Tariff Cuts And Rare Earths: Key Demands In Trump's China Trade Talks

Table of Contents

Demands for Tariff Reductions: A Core Tenet of Trump's Trade Strategy

A central pillar of Trump's trade strategy with China involved significant tariff reductions. The administration argued these cuts were necessary to level the playing field for American businesses and address persistent trade imbalances. This approach aimed to protect American industries from what were perceived as unfair trade practices by China.

The Rationale Behind Tariff Cuts

The US argued that China's trade practices, including intellectual property theft, forced technology transfers, and subsidized industries, created an uneven playing field. The administration aimed to use tariffs as leverage to force China into negotiating fairer terms.

- Examples of specific tariffs imposed: Tariffs were imposed on a wide range of Chinese goods, including steel, aluminum, consumer electronics, and agricultural products. These tariffs varied significantly in percentage, impacting different sectors differently.

- Industries affected: American industries ranging from manufacturing and agriculture to technology were affected by both the imposed tariffs and China's retaliatory tariffs. The impact varied greatly depending on the industry's reliance on trade with China and the specifics of the tariffs.

- Alleged unfair trade practices: The US cited various practices as unfair, including state subsidies for Chinese companies, dumping goods below market value, and the theft of intellectual property. These accusations fueled the push for tariff reductions as a means of addressing these issues.

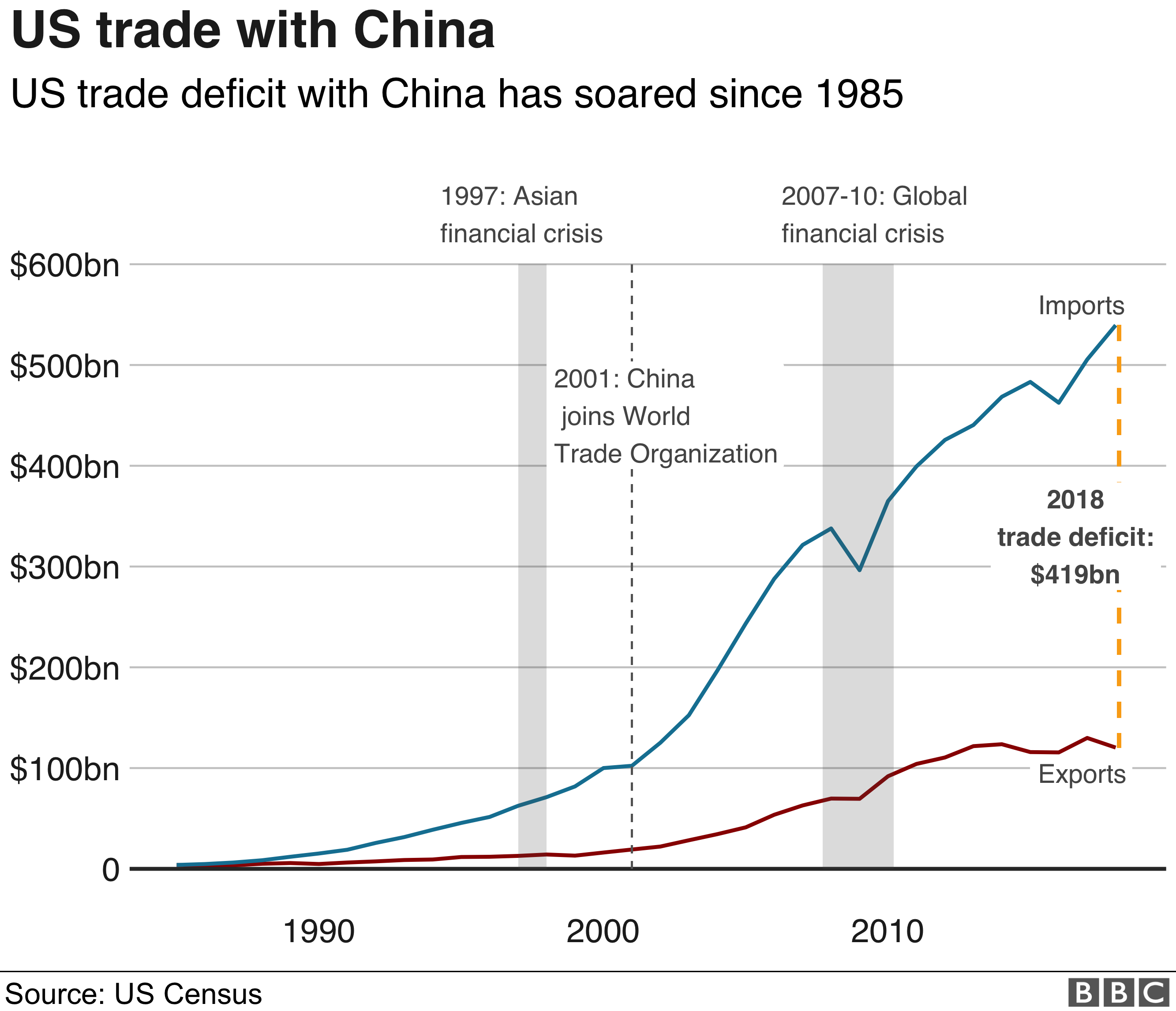

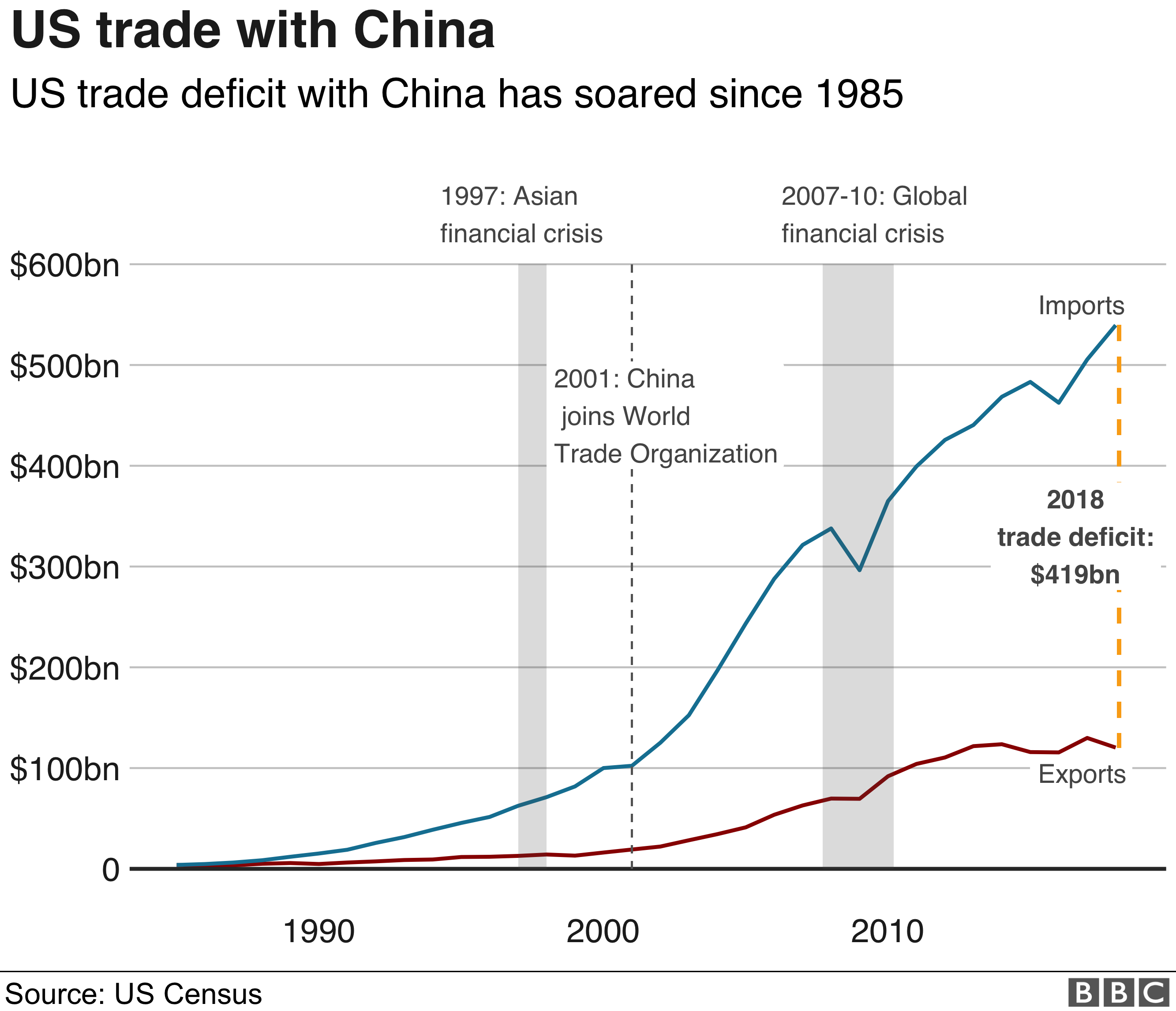

- Data on trade deficits between the US and China: The US consistently ran a large trade deficit with China, fueling concerns about the impact on the US economy and jobs. These deficits were a key driver behind the administration's push for tariff reductions.

- Impact of tariffs on consumer prices and businesses: The tariffs imposed by both the US and China had a ripple effect on consumer prices and businesses. Increased costs for imported goods led to higher prices for consumers, while businesses faced challenges in managing their supply chains and production costs.

China's Counterarguments and Negotiating Tactics

China countered the US demands with its own retaliatory tariffs and threatened disruptions to global supply chains. This created a tense atmosphere marked by escalating trade tensions.

- Examples of Chinese retaliatory actions: China responded to US tariffs with its own tariffs on American goods, targeting key agricultural products and other exports. This led to significant disruptions in global trade.

- Impact on global markets: The trade war between the US and China had a significant impact on global markets, leading to uncertainty and volatility in various sectors. Supply chains were disrupted, and businesses faced increased costs and risks.

- Leverage held by both sides: Both the US and China possessed significant leverage during negotiations. The US held the power to impose tariffs and disrupt Chinese exports to the US market. China, on the other hand, held leverage through its control over crucial supply chains and its role in global manufacturing.

Securing Access to China's Rare Earths: A Strategic Imperative

Another crucial demand in Trump's China trade talks centered on securing access to China's dominant rare earth mineral market. Rare earth minerals are critical components in many modern technologies, and China's near-monopoly posed a significant strategic challenge for the US.

The Importance of Rare Earths in Modern Technology

Rare earth elements are essential components in a wide range of high-tech applications, including defense systems, renewable energy technologies, and consumer electronics. Their strategic importance is undeniable.

- Specific applications of rare earths: Rare earths are crucial for the production of high-strength magnets, lasers, catalysts, and various other specialized components. These applications span diverse sectors, including defense, clean energy (wind turbines, electric vehicles), and consumer electronics (smartphones, computers).

- Dependence of US technology on these minerals: The US technology sector is heavily reliant on rare earth minerals, creating a vulnerability given China's dominant position in the global supply chain.

China's Dominance in Rare Earth Production and its Implications

China controls a significant portion of the global rare earth refining capacity, giving it substantial leverage in international trade negotiations. This dominance raises concerns about supply chain security and the potential for geopolitical manipulation.

- Statistics on China's market share: China's market share in rare earth refining significantly outweighs that of any other nation, making it a near-monopoly.

- Potential risks of dependence: Over-reliance on China for rare earths poses significant risks for the US, including potential supply disruptions, price manipulation, and geopolitical pressure.

- Concerns regarding supply chain security and diversification strategies: The US has recognized the need to diversify its sources of rare earths and reduce its dependence on China. This involves exploring alternative sources, investing in domestic production, and strengthening international partnerships.

US Efforts to Reduce Reliance on Chinese Rare Earths

Recognizing the strategic importance and vulnerability, the US has taken steps to reduce its reliance on China for rare earths.

- Government initiatives: The US government has launched several initiatives aimed at boosting domestic rare earth production and processing, including research and development funding and tax incentives.

- Private sector investments: Private sector companies have also invested in rare earth mining and processing facilities within the US to expand domestic production and supply.

- International collaborations: The US has explored international collaborations to diversify its supply chains and secure access to rare earths from other reliable sources.

Conclusion

Trump's China trade talks revolved around two critical demands: significant tariff reductions to address trade imbalances and unfair trade practices, and securing access to China's dominant rare earth mineral market. Both issues highlighted strategic vulnerabilities for the US and underscored the need for a more balanced and secure trade relationship. Understanding the complexities of these negotiations, including the implications of tariff disputes and rare earth dominance, remains crucial for navigating the current geopolitical and economic landscape. Further research into the lasting impacts of these negotiations and the ongoing evolution of US-China trade relations is essential. Continue your exploration of Trump's China trade talks to gain a deeper understanding of this pivotal period in global economics.

Featured Posts

-

High Yield Dividend Investing A Simple Effective Strategy

May 11, 2025

High Yield Dividend Investing A Simple Effective Strategy

May 11, 2025 -

The Countrys Top Business Locations A Comprehensive Map And Guide

May 11, 2025

The Countrys Top Business Locations A Comprehensive Map And Guide

May 11, 2025 -

From Pop Star To Entrepreneur Jessica Simpsons Journey Of Self Discovery

May 11, 2025

From Pop Star To Entrepreneur Jessica Simpsons Journey Of Self Discovery

May 11, 2025 -

Palou Edges Out Dixon In Thermal Club Warm Up Session

May 11, 2025

Palou Edges Out Dixon In Thermal Club Warm Up Session

May 11, 2025 -

Greenland And The Us Military Analyzing The Proposed Transfer To Northern Command

May 11, 2025

Greenland And The Us Military Analyzing The Proposed Transfer To Northern Command

May 11, 2025