Stock Market Today: Dow Jones & S&P 500 Live Updates (May 27)

Table of Contents

Dow Jones Performance Today (May 27):

Opening Prices and Initial Trends:

The Dow Jones Industrial Average opened at 33,820, showing a 0.2% increase from yesterday's closing price of 33,750. Early trading activity indicated a bullish sentiment, with several blue-chip stocks showing positive gains in the first hour of trading. This initial upward momentum suggested a positive start to the day for the Dow.

- Opening Price: 33,820

- Percentage Change from Previous Close: +0.2%

- Early Trading Activity: Bullish

Key Factors Affecting the Dow Jones:

Several factors contributed to the Dow Jones's performance throughout the day. Positive economic data releases, particularly a better-than-expected manufacturing PMI report, boosted investor confidence. However, rising interest rate concerns and ongoing geopolitical uncertainties tempered this enthusiasm. Furthermore, strong earnings reports from several technology companies provided a counterbalance to negative sentiment in other sectors.

- Positive Economic Data: The strong manufacturing PMI report fueled positive sentiment.

- Interest Rate Concerns: Concerns about further interest rate hikes by the Federal Reserve created some downward pressure.

- Geopolitical Uncertainty: Ongoing global tensions continued to exert a degree of influence on market volatility.

- Strong Tech Earnings: Positive earnings reports from major tech companies helped offset some of the negative factors.

- Oil Prices: Fluctuations in oil prices also impacted energy sector stocks and the overall market.

Closing Prices and Overall Performance:

The Dow Jones closed at 33,950, representing a 130-point gain or a 0.4% increase compared to the previous day's close. This positive performance suggests a moderately bullish sentiment within the market, albeit with lingering concerns.

- Closing Price: 33,950

- Percentage Change: +0.4%

- Comparison to Previous Day: Positive performance, exceeding the opening gains.

S&P 500 Performance Today (May 27):

Opening Prices and Initial Trends:

The S&P 500 opened at 4,200, a slight 0.1% increase from its previous closing price. Early trading mirrored the Dow's initial bullish trend, reflecting broad market optimism. However, this optimism proved somewhat fragile as the day progressed.

- Opening Price: 4,200

- Percentage Change from Previous Close: +0.1%

- Early Market Sentiment: Cautiously bullish

Key Sectors Driving the S&P 500's Performance:

The technology sector performed exceptionally well, contributing significantly to the S&P 500's gains. Energy stocks also saw considerable gains, driven by rising oil prices. However, the financial sector showed more modest growth, reflecting the interest rate concerns mentioned earlier.

- Technology: +1.2% - Strong earnings reports and positive investor sentiment boosted tech stocks.

- Energy: +0.8% - Rising oil prices fueled gains in the energy sector.

- Financials: +0.3% - Modest growth due to concerns over interest rate hikes.

- Consumer Discretionary: +0.5% - Increased consumer spending contributed to moderate gains.

- Healthcare: +0.2% - Relatively stable performance.

Closing Prices and Overall Market Sentiment:

The S&P 500 closed at 4,215, a 15-point increase or a 0.4% rise from the previous day’s close. Overall market sentiment can be characterized as cautiously optimistic, with the potential for further gains tempered by lingering economic uncertainties.

- Closing Price: 4,215

- Percentage Change: +0.4%

- Overall Market Sentiment: Cautiously optimistic

Correlation Between Dow Jones and S&P 500:

Both the Dow Jones and the S&P 500 exhibited similar positive performance on May 27th. Their percentage changes were nearly identical, suggesting a strong correlation between these two major indices. This parallel movement reflects a broad-based market trend rather than sector-specific drivers.

- Percentage Change Comparison: Both indices showed approximately 0.4% growth.

- Discussion of Divergence: Minimal divergence was observed.

- Reasons for Similarities: The similar performance reflects overall market sentiment influenced by shared economic factors.

Looking Ahead: Market Predictions for Tomorrow:

Predicting tomorrow's market movement with certainty is impossible. However, based on today's performance, we might anticipate a continuation of the cautiously optimistic trend. However, market volatility remains a factor to consider. Economic data releases and geopolitical events will likely continue to influence market sentiment.

- Anticipated Market Trends: Potential for continued moderate growth, but with the possibility of short-term fluctuations.

- Potential Influencing Factors: Upcoming economic data releases, geopolitical developments, and corporate earnings reports.

- Cautionary Note: Market volatility is inherent, and significant changes could occur unexpectedly.

Conclusion:

Today's stock market performance saw the Dow Jones and S&P 500 both exhibiting positive growth, mirroring a broader market trend. While positive economic indicators contributed to the gains, concerns regarding interest rates and geopolitical factors tempered the overall optimism. The close correlation between the two indices suggests a consistent market-wide sentiment.

Stay tuned for tomorrow's Stock Market Today update on the Dow Jones and S&P 500, and subscribe to receive daily market insights! [Link to Subscription]

Featured Posts

-

Hailee Steinfelds Stunning Red Cape At The Sinner Photo Call In Mexico

May 28, 2025

Hailee Steinfelds Stunning Red Cape At The Sinner Photo Call In Mexico

May 28, 2025 -

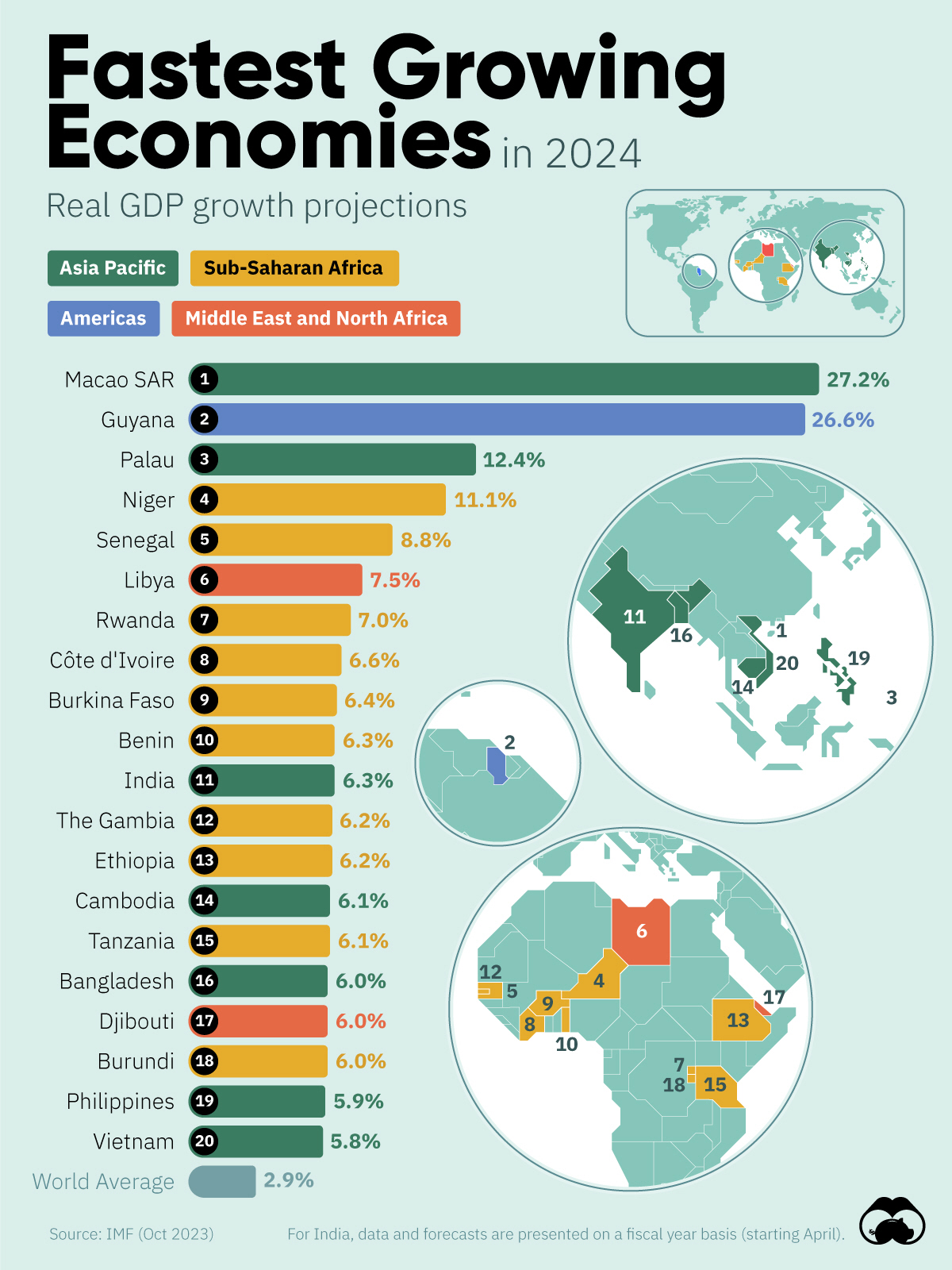

Where To Start A Business A Map Of The Countrys Fastest Growing Markets

May 28, 2025

Where To Start A Business A Map Of The Countrys Fastest Growing Markets

May 28, 2025 -

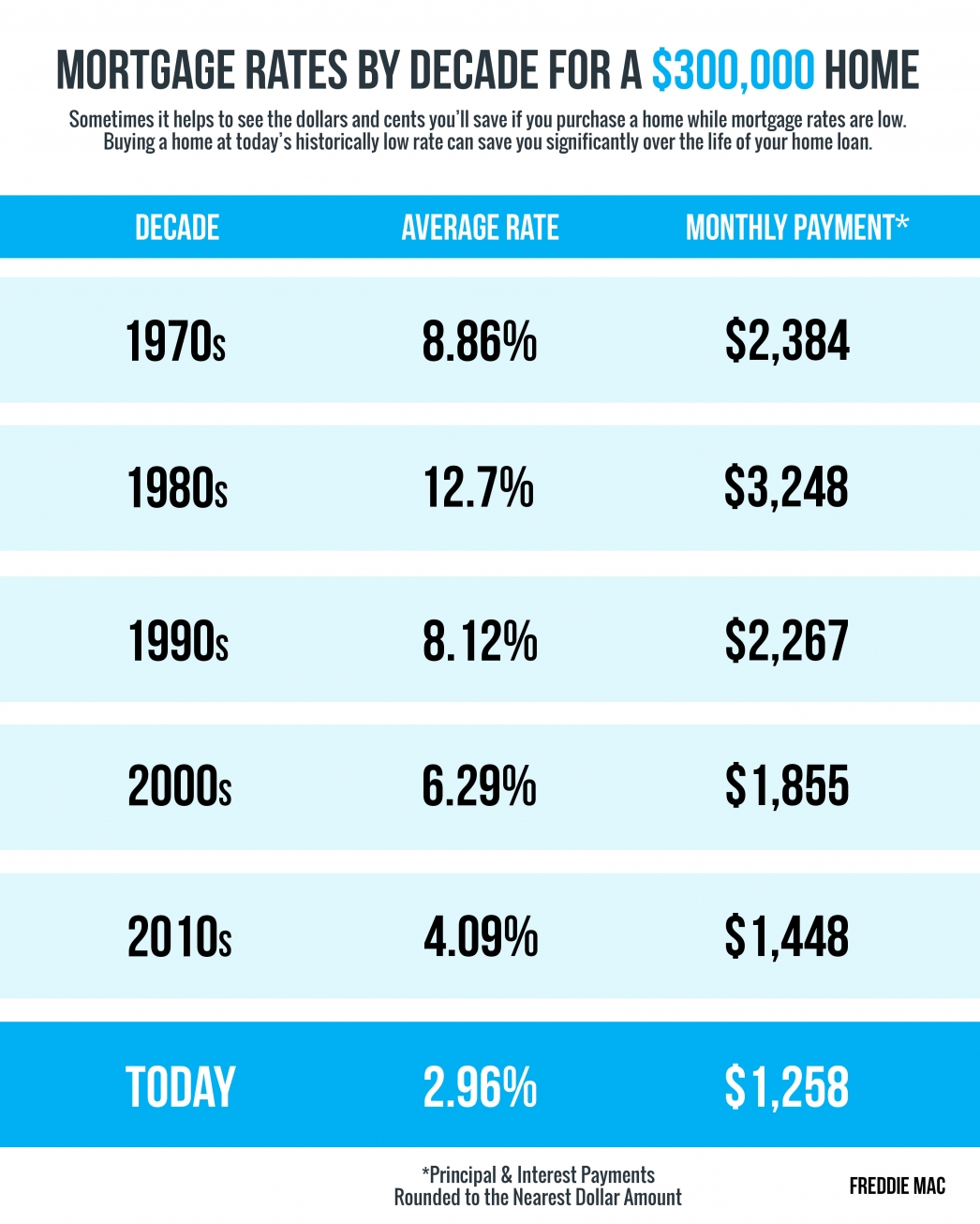

Personal Loan Interest Rates A Quick Comparison For Today

May 28, 2025

Personal Loan Interest Rates A Quick Comparison For Today

May 28, 2025 -

Garnacho Snubs Young Manchester United Fan Autograph Incident Stirs Controversy

May 28, 2025

Garnacho Snubs Young Manchester United Fan Autograph Incident Stirs Controversy

May 28, 2025 -

Beyond Bmw And Porsche A Look At The Wider Automotive Landscape In China

May 28, 2025

Beyond Bmw And Porsche A Look At The Wider Automotive Landscape In China

May 28, 2025

Latest Posts

-

Monte Carlo Victory For Alcaraz Musettis Injury Ends His Run

May 30, 2025

Monte Carlo Victory For Alcaraz Musettis Injury Ends His Run

May 30, 2025 -

Alcarazs Monte Carlo Conquest Musetti Forced To Retire

May 30, 2025

Alcarazs Monte Carlo Conquest Musetti Forced To Retire

May 30, 2025 -

Monte Carlo Masters 2025 Final Preview Alcaraz Vs Musetti

May 30, 2025

Monte Carlo Masters 2025 Final Preview Alcaraz Vs Musetti

May 30, 2025 -

Carlos Alcaraz Triumphs In Monte Carlo Musettis Retirement Hands Him Victory

May 30, 2025

Carlos Alcaraz Triumphs In Monte Carlo Musettis Retirement Hands Him Victory

May 30, 2025 -

Alcaraz Vs Musetti A Monte Carlo Masters 2025 Final Prediction

May 30, 2025

Alcaraz Vs Musetti A Monte Carlo Masters 2025 Final Prediction

May 30, 2025