Tariff Chaos? Find Stability With Microsoft And Other Software Stocks

Table of Contents

The Resilience of the Software Industry to Tariff Impacts

The software industry possesses inherent characteristics that make it less susceptible to the negative impacts of tariffs compared to sectors heavily reliant on physical goods.

Reduced Physical Dependence

Software companies are significantly less reliant on physical goods and global supply chains than manufacturers or retailers. This reduced physical dependence translates to several key advantages:

- Lower transportation costs: Software is distributed digitally, eliminating the high costs and logistical complexities associated with shipping physical products across borders. This minimizes exposure to tariff increases on imported materials or finished goods.

- Reduced reliance on international manufacturing: Unlike many industries that rely on global manufacturing networks, software development can be largely localized, further reducing vulnerability to tariff-related disruptions.

- Digital distribution models: The ability to deliver software directly to customers via the internet bypasses many of the supply chain challenges and tariff implications faced by traditional businesses.

Recurring Revenue Models

Many software companies operate on subscription-based models or cloud services, generating consistent and predictable revenue streams:

- Consistent cash flow: Recurring revenue provides a stable income flow, even during economic downturns, mitigating the risk associated with fluctuating demand for one-time purchases.

- Reduced reliance on one-time sales: The predictability of subscription revenue makes financial forecasting more reliable, reducing volatility and increasing investor confidence.

- Predictable future earnings: This stable revenue model allows software companies to better plan for future investments and growth, further enhancing their resilience.

Increased Demand During Economic Uncertainty

Paradoxically, economic uncertainty often increases the demand for software solutions:

- Automation initiatives: Businesses seek to improve efficiency and reduce labor costs through automation, driving demand for relevant software.

- Cloud migration for cost savings: Moving operations to the cloud can offer significant cost savings, particularly during economic downturns, fueling demand for cloud-based software and services.

- Software upgrades for productivity gains: Companies invest in software upgrades to improve productivity and streamline operations, seeking to optimize efficiency in challenging economic times.

Microsoft as a Prime Example of Stability

Microsoft serves as a compelling example of a software company demonstrating exceptional stability and resilience.

Diversified Revenue Streams

Microsoft's business model is remarkably diversified, minimizing its reliance on any single product or market segment:

- Reduced reliance on any single product: Revenue is generated from a diverse portfolio including Windows, Office 365, Azure, Xbox, and various other enterprise solutions, reducing the impact of potential setbacks in any one area.

- Strong market share in multiple sectors: Microsoft holds dominant positions in multiple software markets, providing a strong foundation for consistent revenue generation.

- Ongoing innovation and expansion: Consistent investment in R&D and strategic acquisitions ensures Microsoft remains at the forefront of technological innovation, driving future growth.

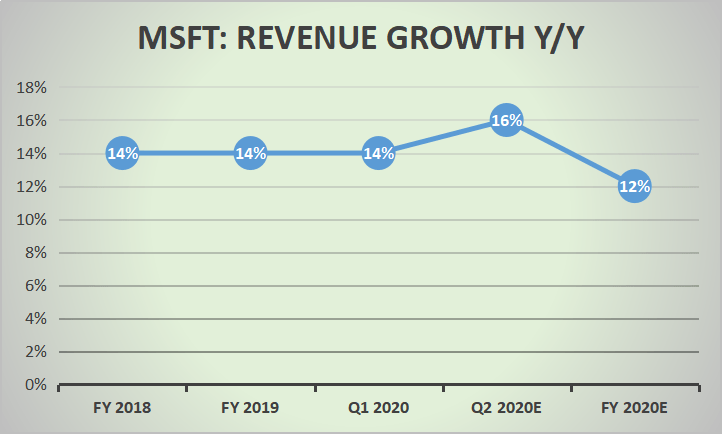

Strong Financial Performance

Microsoft consistently demonstrates strong financial performance, a hallmark of its resilience to economic fluctuations:

- Stable earnings reports: Years of consistently strong earnings reports underscore the company's robust business model and ability to navigate economic challenges.

- Consistent dividend payments: The company's consistent dividend payments reflect its commitment to returning value to shareholders and reinforce its financial strength.

- Robust balance sheet: Microsoft maintains a healthy balance sheet, providing a financial cushion to weather economic storms.

Long-Term Growth Potential

Microsoft's strategic investments in emerging technologies position it for continued long-term growth:

- Investment in R&D: Significant investment in research and development keeps Microsoft at the forefront of innovation in areas like AI and cloud computing.

- Strategic acquisitions: Acquisitions of promising technology companies further strengthen Microsoft's portfolio and expand its reach into new markets.

- Expansion into new markets: Microsoft continues to explore and expand into new and emerging markets, ensuring future growth opportunities.

Diversifying Your Portfolio with Other Stable Software Stocks

While Microsoft is a standout example, diversifying your portfolio with other stable software stocks is crucial for optimal risk management.

Identifying Recession-Proof Software Companies

When considering other software companies, look for these key characteristics:

- Strong market position: Companies with dominant market share are typically less susceptible to competitive pressures.

- Recurring revenue models: Subscription-based models provide predictable revenue streams, enhancing stability.

- Innovative product offerings: Continuous innovation ensures relevance and sustained market demand.

- Robust financial performance: Consistent profitability and strong balance sheets are indicators of financial health.

Examples of Other Strong Software Stocks

Several other publicly traded software companies exhibit a history of stable performance. These include:

- Adobe: Known for its Creative Cloud suite, Adobe benefits from a recurring revenue model and strong market position in creative software.

- Salesforce: The leading CRM (Customer Relationship Management) provider, Salesforce enjoys consistent growth fueled by its cloud-based platform and strong enterprise customer base.

- Oracle: A major player in enterprise software, Oracle benefits from its large customer base and diverse product portfolio.

The Importance of Due Diligence

Remember that thorough research is essential before investing in any stock. Understand each company's financial statements, competitive landscape, and future growth prospects before making any investment decisions.

Conclusion

Investing in software stocks, especially established companies like Microsoft, can offer a degree of stability and protection during periods of economic uncertainty, such as those caused by tariff volatility. The resilience of the software industry, combined with the strong financial performance of leading companies, makes them a compelling addition to a diversified portfolio. Don't let tariff chaos destabilize your investment strategy. Explore the potential of software stocks, including Microsoft and other industry leaders, to build a more resilient and stable portfolio. Research your options and consider adding these strong performers to your investment strategy today. Learn more about diversifying with software stocks and building a robust portfolio.

Featured Posts

-

Microsoft Leads Software Stocks As Tariff Safe Haven

May 16, 2025

Microsoft Leads Software Stocks As Tariff Safe Haven

May 16, 2025 -

Assessing Trumps Oil Price Preference A Goldman Sachs Social Media Analysis

May 16, 2025

Assessing Trumps Oil Price Preference A Goldman Sachs Social Media Analysis

May 16, 2025 -

Addressing Canadas Resource Issues A Bulldog Bankers Perspective

May 16, 2025

Addressing Canadas Resource Issues A Bulldog Bankers Perspective

May 16, 2025 -

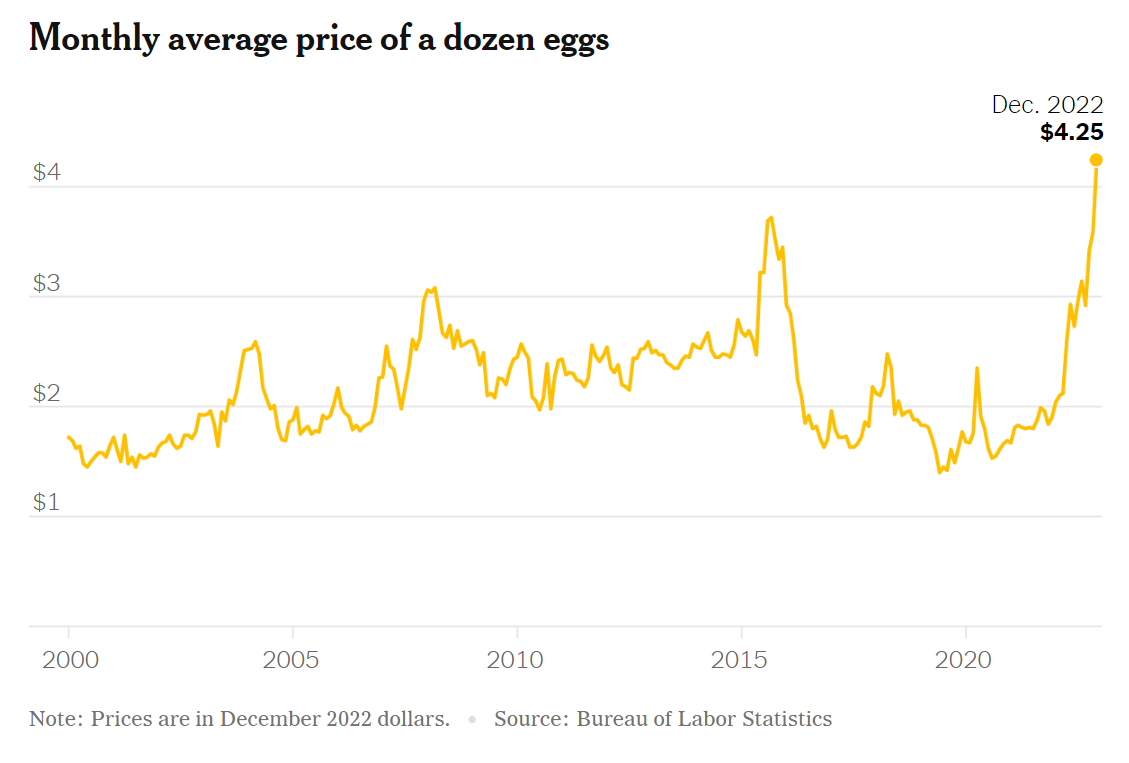

Egg Price Crash Dozens Now 5 In The United States

May 16, 2025

Egg Price Crash Dozens Now 5 In The United States

May 16, 2025 -

Will Jacob Wilson And Max Muncy Reunite On Opening Day 2025

May 16, 2025

Will Jacob Wilson And Max Muncy Reunite On Opening Day 2025

May 16, 2025

Latest Posts

-

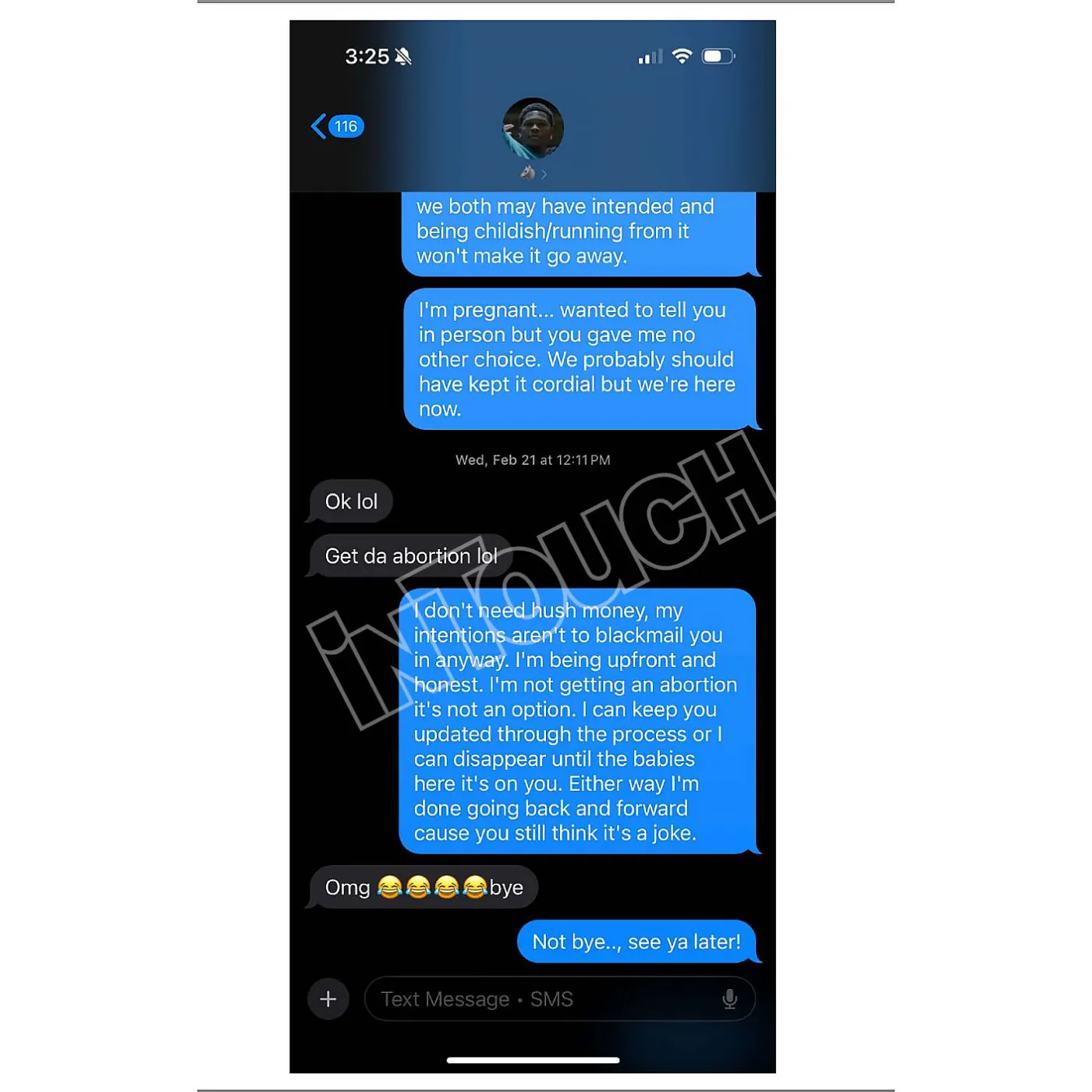

Anthony Edwards Baby Mamas Reaction To Reported Lack Of Visitation And Custody

May 16, 2025

Anthony Edwards Baby Mamas Reaction To Reported Lack Of Visitation And Custody

May 16, 2025 -

Ayesha Howard Awarded Custody After Paternity Dispute With Anthony Edwards

May 16, 2025

Ayesha Howard Awarded Custody After Paternity Dispute With Anthony Edwards

May 16, 2025 -

50 000 Fine For Anthony Edwards Nba Addresses Players Comments

May 16, 2025

50 000 Fine For Anthony Edwards Nba Addresses Players Comments

May 16, 2025 -

Court Awards Custody To Ayesha Howard In Anthony Edwards Paternity Case

May 16, 2025

Court Awards Custody To Ayesha Howard In Anthony Edwards Paternity Case

May 16, 2025 -

From Torpedo Bat To Game Tying Double Muncys Quick Switch

May 16, 2025

From Torpedo Bat To Game Tying Double Muncys Quick Switch

May 16, 2025