the African market. Transparency and communication around this decision will be key.

- Broader Implications for Foreign Investment: The exit could influence investor sentiment regarding these regions, creating uncertainty that may affect future investment decisions.

The developments concerning PwC’s actions in Africa signal a wider shift in the dynamics of the professional services sector on the continent.

Conclusion: Understanding the Implications of PwC Exits Africa

PwC's withdrawal from nine African nations represents a significant development in the continent's business landscape. The decision appears driven by a combination of economic challenges, regulatory complexities, competitive pressures, and internal strategic priorities. The impact on businesses across various sectors will be substantial, requiring adjustments in auditing practices, access to advisory services, and overall business strategies. The market will likely see increased competition, potential consolidation, and the emergence of new local players. The long-term implications extend to investor sentiment, FDI, and PwC's global brand reputation. Understanding these implications is crucial for businesses and stakeholders alike.

Stay updated on the impact of PwC exits in Africa and learn more about the future of business in Africa post-PwC withdrawal by following reputable business news sources and industry analysts. This rapidly evolving situation demands continued attention and informed decision-making.

Featured Posts

-

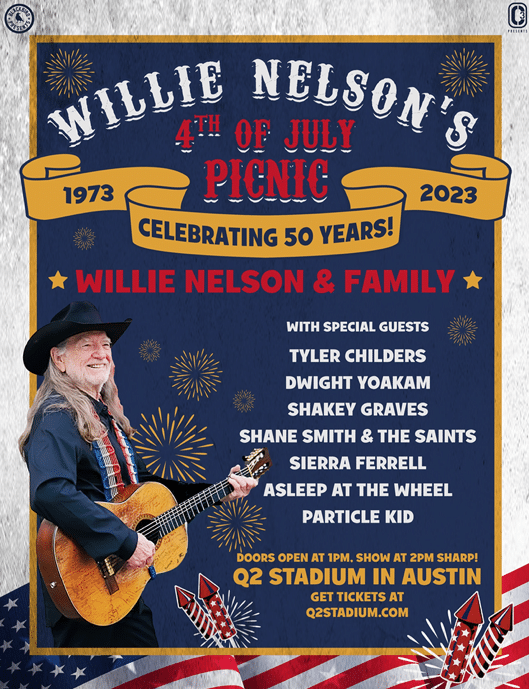

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025 -

The Complexities Of All American Product Manufacturing

Apr 29, 2025

The Complexities Of All American Product Manufacturing

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 29, 2025 -

Jeff Goldblums Wife Everything You Need To Know About Emilie Livingston

Apr 29, 2025

Jeff Goldblums Wife Everything You Need To Know About Emilie Livingston

Apr 29, 2025 -

Black Hawk Pilot Rebecca Lobachs Fatal Decision Ignoring Co Pilot Warnings

Apr 29, 2025

Black Hawk Pilot Rebecca Lobachs Fatal Decision Ignoring Co Pilot Warnings

Apr 29, 2025

Latest Posts

-

La Vie De Chantal Ladesou En Dehors De Paris Famille Et Tranquillite

May 12, 2025

La Vie De Chantal Ladesou En Dehors De Paris Famille Et Tranquillite

May 12, 2025 -

Chantal Ladesou Critique Ouvertement Ines Reg Elle Aime Le Conflit

May 12, 2025

Chantal Ladesou Critique Ouvertement Ines Reg Elle Aime Le Conflit

May 12, 2025 -

Mask Singer 2025 Demasquons L Autruche Analyse Des Indices Et Pronostics

May 12, 2025

Mask Singer 2025 Demasquons L Autruche Analyse Des Indices Et Pronostics

May 12, 2025 -

Ines Reg Et Chantal Ladesou Une Nouvelle Polemique Enflamme La Toile

May 12, 2025

Ines Reg Et Chantal Ladesou Une Nouvelle Polemique Enflamme La Toile

May 12, 2025 -

Philippe Candeloro Et Chantal Ladesou Ambassadeurs De La Vente Des Vins De Nuits Saint Georges

May 12, 2025

Philippe Candeloro Et Chantal Ladesou Ambassadeurs De La Vente Des Vins De Nuits Saint Georges

May 12, 2025