Rockwell Automation's Strong Earnings Drive Market Gains

Table of Contents

Record Revenue Growth Fuels Rockwell Automation's Success

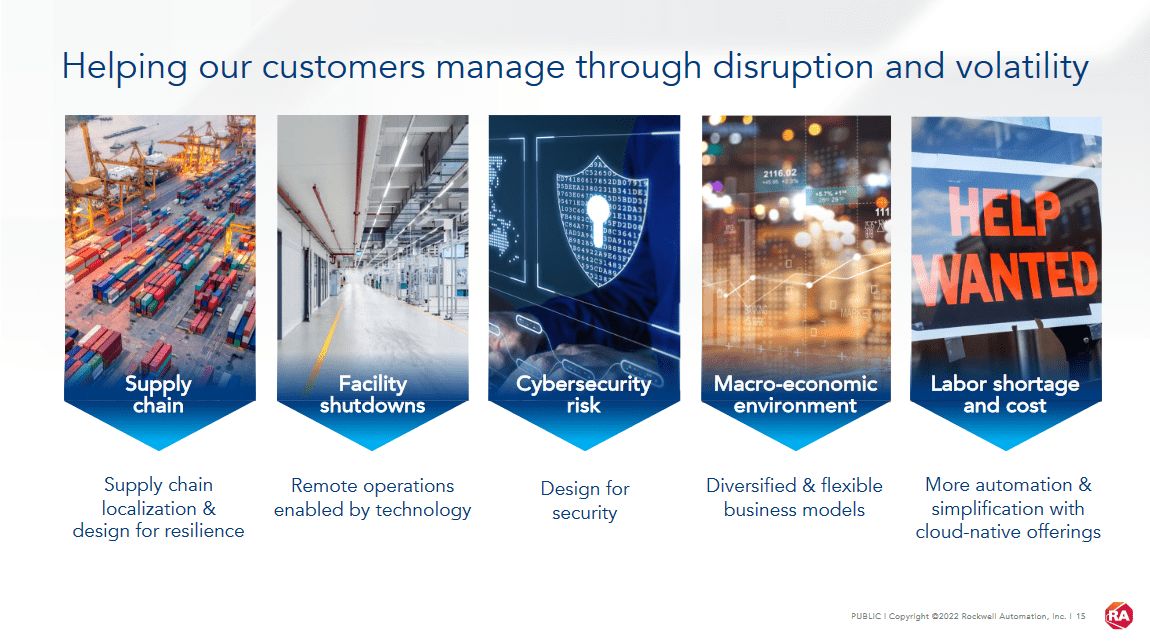

Rockwell Automation's recent earnings report showcased impressive revenue growth, exceeding expectations and solidifying its position as a market leader in industrial automation. This sales increase is a strong indicator of the overall health of the industrial sector and highlights the growing demand for advanced automation solutions.

-

Significant Percentage Increase: The company reported a [Insert specific percentage]% increase in revenue compared to the same quarter last year, demonstrating substantial growth momentum. This surpasses analysts' predictions and reflects a strong performance across various market segments.

-

Diverse Product Segment Contributions: This revenue growth wasn't concentrated in a single area; strong performances were seen across industrial control, software, and services segments. The robust demand for software solutions, particularly in areas like Industrial IoT (IIoT) and digital transformation, significantly contributed to the overall increase.

-

Strategic Partnerships and New Contracts: Several significant new contracts and strategic partnerships played a crucial role in boosting Rockwell Automation's sales. These collaborations broadened the company's reach into new markets and enhanced its product offerings, leading to increased market penetration and revenue generation. [Mention specific examples if available].

-

Robust Order Backlog: The company also reported a substantial order backlog, suggesting continued strong demand and providing a positive outlook for future revenue growth. This backlog indicates that the positive momentum is expected to continue in the coming quarters.

-

Market Share and Competitive Advantage: Rockwell Automation’s strong revenue growth indicates a strengthening of its market share and solidifies its competitive advantage within the industrial automation sector. This success is a testament to the company's innovative solutions and its ability to meet the evolving needs of its customers.

Increased Profitability Demonstrates Operational Efficiency

Beyond revenue growth, Rockwell Automation demonstrated significant improvements in profitability, showcasing enhanced operational efficiency and effective cost management. This increase in profit margin is a critical indicator of the company’s financial health and its ability to generate substantial returns.

-

Profit Margin Expansion: The company's profit margin increased by [Insert specific percentage]%, exceeding analysts' expectations. This improvement reflects the success of the company's initiatives to optimize its operations and control costs.

-

Supply Chain Management and Cost Reduction: Effective supply chain management and strategic cost reduction measures played a key role in boosting profitability. Rockwell Automation implemented efficient processes to mitigate the impact of supply chain disruptions and control operational expenses.

-

Operational Efficiency Initiatives: Initiatives focused on streamlining processes, improving manufacturing efficiency, and leveraging technological advancements to automate internal operations contributed significantly to the increased profit margin.

-

Impact on Investor Confidence: This improved profitability has significantly boosted investor confidence in Rockwell Automation, resulting in a positive impact on the company's stock price and overall market valuation.

Positive Outlook for the Industrial Automation Sector

The strong performance of Rockwell Automation reflects a broader positive trend within the industrial automation sector. Several key factors indicate continued growth and exciting opportunities in this dynamic market.

-

Industry 4.0 and Digital Transformation: The ongoing adoption of Industry 4.0 principles and digital transformation initiatives across various industries is driving significant demand for industrial automation solutions. Companies are increasingly investing in automation to enhance efficiency, improve productivity, and gain a competitive edge.

-

Technological Advancements: Rapid advancements in technologies like artificial intelligence (AI), machine learning (ML), and the Industrial Internet of Things (IIoT) are fueling innovation within the industrial automation sector, creating new opportunities for growth.

-

Long-Term Growth Prospects: The long-term growth prospects for Rockwell Automation and the wider industrial automation market remain positive, driven by sustained demand for automation solutions across various industries.

-

Potential Challenges and Risks: While the outlook is positive, it's important to acknowledge potential challenges like geopolitical instability, economic downturns, and fluctuations in raw material prices, which could impact future growth.

Rockwell Automation's Strategic Initiatives Driving Growth

Rockwell Automation's success is not merely a result of market trends; it's also a testament to its proactive strategic initiatives.

-

Investment in R&D and Innovation: Significant investments in research and development (R&D) are driving innovation and the development of cutting-edge automation technologies, which strengthens the company's competitive position.

-

Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions have broadened Rockwell Automation's product portfolio, expanded its market reach, and enhanced its technological capabilities.

-

Sustainability Initiatives: A focus on sustainability initiatives resonates with environmentally conscious customers and positions Rockwell Automation as a responsible corporate citizen, attracting environmentally conscious investors.

Conclusion

Rockwell Automation's strong earnings, driven by robust revenue growth and enhanced profitability, paint a positive picture for both the company and the broader industrial automation sector. The company's strategic initiatives and the ongoing demand for advanced automation solutions position it for continued success. The impressive Q[Quarter] earnings are a clear indication of the company's strength and the positive trajectory of the industrial automation market.

Call to Action: Stay informed about Rockwell Automation's performance and the evolving landscape of industrial automation. Follow our updates for insights into future Rockwell Automation earnings and their impact on market gains. Learn more about investing in the industrial automation sector by visiting [link to relevant resource].

Featured Posts

-

Novace Bez Tebe Ni Ja Ne Bih Bio Ovde Mensik O Dokovicevom Uticaju

May 17, 2025

Novace Bez Tebe Ni Ja Ne Bih Bio Ovde Mensik O Dokovicevom Uticaju

May 17, 2025 -

Rune Osvaja Barselonu Pobeda Nad Povredjenim Alkarasom

May 17, 2025

Rune Osvaja Barselonu Pobeda Nad Povredjenim Alkarasom

May 17, 2025 -

Buying A House Managing Student Loan Debt Effectively

May 17, 2025

Buying A House Managing Student Loan Debt Effectively

May 17, 2025 -

Student Loan Debt Relief Black Americans Response To Trumps Actions

May 17, 2025

Student Loan Debt Relief Black Americans Response To Trumps Actions

May 17, 2025 -

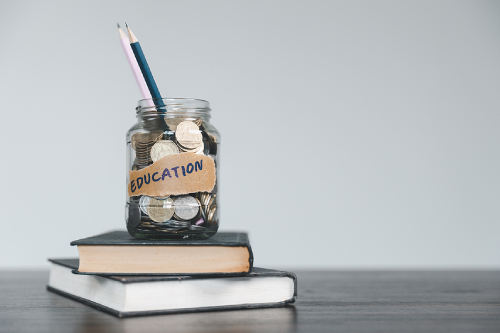

Donald Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025

Donald Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025

Latest Posts

-

Analyzing The Pistons And Knicks Key Differences And Winning Strategies

May 17, 2025

Analyzing The Pistons And Knicks Key Differences And Winning Strategies

May 17, 2025 -

Detroit Pistons Vs New York Knicks Predicting Success

May 17, 2025

Detroit Pistons Vs New York Knicks Predicting Success

May 17, 2025 -

Piston Vs Knicks A Season Head To Head Comparison

May 17, 2025

Piston Vs Knicks A Season Head To Head Comparison

May 17, 2025 -

Emirates Id Fees For Newborn Babies A Guide For Uae Residents March 2025

May 17, 2025

Emirates Id Fees For Newborn Babies A Guide For Uae Residents March 2025

May 17, 2025 -

27 Puntos De Anunoby Impulsan A Knicks A Vencer A 76ers

May 17, 2025

27 Puntos De Anunoby Impulsan A Knicks A Vencer A 76ers

May 17, 2025