The GOP Tax Plan And The National Deficit: Fact Vs. Fiction

Table of Contents

The GOP Tax Plan's Projected Revenue Impacts

Initial Projections vs. Reality

Initial projections surrounding the 2017 GOP tax cuts, often touted as stimulative, predicted significant revenue increases fueled by economic growth. However, reality painted a different picture. The Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT), while employing differing methodologies, both projected a substantial increase in the national deficit due to the tax cuts.

- CBO Projection: The CBO's initial estimates significantly underestimated the revenue shortfall.

- JCT Projection: The JCT's projections, while closer to the actual outcome, still failed to fully capture the magnitude of the revenue loss.

- Reality: Actual revenue collected fell considerably short of initial optimistic projections, primarily due to slower-than-anticipated economic growth and changes in taxpayer behavior. This discrepancy highlights the inherent challenges in accurately forecasting economic outcomes influenced by tax policy.

Dynamic Scoring and its Limitations

The concept of "dynamic scoring" underpins many arguments supporting supply-side economics. This approach posits that tax cuts stimulate economic growth so significantly that the resulting increase in tax revenue offsets the initial revenue loss. However, dynamic scoring has significant limitations:

- Uncertain Economic Growth: Predicting the precise amount of economic growth resulting from tax cuts is inherently uncertain, making accurate estimations challenging.

- Behavioral Responses: Dynamic scoring often fails to accurately account for changes in taxpayer behavior, such as increased saving instead of investment.

- Alternative Models: Alternative economic models, such as static scoring which doesn't account for economic growth, often provide more conservative and arguably more accurate projections.

The Impact of Increased Spending Under the GOP Tax Plan

Relationship Between Tax Cuts and Spending

While the GOP tax plan focused on tax cuts, the subsequent increase in the national deficit is not solely attributable to reduced revenue. Increased government spending plays a crucial role.

- Discretionary Spending: Increases in defense spending and other discretionary programs contributed significantly to the deficit expansion.

- Mandatory Spending: The growth of entitlement programs like Social Security and Medicare, while not directly linked to the tax plan, also exerts upward pressure on the national debt.

- Fiscal Stimulus: Government spending increases in response to economic downturns further amplify the deficit.

Fiscal Responsibility and the National Debt

The sustained expansion of the national deficit under the GOP tax plan has profound long-term implications:

- Higher Interest Rates: Increased borrowing to finance the deficit can lead to higher interest rates, impacting both the government and the private sector.

- Reduced Government Investment: Growing debt can constrain future government spending on vital social programs and infrastructure.

- Intergenerational Equity: The increased national debt burdens future generations with the responsibility of repaying the accumulated debt.

Alternative Explanations for Changes in the National Deficit

Economic Factors Beyond Tax Policy

Attributing changes in the national deficit solely to the GOP tax plan overlooks significant external economic factors:

- Economic Slowdowns: Recessions and economic downturns automatically reduce tax revenue and increase government spending on social safety nets.

- Global Economic Conditions: Global economic instability and trade wars can significantly impact the US economy and the national deficit.

- Government Responses to Crises: Unforeseen crises, such as the COVID-19 pandemic, necessitate substantial government spending, regardless of tax policies.

Comparing Deficit Growth Under Different Administrations

Analyzing deficit growth across different administrations reveals that multiple factors influence the national debt. Simple comparisons, without considering the economic context of each period, can be misleading. For example, comparing deficit growth during a period of economic expansion with growth during a recession is inherently flawed. Using charts and graphs to visualize the data alongside explanations of relevant economic conditions is crucial for a fair comparison.

Conclusion

Separating fact from fiction regarding the GOP Tax Plan and the National Deficit requires a nuanced understanding of complex economic interactions. While the tax cuts undeniably contributed to an increase in the national debt, the impact is not solely attributable to the tax plan itself. External economic factors and increases in government spending also played significant roles. Common misconceptions arise from oversimplifying a multifaceted issue. It's crucial to consult reputable sources like the CBO and JCT for reliable data and analysis. Engage in informed discussions, critically evaluate future economic proposals, and demand transparent and accountable fiscal policies. Understanding the intricacies of the GOP Tax Plan and the National Deficit is crucial for responsible civic engagement.

Featured Posts

-

Finansoviy Reyting Ukrayini 2024 Lideri Rinku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 21, 2025

Finansoviy Reyting Ukrayini 2024 Lideri Rinku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 21, 2025 -

Peppa Pig Theme Park Texas What To Expect On Your Visit

May 21, 2025

Peppa Pig Theme Park Texas What To Expect On Your Visit

May 21, 2025 -

Big Bear Ai Bbai Understanding The Recent Analyst Downgrade

May 21, 2025

Big Bear Ai Bbai Understanding The Recent Analyst Downgrade

May 21, 2025 -

Finding Strength In Challenges A Practical Guide To Resilience

May 21, 2025

Finding Strength In Challenges A Practical Guide To Resilience

May 21, 2025 -

Pivdenniy Mist Rekonstruktsiya Pidryadniki Byudzhet Ta Termini

May 21, 2025

Pivdenniy Mist Rekonstruktsiya Pidryadniki Byudzhet Ta Termini

May 21, 2025

Latest Posts

-

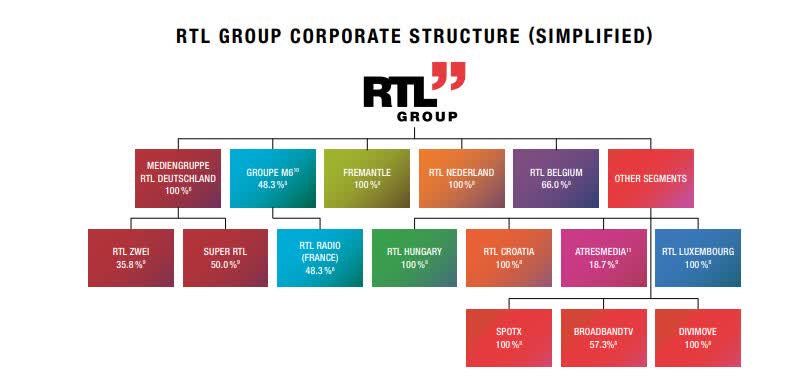

Is Rtl Group Poised For Streaming Success A Look At Profitability Projections

May 21, 2025

Is Rtl Group Poised For Streaming Success A Look At Profitability Projections

May 21, 2025 -

Architektin Legt Endgueltige Form Am Bau Fest

May 21, 2025

Architektin Legt Endgueltige Form Am Bau Fest

May 21, 2025 -

Rtl Group Achieving Streaming Profitability Analysis And Outlook

May 21, 2025

Rtl Group Achieving Streaming Profitability Analysis And Outlook

May 21, 2025 -

Is Mainzs Henriksen The Next Big Managerial Talent After Klopp And Tuchel

May 21, 2025

Is Mainzs Henriksen The Next Big Managerial Talent After Klopp And Tuchel

May 21, 2025 -

Kaellmanin Ja Hoskosen Sopimus Puolan Seuran Kanssa Paeaettyy

May 21, 2025

Kaellmanin Ja Hoskosen Sopimus Puolan Seuran Kanssa Paeaettyy

May 21, 2025