Should You Invest In This AI Quantum Computing Stock?

Table of Contents

1. Understanding AI Quantum Computing and its Market Potential

What is AI Quantum Computing?

Quantum computing leverages the principles of quantum mechanics to perform calculations beyond the capabilities of classical computers. Unlike classical bits representing 0 or 1, quantum bits (qubits) can represent both simultaneously through superposition. This, combined with entanglement (linking qubits' fates), allows for exponentially faster processing power for specific problems. AI enhances quantum computing by optimizing algorithms, managing complex data sets, and accelerating the development of quantum applications. This synergy is driving rapid innovation in fields like drug discovery, materials science, and financial modeling.

Market Size and Growth Projections

The AI quantum computing market is still nascent but shows explosive growth potential. Reports from Grand View Research and other market analysts project substantial growth.

- Market size in 2023: Estimates vary, but many place it in the low billions of dollars.

- Projected size in 2030: Predictions range from tens to hundreds of billions, depending on technological breakthroughs and market adoption rates.

- Key growth drivers: Government funding initiatives (e.g., the US National Quantum Initiative), increasing private sector investment, and advancements in qubit technology are driving significant market growth.

Key Players in the AI Quantum Computing Industry

Several companies are at the forefront of AI quantum computing development and commercialization. These include established tech giants like Google, IBM, and Microsoft, alongside emerging startups focusing on specific quantum technologies and applications. Keeping track of these companies and their advancements is crucial for any investor in this space.

2. Analyzing a Specific AI Quantum Computing Stock (Example: IonQ)

For this analysis, let's consider IonQ, a publicly traded company specializing in trapped-ion quantum computing. This is not a recommendation, but an example to illustrate the process.

Company Overview and Business Model

IonQ develops and commercializes trapped-ion quantum computers, offering cloud access to their systems for researchers and businesses. Their business model focuses on providing quantum computing as a service (QCaaS), targeting various industries needing advanced computational power. They also license their technology to other companies.

Financial Performance and Valuation

Analyzing IonQ's financial statements requires careful consideration of their stage of development. While revenue may be limited initially, focusing on key metrics like research and development spending, strategic partnerships, and the overall growth trajectory is important. (Note: Replace this with actual financial data from IonQ's public filings for a complete analysis).

- Revenue growth: Assess the year-over-year revenue growth to gauge market traction.

- Profitability margins: IonQ, like many early-stage quantum computing companies, is likely not yet profitable. Focus on the path to profitability.

- Debt-to-equity ratio: A high debt-to-equity ratio could signify financial risk.

- Key financial ratios: Analyze relevant ratios to evaluate financial health and sustainability.

Competitive Landscape and Risks

The AI quantum computing industry is highly competitive. IonQ faces competition from established players and emerging startups.

- Main competitors: IBM, Google, Rigetti Computing, and others are key competitors.

- Potential technological disruptions: New qubit technologies could render current approaches obsolete.

- Regulatory risks: Government regulations on quantum computing could impact growth.

- Market risks: The market for quantum computing is still developing, creating inherent volatility.

3. Investment Strategies and Considerations

Risk Tolerance and Investment Goals

Investing in an AI quantum computing stock like IonQ is inherently high-risk, high-reward. Only investors with a high risk tolerance and a long-term investment horizon should consider this. Conservative investors should avoid this sector.

Diversification and Portfolio Management

Diversification is crucial. Don't put all your eggs in one basket. Allocate only a small percentage of your portfolio to AI quantum computing stocks to mitigate risk.

Due Diligence and Research

Thorough due diligence is paramount before investing in any AI quantum computing stock. Understand the technology, the company's financial health, the competitive landscape, and the associated risks.

Conclusion:

Investing in AI quantum computing stocks presents a unique opportunity, but it carries substantial risks. The potential rewards are enormous, but the path is uncertain. This analysis of IonQ serves as an example of the due diligence process required. Remember to conduct thorough research and consult with a financial professional before investing in any AI quantum computing stock. Your financial future depends on informed decisions.

Featured Posts

-

Is The Trans Australia Run World Record About To Fall

May 21, 2025

Is The Trans Australia Run World Record About To Fall

May 21, 2025 -

The David Walliams Simon Cowell Rift A Britains Got Talent Story

May 21, 2025

The David Walliams Simon Cowell Rift A Britains Got Talent Story

May 21, 2025 -

Gangsta Granny Comparing The Book To The Stage Adaptation

May 21, 2025

Gangsta Granny Comparing The Book To The Stage Adaptation

May 21, 2025 -

Sound Perimeter And Shared Experience The Power Of Music

May 21, 2025

Sound Perimeter And Shared Experience The Power Of Music

May 21, 2025 -

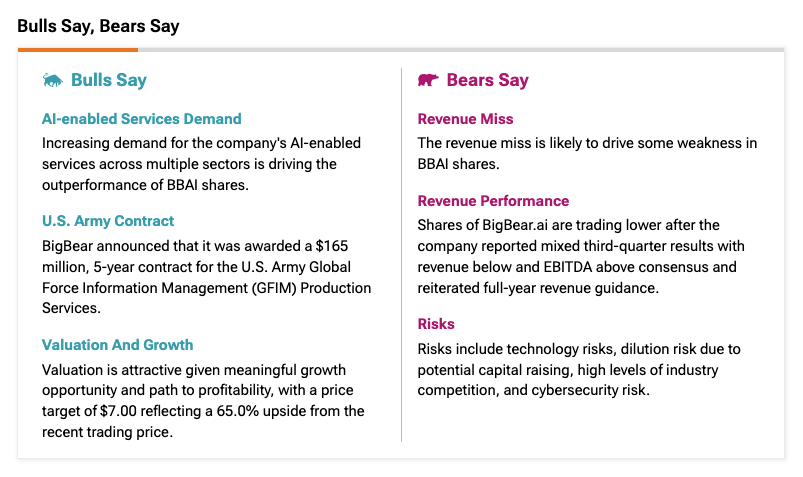

Big Bear Ai Bbai Retains Buy Rating Defense Spending Fuels Investment

May 21, 2025

Big Bear Ai Bbai Retains Buy Rating Defense Spending Fuels Investment

May 21, 2025