Sasol's 2023 Strategy Update: What Investors Need To Know

Table of Contents

Financial Performance and Outlook

Sasol's financial performance for the period, as detailed in the 2023 strategy update, offers a mixed bag for investors. While certain metrics show improvement, others present ongoing challenges. Understanding these nuances is crucial for assessing the overall health and future prospects of the company. Key areas to consider include revenue generation, profitability, debt reduction progress, and the sustainability of dividend payouts.

-

Review of key financial figures: The update should detail revenue, net income, and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Investors should analyze the growth or decline in these figures compared to previous periods and industry benchmarks. A thorough understanding of the drivers behind these numbers – whether positive or negative – is essential.

-

Analysis of debt reduction strategies and their effectiveness: Sasol's debt levels have been a focus for investors. The 2023 update should provide details on the effectiveness of strategies implemented to reduce debt. Investors need to assess whether the progress made is sufficient and sustainable in the long term. Analyzing the debt-to-equity ratio and interest coverage ratios will provide further insight.

-

Discussion of dividend policy and future payout expectations: Dividend payouts are a key consideration for many investors. The strategy update should clarify Sasol's dividend policy, outlining any changes and expectations for future payouts. Understanding the rationale behind any dividend changes and the company's commitment to returning value to shareholders is critical.

-

Assessment of future financial outlook based on market predictions: Sasol's projections for future financial performance, considering market conditions and anticipated industry trends, are crucial. Investors should carefully evaluate the assumptions underlying these projections and compare them to their own assessment of the market. Analyzing the sensitivity of these projections to various external factors is equally vital.

Strategic Priorities and Initiatives

Sasol's 2023 strategy update emphasizes several key strategic priorities designed to drive future growth and sustainability. Understanding these priorities is crucial for assessing the company's long-term vision and potential. Key areas of focus include growth opportunities, innovation, sustainability targets, and ESG (Environmental, Social, and Governance) performance.

-

Discussion of key strategic pillars: Sasol's strategic pillars likely encompass operational excellence, growth in specific sectors (e.g., chemicals, energy), and market diversification. Investors should analyze the feasibility and potential returns associated with these pillars.

-

Analysis of R&D investments and technological advancements: Innovation is crucial in the energy and chemicals sectors. The update should highlight Sasol's investment in research and development and any significant technological advancements. This insight helps gauge the company's competitiveness and its ability to adapt to future market demands.

-

Overview of sustainability targets and decarbonization plans: In an increasingly environmentally conscious world, Sasol's sustainability targets and decarbonization plans are paramount. Investors should assess the ambition and realism of these targets, considering the company's operational footprint and industry trends.

-

Assessment of Sasol’s ESG performance and future commitments: ESG performance is becoming increasingly important to investors. The update should detail Sasol's ESG performance metrics and its future commitments. Analyzing this information helps assess the company's alignment with investor preferences and its risk profile related to ESG factors.

Operational Highlights and Challenges

Sasol's operational performance is central to its financial health. The 2023 strategy update should provide insights into production volumes across different business segments, operational efficiency improvements or setbacks, and any significant operational challenges.

-

Review of production output across different business segments: Investors need a detailed understanding of Sasol's production output in its various segments (e.g., chemicals, energy). Analyzing the performance of each segment helps identify areas of strength and weakness.

-

Analysis of operational efficiency improvements or setbacks: Improvements in operational efficiency are crucial for profitability. The strategy update should highlight efforts to improve efficiency and any setbacks encountered.

-

Discussion of any significant operational challenges: The update should address any significant operational challenges, such as supply chain issues, safety incidents, or regulatory hurdles. Understanding these challenges and how Sasol plans to mitigate them is essential.

-

Assessment of the company's resilience to external risks: Geopolitical instability and commodity price fluctuations represent significant external risks. The strategy update should assess Sasol's resilience to these risks and the measures in place to manage them.

Impact on Investors and Investment Implications

The Sasol 2023 strategy update significantly impacts investor sentiment and investment decisions. Analyzing the potential impact on Sasol's share price, valuation, and analyst ratings is crucial for informed investment choices.

-

Analysis of the potential impact on Sasol's share price: The strategy update may influence investor confidence, potentially affecting the Sasol share price. Understanding the factors influencing this impact is vital.

-

Discussion of the company's valuation and its attractiveness to investors: The update should provide insights into Sasol's valuation, allowing investors to assess its attractiveness relative to other investment opportunities.

-

Summary of analyst ratings and forecasts for Sasol stock: Tracking analyst ratings and forecasts provides an independent perspective on Sasol's future prospects. Comparing these views with your own analysis is important.

-

Investment recommendations based on the strategy update: Based on the combined analysis of financial performance, strategic priorities, operational highlights, and market dynamics, investors can formulate informed investment recommendations.

Conclusion

Sasol's 2023 strategy update reveals a company navigating a dynamic energy landscape, focusing on financial stability, strategic growth, and sustainability. While challenges remain, the outlined initiatives provide a roadmap for future success. However, diligent monitoring of Sasol's performance against these goals is necessary. Stay informed on Sasol's progress by regularly reviewing their investor relations materials and conducting thorough due diligence before making any investment decisions related to Sasol stock and future Sasol strategy announcements. Understanding the intricacies of the Sasol 2023 strategy update is crucial for informed investment choices.

Featured Posts

-

Tampoy Perissotera Epeisodia Sto Mega Kathe Evdomada

May 20, 2025

Tampoy Perissotera Epeisodia Sto Mega Kathe Evdomada

May 20, 2025 -

Pandemic Fraud Lab Owner Admits To Falsifying Covid Test Results

May 20, 2025

Pandemic Fraud Lab Owner Admits To Falsifying Covid Test Results

May 20, 2025 -

New Ai Powered Writing Course Agatha Christie Style Bbc

May 20, 2025

New Ai Powered Writing Course Agatha Christie Style Bbc

May 20, 2025 -

Hamiltonin Siirto Ferrarille Unelma Vai Painajainen

May 20, 2025

Hamiltonin Siirto Ferrarille Unelma Vai Painajainen

May 20, 2025 -

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Latest Posts

-

Bucharest Tiriac Open Cobolli Secures Maiden Atp Win

May 20, 2025

Bucharest Tiriac Open Cobolli Secures Maiden Atp Win

May 20, 2025 -

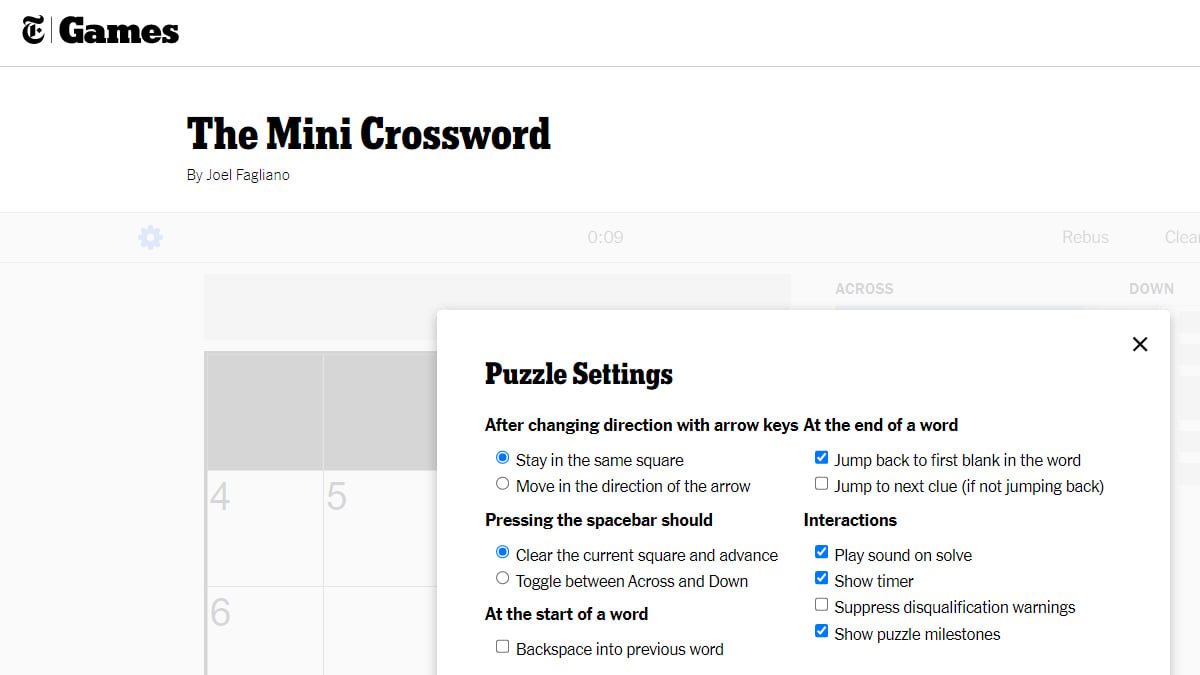

Complete Guide Nyt Mini Crossword Solutions March 24 2025

May 20, 2025

Complete Guide Nyt Mini Crossword Solutions March 24 2025

May 20, 2025 -

Nyt Mini Crossword Help Answers And Clues For March 24 2025

May 20, 2025

Nyt Mini Crossword Help Answers And Clues For March 24 2025

May 20, 2025 -

Nyt Mini Crossword Answers And Clues March 24 2025

May 20, 2025

Nyt Mini Crossword Answers And Clues March 24 2025

May 20, 2025 -

Nyt Mini Crossword Hints And Answers March 20 2025

May 20, 2025

Nyt Mini Crossword Hints And Answers March 20 2025

May 20, 2025