State Treasurers Confront Tesla Board Regarding Musk's Leadership

Table of Contents

Concerns Regarding Musk's Public Statements and Behavior

Elon Musk's leadership style, characterized by outspoken pronouncements and often erratic behavior on social media, has become a major point of contention. This section analyzes how his actions directly impact Tesla's stock price and brand reputation.

Impact on Tesla's Stock Price

Musk's impulsive tweets and controversial statements have repeatedly caused significant volatility in Tesla's stock price. His actions undermine investor confidence and create uncertainty in the market.

- Examples of tweets/actions negatively impacting stock price: Musk's tweets about taking Tesla private in 2018, his comments about Dogecoin, and his recent pronouncements regarding potential future product releases have all led to sharp stock price fluctuations.

- Quantitative data demonstrating stock volatility: Analysis of Tesla's stock performance reveals a clear correlation between Musk's public statements and significant price swings, often resulting in substantial losses for investors. Studies have shown a measurable negative impact on Tesla's market capitalization following controversial announcements.

- Analysis of investor sentiment: Following many of Musk's controversial actions, investor sentiment surveys reveal a decline in confidence, reflecting concerns about the company's long-term stability and prospects under his leadership.

Reputational Risk for Tesla

Musk's behavior poses a significant reputational risk to Tesla. Negative media coverage and public perception of his erratic actions can damage the brand's image and erode consumer trust.

- Examples of negative media coverage: Numerous news outlets have highlighted the risks associated with Musk's leadership style, raising concerns about corporate governance and the potential for damaging legal repercussions.

- Potential effects on consumer trust and brand loyalty: Negative publicity can deter potential customers, impacting sales and market share. Existing customers may also reconsider their loyalty to the brand, affecting long-term revenue.

- Discussion of ethical considerations: Musk's actions raise serious ethical questions about corporate social responsibility and the importance of responsible leadership in a publicly traded company.

State Treasurers' Actions and Calls for Accountability

State treasurers, representing significant investments in Tesla stock on behalf of their states' pension funds and other public entities, are taking a stand. Their actions signal a growing movement toward greater corporate accountability.

Specific Demands of the State Treasurers

These state treasurers are demanding significant changes at Tesla. Their calls for accountability reflect growing concerns about Musk's leadership and its impact on the company's long-term success.

- Specific demands: The demands vary, but generally include calls for improved corporate governance, potentially including changes in leadership structure, enhanced transparency in communication, and stricter oversight of Musk's public pronouncements.

- States involved and investment amounts: The precise details of the investments vary depending on the state, but collectively, these treasurers represent a substantial financial stake in Tesla.

- Quotes from key figures: Statements from involved state treasurers emphasize their concern for protecting public funds and ensuring responsible corporate governance at Tesla.

The Legal and Financial Ramifications for Tesla

Tesla faces potential legal and financial repercussions if it fails to address the concerns raised by the state treasurers. The actions of these influential investors could trigger significant consequences.

- Potential lawsuits and shareholder activism: State treasurers and other institutional investors could initiate lawsuits or engage in shareholder activism to pressure the board into making changes.

- Financial penalties and reputational damage: Failure to address the concerns adequately could lead to significant financial penalties and further damage to Tesla's reputation.

- Long-term effects on investment and growth: The ongoing conflict could negatively impact future investments and hinder Tesla's long-term growth prospects.

The Broader Implications for Corporate Governance

The conflict between state treasurers and Tesla's board has far-reaching implications for corporate governance, highlighting the growing power of institutional investors.

The Role of Institutional Investors

Institutional investors, including state treasurers, pension funds, and mutual funds, are increasingly using their collective influence to demand greater corporate accountability.

- Growing influence of ESG investing: Environmental, Social, and Governance (ESG) investing is gaining traction, placing increasing pressure on companies to adopt more responsible leadership and governance practices.

- Power of collective action by institutional investors: The coordinated action by state treasurers demonstrates the significant power institutional investors wield in holding companies accountable.

- Examples of similar situations: This situation mirrors similar instances where institutional investors have successfully pressured companies to make changes in leadership or governance practices.

The Future of Tesla's Leadership

The outcome of this conflict remains uncertain, but it could significantly impact Tesla's leadership structure and corporate governance policies.

- Potential scenarios and likelihood: Possible outcomes range from minor adjustments in communication practices to more substantial changes in leadership or governance. The likelihood of each scenario depends on Tesla's response and the persistence of the state treasurers.

- Impact on Tesla's future strategic direction: The conflict could significantly influence Tesla's future strategic direction, particularly concerning corporate social responsibility and risk management.

- Long-term outlook for Tesla’s stock price: The resolution of this conflict will likely have a significant, though presently unpredictable, impact on Tesla's long-term stock performance.

Conclusion

The conflict between state treasurers and Tesla's board regarding Musk's leadership highlights critical issues in corporate governance. The state treasurers' actions represent a powerful demonstration of institutional investor influence and a growing demand for greater accountability from public companies. The potential consequences for Tesla, including legal ramifications, reputational damage, and long-term financial impact, are substantial. This case underscores the increasing role of institutional investors in shaping corporate governance and the need for responsible leadership in the business world. Stay informed about this developing situation and its implications for the future of Tesla and the broader business world by following further updates on "State Treasurers Confront Tesla Board."

Featured Posts

-

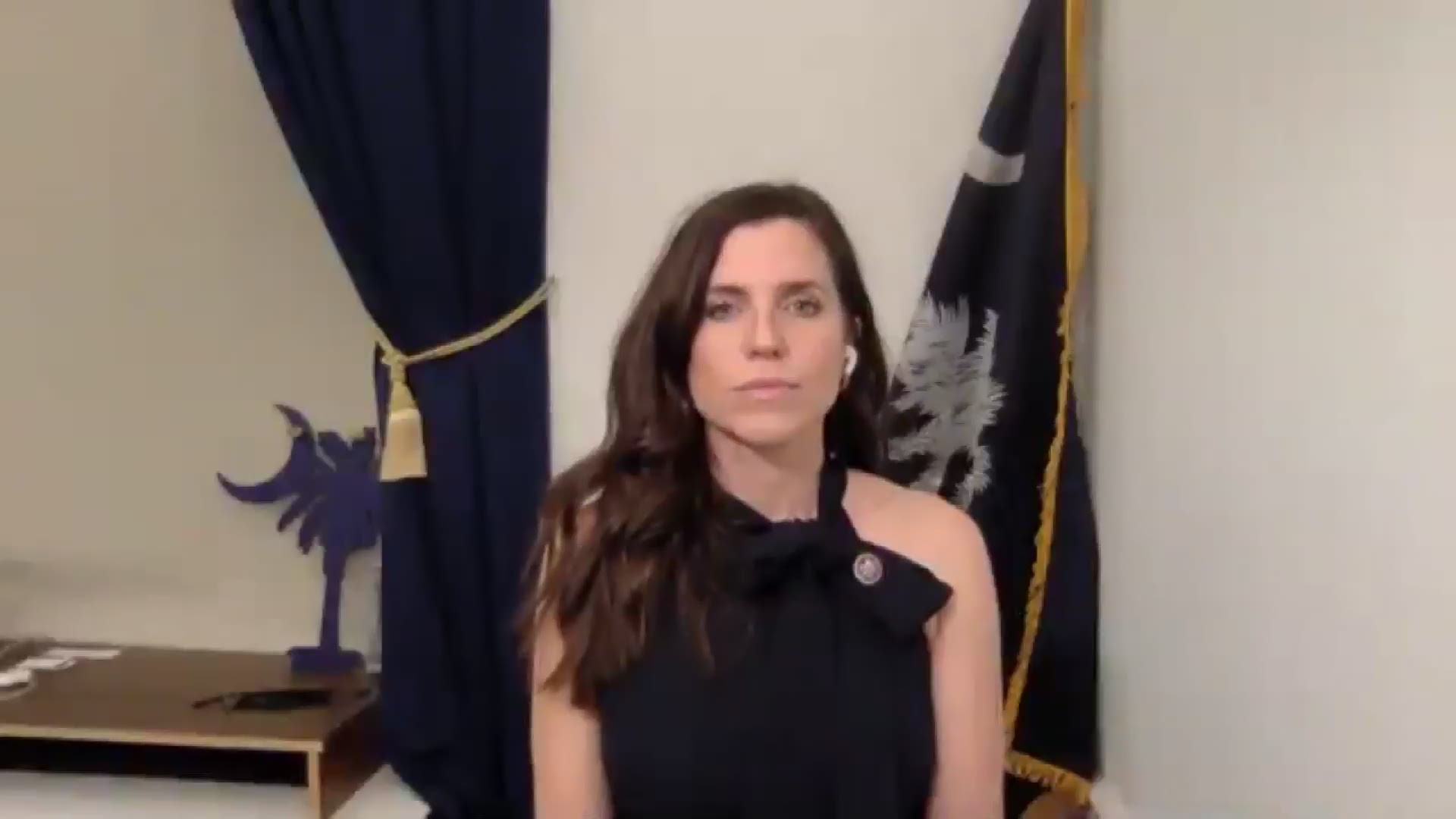

Tensions Flare South Carolina Voter Challenges Rep Nancy Mace

Apr 23, 2025

Tensions Flare South Carolina Voter Challenges Rep Nancy Mace

Apr 23, 2025 -

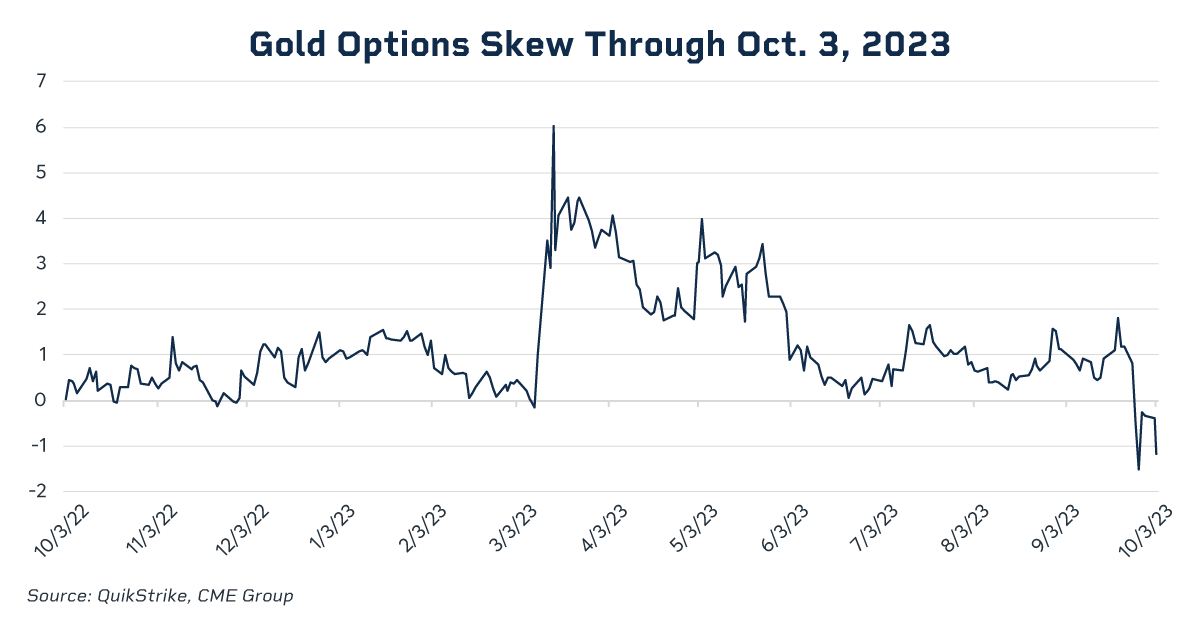

Gold Price Soars To 3500 Amidst Stock Market Volatility

Apr 23, 2025

Gold Price Soars To 3500 Amidst Stock Market Volatility

Apr 23, 2025 -

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025 -

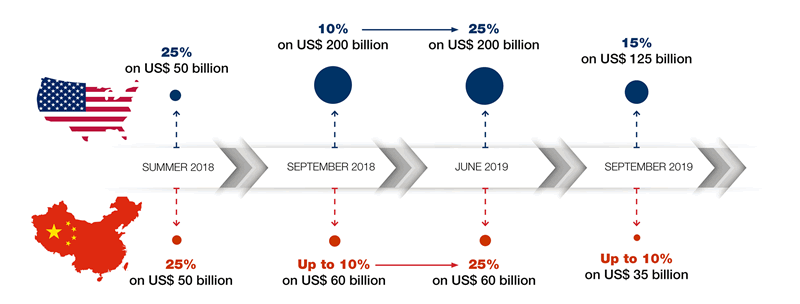

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025 -

Cincinnati Reds 1 0 Defeat Extends Bizarre Mlb Losing Streak

Apr 23, 2025

Cincinnati Reds 1 0 Defeat Extends Bizarre Mlb Losing Streak

Apr 23, 2025

Latest Posts

-

Analyzing The Disparate Starts Of Aaron Judge And The Atlanta Braves

May 11, 2025

Analyzing The Disparate Starts Of Aaron Judge And The Atlanta Braves

May 11, 2025 -

Yankees Rays Series Key Injuries To Watch April 17 20

May 11, 2025

Yankees Rays Series Key Injuries To Watch April 17 20

May 11, 2025 -

Yankees Vs Rays Injury Report April 17th 20th

May 11, 2025

Yankees Vs Rays Injury Report April 17th 20th

May 11, 2025 -

Yankees Judge Blazes While Braves Falter Analyzing The Contrasting Starts

May 11, 2025

Yankees Judge Blazes While Braves Falter Analyzing The Contrasting Starts

May 11, 2025 -

Rays Vs Yankees Updated Injury List For April 17 20 Games

May 11, 2025

Rays Vs Yankees Updated Injury List For April 17 20 Games

May 11, 2025