The Impact Of Trump's Signature Bill On The AI Industry

Table of Contents

Fiscal Impact of Trump's Signature Bill on AI Investment

The Tax Cuts and Jobs Act of 2017 significantly altered the financial landscape for the AI industry, primarily through its tax incentive provisions and corporate tax rate reductions.

Tax Incentives and their Effect on AI Startups

The bill's tax cuts injected a significant boost into venture capital funding for AI startups. Lower capital gains taxes incentivized investors to pour more money into this burgeoning sector. This, in turn, fueled increased Research and Development (R&D) spending within the AI industry. While quantifying the exact impact is challenging, anecdotal evidence and industry reports suggest a surge in funding for AI companies post-2017. For example, companies specializing in machine learning and deep learning saw a noticeable uptick in investment rounds. Conversely, some argue that the benefits were unevenly distributed, with larger, established firms potentially benefiting more than smaller startups.

- Increased investment: Venture capital funding for AI startups increased significantly after the bill's passage.

- Attraction of foreign investment: Lower taxes made the US a more attractive destination for foreign investment in AI.

- Growth of AI hubs: Existing AI hubs experienced further growth, while new ones emerged, driven by increased funding and activity.

Corporate Tax Cuts and Large-Scale AI Development

The reduction in the corporate tax rate from 35% to 21% had a profound effect on the ability of large technology companies to invest heavily in AI. This freed up substantial capital for infrastructure development, including the construction of massive data centers and the acquisition of advanced computing power crucial for AI development. Companies like Google, Amazon, and Microsoft significantly increased their R&D budgets allocated to AI, leading to advancements in areas like natural language processing, computer vision, and cloud-based AI services.

However, this concentration of resources in the hands of a few tech giants also raised concerns about increased consolidation within the AI industry, potentially leading to monopolies and reduced competition.

- Increased R&D budgets: Major tech companies dramatically increased their investment in AI research and development.

- Development of new AI technologies: The increased funding facilitated breakthroughs and the development of cutting-edge AI technologies.

- Potential for monopolies: The concentration of resources in a few hands raised concerns about market dominance and reduced competition.

Regulatory Changes and their Influence on the AI Landscape

The Tax Cuts and Jobs Act of 2017, while primarily focused on fiscal policy, indirectly influenced the regulatory environment surrounding AI. Its emphasis on deregulation had both positive and negative implications.

Deregulation and its Effects on AI Innovation

The bill's relatively hands-off approach to AI regulation fostered a climate of accelerated innovation. Reduced bureaucratic hurdles allowed AI companies to develop and deploy their technologies more rapidly. This fostered a dynamic and competitive environment, potentially pushing the boundaries of AI capabilities. However, this speed came at the cost of potentially overlooking crucial ethical considerations and safety concerns.

- Accelerated innovation: Reduced regulations led to a faster pace of AI development and deployment.

- Reduced bureaucratic hurdles: Companies faced fewer regulatory obstacles, speeding up the development process.

- Potential ethical concerns: The rapid pace of development raised concerns about the ethical implications of unchecked AI innovation.

Impact on Data Privacy and AI Ethics

While the Tax Cuts and Jobs Act didn't directly address data privacy, its indirect impact is noteworthy. The lack of specific AI-focused regulations in the bill left a gap in addressing the ethical use of data in AI systems. This raised concerns about algorithmic bias, fairness, and accountability in AI applications. The subsequent need for additional legislation to address these concerns highlights a potential oversight in the original bill.

- Changes to data protection regulations: The bill did not directly address data privacy, leading to a need for subsequent legislation.

- Impact on algorithmic bias: The lack of clear regulations increased concerns about algorithmic bias and fairness.

- Ethical frameworks for AI development: The bill's silence on AI ethics emphasized the need for developing robust ethical frameworks for AI development and deployment.

Long-Term Effects of Trump's Signature Bill on the Future of AI

The long-term consequences of the Tax Cuts and Jobs Act on the AI industry are still unfolding, but several key trends are emerging.

Competitive Advantage and Global Standing

The bill's impact on the US's global competitiveness in AI is a complex issue. While increased investment fostered innovation, concerns remain about the potential for monopolistic practices and the uneven distribution of benefits. The US still retains a strong position in AI, but other countries are rapidly catching up, challenging its global leadership. The bill's effects on attracting and retaining AI talent are similarly mixed; while high salaries are attractive, concerns about ethical regulations and potential biases might deter some.

- Global competitiveness in AI: The US maintains a strong position but faces increasing competition from other nations.

- Attraction of AI talent: The US remains attractive but faces competition from countries with strong AI programs and regulations.

- Comparison to other countries: The US's approach, influenced by the bill, contrasts with the more regulatory approaches adopted by other nations.

Unintended Consequences and Future Policy Recommendations

The Tax Cuts and Jobs Act, while stimulating AI investment, also had unintended consequences. The lack of targeted AI regulation created challenges in addressing ethical concerns and ensuring responsible AI development. Future legislation should focus on establishing clear guidelines for data privacy, algorithmic fairness, and the ethical deployment of AI technologies. A balanced approach that encourages innovation while mitigating risks is crucial for the responsible development of AI.

- Unforeseen consequences: The bill's lack of specific AI regulation led to unforeseen challenges regarding ethical concerns and responsible development.

- Policy recommendations: Future legislation should address data privacy, algorithmic bias, and the ethical deployment of AI.

- Responsible AI development: A balanced approach is needed to foster innovation while minimizing risks and ensuring ethical considerations are addressed.

Conclusion: Assessing the Legacy of Trump's Signature Bill on the AI Industry

The Tax Cuts and Jobs Act of 2017 significantly impacted the AI industry, primarily through its fiscal policies. While the bill spurred investment and accelerated innovation, it also highlighted the need for a more nuanced and comprehensive regulatory framework addressing ethical concerns and responsible AI development. The long-term effects of this legislation are still unfolding, and its legacy will be defined by how effectively future policies address the challenges and opportunities it created. Understanding the full ramifications of Trump's Signature Bill on the AI industry requires further analysis. Continue your research by exploring [link to relevant resources, e.g., Congressional Research Service reports, academic papers] and join the conversation on the future of AI regulation.

Featured Posts

-

Viral Tik Tok Suki Waterhouse And The Twink Reference 97 1 Zht

May 20, 2025

Viral Tik Tok Suki Waterhouse And The Twink Reference 97 1 Zht

May 20, 2025 -

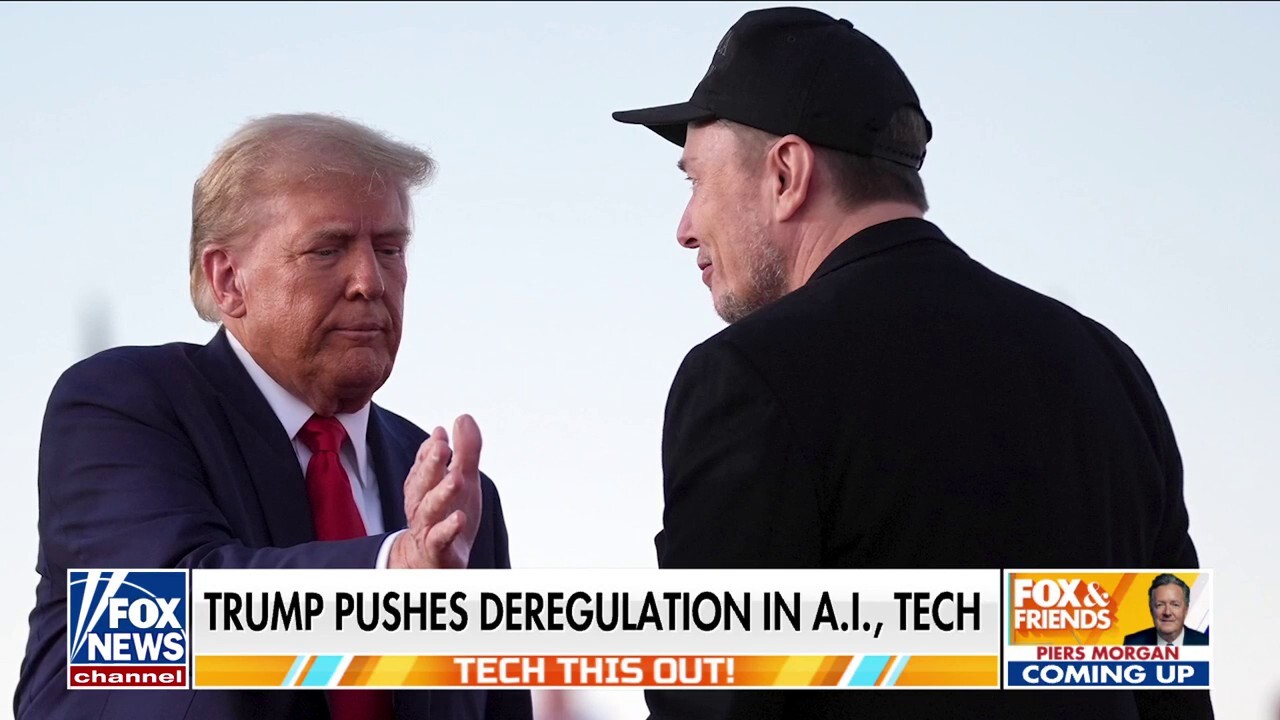

Sell America Bonds Moodys 30 Year Yield Surge To 5

May 20, 2025

Sell America Bonds Moodys 30 Year Yield Surge To 5

May 20, 2025 -

Affaire Aramburu Mise A Jour Sur La Recherche Des Suspects Neo Nazis

May 20, 2025

Affaire Aramburu Mise A Jour Sur La Recherche Des Suspects Neo Nazis

May 20, 2025 -

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Et La Participation Des Maires

May 20, 2025

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Et La Participation Des Maires

May 20, 2025 -

Suki Waterhouses North American Tour The Surface Experience

May 20, 2025

Suki Waterhouses North American Tour The Surface Experience

May 20, 2025

Latest Posts

-

The Power Of Sound Musics Unifying Perimeter

May 21, 2025

The Power Of Sound Musics Unifying Perimeter

May 21, 2025 -

Sharing Success A Louth Food Businesss Guide To Growth

May 21, 2025

Sharing Success A Louth Food Businesss Guide To Growth

May 21, 2025 -

Sound Perimeter How Music Connects Us

May 21, 2025

Sound Perimeter How Music Connects Us

May 21, 2025 -

Young Entrepreneurs Journey Building A Food Business In Louth And Beyond

May 21, 2025

Young Entrepreneurs Journey Building A Food Business In Louth And Beyond

May 21, 2025 -

From Food Hero To Business Mentor A Louth Success Story

May 21, 2025

From Food Hero To Business Mentor A Louth Success Story

May 21, 2025