Record ETF Investments: Why Investors Are Choosing Exchange-Traded Funds

Table of Contents

Low Costs and Expense Ratios: A Key Driver of ETF Growth

One of the most significant factors contributing to the popularity of ETF investments is their remarkably low cost. Unlike actively managed mutual funds, which often charge high fees, ETFs typically boast significantly lower expense ratios. This translates directly into greater returns for investors over the long term, allowing more of your money to work for you.

-

Comparison of average ETF expense ratios vs. mutual fund expense ratios: While mutual fund expense ratios can average 1% or more, many ETFs charge significantly less, with some boasting expense ratios of 0.05% or even lower. This seemingly small difference compounds dramatically over time.

-

Explanation of how small differences in expense ratios compound over time: A 1% expense ratio on a $10,000 investment means you pay $100 annually. Over 20 years, that adds up to $2,000 – a considerable chunk of your potential returns. Lower-cost ETFs significantly mitigate this impact.

-

Examples of low-cost ETFs across different asset classes: Investors can find extremely cheap ETFs tracking broad market indices like the S&P 500, as well as sector-specific ETFs focusing on technology, healthcare, or energy. These low-cost ETFs provide efficient access to diverse asset classes without sacrificing affordability.

Diversification and Portfolio Management Simplified

ETF diversification is another cornerstone of their appeal. ETFs allow investors to effortlessly diversify their portfolios across various asset classes, including stocks, bonds, and commodities, and across different market sectors. This eliminates the need to select individual stocks or bonds, simplifying portfolio construction and reducing risk.

-

Examples of ETFs that offer broad market diversification (e.g., S&P 500 ETFs): Investing in an S&P 500 ETF provides instant exposure to 500 of the largest US companies, significantly mitigating risk associated with investing in individual stocks.

-

Discussion of sector-specific ETFs and their use in strategic asset allocation: Sector ETFs allow investors to tailor their portfolios to specific market segments. For example, investors bullish on technology can allocate a portion of their investments to a technology-focused ETF.

-

Explanation of how ETFs simplify portfolio rebalancing: Rebalancing your portfolio—adjusting your asset allocation to maintain your desired risk level—is simplified with ETFs. The ease of buying and selling ETFs on exchanges makes adjusting your portfolio straightforward.

Transparency and Easy Access: Understanding Your Investments

ETF transparency is a key differentiator. Unlike some investment vehicles, ETFs offer clear visibility into their underlying holdings. Investors can readily access information on the specific assets held by an ETF, ensuring complete understanding of their investments. Furthermore, the liquidity of ETFs—their ease of buying and selling—contributes to their popularity.

-

Comparison of ETF transparency to that of other investment vehicles: Unlike some hedge funds or private equity investments, where holdings information may be opaque, ETF holdings are publicly available, promoting investor confidence.

-

Explanation of how to access ETF holdings information: Most ETF providers readily publish their holdings on their websites, providing investors with a clear picture of their investments.

-

Discussion of ETF trading volume and its impact on liquidity: High trading volume in most ETFs means investors can easily buy or sell shares without significantly impacting the price. This liquidity is a major advantage over less liquid investment options.

Tax Efficiency: Minimizing Your Tax Burden

ETF tax efficiency is another compelling advantage. Because ETFs generally have lower turnover than actively managed mutual funds, they tend to generate fewer capital gains distributions, leading to potentially lower tax liabilities for investors. This contributes to maximizing your overall returns.

Accessibility and Suitability for Various Investor Profiles

ETF investments cater to a wide range of investor profiles and experience levels. From beginner investors looking for simple, low-cost diversification to experienced professionals employing sophisticated investment strategies, ETFs offer a flexible and accessible option.

-

Examples of ETFs suitable for different risk tolerances: From conservative bond ETFs to more aggressive growth stock ETFs, the diversity in ETF offerings caters to various risk appetites.

-

Discussion of how ETFs can be used in different investment strategies (e.g., value investing, growth investing): ETFs can be incorporated into a variety of investment strategies, offering flexibility for investors with different approaches.

-

Mention of robo-advisors and their use of ETFs in portfolio construction: Many robo-advisors utilize ETFs as the core building blocks of their automated portfolio management services, highlighting their suitability for various investment styles.

Conclusion

The surge in record ETF investments is a testament to their compelling attributes. Their low costs, robust diversification capabilities, unparalleled transparency, tax efficiency, and accessibility make them an ideal investment vehicle for individuals at all stages of their financial journey. By simplifying portfolio management and offering efficient access to various asset classes, ETFs have redefined the landscape of modern investing. Consider the benefits of incorporating Exchange-Traded Funds into your investment strategy. Explore the wide range of available ETFs and find the ones that best suit your financial goals. Start building your diversified portfolio with ETF investments today!

Featured Posts

-

Dutch Investors 65 Billion Stake Raises Concerns For Us Money Managers

May 28, 2025

Dutch Investors 65 Billion Stake Raises Concerns For Us Money Managers

May 28, 2025 -

Ukraine Granted Permission For Deeper Strikes Into Russia Merzs Decision

May 28, 2025

Ukraine Granted Permission For Deeper Strikes Into Russia Merzs Decision

May 28, 2025 -

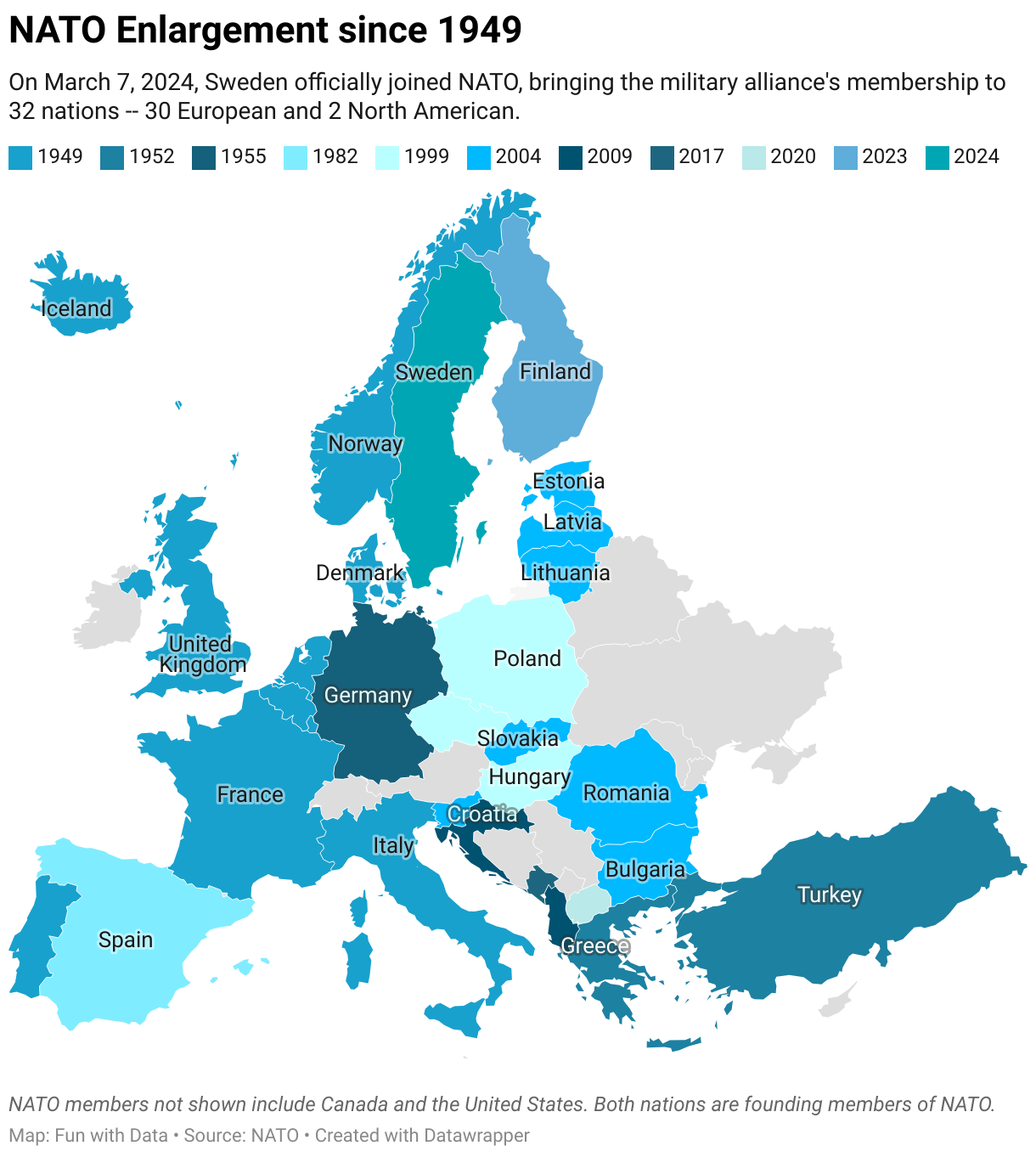

5 Defense Spending Target Nato Chiefs Update On Member Progress

May 28, 2025

5 Defense Spending Target Nato Chiefs Update On Member Progress

May 28, 2025 -

Sinners Italian Open Draw A Tough Road To Recovery

May 28, 2025

Sinners Italian Open Draw A Tough Road To Recovery

May 28, 2025 -

Abd De Tueketici Kredilerinin Mart Ayi Performansi Ve Etkileri

May 28, 2025

Abd De Tueketici Kredilerinin Mart Ayi Performansi Ve Etkileri

May 28, 2025