SEC Chairman Atkins To Restructure Crypto Broker Rules

Table of Contents

The Current Regulatory Landscape for Crypto Brokers

Currently, the regulatory environment surrounding crypto businesses operating as brokers is notably ambiguous. The lack of clear-cut definitions for crypto assets under existing securities laws creates significant hurdles for compliance. Many existing regulations, designed for traditional financial markets, are ill-equipped to handle the decentralized and innovative nature of the cryptocurrency world.

- Lack of clear definitions: The SEC has struggled to definitively classify many cryptocurrencies as securities or commodities, leading to uncertainty for broker-dealers. This ambiguity makes it difficult to determine the appropriate regulatory framework.

- Regulatory mismatch: Traditional securities laws often fail to adequately address the unique aspects of crypto trading, such as decentralized exchanges and automated market makers (AMMs).

- Compliance challenges: Crypto brokers face considerable difficulties in complying with existing securities laws, including registration requirements, anti-money laundering (AML) rules, and know-your-customer (KYC) regulations.

- Past SEC actions: The SEC has taken enforcement actions against several cryptocurrency platforms for alleged violations of securities laws, highlighting the existing regulatory uncertainty and the potential for penalties. These actions underscore the need for clearer guidelines.

Key Aspects of the Proposed Restructuring

Chairman Atkins' plan for restructuring crypto broker rules aims to bring much-needed clarity and oversight to the industry. The proposed changes are wide-ranging and target several key areas:

- Increased registration scrutiny: The SEC intends to increase scrutiny of the registration and licensing processes for crypto broker-dealers, ensuring that only compliant entities operate in the market.

- Stricter custody requirements: New rules are anticipated concerning the custody of digital assets, potentially requiring higher security standards and more transparent practices by brokers.

- Enhanced reporting and transparency: The restructuring will likely mandate more robust reporting and transparency requirements, providing greater visibility into the activities of crypto broker-dealers.

- Strengthened AML/KYC compliance: More stringent anti-money laundering (AML) and know-your-customer (KYC) compliance measures are expected to combat illicit activities within the crypto market.

- Security classification clarification: A key goal is to provide clearer guidance on which cryptocurrencies are considered securities, resolving the ambiguity that currently plagues the industry.

Potential Impacts on the Crypto Industry

The proposed restructuring of crypto broker rules carries both potential benefits and drawbacks for the cryptocurrency industry:

- Increased investor confidence: Greater regulatory clarity could lead to increased investor confidence, attracting more institutional and retail capital into the crypto market.

- Reduced illicit activity: Enhanced AML/KYC compliance and increased oversight could effectively curb illicit activities, such as money laundering and terrorist financing, within the crypto space.

- Higher compliance costs: The stricter regulations and increased reporting requirements will likely lead to higher compliance costs for crypto brokers, potentially harming smaller players and hindering innovation.

- Innovation limitations: Overly burdensome regulations could stifle innovation and experimentation within the cryptocurrency space, limiting the development of new technologies and applications.

- Impact on retail access: The changes could impact the accessibility of crypto investments for retail investors, potentially increasing barriers to entry.

Reactions and Opinions from the Crypto Community

The proposed changes have elicited a mixed response from various stakeholders in the crypto community:

- Industry leaders' concerns: Prominent crypto exchanges and industry leaders have expressed concerns about the potential impact of the proposed regulations on innovation and competition.

- Legal experts' analysis: Legal experts and regulatory analysts are divided on the effectiveness and potential unintended consequences of the restructuring.

- Investor perspectives: Cryptocurrency investors and traders hold varying opinions, with some welcoming increased regulatory clarity while others worry about potential restrictions on their trading activities.

- Potential legal challenges: There's a possibility of legal challenges to the restructuring from crypto businesses and individuals who believe the new rules are overly burdensome or unfair.

Conclusion

The SEC's restructuring of crypto broker rules under Chairman Atkins marks a pivotal moment for the cryptocurrency industry. While the proposed changes aim to enhance investor protection and curtail illegal activities, they also pose significant hurdles for crypto businesses. The ultimate outcome will significantly shape the future of cryptocurrency trading and investment in the United States.

Call to Action: Stay informed about the constantly evolving landscape of crypto regulation. Follow the latest developments regarding the SEC’s restructuring of crypto broker rules under Chairman Atkins to effectively navigate this dynamic environment and understand its impact on your investments and business. Learn more about the implications of these changes at [link to relevant resource, e.g., SEC website or a reputable financial news source].

Featured Posts

-

Spoment Na Dzherard Btlr Za Blgariya Koyto Razvlnuva Fenovete

May 13, 2025

Spoment Na Dzherard Btlr Za Blgariya Koyto Razvlnuva Fenovete

May 13, 2025 -

Colin Josts Earnings Compared To Scarlett Johansson Analyzing The Wealth Gap In Celebrity Relationships

May 13, 2025

Colin Josts Earnings Compared To Scarlett Johansson Analyzing The Wealth Gap In Celebrity Relationships

May 13, 2025 -

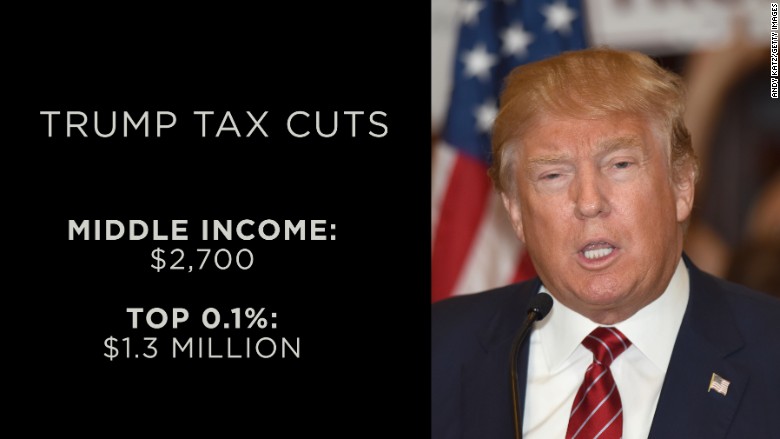

Details Emerge House Republicans Plan For Trump Tax Cuts

May 13, 2025

Details Emerge House Republicans Plan For Trump Tax Cuts

May 13, 2025 -

Eao Gazifikatsiya V Ramkakh Programmy Razvitiya Gazproma

May 13, 2025

Eao Gazifikatsiya V Ramkakh Programmy Razvitiya Gazproma

May 13, 2025 -

Toronto Raptors Rebuilding Year Seventh Best Lottery Odds

May 13, 2025

Toronto Raptors Rebuilding Year Seventh Best Lottery Odds

May 13, 2025

Latest Posts

-

Todays News Air Traffic Controller Crisis Major Court Cases And The Rise Of Thc Beverages

May 13, 2025

Todays News Air Traffic Controller Crisis Major Court Cases And The Rise Of Thc Beverages

May 13, 2025 -

Self Defense Insurance Protecting Yourself After A Shooting Incident

May 13, 2025

Self Defense Insurance Protecting Yourself After A Shooting Incident

May 13, 2025 -

Townhouse Hit By Three Separate Car Crashes In Two Years Cnn

May 13, 2025

Townhouse Hit By Three Separate Car Crashes In Two Years Cnn

May 13, 2025 -

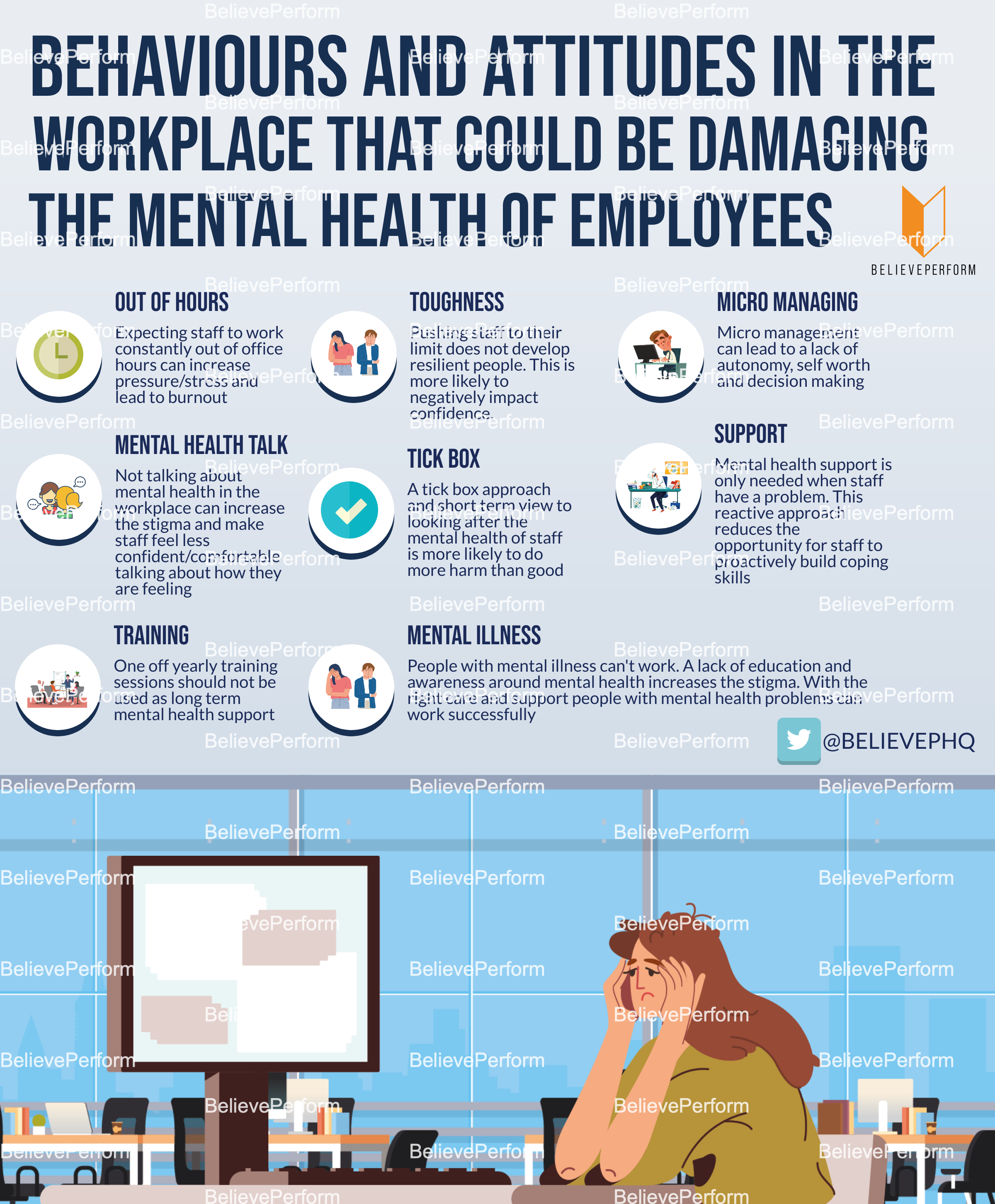

Power Shift In The Workplace How Bosses Attitudes Impact Employees

May 13, 2025

Power Shift In The Workplace How Bosses Attitudes Impact Employees

May 13, 2025 -

India Pakistan Tensions Ease A Delicate Ceasefire Holds

May 13, 2025

India Pakistan Tensions Ease A Delicate Ceasefire Holds

May 13, 2025