Should I Refinance My Federal Student Loans? A Step-by-Step Analysis

Table of Contents

H2: Understanding Your Current Federal Student Loans

Before even considering refinancing, you must thoroughly understand your existing federal student loans. This involves identifying the types of loans you have and grasping their current interest rates and repayment plans.

H3: Types of Federal Student Loans

Federal student loans come in various forms, each with its own set of terms and conditions. Understanding these differences is crucial before exploring refinancing options. Key types include:

- Direct Subsidized Loans: The government pays the interest while you're in school (under certain conditions) and during grace periods.

- Direct Unsubsidized Loans: Interest accrues from the moment the loan is disbursed, even while you're in school.

- Direct Consolidation Loan: This allows you to combine multiple federal student loans into a single loan, potentially simplifying repayment.

- Other Federal Student Aid Programs: There are other federal programs offering student financial assistance that may affect your refinancing eligibility. It's important to understand how these programs are related to your loans.

Knowing the specific type of federal student loan you hold is the first step towards understanding your repayment options and whether refinancing would be beneficial. You can find this information through the National Student Loan Data System (NSLDS) website or your loan servicer's statements.

H3: Current Interest Rates and Repayment Plans

Your current interest rate significantly impacts your monthly payments and total repayment cost. Equally important is understanding your current repayment plan. Common plans include:

- Standard Repayment Plan: Fixed monthly payments over a 10-year period.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

- Income-Driven Repayment (IDR) Plans: Payments are based on your income and family size. These plans typically extend repayment over a longer period (20-25 years).

To find this information, check your loan documents or your loan servicer's website. Calculating your current monthly payments will provide a baseline for comparison when considering refinancing options. Understanding your loan terms, including the loan length and any associated fees, is also essential.

- Steps to find your loan information: Check your loan documents, access your online account with your loan servicer, or contact your servicer directly.

- Calculating current monthly payments: Use an online student loan calculator or refer to your loan servicer's statement.

- Understanding loan terms: Carefully review your loan documents to understand the length of your loan, the interest rate, and any associated fees.

H2: Exploring Private Student Loan Refinancing Options

If you decide to explore refinancing, you'll be working with private lenders. This section details the process and what to look for.

H3: How Private Refinancing Works

Private refinancing involves replacing your federal student loans with a new loan from a private lender. This new loan will likely have a different interest rate and repayment terms than your federal loans. The process typically involves applying online, providing documentation, and undergoing a credit check. Keywords: private lender, refinancing, student loan refinance.

H3: Comparing Interest Rates and Terms

Shopping around for the best rates is critical. Different lenders offer varying interest rates, fees, and repayment terms. Compare offers based on:

- Annual Percentage Rate (APR): This represents the total cost of the loan, including interest and fees.

- Interest Rate: The percentage charged on the outstanding loan balance.

- Repayment Terms: The length of the loan and the monthly payment amount.

Remember to compare the APR, not just the interest rate, as fees can significantly affect the total cost of the loan.

- Factors to consider when choosing a private lender: Reputation, customer reviews, transparency of fees, and customer service.

- Shopping for the best rates: Compare offers from multiple lenders to ensure you get the best possible terms.

- Potential fees: Be aware of potential fees such as application fees and origination fees.

H2: Weighing the Pros and Cons of Refinancing Federal Student Loans

Refinancing your federal student loans can offer potential benefits but also comes with significant drawbacks. Careful consideration of both is crucial.

H3: Potential Benefits of Refinancing

- Lower Interest Rates: You might secure a lower interest rate than what you currently have on your federal loans, leading to lower monthly payments and reduced total interest paid.

- Shorter Repayment Terms: A shorter loan term can help you pay off your debt faster.

- Simplified Payments: Consolidating multiple loans into one simplifies the repayment process.

H3: Potential Drawbacks of Refinancing

-

Loss of Federal Loan Protections: This is perhaps the most significant drawback. Refinancing means losing access to crucial federal benefits such as income-driven repayment plans, deferment, and forbearance options. These are safety nets that can provide financial relief during difficult times.

-

Impact on Credit Score: Defaulting on a private loan can severely damage your credit score, making it harder to secure loans or credit in the future.

-

Implications for Future Federal Programs: Refinancing may affect your eligibility for future federal student loan programs or other forms of financial assistance.

-

Risks of losing federal loan benefits: Carefully consider the potential consequences of losing access to income-driven repayment, deferment, and forbearance options.

-

Impact on credit score from default: A defaulted private loan can severely damage your credit, making it harder to obtain credit in the future.

-

Implications for future federal programs: Refinancing could impact future access to federal student loan programs and other government aid.

H2: Step-by-Step Guide to Refinancing

If, after careful consideration, you decide to proceed, this section outlines the refinancing process.

H3: Checking Your Credit Score

Lenders use your credit score to assess your creditworthiness. A higher credit score typically results in more favorable loan terms. Check your credit report for accuracy and work to improve your score if necessary.

H3: Comparing Lenders and Rates

Before applying, compare offers from multiple lenders to secure the best interest rate and repayment terms.

H3: Completing the Application Process

The application process usually involves providing personal and financial information, along with documentation such as pay stubs and tax returns.

- Checklist of documents: Gather all necessary documents before starting the application, such as proof of income, employment history, and identification.

- Typical processing time: Understand that loan applications can take several weeks to process.

- Steps after approval: Once approved, carefully review the loan documents before signing and ensure you understand the terms and conditions.

3. Conclusion

Deciding whether to refinance your federal student loans is a critical financial decision. Understanding your current loans, exploring private refinancing options, and carefully weighing the pros and cons are all crucial steps. Remember the significant risk of losing federal student loan protections. Make an informed decision about refinancing your federal student loans, carefully weigh the benefits and drawbacks of student loan refinancing, and don't rush into federal student loan refinancing. Thoroughly assess your financial situation and future needs before making a commitment.

Featured Posts

-

Tony Bennett His Collaborations And Impact On People

May 17, 2025

Tony Bennett His Collaborations And Impact On People

May 17, 2025 -

Mariners Vs Athletics Injury Report March 27 30

May 17, 2025

Mariners Vs Athletics Injury Report March 27 30

May 17, 2025 -

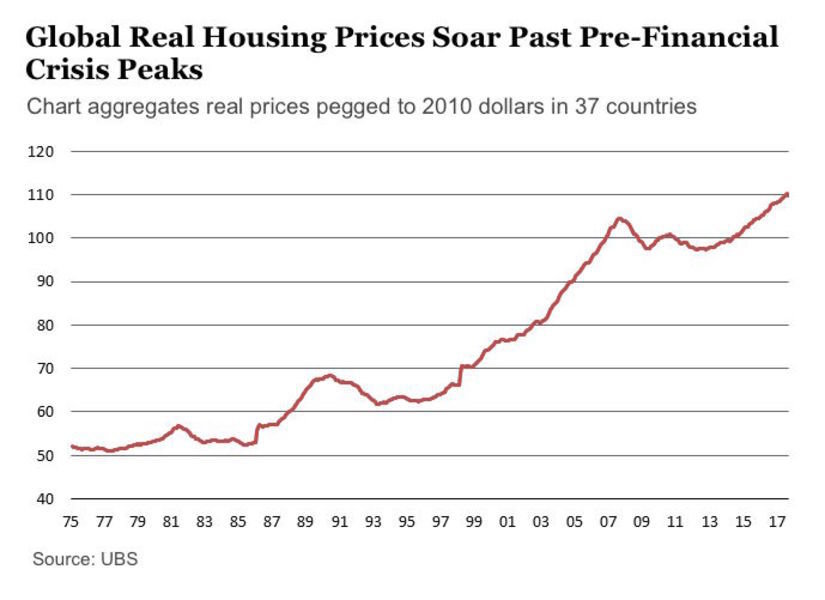

Market Downturn The Ultra High Net Worth Are Investing In Luxury Real Estate

May 17, 2025

Market Downturn The Ultra High Net Worth Are Investing In Luxury Real Estate

May 17, 2025 -

Tom Thibodeau And Mikal Bridges Resolving Post Game Tensions

May 17, 2025

Tom Thibodeau And Mikal Bridges Resolving Post Game Tensions

May 17, 2025 -

Soundproof Living In Tokyo Benefits And Options For Quiet Residences

May 17, 2025

Soundproof Living In Tokyo Benefits And Options For Quiet Residences

May 17, 2025

Latest Posts

-

Review Of Jackbit Among The Best Bitcoin Casinos For 2025

May 17, 2025

Review Of Jackbit Among The Best Bitcoin Casinos For 2025

May 17, 2025 -

Best Crypto Casinos 2025 Is Jackbit The Winner

May 17, 2025

Best Crypto Casinos 2025 Is Jackbit The Winner

May 17, 2025 -

Jackbit Casino Review A Top Contender For Best Crypto Casino In 2025

May 17, 2025

Jackbit Casino Review A Top Contender For Best Crypto Casino In 2025

May 17, 2025 -

United States Crypto Casinos Jackbits Position Among The Best

May 17, 2025

United States Crypto Casinos Jackbits Position Among The Best

May 17, 2025 -

Jackbit Casino Review A Top Bitcoin Casino In The United States

May 17, 2025

Jackbit Casino Review A Top Bitcoin Casino In The United States

May 17, 2025