Rising Sea Levels, Falling Credit Scores: The Homebuyer's Climate Risk

Table of Contents

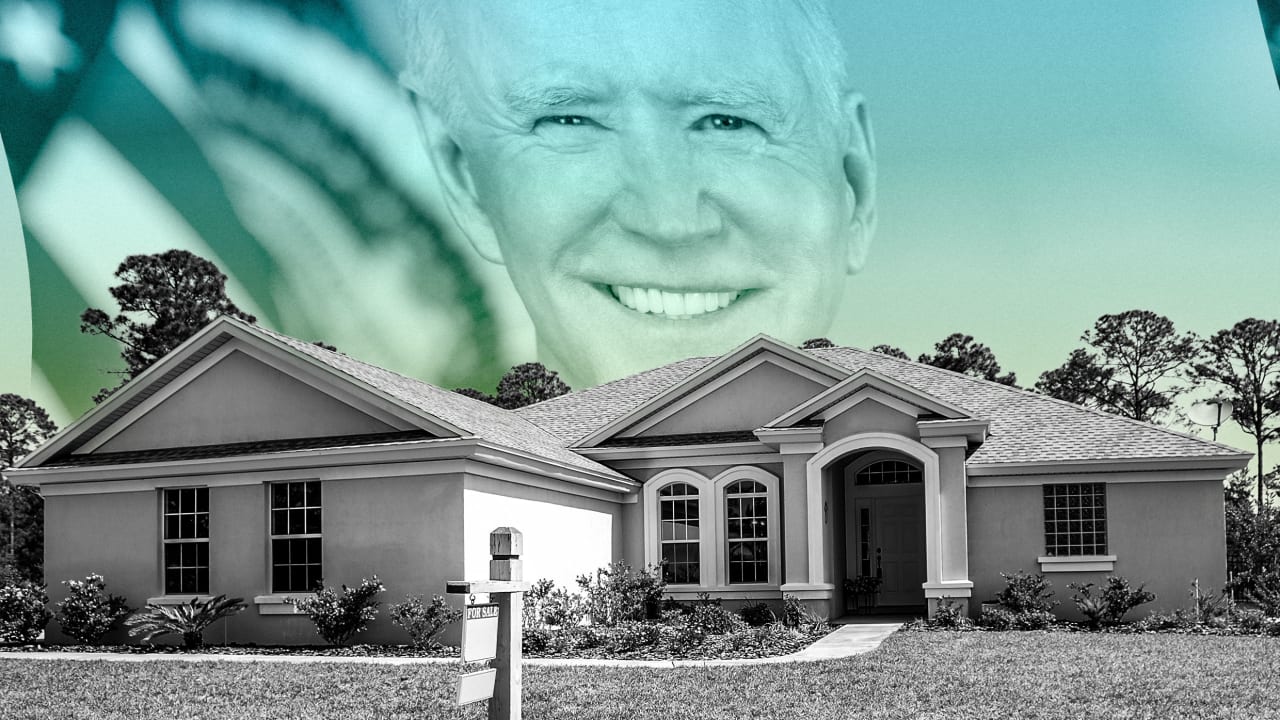

How Rising Sea Levels Decrease Property Values

The direct impact of rising sea levels on property values is undeniable. Flooding and coastal erosion, exacerbated by increasingly frequent and severe storms linked to climate change, cause significant and lasting damage. Properties in flood-prone zones become less desirable, leading to a decline in market value. This devaluation isn't just about physical damage; it's also about perceived risk. Buyers are hesitant to invest in properties threatened by rising waters, further depressing prices.

Government regulations and building codes also play a significant role. Stricter regulations in high-risk areas, designed to improve safety and resilience, can limit development and potentially decrease property values. This is particularly true for areas designated as high-risk flood zones by the Federal Emergency Management Agency (FEMA).

- Increased insurance premiums: Homeowners in high-risk areas face dramatically higher insurance premiums, making ownership more expensive.

- Difficulty selling properties in flood-prone zones: Finding buyers for properties in vulnerable areas becomes increasingly challenging.

- Reduced demand due to perceived risk: The perception of risk alone can significantly impact market value, regardless of immediate physical damage.

- Potential for government buyouts and relocation programs: In some cases, governments may buy out properties in high-risk zones, often at below-market value.

The Impact of Property Value Decline on Credit Scores

Mortgage lenders base their risk assessments heavily on property value. When property values decline, as they often do in areas affected by rising sea levels, homeowners can quickly find themselves in negative equity – owing more on their mortgage than their home is worth. This situation is precarious and can significantly impact credit scores.

Negative equity makes default and foreclosure more likely. The resulting impact on your credit report and FICO score can be devastating, making it difficult to secure future loans, purchase a new home, or even obtain favorable interest rates on other credit products.

- Increased Loan-to-Value (LTV) ratio: A declining property value increases the LTV ratio, making your mortgage riskier to lenders.

- Potential for default and foreclosure: Negative equity significantly increases the chances of defaulting on your mortgage, leading to foreclosure.

- Impact on credit reports and FICO scores: Foreclosure and short sales are major negative marks on your credit history, severely impacting your credit score.

- Difficulty securing future loans: A damaged credit score can make it extremely challenging to obtain any type of loan in the future.

Rising Insurance Premiums and Their Effect on Finances

The cost of protecting your home from climate-related risks is rising rapidly. Flood insurance, in particular, has become increasingly expensive in vulnerable coastal areas. This added financial burden can significantly impact household finances, potentially leading to missed payments on mortgages or other debts. These missed payments, in turn, can negatively impact your credit score, creating a vicious cycle.

- Difficulty affording premiums: The escalating cost of insurance can make it difficult to stay current on payments.

- Potential for late payments impacting credit scores: Missed or late insurance payments can have a direct negative effect on your credit report.

- Impact on overall financial stability: Increased insurance costs can strain your budget, affecting your overall financial health.

- Increased financial stress: The added financial pressure can lead to stress and potentially impact other aspects of your life.

Mitigating Climate Risk When Buying a Home

Proactive steps can significantly reduce the financial risks associated with climate change when purchasing a home. Thorough research is crucial. Before committing to a purchase, investigate the property's vulnerability to flooding, erosion, and other climate-related hazards.

- Use online tools to check flood risk and other hazards: Websites like FEMA's Flood Map Service Center provide valuable information about flood risk.

- Consider elevation and proximity to waterways: Higher elevations and greater distances from waterways offer better protection.

- Secure adequate insurance coverage: Understand your insurance needs and secure comprehensive coverage, including flood insurance.

- Diversify investments: Don't put all your financial eggs in one basket. Diversify your investments to mitigate risk.

Conclusion: Protecting Your Credit Score in the Face of Rising Sea Levels

Rising sea levels pose a significant threat to coastal property values, directly impacting homeowners' financial stability and credit scores. Negative equity resulting from property devaluation and the increasing costs of climate-related insurance can lead to missed payments and ultimately damage your credit history. Understanding climate risk is paramount when making homebuying decisions. Conduct a thorough climate risk assessment, utilizing available resources to evaluate potential hazards. Protect your credit score and your financial future by making informed choices; engage in a comprehensive homebuyer's guide to climate risk to minimize your exposure. A proactive approach to climate risk assessment is essential to ensure a sound financial future and protect your credit score from the impacts of rising sea levels and climate change.

Featured Posts

-

Pro D2 L Asbh A Biarritz Un Defi Mental

May 20, 2025

Pro D2 L Asbh A Biarritz Un Defi Mental

May 20, 2025 -

Status Dedushki Mikhael Shumakher

May 20, 2025

Status Dedushki Mikhael Shumakher

May 20, 2025 -

Biarritz Ou Manger Les Dernieres Ouvertures De Restaurants

May 20, 2025

Biarritz Ou Manger Les Dernieres Ouvertures De Restaurants

May 20, 2025 -

Solo Trip Guide Tips And Tricks For The Independent Traveler

May 20, 2025

Solo Trip Guide Tips And Tricks For The Independent Traveler

May 20, 2025 -

Exploring The Reasons For D Wave Quantum Inc S Qbts 2025 Stock Slump

May 20, 2025

Exploring The Reasons For D Wave Quantum Inc S Qbts 2025 Stock Slump

May 20, 2025

Latest Posts

-

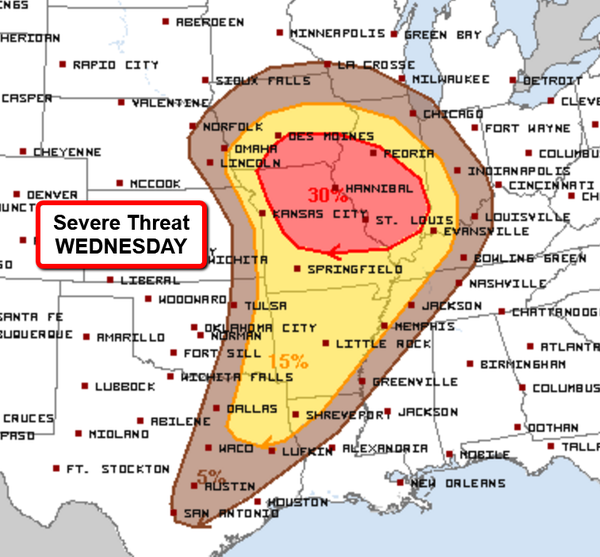

Fast Moving Storms Recognizing And Responding To Damaging Winds

May 20, 2025

Fast Moving Storms Recognizing And Responding To Damaging Winds

May 20, 2025 -

Prepare For High Winds A Guide To Fast Moving Storms

May 20, 2025

Prepare For High Winds A Guide To Fast Moving Storms

May 20, 2025 -

Bundesliga Leverkusen Victory Delays Bayerns Championship Party Kane Sidelined

May 20, 2025

Bundesliga Leverkusen Victory Delays Bayerns Championship Party Kane Sidelined

May 20, 2025 -

Staying Safe During Fast Moving Storms With High Winds

May 20, 2025

Staying Safe During Fast Moving Storms With High Winds

May 20, 2025 -

Boosting Resilience Practical Steps For Improved Mental Well Being

May 20, 2025

Boosting Resilience Practical Steps For Improved Mental Well Being

May 20, 2025