The Fallout From Hudson's Bay Closures: A Retail Real Estate Reshuffle

Table of Contents

The recent closures of Hudson's Bay Company (HBC) stores across Canada have sent shockwaves through the retail landscape, triggering a significant real estate reshuffle with implications for landlords, developers, and competing retailers. This article will analyze the consequences of these Hudson's Bay closures and explore the evolving retail real estate market in Canada.

<h2>Impact on Landlords and Property Values</h2>

The sudden vacancy of large retail spaces previously occupied by HBC will significantly impact landlords' rental income and property values. This creates both challenges and opportunities.

<h3>Decreased Rental Income and Vacancy Rates</h3>

The immediate impact of Hudson's Bay closures is a substantial decrease in rental income for landlords. These large vacant spaces represent a significant loss of revenue. This will likely lead to:

- Negotiations for reduced rent with new tenants: Landlords will be forced to negotiate lower rental rates to attract new tenants to fill the massive spaces left behind by HBC.

- Increased competition among landlords: The increased supply of vacant retail space will intensify competition amongst landlords, driving rental rates down further.

- Potential downward pressure on property values in affected areas: High vacancy rates and reduced rental income can negatively impact the overall assessed value of properties, particularly in areas heavily reliant on retail activity. This is a significant concern for commercial real estate investors.

<h3>Redevelopment Opportunities</h3>

However, the closures also present opportunities for redevelopment. Landlords may seize this chance to modernize and repurpose these large spaces, potentially converting them into:

- Mixed-use developments: Incorporating residential units, office spaces, and entertainment venues alongside retail can create vibrant, self-sustaining communities and attract a wider range of tenants.

- Smaller retail units: Dividing the large spaces into smaller units can attract a diverse range of smaller businesses, creating a more dynamic retail environment. This diversification reduces risk and maximizes rental income potential.

- Modernized spaces to attract new, experience-driven retailers: Renovating these spaces to meet the demands of today’s experience-driven retail market—with features like improved lighting, open layouts, and technology integration—can attract higher-paying tenants.

<h2>Opportunities for Competing Retailers</h2>

The closure of HBC stores presents significant opportunities for competing retailers to expand their market share and strengthen their presence.

<h3>Expansion and Market Share Gains</h3>

Competitors like Walmart, Target, and other department stores can capitalize on the vacated HBC locations by:

- Acquiring vacated HBC locations for expansion: Securing these prime retail locations allows for immediate expansion into new markets or strengthening existing ones.

- Capturing a larger share of the market previously held by HBC: With HBC's departure, there's a significant void in the market, and competitors are well-positioned to attract those former customers.

- Attracting former HBC customers: Targeted marketing campaigns can effectively attract customers who are now looking for alternative shopping destinations.

<h3>Strategic Location Advantages</h3>

Securing these prime retail spaces offers substantial advantages:

- Established customer traffic patterns: These locations already benefit from established foot traffic, reducing the need for extensive marketing efforts to attract customers.

- High visibility and accessibility: HBC locations are typically situated in high-traffic areas with easy access, providing optimal visibility and accessibility for new tenants.

- Enhanced brand presence in key markets: Acquiring these locations significantly enhances a retailer’s brand presence and strengthens its market position.

<h2>The Broader Implications for the Retail Sector</h2>

The Hudson's Bay closures highlight broader challenges facing traditional brick-and-mortar retailers.

<h3>Shifting Consumer Preferences</h3>

The closures reflect significant shifts in the retail landscape:

- The rise of e-commerce: Online shopping continues to grow, impacting the viability of traditional retail models.

- Changing consumer shopping habits: Consumers are increasingly demanding convenience, personalized experiences, and omnichannel shopping options.

- Increased competition from online marketplaces: Online marketplaces offer vast product selection and competitive pricing, making it challenging for traditional retailers to compete.

<h3>Adapting to the Evolving Retail Landscape</h3>

To thrive in this evolving environment, retailers must adapt:

- Omnichannel strategies: Integrating online and offline shopping experiences to offer customers seamless and convenient shopping options is essential for survival.

- Personalized customer service and engagement: Providing tailored experiences, loyalty programs, and personalized recommendations enhances customer satisfaction and loyalty.

- Experiential retail: Creating unique in-store experiences that go beyond simply selling products – incorporating entertainment, events, and interactive elements – can attract customers to physical stores.

<h2>Conclusion</h2>

The fallout from Hudson's Bay closures presents a complex and dynamic situation with significant consequences for the retail real estate market. Landlords face challenges, but also redevelopment opportunities. Competing retailers can benefit from expansion and market share gains. The broader impact highlights the need for the retail sector to adapt to changing consumer preferences and the rise of e-commerce. Understanding the implications of these Hudson's Bay closures is crucial for navigating the evolving retail landscape. To stay ahead of the curve and learn more about the impact of major retail closures, continue following industry news and analysis related to retail real estate reshuffling and Canadian retail market trends.

Featured Posts

-

Calendario Laboral Espana Festivo 21 De Abril Y Puente Para 16 5 Millones

Apr 23, 2025

Calendario Laboral Espana Festivo 21 De Abril Y Puente Para 16 5 Millones

Apr 23, 2025 -

Brewers Edge Royals With 11th Inning Walk Off Bunt

Apr 23, 2025

Brewers Edge Royals With 11th Inning Walk Off Bunt

Apr 23, 2025 -

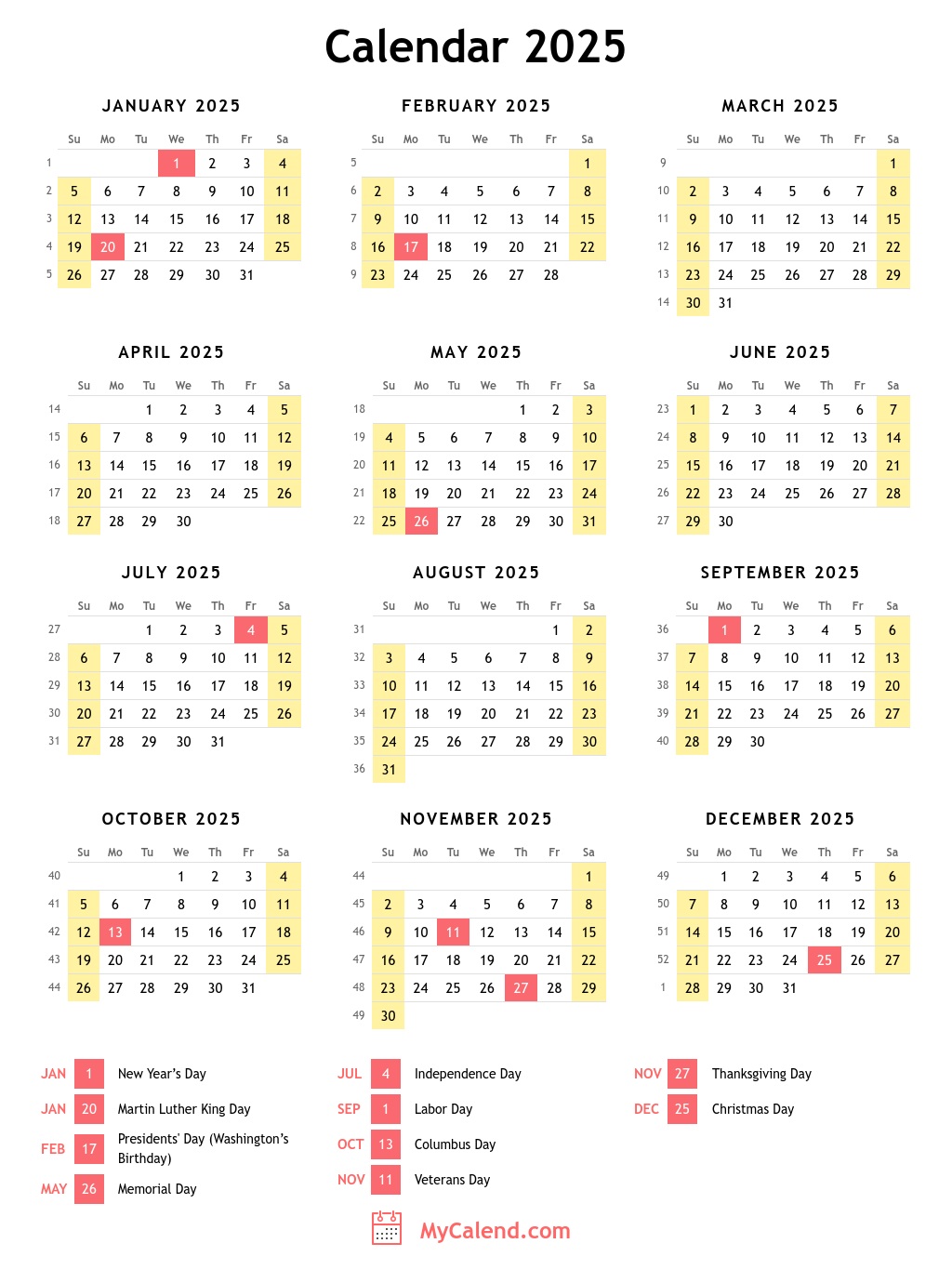

2025 Us Holiday Calendar A Complete Guide To Federal And Non Federal Holidays

Apr 23, 2025

2025 Us Holiday Calendar A Complete Guide To Federal And Non Federal Holidays

Apr 23, 2025 -

Millions Lost Inside The Office365 Executive Account Hacking Scandal

Apr 23, 2025

Millions Lost Inside The Office365 Executive Account Hacking Scandal

Apr 23, 2025 -

Hangi Diziler Var 17 Subat Pazartesi Tv Dizileri

Apr 23, 2025

Hangi Diziler Var 17 Subat Pazartesi Tv Dizileri

Apr 23, 2025

Latest Posts

-

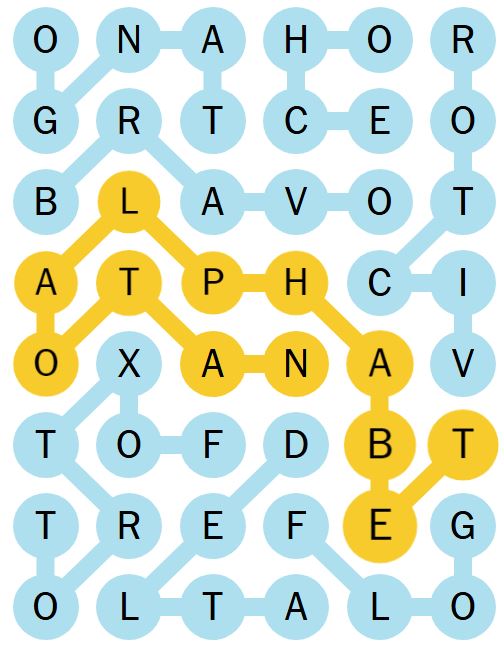

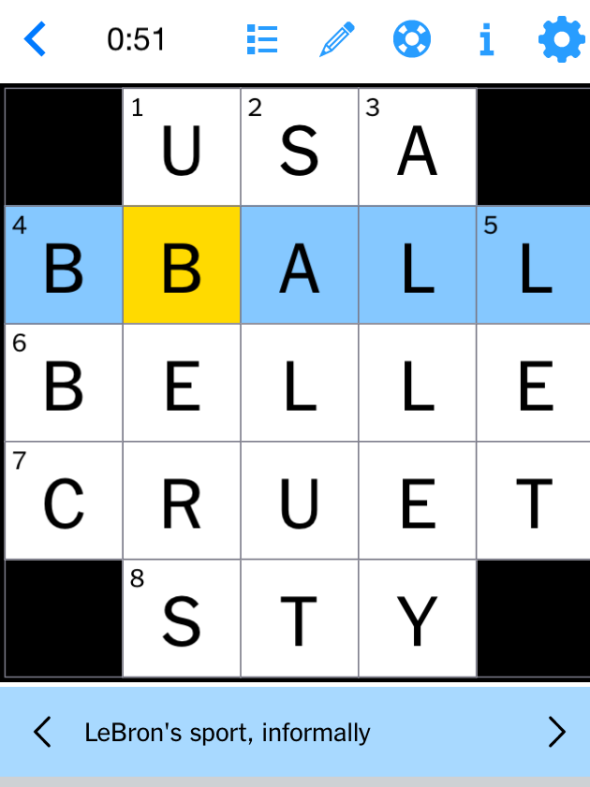

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025 -

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025 -

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025 -

April 10th Nyt Strands Solutions Game 403

May 10, 2025

April 10th Nyt Strands Solutions Game 403

May 10, 2025 -

Wednesday April 9 Nyt Strands Solutions Game 402

May 10, 2025

Wednesday April 9 Nyt Strands Solutions Game 402

May 10, 2025