Sharp Decline In Amsterdam Stock Exchange: 7% Opening Plunge

Table of Contents

Potential Causes of the AEX's 7% Plunge

Several interconnected factors likely contributed to the dramatic 7% drop in the AEX. Understanding these causes is crucial for assessing the situation's severity and potential long-term effects.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, significantly impacting investor sentiment and market stability.

- Increased global inflation and interest rate hikes: Persistent inflation across the globe has forced central banks, including the European Central Bank, to implement aggressive interest rate hikes. This increases borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability.

- Geopolitical tensions impacting global supply chains: The ongoing war in Ukraine, coupled with escalating geopolitical tensions in other regions, continues to disrupt global supply chains, leading to shortages, price increases, and overall economic instability. This uncertainty directly affects businesses' ability to operate efficiently, impacting their stock performance.

- Concerns about a potential recession impacting investor sentiment: Growing concerns about a potential global recession are weighing heavily on investor sentiment. The fear of reduced corporate earnings and decreased consumer spending is driving investors towards safer assets, leading to a sell-off in riskier equities like those listed on the AEX.

Sector-Specific Factors

The decline wasn't uniform across all sectors. Certain industries experienced disproportionately large losses.

- Energy sector downturn: Fluctuations in global energy prices, particularly natural gas, significantly impacted energy companies listed on the AEX. Decreased demand or supply chain issues could explain the sharp drop in their share values. For example, [insert example of an energy company listed on the AEX and its percentage loss].

- Technology stock corrections: The technology sector has been experiencing a correction, with several tech companies listed on the AEX experiencing substantial losses. This could be attributed to increased interest rates making growth stocks less attractive and a reassessment of valuations. [Insert example of a tech company and its percentage loss].

- Financial sector concerns: Concerns about rising interest rates and potential loan defaults could have negatively affected financial institutions listed on the AEX, contributing to the overall market decline. [Insert example of a financial company and its percentage loss].

Domestic Economic Concerns

Internal factors within the Netherlands also played a role in the AEX's downturn.

- High inflation and cost of living: The Netherlands, like many European countries, is grappling with high inflation, impacting consumer spending and business confidence. This directly affects the profitability of companies and their stock valuations.

- Government policies: Recent government policies or announcements, perhaps related to taxation or regulation, may have negatively impacted investor confidence and contributed to the market decline. Specific details on these policies would need further research.

- Housing market slowdown: A potential slowdown in the Dutch housing market, a significant aspect of the Dutch economy, could impact related sectors and contribute to negative investor sentiment.

Impact of the Decline on Investors and the Dutch Economy

The 7% plunge in the AEX has significant implications for investors and the Dutch economy.

Investor Sentiment and Confidence

The sharp decline has undoubtedly shaken investor confidence, leading to increased market volatility and potential for further price fluctuations.

- Decreased trading activity: Investors may become hesitant to trade, waiting for more clarity on the market's direction.

- Shift towards safer investments: Investors might shift their portfolios towards less risky assets, such as government bonds, further impacting the AEX.

- Long-term investment strategy reassessment: Investors with long-term investment strategies may need to reassess their plans, considering the increased uncertainty.

Economic Consequences for the Netherlands

The AEX decline has broader implications for the Netherlands' overall economic health.

- Reduced consumer spending: Decreased market confidence can lead to reduced consumer spending, further impacting economic growth.

- Impact on employment: If companies experience reduced profitability due to the stock market decline, they may be forced to cut jobs.

- Government intervention: The Dutch government may need to implement economic stimulus measures to mitigate the negative consequences.

Expert Opinions and Market Predictions

Understanding expert opinions is vital for navigating the current market uncertainty.

Analyst Comments and Forecasts

Financial analysts offer varying perspectives on the AEX's future performance. Some predict a short-term recovery, while others foresee a more prolonged downturn. [Insert quotes from financial analysts and their predictions]. It's crucial to note that these are predictions, not guarantees.

Trading Strategies in a Volatile Market

Given the current market volatility, investors need to adapt their trading strategies.

- Diversification: Diversifying investments across different asset classes and sectors is crucial to mitigate risk.

- Risk management: Implementing robust risk management strategies is paramount, including setting stop-loss orders and carefully assessing risk tolerance.

- Long-term perspective: Maintaining a long-term investment perspective is crucial, avoiding impulsive decisions driven by short-term market fluctuations.

Conclusion

The sharp 7% decline in the Amsterdam Stock Exchange marks a significant event with potentially far-reaching consequences for investors and the Dutch economy. Global uncertainty, sector-specific factors, and domestic economic concerns all played a role in this dramatic drop. Understanding these contributing factors is essential for navigating the current market volatility.

Call to Action: Stay informed about the ongoing developments in the Amsterdam Stock Exchange (AEX) and consider consulting a financial advisor to navigate this period of market volatility. Understanding the factors contributing to the sharp decline in the AEX is crucial for making informed investment decisions. Monitor the Amsterdam Stock Exchange closely for further updates and adjust your investment strategy accordingly.

Featured Posts

-

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025 -

Bardellas Path To Power Can He Unite Frances Right

May 24, 2025

Bardellas Path To Power Can He Unite Frances Right

May 24, 2025 -

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025 -

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025 -

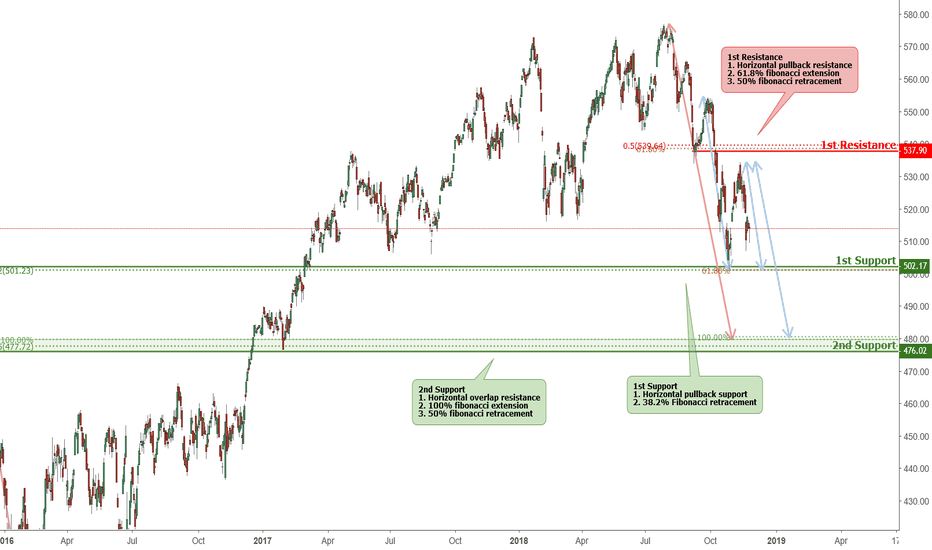

Aex Index Falls Below Key Support Level Marking A Significant Low

May 24, 2025

Aex Index Falls Below Key Support Level Marking A Significant Low

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025