Senegal, Gabon, Madagascar, And Beyond: Analyzing PwC's African Withdrawal

Table of Contents

The Scale and Scope of PwC's African Retrenchment

PwC's decision isn't a minor adjustment; it represents a substantial reshaping of its African presence. While the exact details remain fluid, the scale of the retrenchment is considerable, impacting numerous countries beyond Senegal, Gabon, and Madagascar. This involves the closure of offices, reduction of services, and unfortunately, job losses for many employees.

- Key Countries Affected: While specifics vary, reports indicate significant reductions or complete withdrawals from countries including, but not limited to, Senegal, Gabon, Madagascar, Burkina Faso, and several others in Central and West Africa. The exact number of affected countries is still emerging.

- Services Impacted: The impact extends across a range of PwC's services. Auditing, consulting, tax advisory, and other crucial business support services are all likely to be affected, depending on the specific country and the extent of the withdrawal.

- Quantifiable Impact: Precise figures on the number of employees affected, offices closed, and revenue losses are difficult to obtain definitively at this stage. However, news reports and industry analysis suggest a considerable impact on PwC's overall African operations, representing a significant shift in their strategic priorities.

Underlying Reasons for PwC's Decision

PwC's strategic shift in Africa is likely driven by a complex interplay of factors. It's not a single cause but rather a confluence of challenges impacting the firm's long-term viability and profitability in certain markets.

- Economic Challenges: Several African economies have faced significant economic headwinds in recent years, including periods of instability, currency fluctuations, and reduced business activity. These economic uncertainties can directly impact demand for professional services.

- Regulatory Scrutiny and Compliance Costs: Increased regulatory scrutiny and compliance costs across various African nations add another layer of complexity and expense for businesses, including professional services firms. Navigating diverse regulatory landscapes can be challenging and costly.

- Competitive Pressures: The professional services sector in Africa is becoming increasingly competitive. The emergence of strong local and international firms vying for market share puts pressure on existing players to maintain profitability.

- Internal Restructuring and Prioritization: PwC, like many global corporations, regularly reviews its portfolio of operations and may be prioritizing markets perceived as offering better growth prospects and higher returns on investment.

Impact on Affected African Economies and Businesses

PwC's withdrawal has significant implications for the affected African economies and businesses. The ramifications extend beyond the immediate loss of PwC's services.

- Job Losses and Unemployment: The reduction or closure of PwC offices will undoubtedly lead to job losses, contributing to unemployment in these countries. This will disproportionately affect skilled professionals in the accounting and consulting sectors.

- Access to Auditing and Consulting Services: The departure of a major player like PwC creates a gap in the availability of high-quality auditing and consulting services. This could hinder the growth and development of local businesses.

- Foreign Investment Attraction: The perception of reduced access to robust professional services might negatively impact foreign investment attraction, as investors often seek assurance of high-quality auditing and due diligence capabilities.

- Corporate Governance and Financial Reporting Standards: The withdrawal of PwC might have consequences for corporate governance and financial reporting standards, depending on the extent to which PwC played a role in establishing and maintaining these standards in the affected countries.

Implications for the Future of Professional Services in Africa

PwC's decision has far-reaching implications for the future of the professional services industry in Africa. It reshapes the competitive landscape and presents both challenges and opportunities.

- Shift in Competitive Landscape: Other international and local professional services firms are poised to benefit from PwC's departure, potentially expanding their market share in the affected regions.

- Opportunities for Other Firms: This presents opportunities for competitors, particularly those already established in the region, to expand their service offerings and client base. However, it's a double-edged sword; increased responsibility necessitates enhanced capacity and resources.

- Need for Local Talent and Capacity Building: The departure of PwC underscores the crucial need for further investment in developing local talent and building the capacity of indigenous professional services firms to meet the increasing demand.

Conclusion: Understanding the Long-Term Effects of PwC's African Withdrawal

PwC's African withdrawal is a multifaceted event with significant implications for the affected countries and the broader African professional services sector. The decision stems from a confluence of economic challenges, regulatory pressures, and competitive dynamics, prompting a strategic reassessment of their African operations. The impact on local economies, businesses, and the availability of crucial services is undeniable. Further research into PwC's African withdrawal is crucial to understand the long-term consequences and to inform strategies for fostering a more robust and resilient professional services sector in Africa. Stay informed about the evolving landscape of professional services in Africa following PwC’s recent decisions, and actively support the development of local talent and capacity building to ensure the continent's continued economic progress.

Featured Posts

-

Nyt Spelling Bee February 26th 360 Hints Answers And Solutions

Apr 29, 2025

Nyt Spelling Bee February 26th 360 Hints Answers And Solutions

Apr 29, 2025 -

Will Trump Pardon Rose Exploring The Possibilities And Ramifications

Apr 29, 2025

Will Trump Pardon Rose Exploring The Possibilities And Ramifications

Apr 29, 2025 -

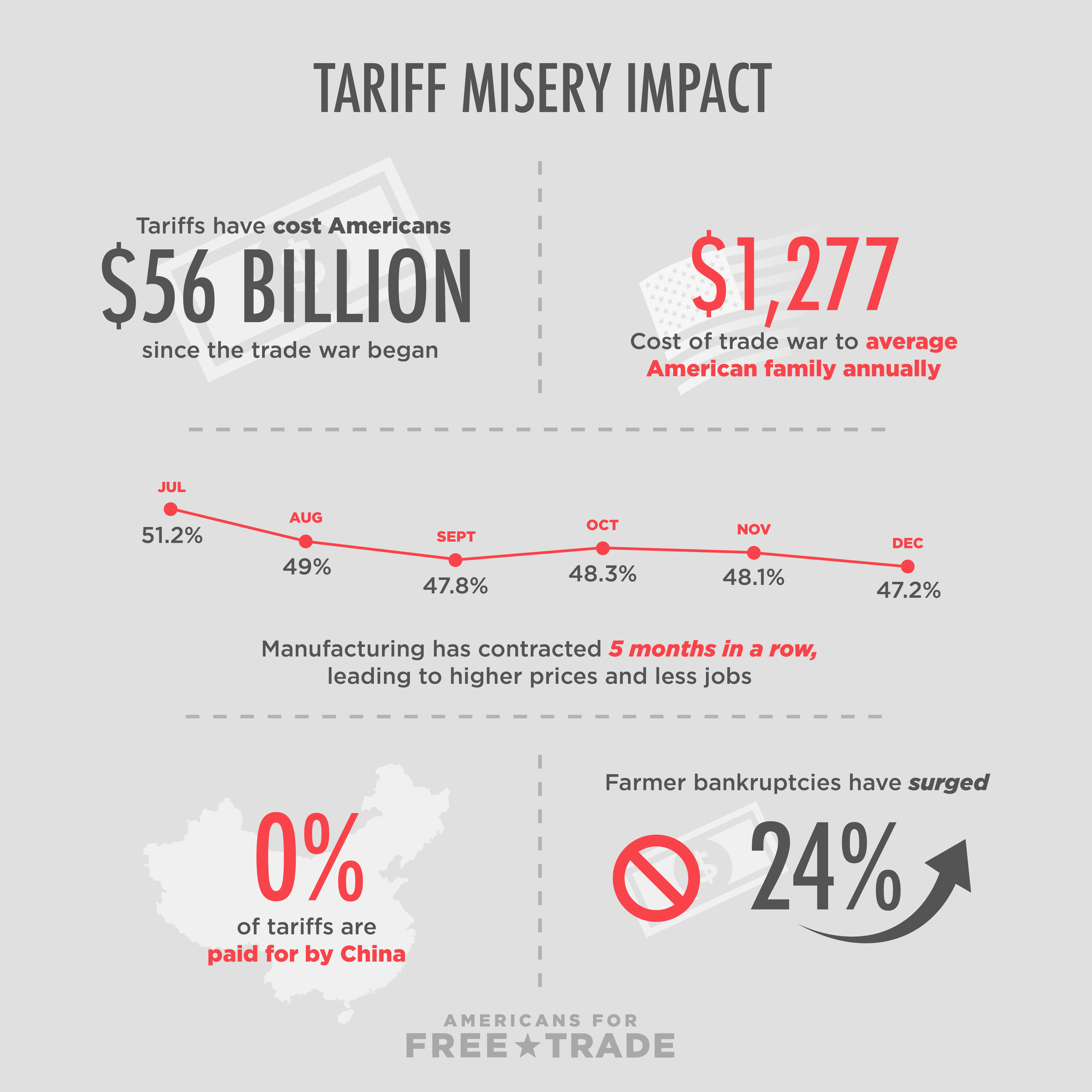

Cost Cutting Measures Surge As U S Companies Face Tariff Woes

Apr 29, 2025

Cost Cutting Measures Surge As U S Companies Face Tariff Woes

Apr 29, 2025 -

Enhancing Road Safety For Individuals With Adhd

Apr 29, 2025

Enhancing Road Safety For Individuals With Adhd

Apr 29, 2025 -

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Latest Posts

-

Mask Singer 2025 L Autruche Demasquee Pronostics Et Revelations

May 12, 2025

Mask Singer 2025 L Autruche Demasquee Pronostics Et Revelations

May 12, 2025 -

Scenes De Menages Longevite Et Complicite Entre Gerard Hernandez Et Chantal Ladesou

May 12, 2025

Scenes De Menages Longevite Et Complicite Entre Gerard Hernandez Et Chantal Ladesou

May 12, 2025 -

Resi Awards 2025 A Look At The Winning Projects

May 12, 2025

Resi Awards 2025 A Look At The Winning Projects

May 12, 2025 -

Chantal Ladesou Cash Sur Ines Reg Dans Mask Singer Ses Revelations Inattendues

May 12, 2025

Chantal Ladesou Cash Sur Ines Reg Dans Mask Singer Ses Revelations Inattendues

May 12, 2025 -

L Indissociable Duo De Scenes De Menages Hernandez Et Ladesou

May 12, 2025

L Indissociable Duo De Scenes De Menages Hernandez Et Ladesou

May 12, 2025