The Hudson's Bay Leases: Weihong Liu's Strategic Investment

Table of Contents

Understanding Weihong Liu's Investment Portfolio and Strategy

Weihong Liu is a prominent figure in the global investment world, known for his shrewd investment decisions and keen eye for undervalued assets. While detailed information about his entire portfolio may not be publicly available, his track record suggests a focus on long-term growth and strategic acquisitions in sectors with high potential for appreciation. Liu's investment style is characterized by:

- Thorough Due Diligence: He meticulously researches potential investments, focusing on fundamental analysis and long-term market trends.

- Value Investing: He seeks opportunities to acquire assets below their intrinsic value, aiming for substantial returns over time.

- Strategic Partnerships: He often collaborates with other experienced investors and developers to maximize returns and mitigate risk.

While specific details of his previous investments in the retail or real estate sectors may not be publicly known, his success suggests a preference for established companies and properties with strong potential for redevelopment or increased rental income. His approach likely involves a careful assessment of both the short-term and long-term prospects of each investment.

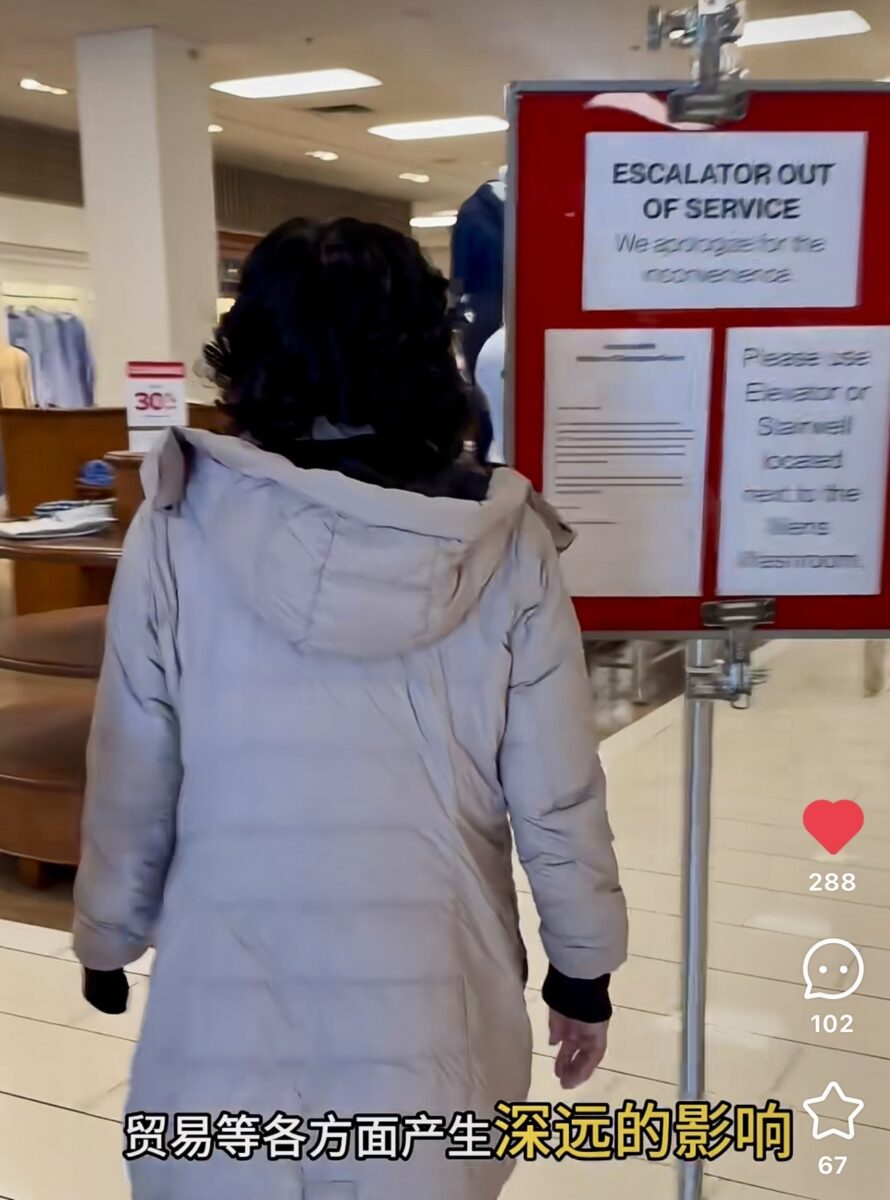

The Appeal of Hudson's Bay Leases: A Prime Real Estate Opportunity

The allure of Hudson's Bay leases lies in several key factors:

- Prime Locations: Many HBC properties are situated in high-demand urban centers across Canada, offering significant advantages in terms of foot traffic, accessibility, and overall desirability. These prime locations contribute significantly to their value.

- High-Value Properties: The buildings themselves are often substantial and well-maintained, presenting opportunities for various uses beyond retail. Their historical significance in some cases also adds to their value.

- Redevelopment Potential: Many of these properties have potential for redevelopment, allowing for increased rental income and property appreciation. This redevelopment potential is a major attraction for investors like Liu.

- Strong Rental Income: The existing lease agreements generate consistent rental income, providing a stable cash flow for investors. This rental income stream is crucial to the overall return on investment.

- High ROI Potential: The combination of prime location, redevelopment potential, and consistent rental income points to a high return on investment (ROI), making these leases attractive to experienced investors.

These high-value properties represent a compelling investment opportunity for anyone seeking strong returns in the Canadian real estate market.

Analyzing the Financial Aspects of Weihong Liu's Hudson's Bay Investment

While the exact financial details of Weihong Liu's investment in Hudson's Bay leases might not be fully public, an analysis of the deal must consider several aspects:

- Investment Amount: The initial investment amount is a crucial factor determining the potential returns and overall risk profile of the investment. While this remains undisclosed, it's likely a substantial figure given the scale and prime locations of the properties involved.

- Return on Investment (ROI): The anticipated ROI depends on various factors, including the purchase price, rental income, potential for redevelopment, and future appreciation in value.

- Financial Risk: Any real estate investment carries inherent risks. Market fluctuations, changes in consumer behavior, and unexpected maintenance costs could all impact returns.

- Market Analysis: Independent market analyses regarding the current and projected value of Hudson's Bay properties would offer crucial insight into the soundness of Liu's investment.

- Financial Projections: Liu would likely have developed detailed financial projections outlining anticipated income, expenses, and overall returns based on various scenarios.

The potential impact on Hudson's Bay Company itself depends largely on the terms of the lease agreements and any potential long-term strategic partnerships that might emerge.

Potential Future Developments and Impacts

The acquisition of these Hudson's Bay leases by Weihong Liu opens up several avenues for future development. He might choose to:

- Refurbish existing properties: Enhancing the current structures to attract new tenants and increase rental income.

- Redevelop properties: Transforming the properties into mixed-use developments incorporating residential or office space alongside retail.

- Attract new tenants: Diversifying the tenant mix to create a more vibrant and sustainable retail environment.

These changes could significantly impact the surrounding communities, potentially leading to increased economic activity, job creation, and improved urban landscapes. Conversely, any large-scale redevelopment might also face community resistance or regulatory hurdles.

Conclusion: The Significance of Weihong Liu's Hudson's Bay Lease Investment – A Look Ahead

Weihong Liu's strategic investment in Hudson's Bay leases represents a significant development in the Canadian real estate market. The acquisition of these prime locations showcases Liu’s confidence in the long-term prospects of Canadian retail and urban development. The analysis highlights the potential for substantial returns, emphasizing the allure of both rental income and the redevelopment potential of these high-value properties. However, it's crucial to acknowledge the inherent financial risks involved in any large-scale real estate investment.

The long-term implications of this investment are far-reaching. Liu’s decisions regarding future development will likely shape the retail landscape and potentially influence surrounding communities. To further explore the intricacies of Hudson's Bay leases, Weihong Liu's investment strategy, and similar strategic real estate investments, further research into relevant market analyses and financial reports is recommended.

Featured Posts

-

Review 2025 Kawasaki Ninja 650 Krt Edition

May 30, 2025

Review 2025 Kawasaki Ninja 650 Krt Edition

May 30, 2025 -

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025 -

Neue Sportart And Eheglueck Steffi Grafs Ueberraschende Enthuellung Mit Andre Agassi

May 30, 2025

Neue Sportart And Eheglueck Steffi Grafs Ueberraschende Enthuellung Mit Andre Agassi

May 30, 2025 -

Competition Bureaus Case Against Google Potential Constitutional Implications

May 30, 2025

Competition Bureaus Case Against Google Potential Constitutional Implications

May 30, 2025 -

August Moon Jacob Alons Latest Release

May 30, 2025

August Moon Jacob Alons Latest Release

May 30, 2025

Latest Posts

-

Zverev Triumphs Munich Semifinals Await After Tough Matches

May 31, 2025

Zverev Triumphs Munich Semifinals Await After Tough Matches

May 31, 2025 -

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025

Zverevs Comeback Victory Sends Him To Munich Semifinals

May 31, 2025 -

Munich Open Shelton Beats Darderi To Reach Semifinals

May 31, 2025

Munich Open Shelton Beats Darderi To Reach Semifinals

May 31, 2025 -

Rome Masters Alcaraz And Passaro Secure Wins At Italian International

May 31, 2025

Rome Masters Alcaraz And Passaro Secure Wins At Italian International

May 31, 2025 -

Italian International Alcaraz Wins Opener Passaro Upsets Dimitrov In Rome

May 31, 2025

Italian International Alcaraz Wins Opener Passaro Upsets Dimitrov In Rome

May 31, 2025