The Unaffordable Dream: How High Down Payments Exclude Canadians From Homeownership

Table of Contents

The Rising Cost of Down Payments in Canada

The dream of owning a home is becoming increasingly elusive for Canadians, largely due to the substantial increase in the cost of down payments. Several factors contribute to this affordability crisis.

Escalating House Prices

House prices across Canada have skyrocketed in recent years, especially in major urban centers like Toronto, Vancouver, and Montreal. This dramatic increase has made saving for a down payment an even more daunting task for potential homebuyers.

- Toronto: Average home price exceeding $1 million.

- Vancouver: Average home price consistently above $1.2 million.

- Montreal: Significant price increases, though generally lower than Toronto and Vancouver.

These increases are driven by several factors including low inventory, high demand fueled by population growth and immigration, and foreign investment. The gap between average home prices and average household incomes is widening, making homeownership a distant reality for many.

The Impact of Interest Rates

Fluctuating and rising interest rates significantly impact mortgage affordability and, consequently, the size of the required down payment. Even a small increase in interest rates can drastically increase the monthly mortgage payment, requiring a larger down payment to qualify for a mortgage.

- A 0.5% increase in interest rates can increase monthly payments by hundreds of dollars.

- The Bank of Canada's stress test further compounds this issue, requiring borrowers to qualify for a mortgage at a higher interest rate than the one they actually receive.

This makes it even more challenging for prospective homebuyers to meet lender requirements, forcing them to save significantly more for a larger down payment.

CMHC Insurance and its Limitations

The Canada Mortgage and Housing Corporation (CMHC) provides mortgage loan insurance, allowing borrowers with down payments of less than 20% to obtain a mortgage. However, CMHC insurance premiums are substantial and add to the overall cost of homeownership.

- A 5% down payment results in significantly higher insurance premiums than a 10% or 20% down payment.

- These premiums can represent a substantial financial burden, especially for first-time homebuyers already struggling to save for a down payment.

The high cost of CMHC insurance further exacerbates the challenges associated with securing a mortgage with a smaller down payment.

The Consequences of High Down Payments on Canadian Homebuyers

The high cost of entry into the housing market due to substantial down payment requirements has several significant consequences for Canadian homebuyers.

Exclusion of First-Time Homebuyers

The impact is particularly acute on younger generations, such as millennials and Gen Z, who face significant challenges in saving for a substantial down payment.

- Homeownership rates among younger generations are declining.

- This exclusion from homeownership has significant implications for long-term financial security and wealth building.

The inability to enter the housing market early in their careers impacts their ability to build equity and accumulate wealth over time.

Increased Rental Costs

The difficulty in achieving homeownership leads to an increase in rental demand, driving up rental costs and placing additional financial strain on renters.

- Rental costs in major Canadian cities have increased significantly.

- Many renters face challenges in finding stable and affordable housing options.

This creates a vicious cycle, where the unaffordability of homeownership exacerbates the affordability crisis in the rental market.

Regional Disparities in Homeownership

The challenges of high down payments are not uniform across Canada. Significant regional disparities exist, with certain provinces and regions facing significantly higher hurdles to homeownership.

- Average home prices and down payment requirements vary considerably across provinces.

- Local economic conditions and government policies contribute to these regional disparities.

This uneven distribution of affordability further highlights the systemic nature of the housing crisis.

Potential Solutions to Address the Down Payment Barrier

Addressing the challenge of high down payments requires a multi-pronged approach.

Government Policies and Initiatives

Various government programs aim to support first-time homebuyers, such as grants or loan programs. However, their effectiveness and accessibility need ongoing review and improvement.

- The First-Time Home Buyers' Incentive offers a shared-equity mortgage loan.

- Provincial programs vary significantly in terms of eligibility and benefits.

More innovative and accessible programs are crucial to make homeownership more attainable for a broader range of Canadians.

Financial Literacy and Savings Strategies

Improving financial literacy and providing effective savings strategies are also vital.

- Budgeting apps and financial planning advice can assist in saving for a down payment.

- Educating Canadians on responsible debt management and saving strategies is essential.

Resources and tools that empower individuals to effectively save for a down payment are crucial.

Addressing Systemic Issues

Finally, addressing broader systemic issues like land speculation and restrictive zoning regulations is necessary for long-term affordability.

- Speculative investment in real estate drives up prices.

- Relaxing zoning regulations could increase housing supply.

Tackling these systemic issues is crucial for creating a more sustainable and affordable housing market.

Conclusion

High down payments are a significant barrier to homeownership for many Canadians. The escalating cost of housing, coupled with rising interest rates and the limitations of CMHC insurance, has created a challenging environment for prospective homebuyers, particularly for first-time buyers and younger generations. The consequences extend beyond individual financial hardship, impacting the rental market and creating regional disparities in affordability. Don't let the high cost of high down payments deter your dream of homeownership. Research available resources and take proactive steps to secure your financial future. Learn more about navigating the Canadian housing market and finding affordable options today!

Featured Posts

-

Middle Managers Bridging The Gap Between Leadership And Employees

May 09, 2025

Middle Managers Bridging The Gap Between Leadership And Employees

May 09, 2025 -

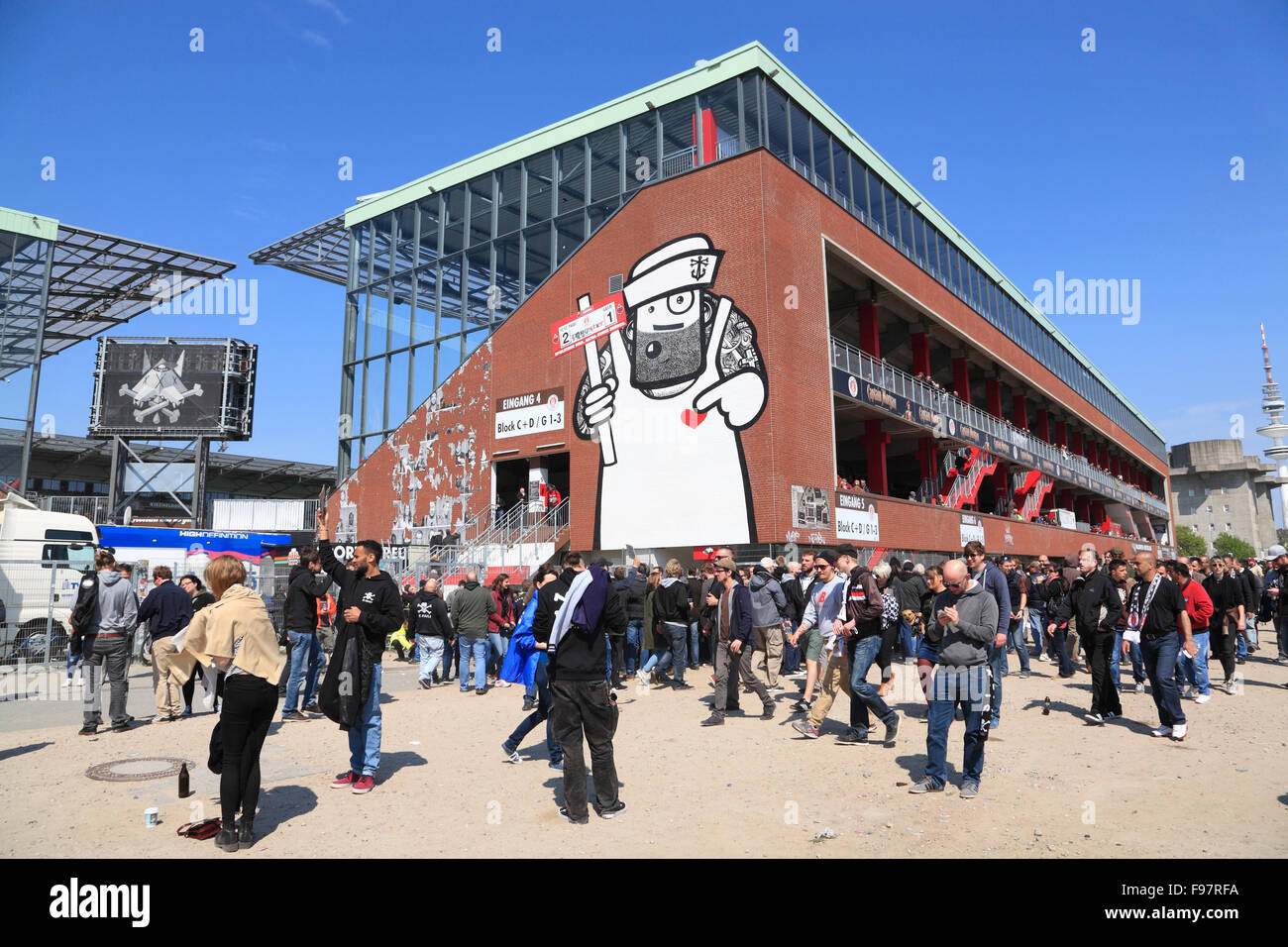

Bayern Munich Vs Fc St Pauli A Detailed Match Preview

May 09, 2025

Bayern Munich Vs Fc St Pauli A Detailed Match Preview

May 09, 2025 -

Golden Knights Triumph Over Red Wings Hertl Scores Two Hat Tricks

May 09, 2025

Golden Knights Triumph Over Red Wings Hertl Scores Two Hat Tricks

May 09, 2025 -

Colin Cowherd Doubles Down Why Jayson Tatum Remains Undervalued

May 09, 2025

Colin Cowherd Doubles Down Why Jayson Tatum Remains Undervalued

May 09, 2025 -

The Unaffordable Dream How High Down Payments Exclude Canadians From Homeownership

May 09, 2025

The Unaffordable Dream How High Down Payments Exclude Canadians From Homeownership

May 09, 2025