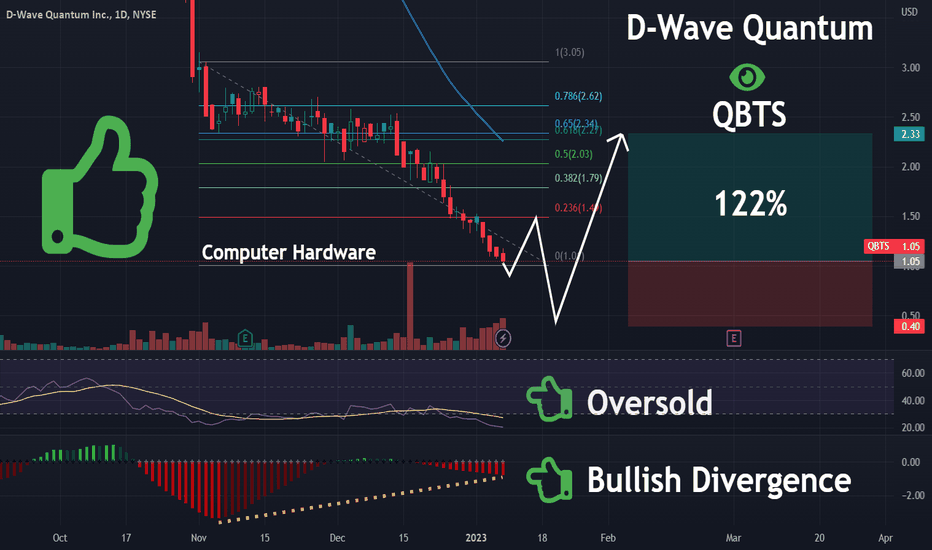

QBTS Stock Earnings: What To Expect And How To Prepare

Table of Contents

Analyzing QBTS's Past Performance to Predict Future Earnings

Analyzing QBTS's historical financial performance is a critical first step in predicting future earnings. By examining trends and patterns, investors can develop more accurate expectations and make better-informed investment choices.

Key Financial Metrics to Watch:

Several key financial metrics provide valuable insights into QBTS's financial health and future prospects. Analyzing these metrics across multiple quarters and years reveals important trends. You can find this data in QBTS's SEC filings (accessible via the SEC's EDGAR database) and on reputable financial news websites.

- Revenue Growth: Consistent year-over-year revenue growth indicates strong demand and market traction. Look for acceleration or deceleration in growth rates, signaling potential positive or negative changes.

- Earnings Per Share (EPS): EPS shows the portion of a company's profit allocated to each outstanding share. Increasing EPS generally reflects improved profitability.

- Gross Margin: This metric reveals the profitability of QBTS's core business operations after deducting the cost of goods sold. A healthy gross margin suggests efficient production and pricing strategies.

- Operating Margin: Operating margin represents profitability after deducting operating expenses. Improving operating margin indicates better operational efficiency and cost control.

- Net Income: Net income is the bottom line – the company's profit after all expenses, including taxes and interest, are deducted. Consistent growth is a very positive sign.

- Debt-to-Equity Ratio: This ratio reveals the company's financial leverage. A high ratio indicates a higher reliance on debt financing, which can pose risks during economic downturns. Analyzing QBTS's historical debt-to-equity ratio will highlight its financial risk profile.

Identifying Growth Drivers and Potential Headwinds:

Understanding the factors influencing QBTS's earnings is essential. Identifying potential growth drivers and headwinds allows for a more nuanced prediction of future performance.

- New Product Launches: Successful new product introductions can significantly boost revenue and earnings. Analyze the potential market impact of any recent or upcoming product launches by QBTS.

- Market Expansion: Expanding into new geographical markets or customer segments can drive revenue growth. Assess QBTS's expansion plans and their potential success.

- Competitive Landscape: Analyze the competitive landscape and QBTS's market share. Increasing competition could put pressure on pricing and margins, impacting earnings.

- Regulatory Changes: Changes in regulations can significantly impact a company's operations and profitability. Keep abreast of any relevant regulatory developments.

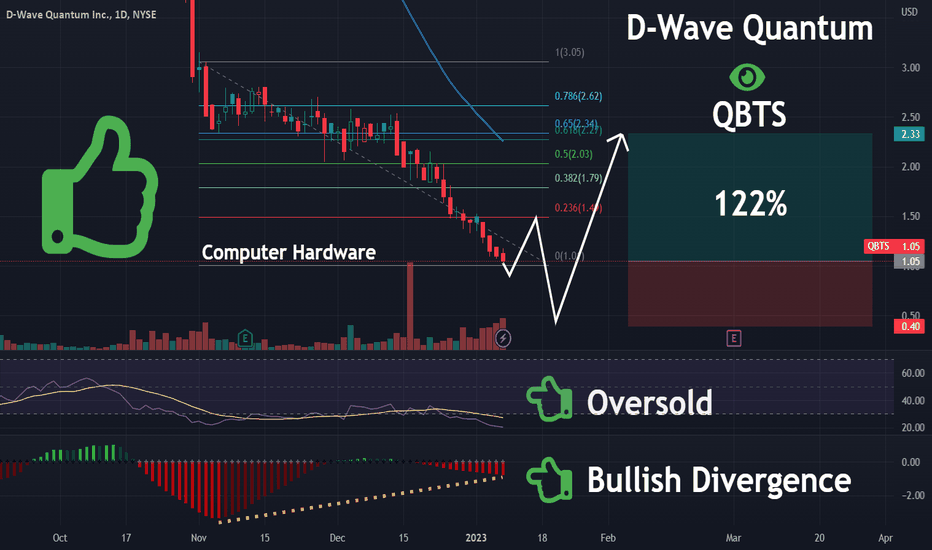

- Economic Conditions: Macroeconomic factors, such as interest rates, inflation, and economic growth, can also significantly influence QBTS's performance. Consider the prevailing economic climate when forecasting earnings.

Understanding Market Sentiment and Analyst Expectations for QBTS Stock Earnings

Market sentiment and analyst expectations play a crucial role in shaping the market's reaction to QBTS stock earnings. Understanding these factors can help investors anticipate potential price movements.

Examining Analyst Ratings and Price Targets:

Reputable financial analysts provide valuable insights into QBTS's prospects. Their ratings (buy, hold, sell) and price targets reflect their expectations for future performance. Review reports from multiple analysts to get a comprehensive picture. Many financial news websites aggregate analyst ratings and price targets.

Gauging Investor Sentiment through Social Media and News:

While not a substitute for fundamental analysis, gauging investor sentiment through social media and news can provide additional context. However, be discerning; not all information is credible. Focus on reputable news sources and filter out noise and speculation. Monitor discussions on relevant financial forums and social media platforms to understand the prevailing mood towards QBTS.

Strategies for Preparing for and Reacting to QBTS Stock Earnings

Effective preparation and a well-defined strategy are essential for navigating the volatility surrounding QBTS stock earnings announcements.

Developing a Pre-Earnings Plan:

Before the earnings announcement, develop a comprehensive plan to manage risk and potential losses.

- Setting Stop-Loss Orders: Stop-loss orders automatically sell your shares if the price drops to a predetermined level, limiting potential losses.

- Defining Entry and Exit Points: Determine specific price points at which you'll buy or sell QBTS stock based on the earnings report.

- Considering Hedging Strategies: Explore hedging strategies, such as options contracts, to mitigate potential downside risk.

- Having a Clear Investment Thesis: Clearly define your investment rationale for owning QBTS stock. This will help you assess whether the earnings report aligns with your expectations.

Post-Earnings Analysis and Adjustment:

After the earnings announcement, thoroughly analyze the actual results and compare them to your expectations and the consensus forecasts.

- Reviewing Actual Results Against Expectations: Carefully review the earnings report, paying attention to key metrics and management commentary.

- Reassessing Investment Thesis: Does the earnings report support your initial investment thesis? Re-evaluate your position based on the new information.

- Adjusting Portfolio Based on Performance: Based on your post-earnings analysis, make necessary adjustments to your portfolio, buying or selling shares as appropriate.

Conclusion

This article provided insights into preparing for QBTS stock earnings, including analyzing historical data, understanding market sentiment, and developing a robust pre-and post-earnings strategy. Successfully navigating QBTS stock earnings requires careful planning and a clear understanding of the company's financial health and market dynamics.

Call to Action: Stay informed about upcoming QBTS stock earnings releases and utilize the strategies discussed in this article to make informed investment decisions. Remember to conduct your own thorough research before making any investment choices regarding QBTS stock earnings and consult with a financial advisor if needed. Regularly monitor QBTS stock earnings announcements for the best investment outcomes.

Featured Posts

-

Abn Amro Ziet Occasionverkoop Explosief Groeien Meer Autobezitters Dan Ooit

May 21, 2025

Abn Amro Ziet Occasionverkoop Explosief Groeien Meer Autobezitters Dan Ooit

May 21, 2025 -

Jellystone Pinata Smashling Leads Teletoon Spring Streaming Lineup

May 21, 2025

Jellystone Pinata Smashling Leads Teletoon Spring Streaming Lineup

May 21, 2025 -

Key Findings From The Old North State Report May 9 2025

May 21, 2025

Key Findings From The Old North State Report May 9 2025

May 21, 2025 -

Legal Fallout E Bays Section 230 Shield Fails In Banned Chemicals Case

May 21, 2025

Legal Fallout E Bays Section 230 Shield Fails In Banned Chemicals Case

May 21, 2025 -

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025

Latest Posts

-

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025 -

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025 -

From Underdogs To Champions Liverpools Journey Under Juergen Klopp

May 22, 2025

From Underdogs To Champions Liverpools Journey Under Juergen Klopp

May 22, 2025 -

Juergen Klopp Set For Anfield Return Before Seasons End

May 22, 2025

Juergen Klopp Set For Anfield Return Before Seasons End

May 22, 2025 -

The David Walliams Simon Cowell Britains Got Talent Fallout

May 22, 2025

The David Walliams Simon Cowell Britains Got Talent Fallout

May 22, 2025