Real-Time Stock Market Data: Dow Jones, S&P 500, Nasdaq (May 29)

Table of Contents

Understanding the Major Indices: Dow Jones, S&P 500, and Nasdaq

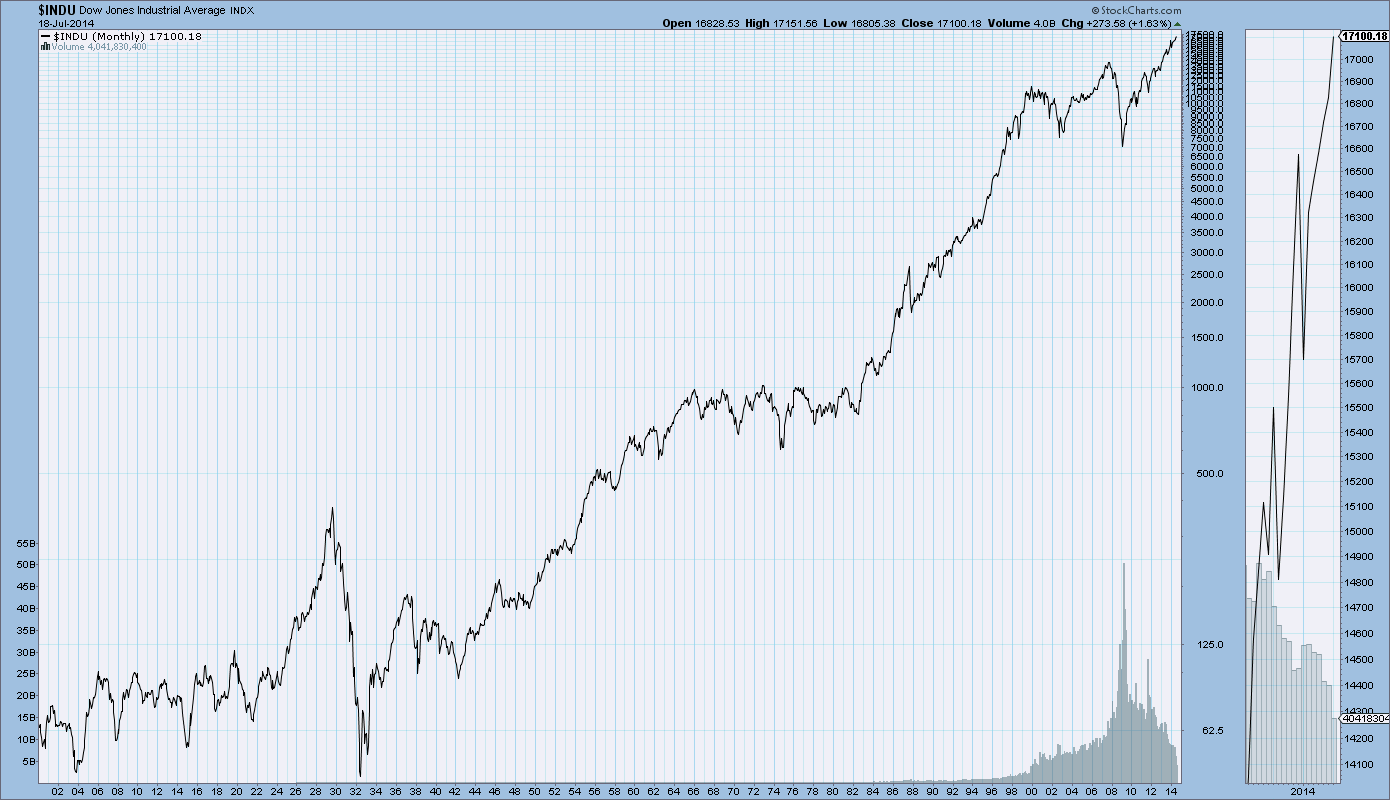

The Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average tracks the performance of 30 large, publicly-owned companies in the United States. These companies represent a diverse range of sectors, providing a snapshot of the overall US economy. Established in 1896, the DJIA holds significant historical importance and remains a widely followed benchmark. However, it's crucial to understand its limitations. As a price-weighted index, the Dow Jones gives disproportionate weight to higher-priced stocks, potentially skewing the overall representation.

- Key Features: 30 large-cap companies, price-weighted, historical significance.

- Limitations: Price weighting can distort representation; doesn't fully reflect market breadth.

The S&P 500

The S&P 500 index tracks 500 large-cap companies, offering a broader representation of the US stock market than the Dow Jones. It's considered a more comprehensive benchmark, encompassing a wider range of sectors and market capitalization. The S&P 500 is frequently used as a benchmark for many investment funds and is often seen as a more accurate reflection of the overall market performance.

- Key Features: 500 large-cap companies, market-cap weighted, broader representation.

- Benefits: More comprehensive than the Dow Jones, widely used as a benchmark.

The Nasdaq Composite

The Nasdaq Composite index primarily focuses on technology companies listed on the Nasdaq Stock Market. It's known for its high concentration of growth stocks and consequently exhibits greater volatility than the Dow Jones or S&P 500. The Nasdaq Composite is a crucial indicator for the technology sector's performance, reflecting the dynamism and risk associated with this rapidly evolving industry.

- Key Features: Primarily technology companies, high growth potential, higher volatility.

- Importance: Key indicator of the technology sector’s performance.

Key Differences and Overlaps

| Index | Number of Companies | Weighting Method | Focus | Volatility |

|---|---|---|---|---|

| Dow Jones | 30 | Price-weighted | Large, diverse companies | Moderate |

| S&P 500 | 500 | Market-cap weighted | Large-cap companies | Moderate |

| Nasdaq Composite | ~3,300 | Market-cap weighted | Technology companies | High |

While distinct in their composition and focus, these indices provide a holistic view of the overall market. Analyzing their trends together offers a more comprehensive understanding of market dynamics.

Sources for Real-Time Stock Market Data

Online Brokerage Platforms

Many online brokerage platforms, such as Fidelity, Schwab, and TD Ameritrade, offer real-time stock market data as part of their services. Features vary, with some offering free basic data while others require paid subscriptions for enhanced features like advanced charting tools and real-time streaming quotes.

- Examples: Fidelity, Schwab, TD Ameritrade, Interactive Brokers.

- Cost: Free basic data; paid subscriptions for advanced features.

Financial News Websites

Reputable financial news websites, including Yahoo Finance, Google Finance, and Bloomberg, provide real-time stock market data alongside news and analysis. Free services typically offer delayed data, while premium subscriptions unlock real-time updates and additional features.

- Examples: Yahoo Finance, Google Finance, Bloomberg, MarketWatch.

- Data Presentation: Charts, graphs, tables, news articles.

Dedicated Data Providers

For professional investors, dedicated data providers like Refinitiv and the Bloomberg Terminal offer comprehensive, high-quality real-time stock market data. These services often include advanced analytics tools, news feeds, and research capabilities, catering to sophisticated investment strategies. These platforms come with substantial subscription costs, reflecting their advanced features.

- Examples: Refinitiv, Bloomberg Terminal.

- Cost: High subscription fees.

Mobile Apps

Numerous mobile applications provide convenient access to real-time stock market data. These apps often offer features like customizable watchlists, price alerts, and integrated charting tools, making them ideal for staying updated on the go.

- Examples: Yahoo Finance app, Google Finance app, Bloomberg app, many brokerage firm apps.

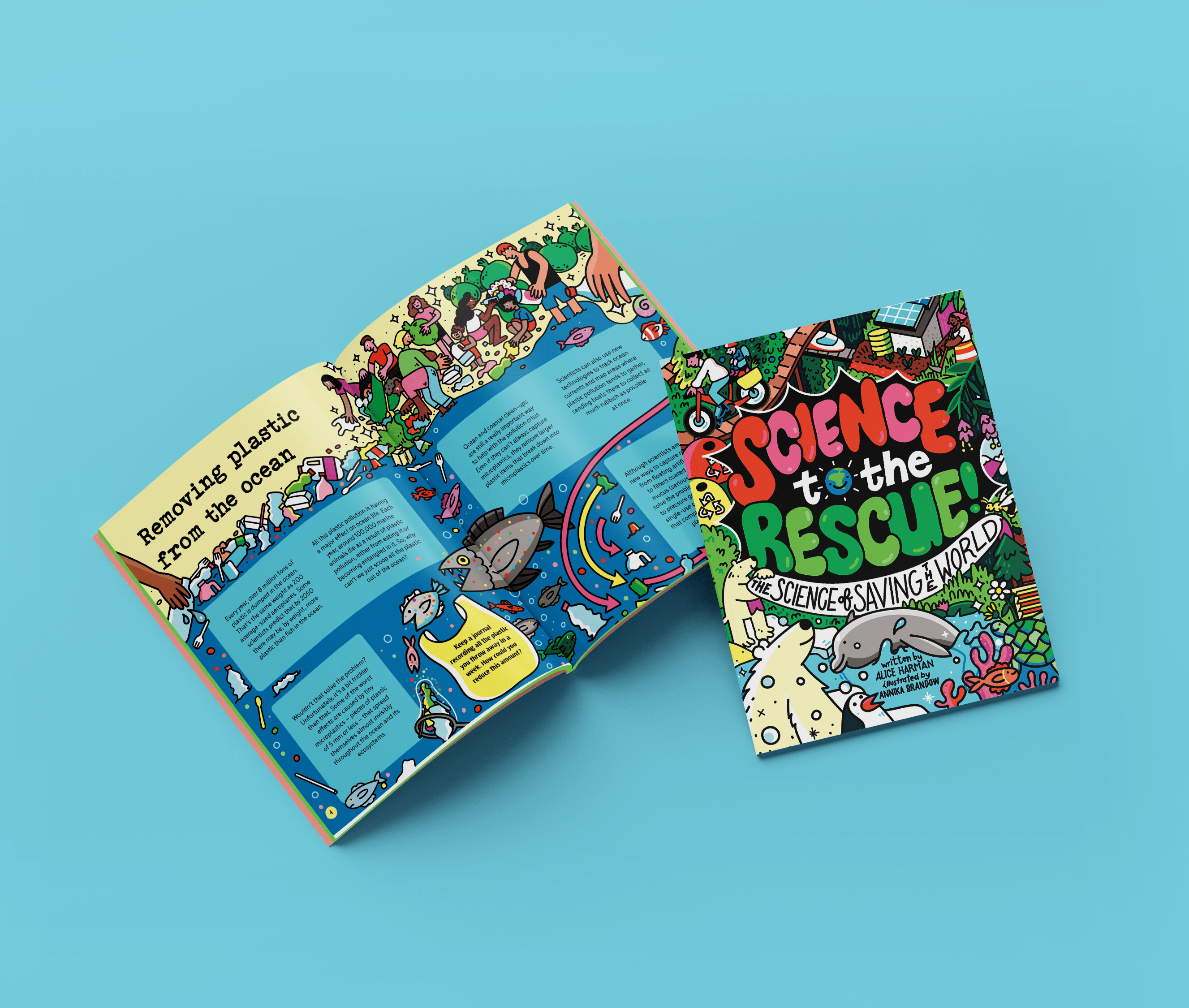

Interpreting Real-Time Stock Market Data

Understanding Price Movements

Stock prices are influenced by a multitude of factors, including news events (earnings reports, economic announcements), economic indicators (inflation, unemployment), and individual company performance (product launches, strategic partnerships). Analyzing these factors is crucial for understanding price fluctuations.

- Key Influences: News, economic data, company performance.

Reading Charts and Graphs

Candlestick charts, line graphs, and other visual representations are essential tools for interpreting stock market data. Understanding these chart types helps to identify trends, patterns, and potential trading opportunities.

- Chart Types: Candlestick charts, line graphs, bar charts.

Using Technical Indicators

Technical indicators, such as moving averages and the Relative Strength Index (RSI), are used in technical analysis to identify trends and potential turning points. These indicators provide quantitative insights into price movements, supporting trading decisions. However, it's vital to remember that technical indicators should be used in conjunction with other forms of analysis.

- Common Indicators: Moving averages, RSI, MACD.

The Importance of Fundamental Analysis

While technical analysis focuses on chart patterns and price movements, fundamental analysis delves into a company's financial health, competitive landscape, and management team. Combining technical and fundamental analysis provides a more holistic view, leading to more informed investment choices.

- Key Aspects: Financial statements, industry analysis, management quality.

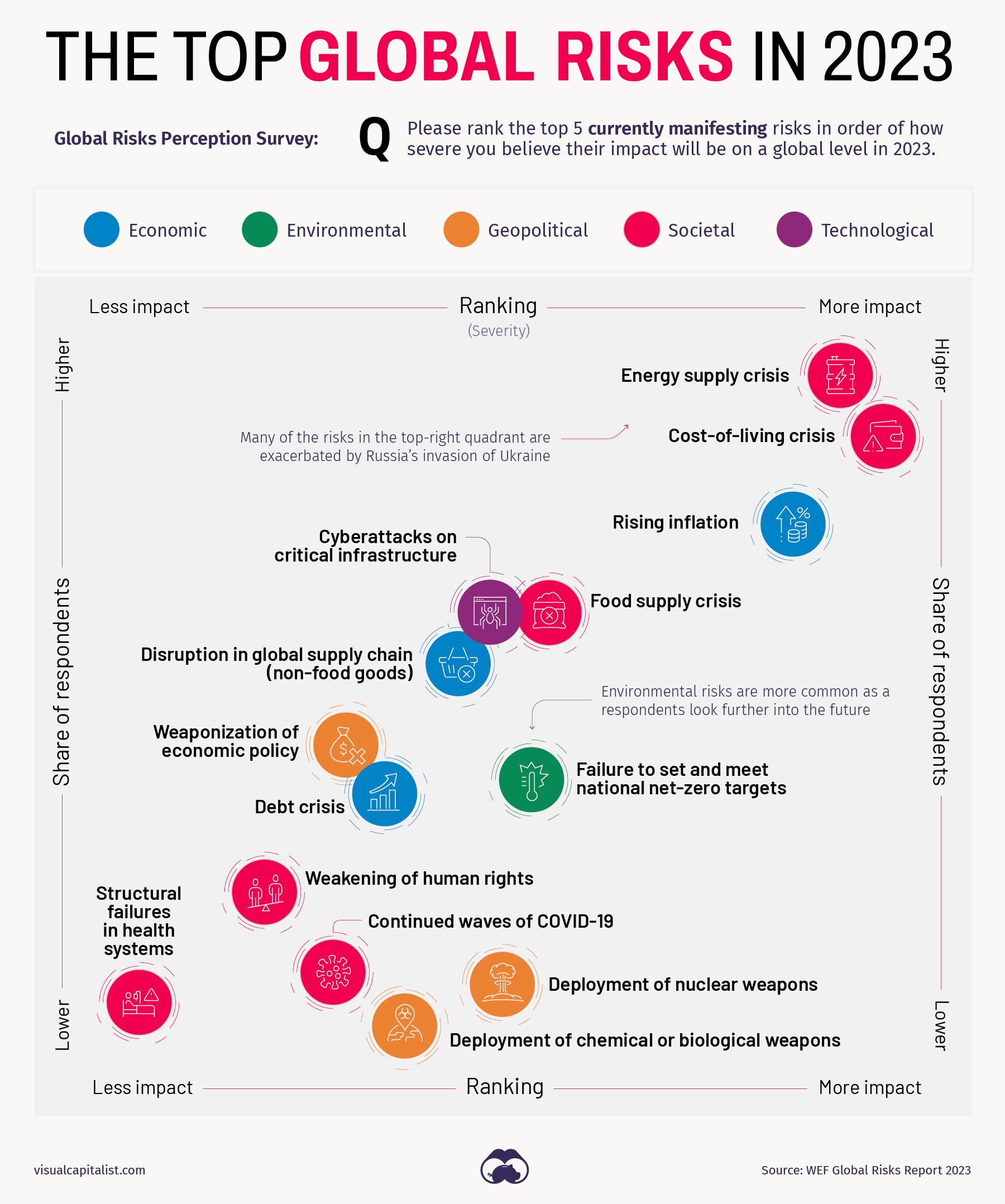

Conclusion: Stay Ahead with Real-Time Stock Market Data

Real-time stock market data is invaluable for informed investment decisions. Understanding the major indices – the Dow Jones, S&P 500, and Nasdaq – and their respective characteristics is the first step. Utilizing reliable sources, like online brokerage platforms, financial news websites, or dedicated data providers, ensures you have access to accurate and up-to-date information. Remember to combine technical and fundamental analysis for a well-rounded approach to investing. Start accessing reliable real-time stock market data today to make smarter investment choices. Explore the resources mentioned above and begin your journey to informed investing.

Featured Posts

-

Miami Open Anisimova Defeats Andreeva

May 30, 2025

Miami Open Anisimova Defeats Andreeva

May 30, 2025 -

Djokovics Winning Start At The French Open

May 30, 2025

Djokovics Winning Start At The French Open

May 30, 2025 -

The High Cost Of Illegal Vehicle Registrations A Virginia Maryland Case Study

May 30, 2025

The High Cost Of Illegal Vehicle Registrations A Virginia Maryland Case Study

May 30, 2025 -

Analyzing Nvidias Forecast Balancing Growth With China Market Risks

May 30, 2025

Analyzing Nvidias Forecast Balancing Growth With China Market Risks

May 30, 2025 -

Ulasan Lengkap Kawasaki W800 My 2025 Harga Spesifikasi And Desain

May 30, 2025

Ulasan Lengkap Kawasaki W800 My 2025 Harga Spesifikasi And Desain

May 30, 2025

Latest Posts

-

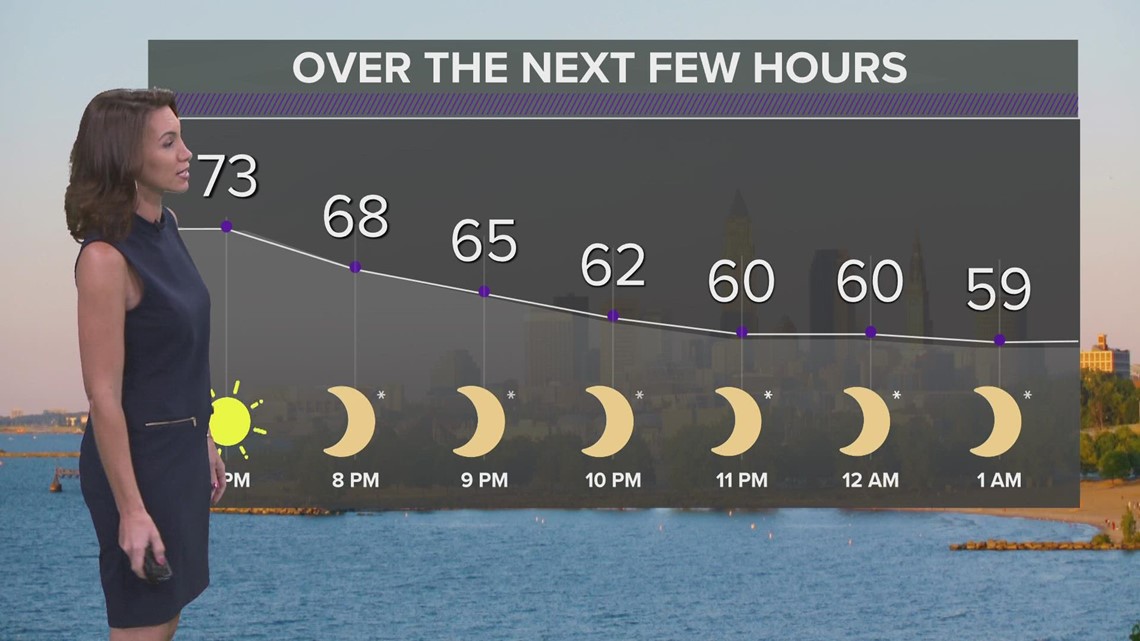

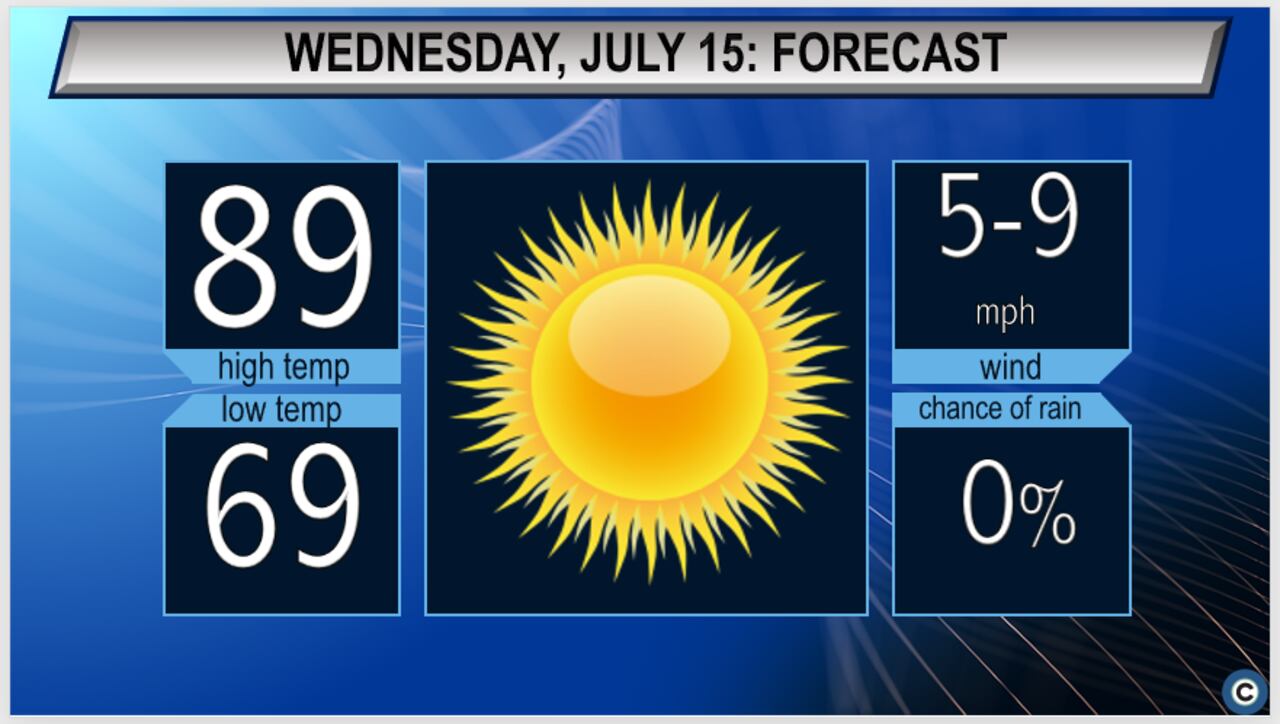

Dry And Sunny Tuesday In Northeast Ohio Weather Forecast

May 31, 2025

Dry And Sunny Tuesday In Northeast Ohio Weather Forecast

May 31, 2025 -

Tuesday Forecast Sunshine Returns To Northeast Ohio

May 31, 2025

Tuesday Forecast Sunshine Returns To Northeast Ohio

May 31, 2025 -

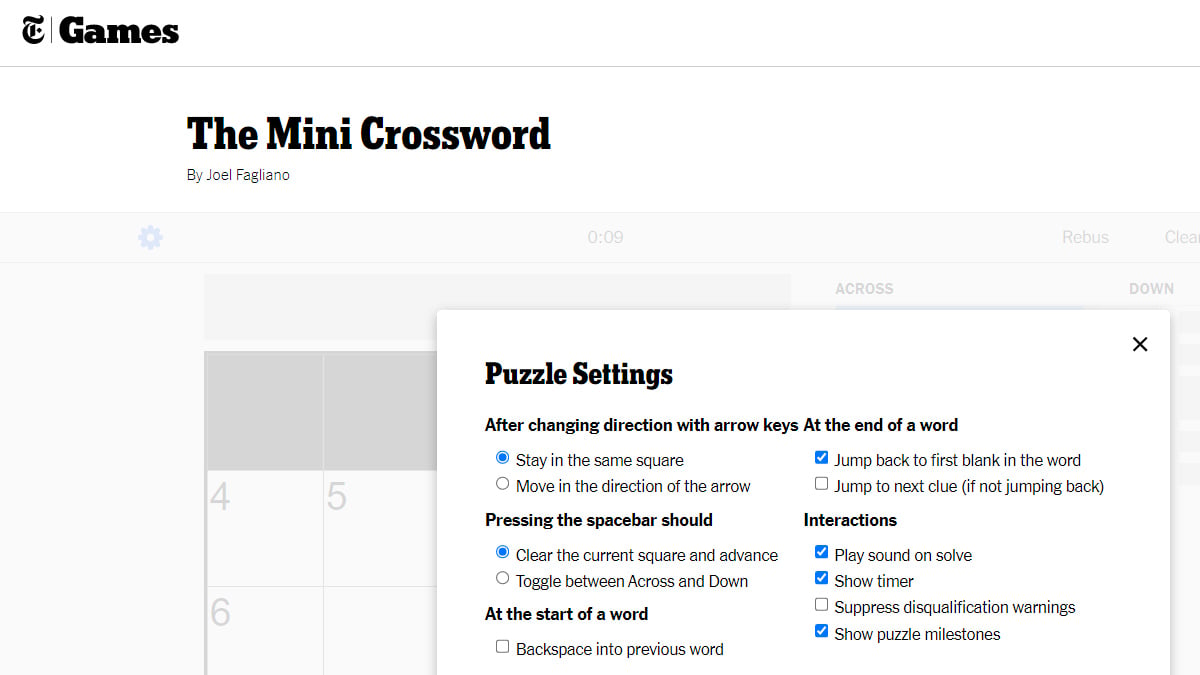

Nyt Mini Crossword Thursday April 10 Clues And Solutions

May 31, 2025

Nyt Mini Crossword Thursday April 10 Clues And Solutions

May 31, 2025 -

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025 -

April 10th Nyt Mini Crossword Clues And Answers

May 31, 2025

April 10th Nyt Mini Crossword Clues And Answers

May 31, 2025