The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Losses Under the GOP Tax Plan

The GOP tax plan's core element is significant tax cuts, projected to drastically reduce government revenue. Let's analyze the key contributors:

Corporate Tax Rate Cuts

The proposed reduction in the corporate tax rate, a central feature of the plan, is projected to lead to substantial revenue losses. For instance, the Tax Policy Center estimates a reduction from 21% to [Insert proposed rate]% could result in a [Insert projected dollar amount] annual revenue loss over the next decade.

- Revenue loss projections by sector: Significant losses are anticipated across various sectors, particularly in large corporations with significant lobbying power. Independent analyses vary, but the consensus points to a substantial negative fiscal impact.

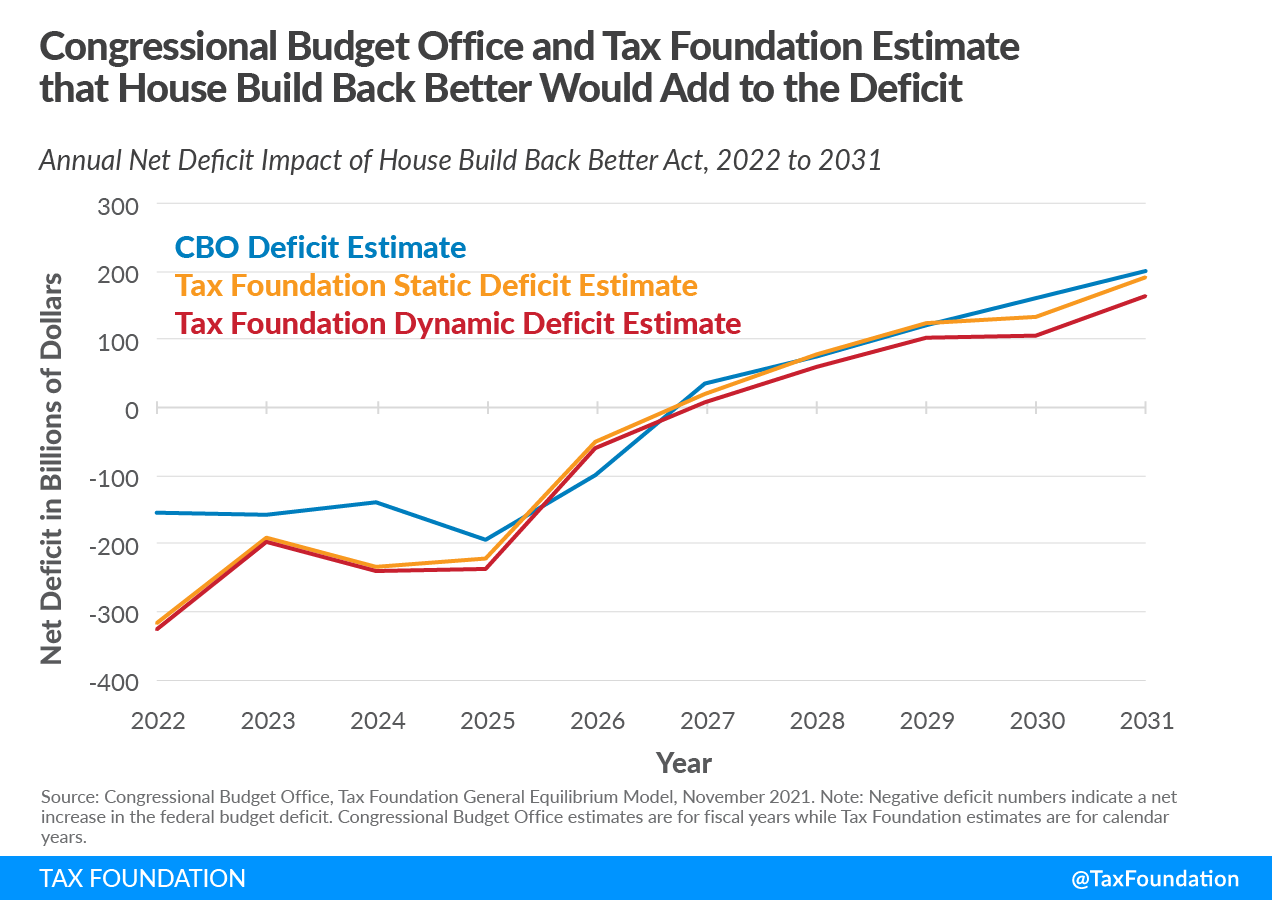

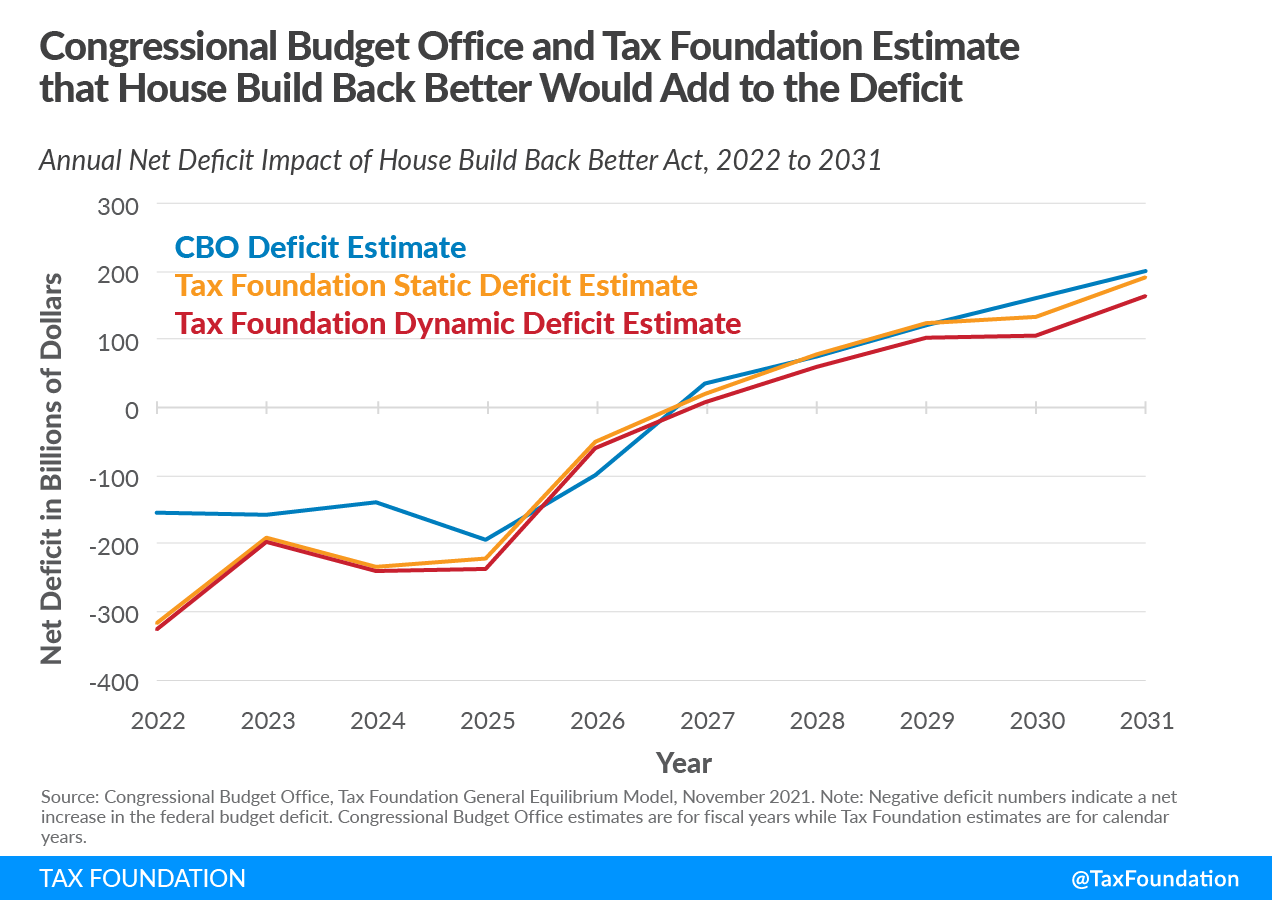

- Independent analyses: Various non-partisan organizations, including the Congressional Budget Office (CBO) and the Committee for a Responsible Federal Budget (CRFB), have released their own projections, generally corroborating substantial revenue loss. These analyses often highlight the limitations of their models and the uncertainties involved in predicting long-term economic effects.

- Potential tax loopholes: The plan's complexity introduces potential for increased exploitation of existing tax loopholes, further exacerbating revenue losses. This necessitates careful analysis to assess the true impact of the proposed changes. Keywords: corporate tax cuts, revenue projections, tax loopholes, fiscal impact.

Individual Income Tax Rate Reductions

Individual income tax rate reductions, another cornerstone of the plan, further contribute to projected revenue losses. The cuts, often targeted at higher income brackets, may stimulate economic activity but also significantly reduce tax revenue.

- Breakdown of tax cuts by income level: The plan generally provides larger tax cuts as income increases. This leads to concerns about increased wealth inequality, as the benefits disproportionately favor higher earners.

- Impact on specific demographics: Analysis needs to consider the impact on various demographics, including low-income families, the middle class, and high-income earners. Some argue this disproportionately benefits the wealthy while providing minimal relief to the majority.

- Potential for increased inequality: The regressive nature of the tax cuts – benefiting higher-income individuals more significantly – raises concerns about exacerbating existing wealth inequality. Keywords: individual tax cuts, income tax brackets, tax burden, wealth inequality.

Increased Government Spending Under the GOP Tax Plan

Beyond reduced revenue, the GOP tax plan's impact on the deficit involves considerations of government spending.

Automatic Spending Increases

Tax cuts can trigger automatic increases in government spending through "automatic stabilizers." For example, lower taxes may boost consumer spending, leading to increased demand for goods and services. This, in turn, could increase government spending on things like social security or unemployment benefits.

- Specific examples of potential spending increases: This indirect effect is difficult to quantify precisely but can be substantial, further compounding the deficit.

- Related economic predictions: Economic models forecasting the plan's effects must incorporate these indirect spending increases for a more accurate assessment.

- Counterarguments: Some argue that the economic stimulus from the tax cuts will offset increased spending, leading to a net positive effect. However, these arguments often rely on optimistic assumptions about economic growth. Keywords: automatic stabilizers, government spending, economic multiplier.

Potential for New Spending Initiatives

While not explicitly stated, the plan may indirectly lead to increased government spending through new initiatives. For instance, promises of infrastructure investment could necessitate significant additional funding.

- Examples of proposed new spending programs: Any new programs proposed alongside tax cuts must be factored into deficit projections.

- Cost estimates: Accurate cost estimates for new programs are crucial but often subject to significant uncertainty.

- Potential long-term implications: The long-term impact of such initiatives on the deficit needs careful consideration. Keywords: government programs, infrastructure spending, social programs.

Economic Growth Projections vs. Reality

The GOP tax plan's justification often centers on projected economic growth that supposedly offsets revenue losses. However, this claim requires careful scrutiny.

Assessing the Economic Growth Claims

The economic models used to project growth under the plan often rely on specific assumptions that may prove unrealistic.

- Comparison of different economic models: Different models generate varying projections, highlighting the inherent uncertainty in such forecasting.

- Analysis of assumptions and limitations: The reliability of the projections hinges on the validity of the underlying assumptions about factors like productivity growth and investor confidence.

- Alternative scenarios: Considering alternative scenarios with less optimistic assumptions about economic growth is crucial to obtaining a more comprehensive picture. Keywords: economic growth, GDP growth, fiscal stimulus, macroeconomic modeling.

Debt-to-GDP Ratio Analysis

The impact on the debt-to-GDP ratio is a key metric for evaluating the long-term fiscal sustainability of the plan.

- Current debt-to-GDP ratio: Understanding the current level provides context for evaluating the projected increase.

- Projections under the plan: The plan's effect on this ratio, a crucial indicator of fiscal health, must be carefully analyzed.

- Comparison to historical trends: Analyzing how the projected increase compares to historical trends sheds light on its potential long-term consequences.

- International comparisons: Comparing the projected debt-to-GDP ratio to those of other developed nations offers valuable perspective. Keywords: national debt, debt-to-GDP ratio, fiscal sustainability, long-term debt.

Conclusion

This GOP Tax Plan Deficit Impact Analysis reveals a concerning picture. Projected revenue losses from significant tax cuts, coupled with potential increases in government spending, point to a substantial increase in the national deficit. The optimistic economic growth projections used to justify the plan often rest on questionable assumptions. The long-term consequences, including a potentially unsustainable increase in the debt-to-GDP ratio, require careful consideration.

Understanding the stark math behind the GOP tax plan's deficit impact is crucial for informed civic engagement. Continue your research into GOP Tax Plan Deficit Impact Analysis to form your own conclusions and participate in shaping responsible fiscal policy. The long-term fiscal health of the nation depends on a thorough understanding and thoughtful debate about the potential consequences of such sweeping tax legislation.

Featured Posts

-

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 20, 2025

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 20, 2025 -

Biarritz Changement De Proprietaire Au Bo Cafe

May 20, 2025

Biarritz Changement De Proprietaire Au Bo Cafe

May 20, 2025 -

Agatha Christie Une Vie D Aventures Et De Mysteres L Integrale

May 20, 2025

Agatha Christie Une Vie D Aventures Et De Mysteres L Integrale

May 20, 2025 -

Formula 1 Yeni Sezon Tarihler Sueruecueler Ve Beklentiler

May 20, 2025

Formula 1 Yeni Sezon Tarihler Sueruecueler Ve Beklentiler

May 20, 2025 -

Will Trent Actor Ramon Rodriguezs Unexpected Scorpion Encounter

May 20, 2025

Will Trent Actor Ramon Rodriguezs Unexpected Scorpion Encounter

May 20, 2025

Latest Posts

-

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 20, 2025

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 20, 2025 -

12 Best Ai Stocks On Reddit Investor Insights

May 20, 2025

12 Best Ai Stocks On Reddit Investor Insights

May 20, 2025 -

Rain Timing Latest Updates And Predictions

May 20, 2025

Rain Timing Latest Updates And Predictions

May 20, 2025 -

Updated Rain Forecast The Most Accurate Timing

May 20, 2025

Updated Rain Forecast The Most Accurate Timing

May 20, 2025 -

Investigating Big Bear Ai Bbai Contact Gross Law Firm For Potential Legal Recourse

May 20, 2025

Investigating Big Bear Ai Bbai Contact Gross Law Firm For Potential Legal Recourse

May 20, 2025