Rising Costs Prompt Lynas Rare Earths To Seek US Funding For Texas Plant

Table of Contents

Soaring Costs and Supply Chain Challenges

The primary driver behind Lynas's pursuit of US funding is the dramatic increase in production costs. Inflation, coupled with rising raw material costs, energy prices, and persistent logistical challenges, is significantly impacting the project's feasibility. Geopolitical instability further exacerbates the situation, creating uncertainty and risk in the global rare earth supply chain. These challenges highlight the vulnerability of relying solely on foreign sources for these critical minerals.

- Increased costs of raw materials: The prices of key rare earth oxides, such as neodymium and praseodymium – essential components in powerful permanent magnets – have skyrocketed in recent years.

- Rising energy prices: The energy-intensive nature of rare earth processing makes the company particularly vulnerable to fluctuating and high energy costs. This significantly impacts overall production expenses.

- Supply chain disruptions and transportation bottlenecks: Global supply chain disruptions, exacerbated by geopolitical events and pandemic-related restrictions, have added to the already high costs of transporting raw materials and finished products.

- Geopolitical risks influencing the stability of rare earth sourcing: The concentration of rare earth mining and processing in a few countries, notably China, creates significant geopolitical risks and vulnerabilities for nations dependent on these imports.

The Strategic Importance of the Texas Plant

The planned Texas plant holds immense strategic importance for the United States. Establishing a significant domestic rare earth processing capacity is crucial for reducing reliance on foreign sources, bolstering national security, and stimulating economic development. This facility will play a key role in securing the supply chain for critical minerals essential for numerous defense and civilian applications.

- Reduced reliance on foreign sources of rare earth materials: The Texas plant will significantly decrease the US dependence on foreign suppliers, mitigating the risks associated with geopolitical instability and trade disputes.

- Enhanced national security by securing a domestic supply chain: A reliable domestic supply of rare earth elements is paramount for national security, ensuring access to critical materials for defense applications.

- Creation of high-skilled jobs in Texas: The project will create numerous high-paying jobs in Texas, boosting the local economy and driving regional development.

- Stimulation of economic growth in the region: The plant will attract further investment and create a hub for innovation in the rare earth sector, stimulating broader economic growth.

- Support for downstream processing of rare earth elements in the US: The facility will facilitate further downstream processing within the US, creating a more complete and resilient domestic supply chain.

Lynas's Funding Strategy and US Government Support

Lynas is actively pursuing various avenues to secure the necessary US government funding for the Texas plant expansion. This includes applications for government grants, loans, and exploration of tax incentives and other investment programs. The company is also seeking to leverage the Defense Production Act (DPA), which aims to expand domestic production of critical materials crucial for national security. Public-private partnerships are also being explored to complement government funding and share the financial burden.

- Applications for government grants and loans: Lynas is actively applying for various government funding programs designed to support the development of domestic critical mineral industries.

- Exploration of tax incentives and other investment programs: The company is investigating various tax incentives and other investment programs offered at the federal and state levels.

- Potential partnerships with US government agencies: Collaborations with relevant agencies are being explored to ensure alignment with national strategic priorities.

- Leveraging the Defense Production Act for critical minerals: The DPA provides mechanisms to support the domestic production of critical minerals, and Lynas is exploring how to utilize these provisions.

- Seeking private investment to complement government funding: Private investment is crucial to supplement government funding and ensure the project's long-term viability.

Potential Impact of US Funding on the Rare Earth Market

Securing US funding for the Lynas Texas plant will have significant ramifications for the global rare earth market. It will likely increase US market share in rare earth production and processing, potentially leading to greater price stability by reducing reliance on a single dominant supplier. Increased competition will also drive innovation and technological advancements in rare earth applications.

- Increased US market share in rare earth production and processing: The plant will significantly bolster the US's share of global rare earth processing capacity.

- Potential stabilization of rare earth prices: Increased domestic supply could help stabilize prices, making rare earth materials more accessible for various industries.

- Increased competition in the global rare earth market: A stronger US presence in the rare earth market will increase competition, benefiting consumers and driving innovation.

- Acceleration of innovation and technological advancements in rare earth applications: Increased domestic production and research could lead to breakthroughs in rare earth applications and technologies.

Conclusion

Lynas Rare Earths' need for US funding to overcome rising costs and build its Texas plant is a critical issue, highlighting the strategic importance of securing a domestic supply chain for rare earth elements. This project will enhance US national security, stimulate economic growth, and reshape the global rare earth market. The potential impact on price stability, market share, and technological innovation is substantial. Learn more about Lynas Rare Earths' investment in the US and understand the crucial role of rare earth elements in modern technology. Explore the future of domestic rare earth production and its implications for US economic and national security.

Featured Posts

-

Relocating To Spain Success And Failure Stories Of American Expats

Apr 29, 2025

Relocating To Spain Success And Failure Stories Of American Expats

Apr 29, 2025 -

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder

Apr 29, 2025

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder

Apr 29, 2025 -

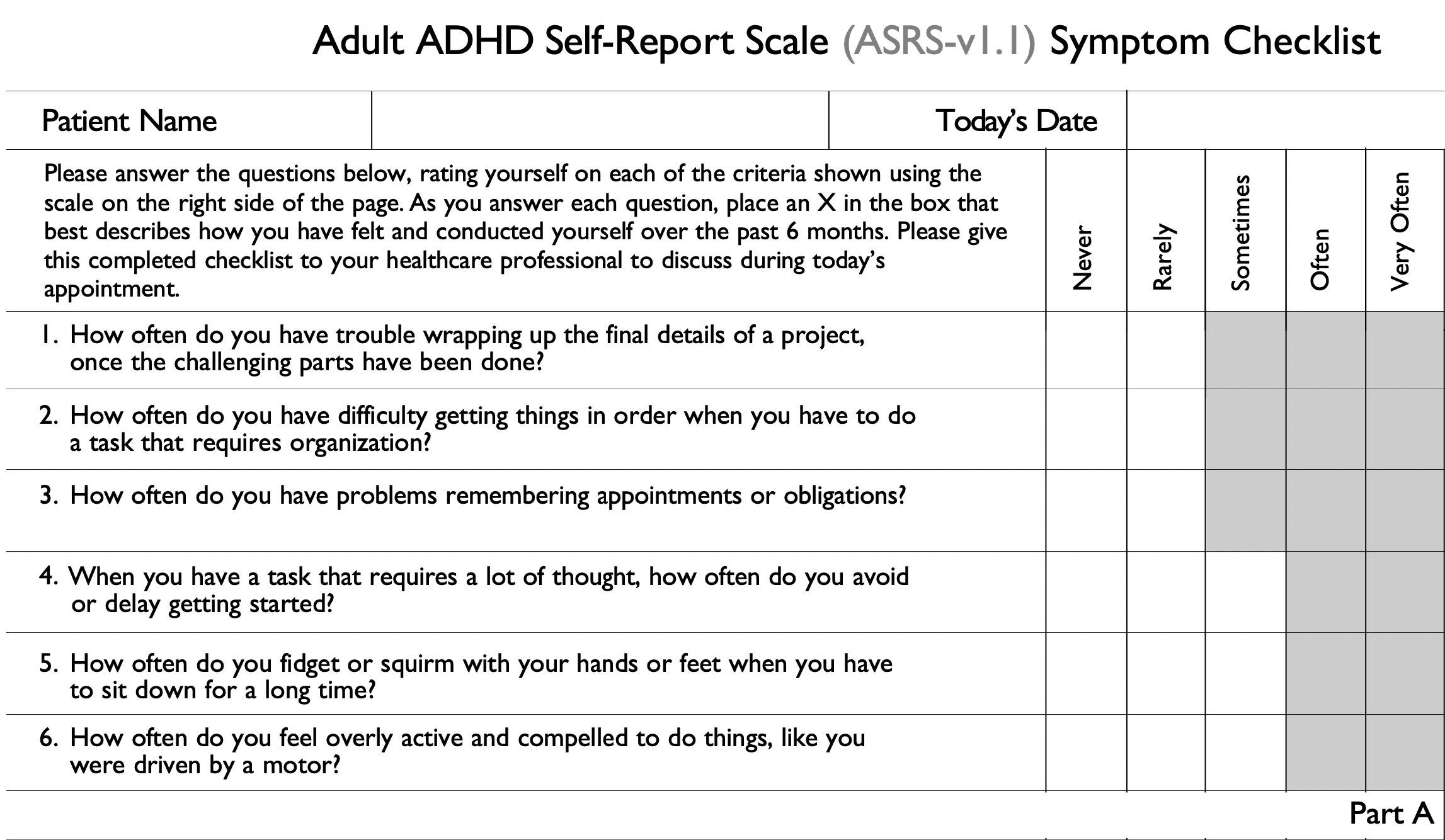

Facing A Possible Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025

Facing A Possible Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025 -

Secret Service Investigation Concludes Cocaine Found At White House

Apr 29, 2025

Secret Service Investigation Concludes Cocaine Found At White House

Apr 29, 2025 -

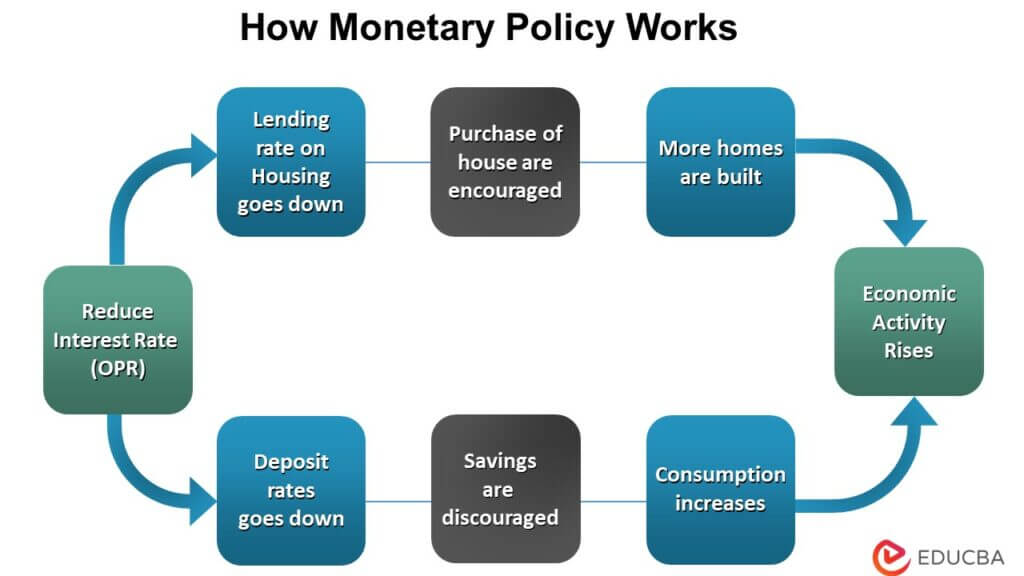

The Bank Of Canadas Monetary Policy A Missed Opportunity Rosenbergs Analysis

Apr 29, 2025

The Bank Of Canadas Monetary Policy A Missed Opportunity Rosenbergs Analysis

Apr 29, 2025

Latest Posts

-

A Conversation With Tom Conrad Leading Sonos Through A Period Of Transition

May 12, 2025

A Conversation With Tom Conrad Leading Sonos Through A Period Of Transition

May 12, 2025 -

The Challenges Of Filming Alligators In Floridas Crystal Clear Springs

May 12, 2025

The Challenges Of Filming Alligators In Floridas Crystal Clear Springs

May 12, 2025 -

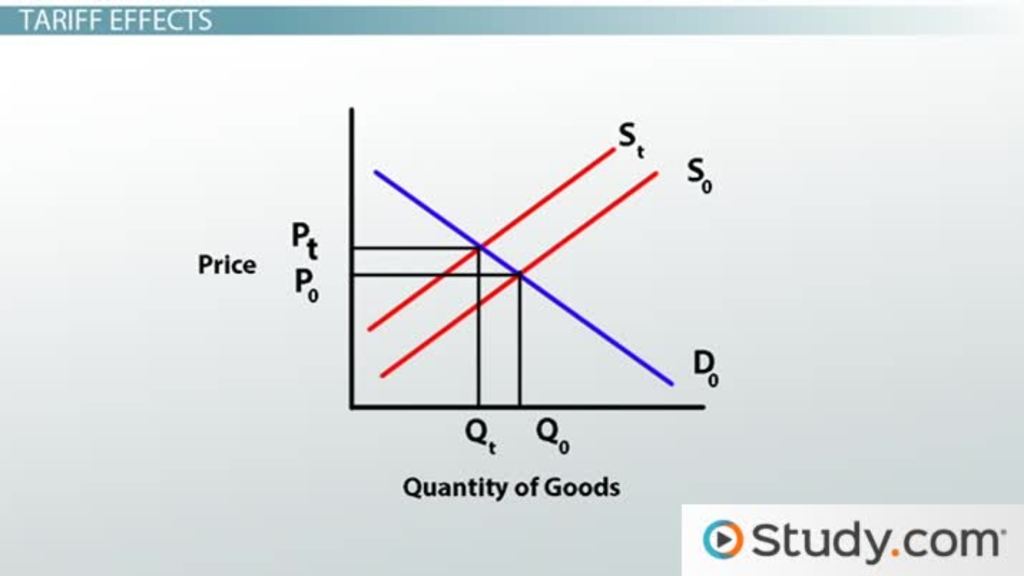

Small Businesses Bear The Brunt Examining The Effects Of Trumps Tariffs

May 12, 2025

Small Businesses Bear The Brunt Examining The Effects Of Trumps Tariffs

May 12, 2025 -

Documenting Floridas Alligator Population A Filming Perspective In Springs

May 12, 2025

Documenting Floridas Alligator Population A Filming Perspective In Springs

May 12, 2025 -

Exclusive Interview Tom Conrad Sonos Interim Ceo On The Future Of Sound

May 12, 2025

Exclusive Interview Tom Conrad Sonos Interim Ceo On The Future Of Sound

May 12, 2025