The Enduring Impact Of Trump's 30% Tariffs On China: A Forecast To Late 2025

Table of Contents

1. The Initial Impact of the 30% Tariffs:

The immediate consequences of Trump's 30% tariffs were dramatic and far-reaching. The ripple effect was felt across numerous sectors, triggering significant disruptions and uncertainty.

1.1 Disruption to Supply Chains: The tariffs created immediate and substantial supply chain disruption. Industries heavily reliant on Chinese imports, such as electronics and textiles, were hit particularly hard. This led to:

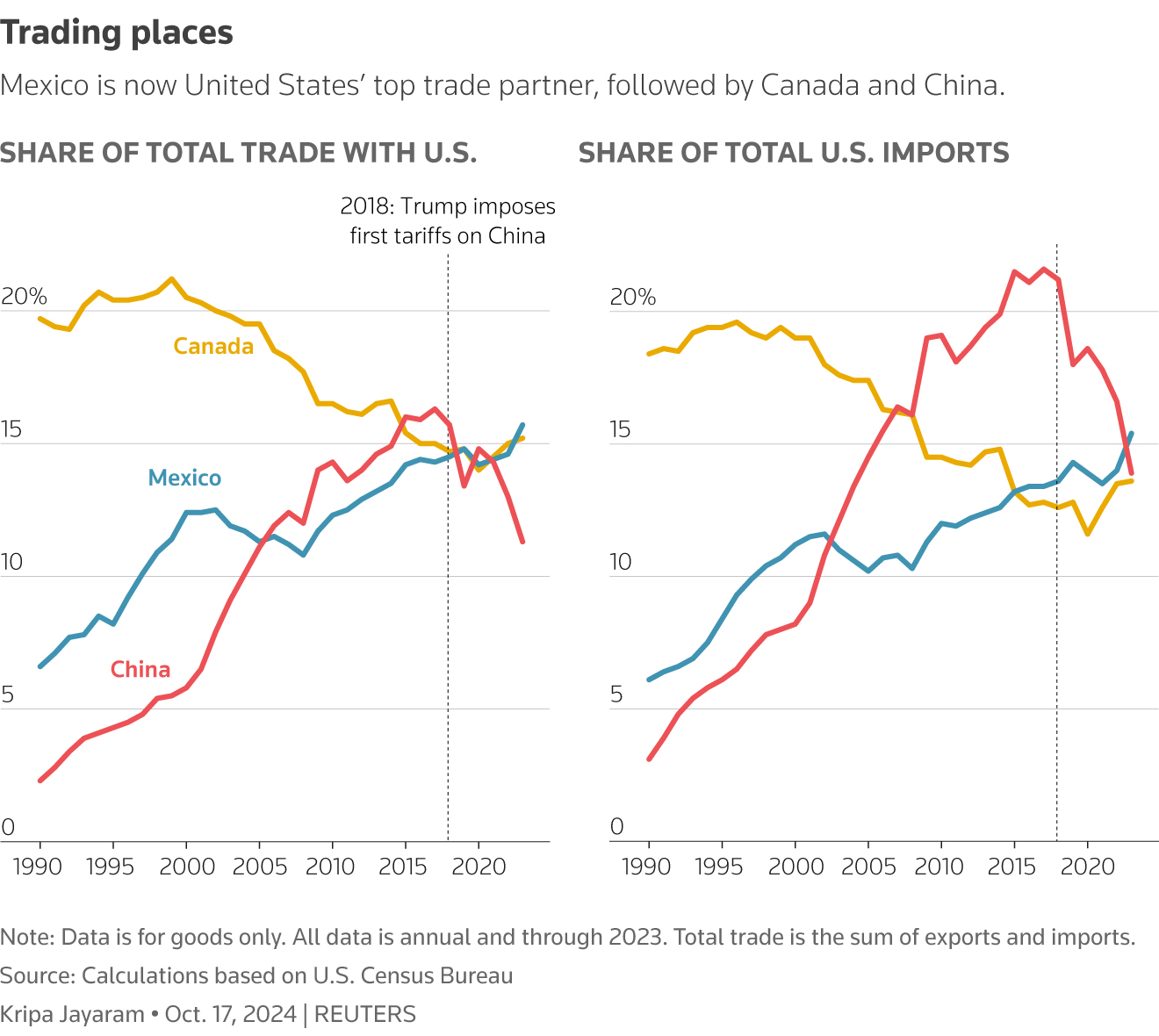

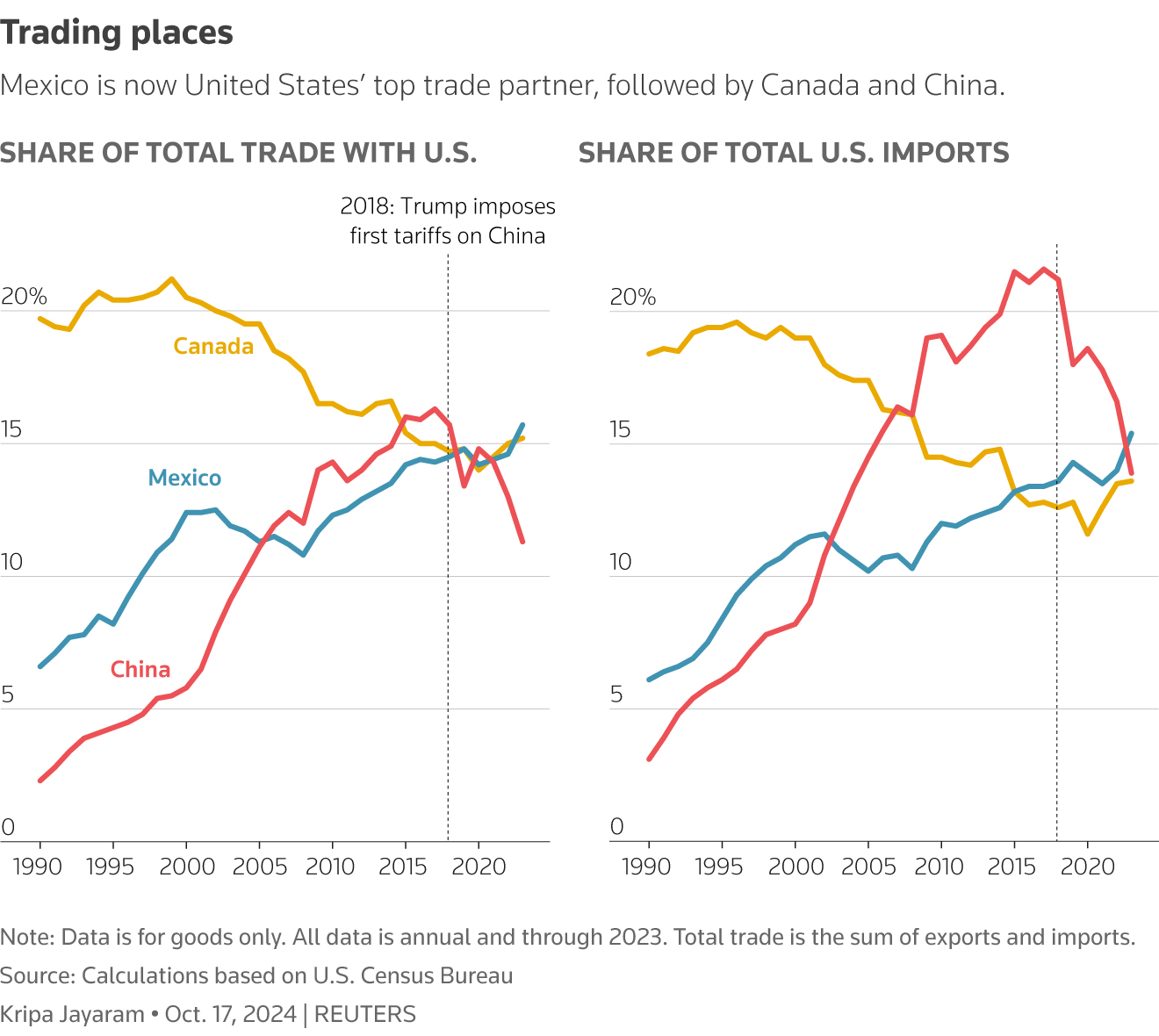

- Relocation of Production: Many companies scrambled to diversify their supply chains, relocating manufacturing to countries like Vietnam, Mexico, and India to avoid the tariff burden. This resulted in increased costs associated with establishing new production lines and training new workforces.

- Increased Shipping Costs: The shift in production locations led to longer shipping distances and increased transportation costs, further adding to the price of goods.

- Delays in Product Delivery: The complex process of reshoring and adjusting supply chains resulted in significant delays in the delivery of products to consumers and businesses alike. The tariff impact on supply chains proved to be a long-lasting challenge, requiring significant adaptation and investment. The global trade disruption significantly impacted businesses' ability to meet consumer demand and maintain profitability.

1.2 Price Increases for Consumers: The increased import costs resulting from the tariffs directly translated into higher prices for consumers in the US. This contributed significantly to inflation and impacted consumer spending patterns. Specific examples include:

- Increased Prices of Electronics: Consumers saw a noticeable increase in the cost of electronics, particularly those with components sourced from China.

- Higher Clothing Costs: The textile and apparel industries felt the full force of the tariffs, leading to higher clothing prices.

- Inflationary Pressure: The tariff impact on consumer prices contributed to a broader inflationary trend in the US economy. Data from the Bureau of Labor Statistics clearly showed the correlation between the tariffs and increased consumer prices. This resulted in altered consumer spending habits as individuals adjusted their budgets to account for the increased cost of goods.

2. Long-Term Economic Consequences:

The long-term economic ramifications of Trump's 30% tariffs on China continue to unfold. The impact has been multifaceted, affecting both US businesses and the broader geopolitical landscape.

2.1 Impact on US Businesses: While some US businesses benefited from increased domestic demand due to the tariffs, the overall impact was complex and varied across sectors.

- Increased Domestic Manufacturing: Some industries saw a boost in domestic manufacturing as companies sought to reduce reliance on Chinese imports. However, this was often accompanied by increased production costs.

- Job Creation (or Lack Thereof): The extent to which the tariffs led to significant job creation in the US remains a subject of debate. While some jobs were created in domestic manufacturing, others were lost in industries heavily reliant on imports from China.

- Business Competitiveness: The tariffs affected the competitiveness of US firms in both domestic and international markets, with some companies benefiting while others struggled to adjust to the new trade landscape.

2.2 Geopolitical Implications: The tariffs significantly strained the US-China relationship, further fueling the ongoing trade war. The geopolitical consequences included:

- Retaliatory Tariffs from China: China retaliated with its own tariffs on US goods, impacting various sectors and creating a tit-for-tat cycle of protectionist measures.

- Changes in Trade Agreements: The tariffs accelerated discussions and negotiations regarding various trade agreements, forcing nations to re-evaluate their strategic alliances and trade partners.

- Shifts in Global Alliances: The heightened trade tensions contributed to shifts in global alliances and economic power dynamics, impacting international relations.

3. Forecasting the Impact Until Late 2025:

Predicting the full economic impact of Trump's 30% tariffs until late 2025 requires careful consideration of various factors.

3.1 Projected Economic Growth: Forecasts for economic growth in both the US and China are intertwined with the lingering effects of these tariffs. While certain economic reports suggest a partial recovery, the full impact is yet to be determined.

- GDP Growth Projections: Economic models predict varying levels of GDP growth in both countries depending on the future direction of trade policy. The long-term economic impact may involve protracted periods of adjustment and adaptation.

- Expert Opinions: Experts offer divergent views on the long-term effects, with some arguing for sustained negative impacts and others forecasting eventual normalization.

3.2 Potential Policy Changes: Future policy changes under different administrations or international agreements could significantly alter the trajectory of the tariffs' impact.

- Trade Negotiations: Ongoing trade negotiations and potential agreements between the US and China could lead to tariff reductions or complete removal.

- Policy Shifts: Changes in US trade policy under future administrations could either perpetuate or alleviate the effects of the tariffs. Future trade agreements could also significantly reshape global trade flows.

4. Conclusion:

Trump's 30% tariffs on China had a profound and multifaceted impact on the global economy. The initial disruption to supply chains and subsequent price increases for consumers were immediate and substantial. The long-term consequences, including effects on US businesses and geopolitical relations, are still unfolding. Our forecast to late 2025 suggests continued economic adjustments and uncertainties, highly dependent on future trade policies and international agreements. The lingering effects of "Trump's 30% Tariffs on China" demand continued research and analysis. We encourage you to explore further resources and engage in thoughtful discussions regarding this crucial aspect of contemporary global economics. Understanding the implications of these tariffs is critical to comprehending the future of US-China trade relations and global economic stability.

Featured Posts

-

Vehicle Subsystem Issue Delays Blue Origin Rocket Launch

May 17, 2025

Vehicle Subsystem Issue Delays Blue Origin Rocket Launch

May 17, 2025 -

Exclusive Averted Midair Collision The Air Traffic Controllers Story

May 17, 2025

Exclusive Averted Midair Collision The Air Traffic Controllers Story

May 17, 2025 -

Should Jalen Brunson End His Podcast Perkins Weighs In

May 17, 2025

Should Jalen Brunson End His Podcast Perkins Weighs In

May 17, 2025 -

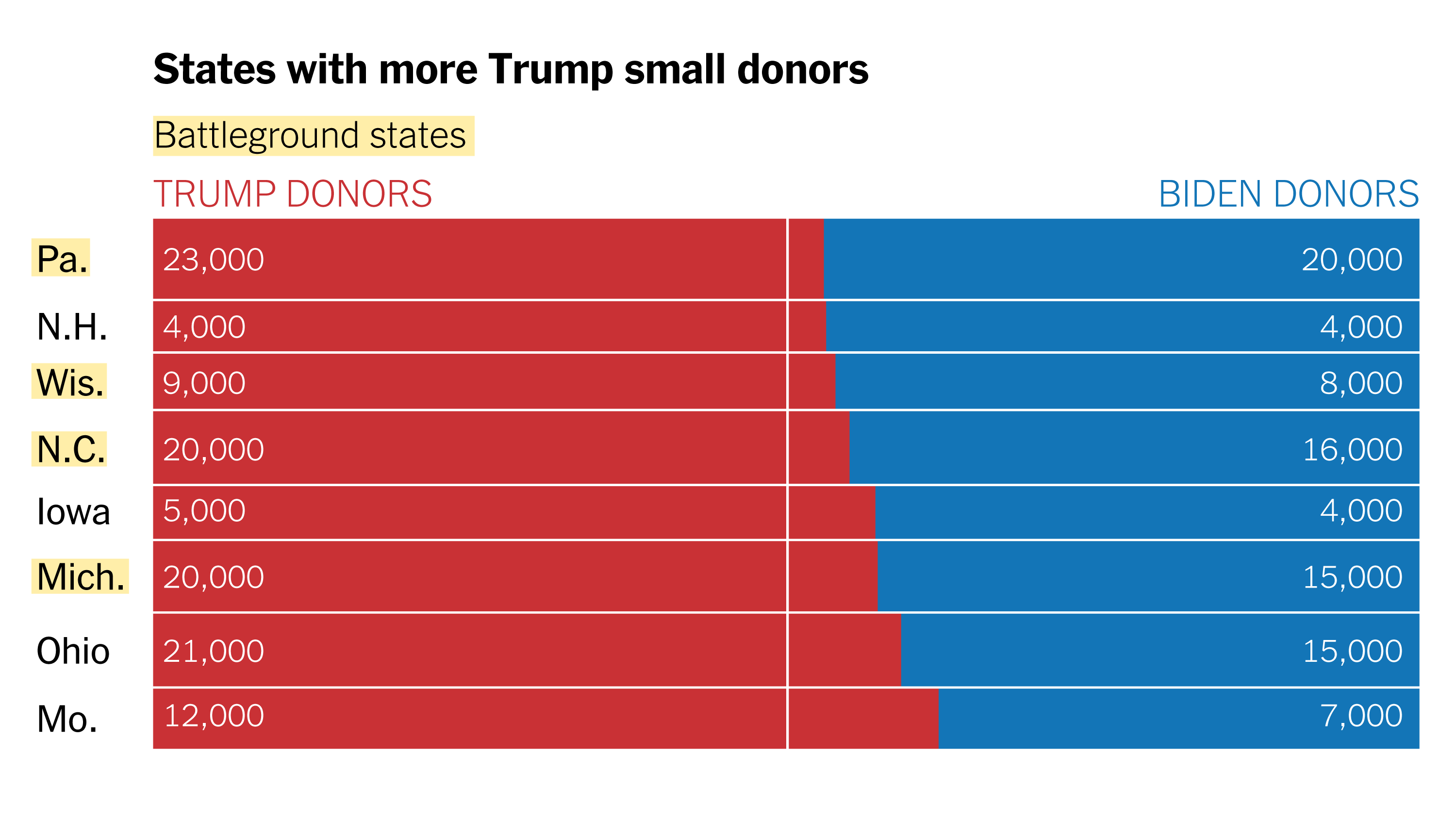

Investigation Exclusive Military Events And Vip Access For Trump Donors

May 17, 2025

Investigation Exclusive Military Events And Vip Access For Trump Donors

May 17, 2025 -

The Knicks Turnaround Thibodeaus Strategic Adjustments And Improved Team Performance

May 17, 2025

The Knicks Turnaround Thibodeaus Strategic Adjustments And Improved Team Performance

May 17, 2025

Latest Posts

-

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025 -

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025 -

Rep Crocketts Criticism Of Trumps Economic Policies Inflation And Wages

May 17, 2025

Rep Crocketts Criticism Of Trumps Economic Policies Inflation And Wages

May 17, 2025 -

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025 -

Crockett Accuses Trump Of Raising Grocery Prices And Threatening Paychecks

May 17, 2025

Crockett Accuses Trump Of Raising Grocery Prices And Threatening Paychecks

May 17, 2025