Regulatory Scrutiny Of Bond Forwards: Impact On Indian Insurers

Table of Contents

H2: IRDAI's Guidelines and Their Impact on Bond Forward Investments

The IRDAI plays a pivotal role in regulating the investment activities of Indian insurers. Its guidelines concerning bond forward investments aim to balance the potential benefits with the inherent risks. These guidelines significantly impact how insurers can utilize these instruments. Key areas covered include limitations on exposure, permissible counterparties, valuation methodologies, and stringent reporting requirements.

- Explanation of specific IRDAI circulars related to bond forwards: The IRDAI has issued several circulars outlining specific regulations, often addressing concerns related to counterparty risk and market volatility. These circulars provide detailed instructions on acceptable practices and reporting procedures.

- Analysis of quantitative limits on bond forward positions: Insurers face quantitative limits on their overall exposure to bond forwards, preventing excessive risk-taking and ensuring solvency. These limits are often calculated as a percentage of net worth or a specific portfolio allocation.

- Discussion of the implications of counterparty risk management regulations: IRDAI guidelines emphasize stringent counterparty risk management. Insurers must meticulously assess the creditworthiness of counterparties before entering into bond forward agreements, mitigating potential losses from defaults. This includes stress testing and rigorous due diligence.

- Overview of the reporting and disclosure requirements: Comprehensive reporting and disclosure requirements ensure transparency and accountability. Insurers must provide regular updates on their bond forward positions, valuation methodologies, and risk management strategies to the IRDAI.

H2: Risk Management Considerations for Bond Forward Trading

Bond forward trading, while potentially lucrative, involves significant risks that insurers must proactively manage. A robust risk management framework is paramount.

- Detailed explanation of interest rate risk and its management in bond forwards: Interest rate fluctuations directly impact the value of bond forwards. Insurers employ various hedging strategies, such as using interest rate swaps or futures contracts, to mitigate this risk.

- Assessment of credit risk associated with counterparties: Default by a counterparty represents a substantial risk. Diversification of counterparties and thorough credit analysis are crucial to mitigate this risk.

- Strategies to mitigate liquidity risk related to bond forward positions: Liquidity risk arises from the inability to quickly unwind positions at favorable prices. Maintaining sufficient liquid assets and managing the timing of transactions help alleviate this risk.

- Best practices for managing operational risk in bond forward trading: Operational risks, including errors in data entry, system failures, and fraud, need careful consideration. Implementing robust internal controls, independent verification, and regular audits minimizes these risks.

H2: The Impact of Regulatory Scrutiny on Investment Strategies

The increased regulatory scrutiny surrounding bond forwards has significantly impacted the investment strategies of Indian insurers.

- Analysis of changes in asset allocation strategies post-regulatory changes: Insurers are recalibrating their asset allocation models to comply with the new regulations. This often involves reducing exposure to higher-risk investments and diversifying across different asset classes.

- Discussion of the impact on portfolio diversification efforts: Regulatory guidelines promote diversification to reduce overall portfolio risk. Insurers are broadening their investments beyond bond forwards, incorporating other instruments to meet regulatory compliance and minimize risk.

- Examination of the effects on return optimization strategies: While regulations aim to mitigate risk, they also impact return optimization strategies. Insurers must find a balance between risk reduction and maximizing returns within the regulatory framework.

- Case studies illustrating how insurers are adapting their investment strategies: Several case studies demonstrate how insurers are successfully adapting, focusing on robust risk management, compliance procedures, and strategic diversification to navigate the evolving regulatory landscape.

H2: Future Trends and Implications for Indian Insurers

The regulatory environment surrounding bond forwards for Indian insurers is constantly evolving.

- Predictions on future regulatory changes related to bond forwards: Future changes are likely to focus on enhancing transparency, strengthening risk management frameworks, and further refining reporting requirements. Technological advancements will likely play a significant role in shaping future regulations.

- Discussion of the role of technology in improving risk management and compliance: Technology like AI and machine learning offer opportunities for improved risk assessment, fraud detection, and regulatory compliance. Insurers are increasingly leveraging these technologies to optimize their operations.

- Analysis of the challenges of maintaining regulatory compliance: Staying compliant with evolving regulations requires substantial investment in technology, training, and internal processes. This presents a significant challenge for many insurers.

- Discussion of potential opportunities arising from the evolving regulatory landscape: Despite the challenges, regulatory changes also open doors to innovation and strategic positioning for insurers who can effectively adapt and comply.

3. Conclusion:

The regulatory scrutiny of bond forwards presents both challenges and opportunities for Indian insurers. Understanding and complying with IRDAI guidelines is crucial for maintaining financial stability and avoiding penalties. Robust risk management frameworks, including hedging strategies and careful counterparty assessment, are essential. Adapting investment strategies to balance risk and return within the regulatory framework is key. Proactive engagement with the evolving regulatory landscape and embracing technological advancements are vital for success. To stay abreast of the latest developments and ensure compliance, regularly consult the IRDAI website and other relevant resources. Successfully navigating the Regulatory Scrutiny of Bond Forwards will be pivotal to the future success of Indian insurers in this dynamic market.

Featured Posts

-

The Future Of Apple Ai Innovation And Market Dominance

May 10, 2025

The Future Of Apple Ai Innovation And Market Dominance

May 10, 2025 -

The Details Of Trumps Proposed Trade Agreement With Britain

May 10, 2025

The Details Of Trumps Proposed Trade Agreement With Britain

May 10, 2025 -

Edmonton Oilers Favored Betting Odds For Kings Series

May 10, 2025

Edmonton Oilers Favored Betting Odds For Kings Series

May 10, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From A Key January 6th Figure

May 10, 2025

Cassidy Hutchinsons Fall Memoir Insights From A Key January 6th Figure

May 10, 2025 -

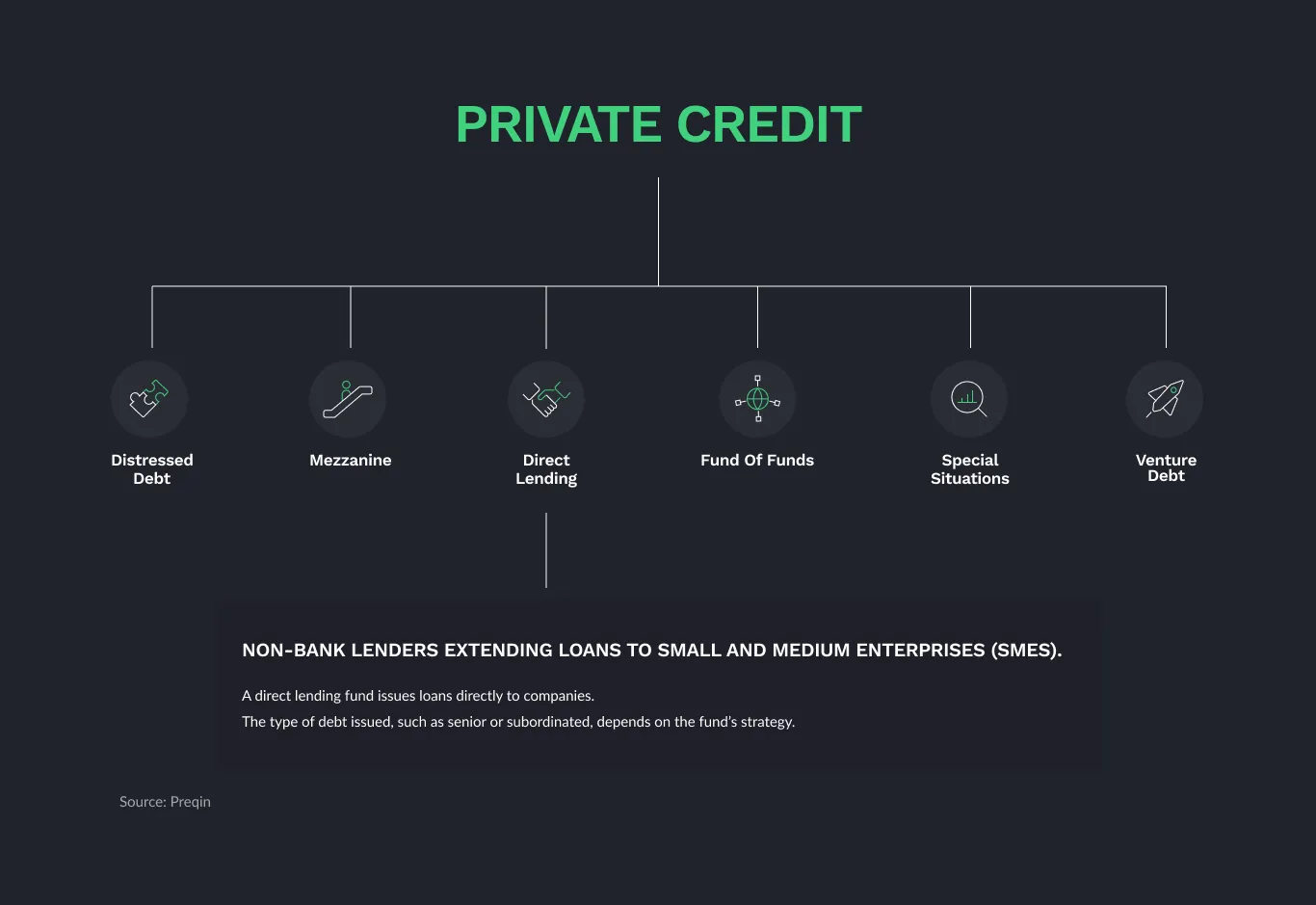

5 Key Dos And Don Ts To Succeed In The Private Credit Market

May 10, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Market

May 10, 2025