The Economic Fallout Of Trump's Tariffs: A Look At Billionaire Losses

Table of Contents

Sectors Hit Hardest by Trump's Tariffs and Billionaire Losses

Trump's trade war, characterized by significant tariff increases, severely impacted several key sectors, leading to substantial billionaire losses.

Retail and Consumer Goods

Tariffs on imported consumer goods, ranging from clothing and electronics to furniture and toys, directly increased prices for consumers. This dampened consumer spending, impacting the bottom lines of major retail giants and their billionaire owners.

- Examples: The increased costs associated with imported goods hurt companies like Walmart (owned by the Walton family) and Target, resulting in reduced profit margins. Clothing retailers faced higher prices for imported apparel, leading to lower sales and impacting the wealth of their billionaire shareholders. Specific products like smartphones and televisions saw price increases due to tariffs on imported components.

- Quantifiable losses are difficult to isolate directly from tariffs, but decreased sales and reduced stock values in many retail giants during this period strongly suggest a negative impact. The "retail billionaires" saw their fortunes shrink as consumer spending slowed.

- Keyword integration: "Retail billionaires," "consumer goods tariffs," "price increases," "impact on sales," "Walmart," "Target".

Manufacturing and Agriculture

The tariffs on steel, aluminum, and agricultural products had a devastating effect on US manufacturers and farmers. Increased input costs and decreased exports led to significant losses for billionaires invested in these sectors.

- Examples: Steel manufacturers faced higher costs for imported raw materials, impacting profitability. The agricultural sector saw reduced exports due to retaliatory tariffs imposed by other countries, harming the wealth of agricultural billionaires. Companies relying on steel and aluminum for production, such as automobile manufacturers, also faced higher costs.

- The disruption to global supply chains, increased input costs, and reduced exports significantly impacted the bottom line for numerous companies. Billionaire owners in manufacturing and agriculture felt the impact directly through decreased profitability and reduced stock valuations.

- Keyword integration: "Manufacturing losses," "agricultural tariffs," "supply chain disruption," "export decline," "input costs."

Technology and Global Supply Chains

The globalized nature of the tech industry made it particularly vulnerable to tariff disruptions. Increased component costs, production delays, and the relocation of manufacturing to other countries significantly impacted tech billionaires.

- Examples: The increased cost of imported components, such as semiconductors and displays, impacted the profitability of many technology companies. Companies faced delays in production due to disruptions in global supply chains. Some companies even shifted manufacturing to countries outside the US to avoid tariffs, impacting both profits and employment.

- The impact on tech billionaires was felt through decreased profits, reduced stock values, and increased operational complexity. The disruption to global supply chains caused significant economic fallout within the sector.

- Keyword integration: "Tech billionaires," "global supply chains," "tariff disruption," "manufacturing relocation," "component costs."

Mechanisms Through Which Billionaires Experienced Losses

Trump's tariffs impacted billionaires through various financial mechanisms.

Decreased Stock Values

The negative economic consequences of the tariffs led to a decline in the stock prices of numerous companies owned or heavily invested in by billionaires.

- Examples: The stock prices of many companies in the retail, manufacturing, and technology sectors declined significantly during the period of increased tariffs. This resulted in substantial losses for billionaire investors and shareholders.

- Charts and graphs illustrating the decline in stock values of specific companies would visually reinforce this point.

- Keyword integration: "Stock market decline," "investment losses," "market capitalization."

Reduced Profits and Revenue

Tariffs directly impacted the profitability and revenue of businesses owned by billionaires, leading to decreased wealth.

- Examples: Increased costs from tariffs squeezed profit margins, resulting in lower earnings for many businesses. Reduced consumer spending further exacerbated this effect. The decreased revenue and profits directly translated to lower personal wealth for billionaire owners.

- Quantifiable data illustrating the decrease in profits and revenues for specific companies would greatly strengthen this argument.

- Keyword integration: "Profit reduction," "revenue decline," "financial losses."

Increased Operational Costs

Tariffs increased operational costs for many businesses, impacting their profitability and shareholder value.

- Examples: Companies faced higher costs for raw materials, imported components, and shipping due to tariffs. These increased costs impacted their bottom lines and reduced their competitiveness.

- The cumulative effect of these increased costs contributed significantly to the billionaire losses resulting from Trump's tariffs.

- Keyword integration: "Operational costs," "input costs," "cost inflation."

Broader Economic Consequences and the Ripple Effect

Trump's tariffs had a broader impact on the US economy, extending beyond billionaire losses.

- Job losses in affected sectors, reduced consumer confidence, and increased inflation were significant consequences. These effects disproportionately impacted lower-income households, exacerbating wealth inequality.

- The trade war contributed to uncertainty in the global marketplace, affecting international trade relationships and economic stability.

- Keyword integration: "Economic recession," "job losses," "inflation," "wealth inequality," "trade deficit," "trade war."

Conclusion: Understanding the Lasting Impact of Trump's Tariffs on Billionaire Losses

This analysis highlights the significant economic fallout from Trump's tariffs and their disproportionate impact on billionaire wealth across various sectors. The mechanisms through which these losses occurred—decreased stock values, reduced profits and revenue, and increased operational costs—demonstrate the far-reaching effects of these trade policies. The broader economic consequences, including job losses and increased inflation, further underscore the substantial negative impact.

This reaffirms our initial thesis: Trump's tariffs led to significant billionaire losses across multiple sectors through various financial mechanisms, and these losses contributed to broader economic instability and increased wealth disparity. The long-term consequences of these trade policies are still unfolding, but the evidence suggests a substantial negative impact on the US economy.

Continue your exploration into the lasting impact of Trump's tariffs and their effects on billionaire losses. Understanding this complex issue is crucial for informed economic discussion and policymaking.

Featured Posts

-

Operation Sindoor Impact Kse 100 Trading Halted Amidst Market Panic

May 09, 2025

Operation Sindoor Impact Kse 100 Trading Halted Amidst Market Panic

May 09, 2025 -

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025 -

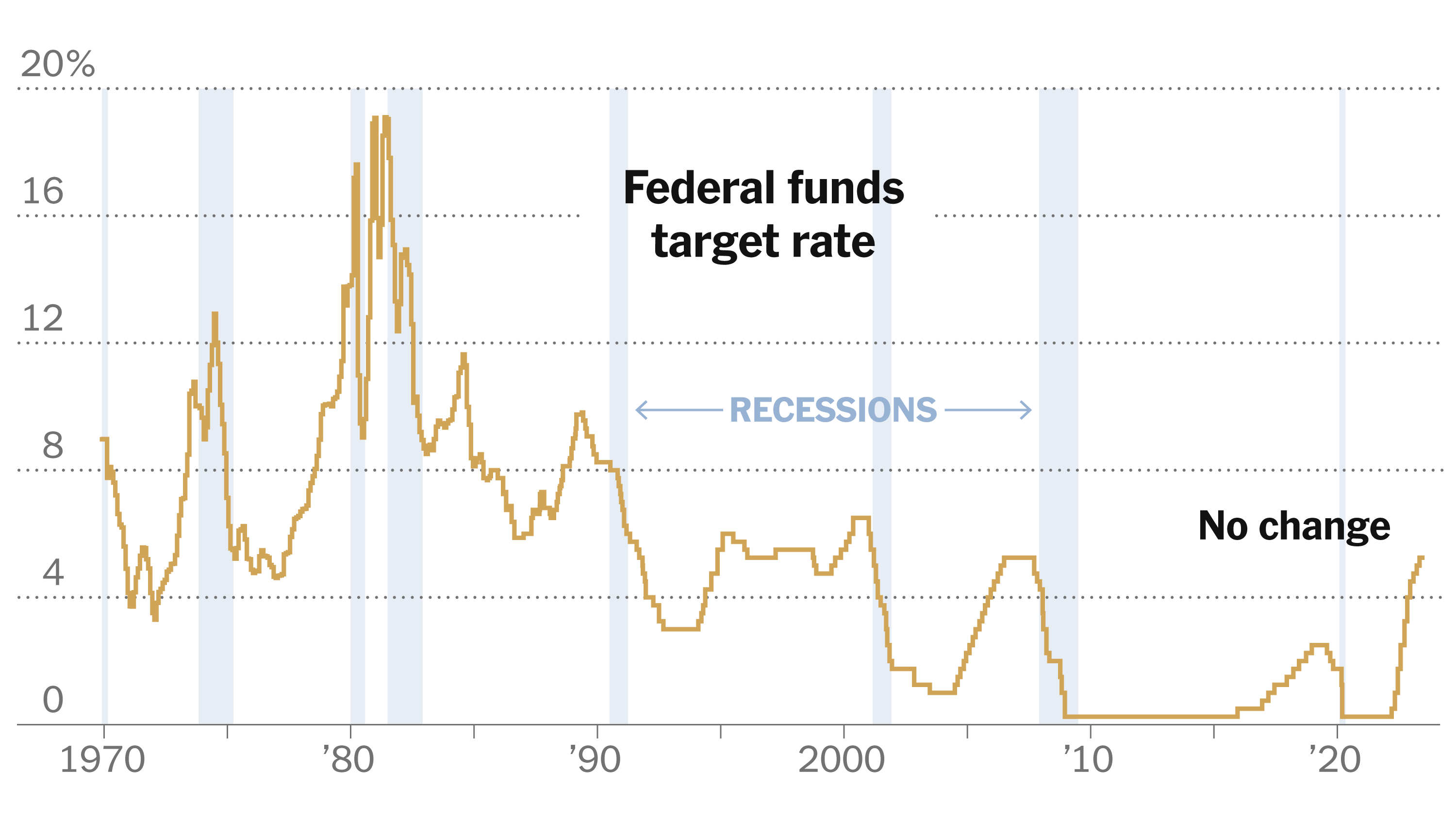

Interest Rate Outlook The Federal Reserves Balancing Act

May 09, 2025

Interest Rate Outlook The Federal Reserves Balancing Act

May 09, 2025 -

Nato And Palantir The Future Of Ai In Public Sector Applications

May 09, 2025

Nato And Palantir The Future Of Ai In Public Sector Applications

May 09, 2025 -

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour Eiffel

May 09, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour Eiffel

May 09, 2025