Stock Market Prediction: Will These 2 Stocks Outperform Palantir In 3 Years?

Table of Contents

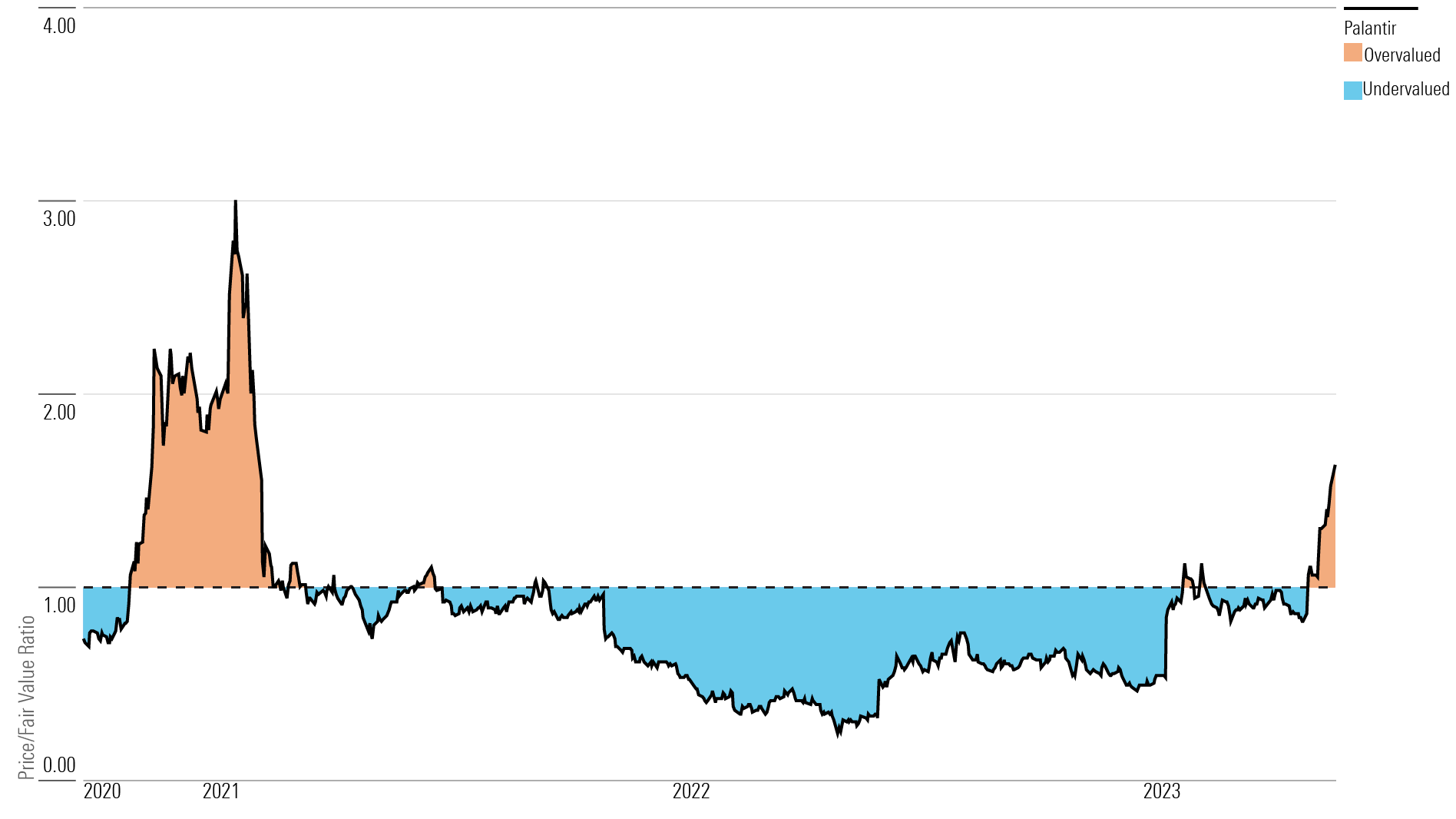

H2: Analyzing Palantir Technologies (PLTR): The Benchmark

H3: Palantir's Current Market Position and Future Projections:

Palantir Technologies, a leader in big data analytics, holds a significant position in both the government and commercial sectors. Its proprietary software platforms, Gotham and Foundry, are used for data integration, analysis, and visualization. However, understanding its future requires careful consideration of various factors.

- Recent Financial Performance: While Palantir has shown revenue growth, profitability remains a key focus for investors. Analyzing its quarterly earnings reports is crucial for accurate stock market prediction.

- Government Contracts: A large portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy. This reliance on government contracts is a significant risk factor.

- Competition Analysis: The big data analytics market is competitive, with established players and emerging startups vying for market share. Palantir faces competition from companies like AWS, Microsoft, and Google.

- Technological Advancements: Palantir's continued investment in research and development (R&D) is essential for maintaining its competitive edge and delivering innovative solutions. Failure to innovate could significantly impact future performance.

H3: Key Factors Influencing Palantir's Future Performance:

Several key factors will influence Palantir's future performance and inform any accurate stock market prediction.

- Government Spending: Fluctuations in government spending on defense and intelligence will directly impact Palantir's revenue. Understanding future government budgets is critical.

- Commercial Market Expansion: Palantir's success in expanding its commercial customer base will be crucial for long-term growth and diversification away from its reliance on government contracts.

- Technological Innovation: The development of new products and features will be essential for attracting and retaining customers in a competitive market. Staying ahead of the technology curve is vital.

H2: Stock #1: Snowflake (SNOW) – A Potential Contender?

H3: Snowflake's Business Model and Competitive Advantages:

Snowflake operates in the cloud data warehousing market, offering a scalable and cost-effective solution for businesses of all sizes. Its unique architecture, based on a "data cloud" model, provides several competitive advantages.

- Revenue Streams: Snowflake generates revenue through subscription fees based on data consumption and storage. This model allows for significant scalability and predictable recurring revenue.

- Market Capitalization: Snowflake boasts a substantial market capitalization, indicating investor confidence in its long-term potential.

- Growth Potential: The cloud data warehousing market is expected to experience significant growth in the coming years, providing ample opportunity for Snowflake's expansion.

- SWOT Analysis: A comprehensive SWOT analysis reveals Snowflake's strengths (scalability, innovation), weaknesses (dependence on cloud providers), opportunities (market expansion), and threats (competition from established players).

H3: Factors Suggesting Outperformance Over Palantir:

Several factors suggest Snowflake's potential to outperform Palantir:

- Projected Revenue Growth: Analysts predict strong revenue growth for Snowflake, driven by increasing cloud adoption and expanding market share.

- Earnings Per Share (EPS): Positive EPS growth is expected, reflecting improving profitability and operational efficiency.

- Valuation Metrics: While valuation is always a consideration, its growth trajectory may justify its current valuation.

- Market Disruption: Snowflake's cloud-based model disrupts traditional data warehousing, creating a significant competitive advantage.

H2: Stock #2: Datadog (DDOG) – Another Strong Challenger?

H3: Datadog's Unique Value Proposition and Growth Strategy:

Datadog provides a monitoring and analytics platform for cloud-scale applications. Its comprehensive platform provides real-time insights into application performance, infrastructure, and security.

- Target Market: Datadog targets businesses leveraging cloud infrastructure and microservices architectures, a rapidly growing market segment.

- Marketing Strategies: Datadog's strong marketing and sales efforts have been crucial for acquiring and retaining customers.

- Expansion Plans: Continued expansion into new markets and product offerings will fuel future growth.

- Intellectual Property: Datadog's proprietary technology and intellectual property provide a significant competitive moat.

H3: Reasons for Potential Outperformance Against Palantir:

Several factors support Datadog's potential to outperform Palantir:

- Management Expertise: Datadog's strong management team possesses significant experience in the technology industry.

- Technological Innovation: Continuous innovation in its platform ensures it remains relevant and competitive.

- Strong Financial Position: A strong financial position provides a solid foundation for future growth.

- Market Opportunities: The increasing adoption of cloud technologies presents significant market opportunities for Datadog.

3. Conclusion:

This article examined the potential of Snowflake (SNOW) and Datadog (DDOG) to outperform Palantir Technologies over the next three years. We analyzed their respective business models, competitive landscapes, and growth prospects, comparing them to Palantir's current market position and future projections. While no stock market prediction is guaranteed, our analysis suggests that both Snowflake and Datadog, due to their strong market positions and growth trajectories in rapidly expanding sectors, possess significant potential to outperform Palantir. Remember, thorough due diligence is crucial before making any investment decisions.

Call to Action: Conduct your own in-depth research before investing. Learn more about Snowflake and Datadog, and continue your journey towards informed stock market prediction and investment strategies. Remember to always diversify your portfolio and consult with a financial advisor before making any investment decisions.

Featured Posts

-

L Heritage De Gustave Eiffel A Dijon Focus Sur Sa Mere Melanie

May 09, 2025

L Heritage De Gustave Eiffel A Dijon Focus Sur Sa Mere Melanie

May 09, 2025 -

Lilysilk And Elizabeth Stewart A Spring Fashion Collaboration

May 09, 2025

Lilysilk And Elizabeth Stewart A Spring Fashion Collaboration

May 09, 2025 -

Who Is Kimbal Musk Exploring Elons Brother And His Business Ventures

May 09, 2025

Who Is Kimbal Musk Exploring Elons Brother And His Business Ventures

May 09, 2025 -

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

New Deals Team Deutsche Banks Focus On Defense Finance Growth

May 09, 2025

New Deals Team Deutsche Banks Focus On Defense Finance Growth

May 09, 2025