The Latest Trump Attack On Jerome Powell: Implications For The Economy

Table of Contents

The Nature of Trump's Recent Criticism

Specific Accusations and Their Context

Trump's criticisms of Jerome Powell frequently center around the Federal Reserve's monetary policy decisions. These attacks often involve accusations of raising interest rates too high, hindering economic growth, and failing to adequately address inflation.

-

Accusation 1 (October 2022): Trump criticized Powell for raising interest rates, claiming it would lead to a recession. He stated (paraphrased, source needed - replace with actual quote and link): "Powell is making a huge mistake raising interest rates, it's going to hurt the economy." This statement came amidst rising inflation and concerns about a potential economic slowdown. [Insert link to a reputable news source verifying this quote]

-

Accusation 2 (November 2023): (Insert another specific accusation with date, quote, and source). This accusation came at a time of [describe economic context, e.g., slowing job growth, persistent inflation]. [Insert link to a reputable news source]

-

Accusation 3 (December 2023): (Insert another specific accusation with date, quote, and source). This followed [describe relevant economic events]. [Insert link to a reputable news source]

Comparison to Past Criticisms

Trump's attacks on Powell are not new. During his presidency, he frequently criticized Powell's monetary policy decisions, often publicly calling for lower interest rates. However, the intensity and frequency of these attacks seem to have increased recently.

-

Similarities: Past and present criticisms share a common theme: disagreement over interest rate policy and its impact on the economy.

-

Differences: The current attacks may be intensified by [explain potential reasons, such as upcoming elections, worsening economic indicators, or political maneuvering]. The perceived severity of the economic situation might be amplifying the criticisms.

Impact on Monetary Policy

Potential for Influencing Fed Decisions

The independence of the Federal Reserve is a cornerstone of the US economic system. However, Trump's attacks raise concerns about the potential for political influence on the Fed's decisions.

-

Importance of Fed Independence: A politically independent central bank is crucial for maintaining price stability and managing the economy effectively, free from short-term political pressures.

-

Potential for Political Pressure: While the Fed strives to maintain its independence, repeated and intense public criticism from the former president can create pressure, potentially influencing their decisions.

-

Consequences of Politicized Monetary Policy: Politicizing monetary policy can erode public trust in the central bank and lead to inconsistent and potentially damaging economic outcomes.

Market Reactions and Investor Sentiment

Trump's attacks on Powell have created uncertainty in financial markets.

-

Market Movements: (Describe specific market reactions, e.g., stock market dips, changes in bond yields following specific attacks. Include charts and graphs if possible.)

-

Investor Sentiment: Investor sentiment often reflects fear of uncertainty. Increased volatility in financial markets signals a lack of confidence in the stability of monetary policy. (Cite expert analysis on market reactions.)

Broader Economic Implications

Uncertainty and its Effect on Business Investment and Consumer Spending

The uncertainty generated by Trump's attacks can negatively impact business investment and consumer confidence.

-

Political Uncertainty and Economic Performance: Political instability often discourages investment as businesses become hesitant to commit capital in an unpredictable environment.

-

Decreased Investment and Consumer Spending: Uncertainty can lead to decreased investment and consumer spending, ultimately slowing down economic growth. (Provide examples of previous instances where political uncertainty negatively impacted the economy.)

International Repercussions

Trump's attacks can also affect international markets and global economic confidence.

-

Role of the US Dollar: The US dollar's role as a global reserve currency makes the US economy highly influential globally. Uncertainty surrounding US economic policy can destabilize international markets.

-

Effects on International Trade and Investment: Political instability in the US can decrease international trade and investment, impacting global economic growth. (Cite expert opinions on global implications).

Conclusion

Trump's recent attacks on Jerome Powell, while not unprecedented, carry significant weight due to their timing and potential impact on the US economy's delicate balance. The uncertainty generated could negatively influence monetary policy, investor confidence, and ultimately, economic growth. It's crucial to closely monitor the situation and its unfolding consequences. Understanding the intricacies of these "Trump Jerome Powell attacks" is paramount for navigating the current economic climate. Stay informed on further developments and the ongoing implications for the US and global economies. The ongoing debate surrounding "Trump Jerome Powell attacks" warrants continued attention from economists and investors alike.

Featured Posts

-

Car Dealers Renew Fight Against Electric Vehicle Mandates

Apr 23, 2025

Car Dealers Renew Fight Against Electric Vehicle Mandates

Apr 23, 2025 -

Michael Lorenzen A Comprehensive Look At His Baseball Career

Apr 23, 2025

Michael Lorenzen A Comprehensive Look At His Baseball Career

Apr 23, 2025 -

Analysis The Anti Trump Protests Sweeping The Us

Apr 23, 2025

Analysis The Anti Trump Protests Sweeping The Us

Apr 23, 2025 -

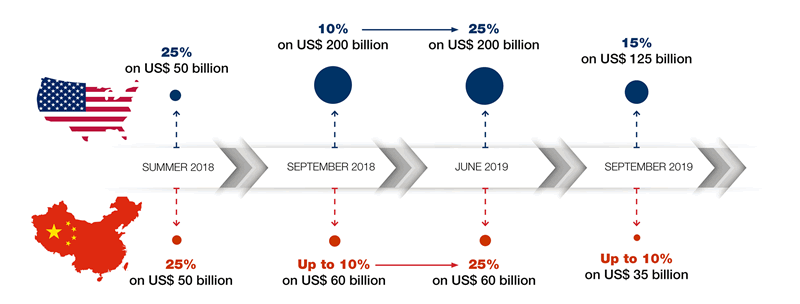

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025 -

Royals Fall To Brewers On 11th Inning Walk Off Bunt

Apr 23, 2025

Royals Fall To Brewers On 11th Inning Walk Off Bunt

Apr 23, 2025

Latest Posts

-

Downtown Revitalization Investing In Sports Stadiums For Economic Growth

May 11, 2025

Downtown Revitalization Investing In Sports Stadiums For Economic Growth

May 11, 2025 -

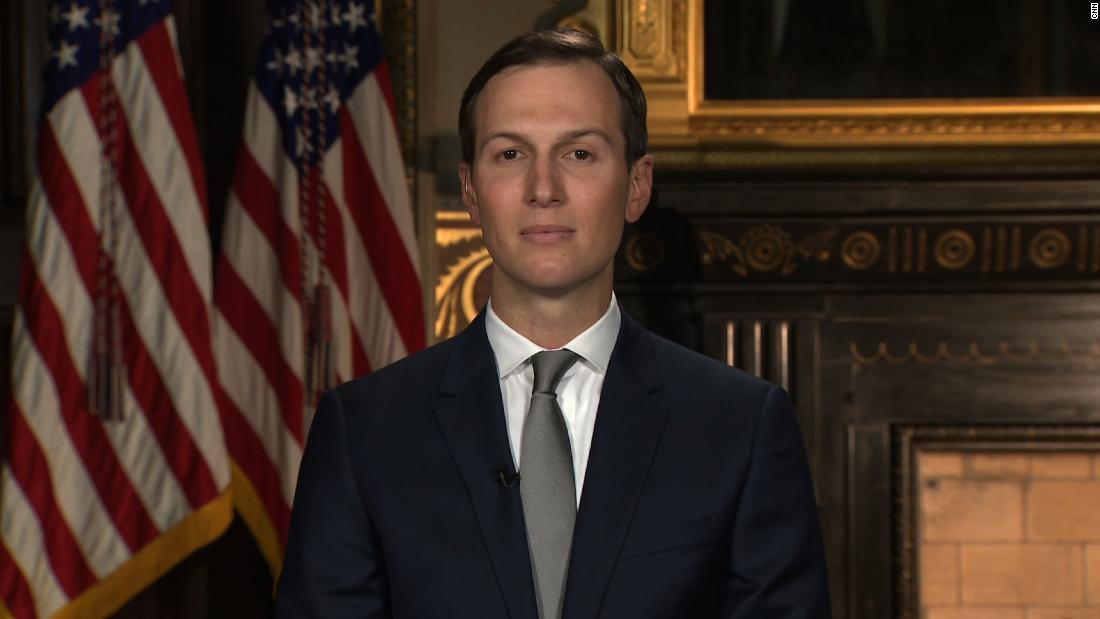

Trumps Middle East Trip Kushners Unseen Influence

May 11, 2025

Trumps Middle East Trip Kushners Unseen Influence

May 11, 2025 -

Whoops Failed Upgrade Promises A Detailed Look At The User Backlash

May 11, 2025

Whoops Failed Upgrade Promises A Detailed Look At The User Backlash

May 11, 2025 -

Can Sports Stadiums Save Dying City Centers A Look At Urban Revitalization

May 11, 2025

Can Sports Stadiums Save Dying City Centers A Look At Urban Revitalization

May 11, 2025 -

Jared Kushners Quiet Role In Trumps Upcoming Middle East Trip

May 11, 2025

Jared Kushners Quiet Role In Trumps Upcoming Middle East Trip

May 11, 2025