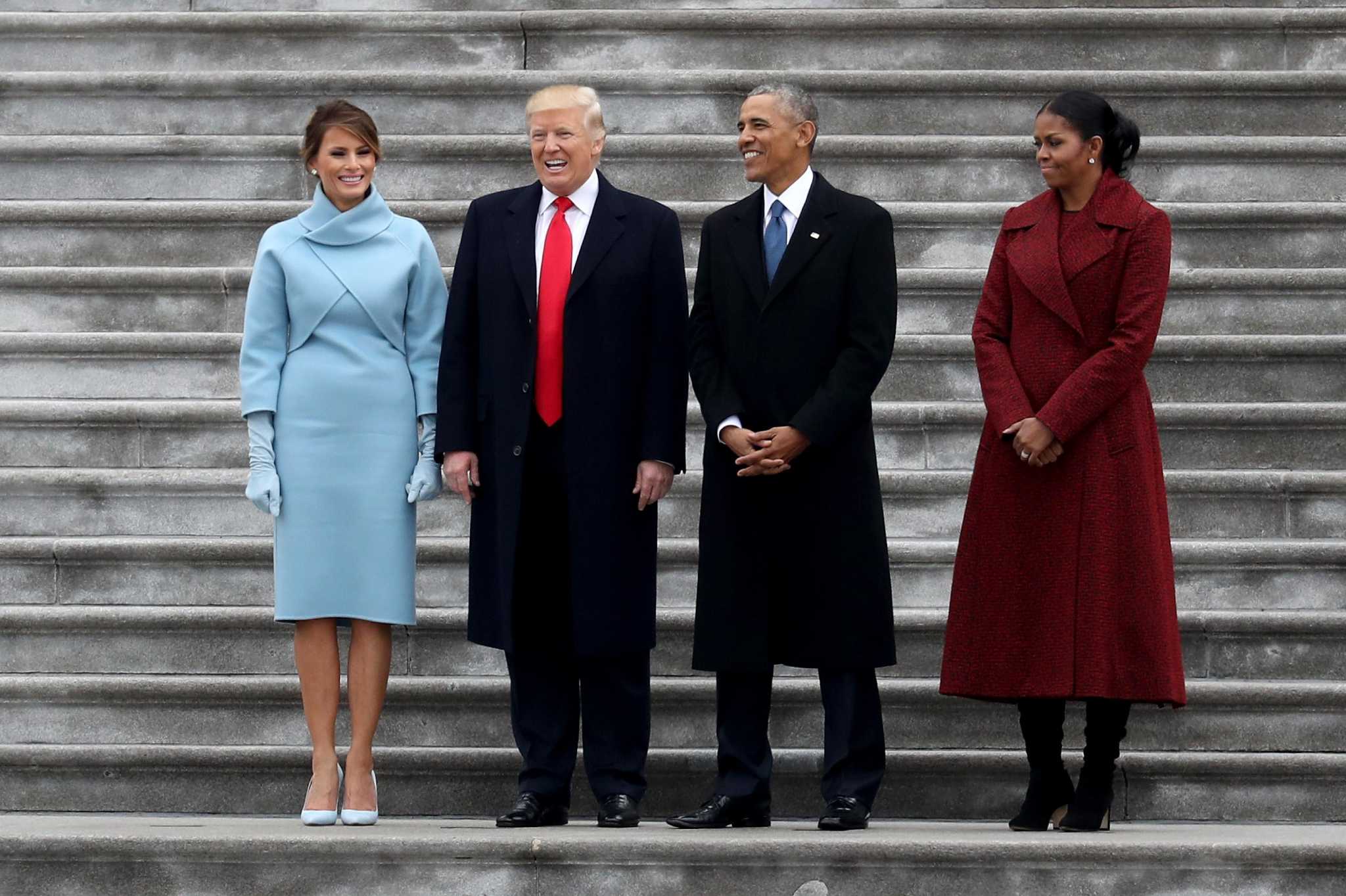

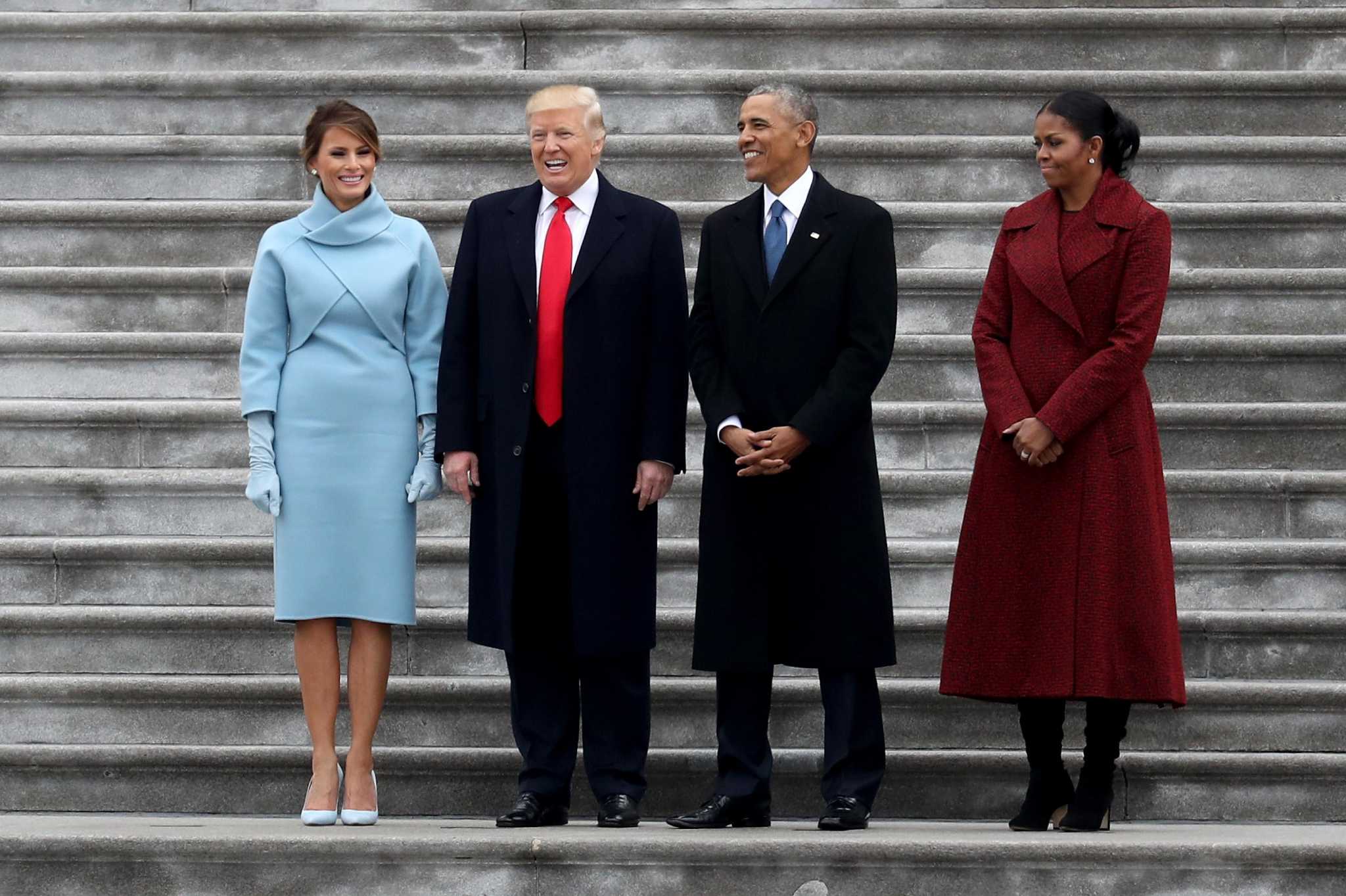

Tech Billionaires' $194 Billion Losses: 100 Days Of Pain After Trump Inauguration

Table of Contents

The Impact of Trump's Policies on Tech Stocks

The early days of the Trump administration ushered in a period of significant policy changes that directly impacted the tech sector, leading to substantial tech billionaires’ losses.

Immigration Restrictions and H-1B Visas

One of the most immediate concerns for the tech industry was the tightening of immigration policies, particularly regarding H-1B visas. These visas are crucial for tech companies to attract and retain skilled foreign workers. Stricter regulations and reduced quotas created a potential talent shortage, impacting innovation and growth.

- Examples: Several tech giants, including Google, Microsoft, and Amazon, rely heavily on H-1B visa holders. Restrictions led to delays in hiring and potential project setbacks.

- Stock Market Reactions: Uncertainty surrounding the H-1B program contributed to investor anxiety, causing fluctuations in the stock prices of affected companies.

- Keywords: H-1B visas, immigration reform, tech talent shortage, stock market impact, tech billionaires' losses.

Trade Wars and Tariffs

The Trump administration's initiation of trade wars and imposition of tariffs on imported goods significantly impacted the tech sector's supply chains and profitability, exacerbating tech billionaires' losses.

- Examples: Tariffs on components sourced from China increased manufacturing costs for numerous tech companies, impacting profit margins.

- Impact on Manufacturing Costs: Increased tariffs led to higher prices for consumers and reduced competitiveness in the global market.

- Stock Price Fluctuations: The uncertainty surrounding trade policies created market volatility, impacting investor confidence and leading to stock price declines.

- Keywords: trade wars, tariffs, supply chain disruptions, tech manufacturing, tech billionaires' losses.

Regulatory Uncertainty

The shifting regulatory landscape under the new administration created uncertainty among investors and contributed to tech billionaires' losses. Changes in antitrust laws, data privacy regulations, and other areas caused significant market volatility.

- Examples: Increased scrutiny of large tech companies' market dominance led to concerns about potential antitrust lawsuits and regulatory interventions.

- Investor Reactions: Uncertainty about future regulations led to a cautious approach by investors, causing a decline in valuations for some tech companies.

- Effects on Company Valuations: The fear of potential fines and regulatory hurdles decreased investor confidence, impacting company valuations and contributing to tech billionaires' losses.

- Keywords: regulatory uncertainty, investor confidence, tech regulation, market volatility, tech billionaires' losses.

Shifting Market Sentiment and Investor Behavior

The political climate and the resulting policy changes dramatically altered market sentiment and investor behavior, contributing to significant tech billionaires' losses.

Increased Volatility and Market Corrections

The uncertainty surrounding the new administration's policies led to increased market volatility and several market corrections.

- Examples: The tech-heavy Nasdaq experienced significant fluctuations, reflecting investor anxiety and risk aversion.

- Investor Fear: Concerns about the long-term impact of policy changes fueled investor fear and a tendency to move capital away from riskier assets, like tech stocks.

- Capital Flight: Investors shifted their investments to sectors perceived as less vulnerable to policy changes, further depressing tech stock prices.

- Keywords: market volatility, market correction, investor fear, capital flight, tech billionaires' losses.

Rotation into Other Sectors

Investors began rotating their portfolios away from the tech sector toward sectors perceived as less risky and more resilient to policy changes.

- Examples: Investors favored sectors like healthcare, infrastructure, and defense, which were viewed as less susceptible to the uncertainty in the tech sector.

- Reasons Behind the Shift: The perceived lower risk and higher stability in these sectors attracted investment capital away from the tech sector.

- Keywords: sector rotation, investment strategy, risk aversion, market trends, tech billionaires' losses.

Individual Tech Billionaire Losses and Their Portfolios

The $194 billion in tech billionaires' losses wasn't evenly distributed. Let's examine the impact on some prominent figures.

Case Studies

The 100 days following the Trump inauguration saw significant declines in the net worth of several tech billionaires.

- Mark Zuckerberg: Facebook's stock price experienced fluctuations, impacting Zuckerberg's net worth.

- Jeff Bezos: Amazon faced regulatory scrutiny and trade war challenges, affecting Bezos' overall wealth.

- Elon Musk: Tesla's stock price volatility directly affected Musk's net worth.

- Keywords: Mark Zuckerberg, Jeff Bezos, Elon Musk, net worth, portfolio diversification, tech billionaires' losses.

Impact on Philanthropy and Investments

The substantial losses experienced by tech billionaires had potential implications for their philanthropic activities and investment strategies.

- Examples: Reductions in philanthropic giving or adjustments to investment portfolios might have been necessary for some billionaires.

- Potential Reductions in Funding: Changes in net worth could have impacted the funding levels for various philanthropic projects.

- Adjustments in Investment Strategies: Billionaires might have adjusted their investment strategies to mitigate risk and diversify their portfolios.

- Keywords: philanthropy, investment strategies, venture capital, tech philanthropy, tech billionaires' losses.

Conclusion: Analyzing the $194 Billion Question – and What's Next for Tech Billionaires

The $194 billion decline in the net worth of tech billionaires in the 100 days following Trump's inauguration was a result of a confluence of factors. These included the impact of Trump's policies on tech stocks (H-1B restrictions, trade wars, regulatory uncertainty), shifting market sentiment and investor behavior (increased volatility, sector rotation), and the resulting individual losses experienced by prominent tech figures. The long-term implications of these tech billionaires' losses remain to be seen, but it's clear that the relationship between politics, policy, and the tech industry continues to be a dynamic and influential force shaping the global economy. Stay informed about the evolving landscape and continue researching the impacts of tech billionaires’ losses and market conditions to understand the future of this powerful industry.

Featured Posts

-

Prognozy Na Matchi Ligi Chempionov 2024 2025 Polufinaly I Final Daty Vremya I Tv

May 09, 2025

Prognozy Na Matchi Ligi Chempionov 2024 2025 Polufinaly I Final Daty Vremya I Tv

May 09, 2025 -

Gap Safety And Wheelchair Access Improvements Needed On The Elizabeth Line

May 09, 2025

Gap Safety And Wheelchair Access Improvements Needed On The Elizabeth Line

May 09, 2025 -

Indonesia Reserve Levels Fall Two Year Low Amidst Currency Volatility

May 09, 2025

Indonesia Reserve Levels Fall Two Year Low Amidst Currency Volatility

May 09, 2025 -

The Elizabeth Stewart And Lilysilk Spring Collaboration Details And Where To Buy

May 09, 2025

The Elizabeth Stewart And Lilysilk Spring Collaboration Details And Where To Buy

May 09, 2025 -

Suncors Record Production Impact Of Inventory Buildup On Sales Volumes

May 09, 2025

Suncors Record Production Impact Of Inventory Buildup On Sales Volumes

May 09, 2025