The World Trading Tournament (WTT): AIMSCAP's Approach To Success

Table of Contents

Understanding the WTT Landscape

Navigating the World Trading Tournament requires a thorough understanding of its structure, rules, and regulations. This competitive trading environment presents unique challenges, and success hinges on adapting your trading strategies to its specific parameters. Understanding these nuances is crucial for effective tournament trading and risk management.

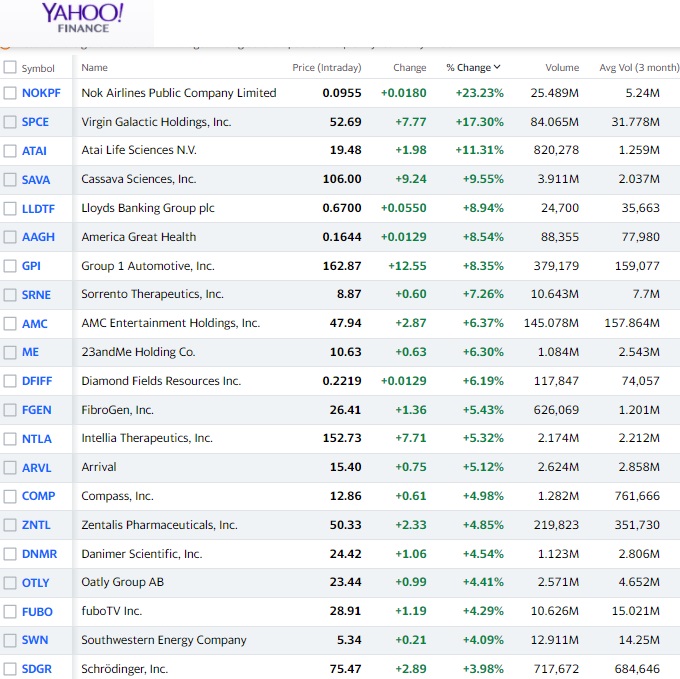

- Analyze past WTT results to identify trends and common strategies: Studying past winners' approaches provides invaluable insights into successful trading techniques within the WTT's framework. Analyzing their risk management and trade selection can offer significant advantages.

- Understand the scoring system and how it impacts trading decisions: The WTT scoring system directly influences your trading choices. Knowing how points are awarded and penalized will guide your risk-reward calculations and trade selection.

- Familiarize yourself with the trading platform used in the WTT: Proficiency with the specific platform used is non-negotiable. Practice and familiarity will minimize technical errors during the high-pressure environment of the competition.

- Develop a robust risk management plan tailored to the tournament's specifics: The WTT demands a meticulously crafted risk management strategy. This plan should consider the tournament's unique constraints, including potential leverage limitations and scoring mechanisms, to protect your capital and maximize your scoring potential. Consider employing techniques like stop-loss orders and position sizing to mitigate potential losses.

AIMSCAP's Core Trading Principles for WTT Success

AIMSCAP's WTT training program is built upon a foundation of core trading principles emphasizing discipline, risk management, and a comprehensive analytical approach. Our methodology combines technical and fundamental analysis, empowering traders to make informed decisions and achieve sustainable success.

- Emphasis on disciplined risk management and position sizing: AIMSCAP stresses the paramount importance of risk management. This involves precise position sizing, limiting potential losses per trade, and adhering to a pre-defined risk tolerance level, regardless of market fluctuations.

- A blend of technical and fundamental analysis for informed trading decisions: We integrate technical analysis (chart patterns, indicators) with fundamental analysis (economic data, company news) to develop a holistic view of the market and enhance trading decisions. This comprehensive approach improves prediction accuracy and reduces reliance on speculation.

- Strategies for managing emotional responses during high-pressure trading situations: The pressure of competitive trading can significantly affect decision-making. AIMSCAP provides techniques to manage trading psychology, mitigating emotional biases that often lead to impulsive and ill-advised trades.

- Importance of thorough market research and analysis before entering trades: We instill a culture of meticulous research. Before any trade, a thorough understanding of market trends, news, and economic indicators is essential for informed decision-making.

- Developing a personalized trading plan adapted to the WTT environment: The WTT demands a tailored trading plan. AIMSCAP guides students in creating personalized plans that align with their risk tolerance, trading style, and the unique parameters of the tournament.

Practical Strategies Employed by AIMSCAP Students

AIMSCAP students have consistently demonstrated success in the WTT by employing a diverse range of effective strategies. These strategies, tailored to the specific demands of the tournament, highlight the importance of adaptability and rigorous backtesting.

- Specific examples of successful trading strategies (e.g., scalping, swing trading, day trading) adapted to the WTT rules: Students have successfully applied various trading styles like scalping, swing trading, and day trading, adapting them to fit the WTT's timeframe limitations and scoring criteria.

- Importance of backtesting strategies rigorously before implementation in the WTT: Backtesting, the process of testing trading strategies on historical data, is crucial. AIMSCAP emphasizes the importance of rigorous backtesting to optimize strategies and identify potential weaknesses before live trading.

- Strategies for adapting trading plans based on real-time market conditions during the WTT: Market dynamics can change rapidly. AIMSCAP trains students to adapt their plans based on real-time market conditions, maintaining flexibility while adhering to their core risk management principles.

- Utilizing various indicators and tools effectively within the WTT environment: Effective use of technical indicators and trading tools is paramount. AIMSCAP provides students with the knowledge to utilize various indicators effectively to analyze market trends and predict potential price movements within the WTT context.

The Role of Mentorship and Community

Beyond technical skills, AIMSCAP fosters a supportive learning environment crucial for success in the demanding WTT arena. Mentorship and a strong community play vital roles in enhancing trading performance.

- Access to experienced mentors for guidance and support: AIMSCAP offers access to experienced mentors providing personalized guidance, feedback, and support throughout the learning process.

- Opportunities for networking and collaboration with fellow traders: The collaborative environment facilitates peer-to-peer learning and networking, enabling students to share experiences, strategies, and insights.

- Regular feedback and analysis of trading performance: Regular performance analysis and feedback sessions allow students to identify areas for improvement and refine their trading approaches continuously.

- A supportive community to share experiences and learn from mistakes: A supportive community allows for open discussions, shared learning from mistakes, and the fostering of a collaborative learning experience.

Conclusion

The World Trading Tournament (WTT) presents a significant challenge, demanding a comprehensive approach that balances technical proficiency, disciplined risk management, and psychological resilience. AIMSCAP's approach combines robust trading principles, practical strategies honed through real-world application, and a supportive community designed to empower traders to excel in this competitive arena. By implementing these strategies and leveraging the resources offered by AIMSCAP, aspiring traders can significantly increase their chances of success in the WTT.

Call to Action: Ready to conquer the World Trading Tournament (WTT)? Learn more about AIMSCAP's proven strategies and begin your journey towards trading success. Visit our website today to discover how we can help you achieve your WTT goals. Master the World Trading Tournament with AIMSCAP!

Featured Posts

-

Jellystone Pinata Smashling Leads Teletoon Spring Streaming Lineup

May 21, 2025

Jellystone Pinata Smashling Leads Teletoon Spring Streaming Lineup

May 21, 2025 -

Prica S Reddita Postaje Film S Sydney Sweeney

May 21, 2025

Prica S Reddita Postaje Film S Sydney Sweeney

May 21, 2025 -

Klopps Liverpool A Retrospective Look At The Transformation

May 21, 2025

Klopps Liverpool A Retrospective Look At The Transformation

May 21, 2025 -

Abdelkebir Rabi Et Les Grands Fusains De Boulemane Echange Au Book Club Le Matin

May 21, 2025

Abdelkebir Rabi Et Les Grands Fusains De Boulemane Echange Au Book Club Le Matin

May 21, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025

Latest Posts

-

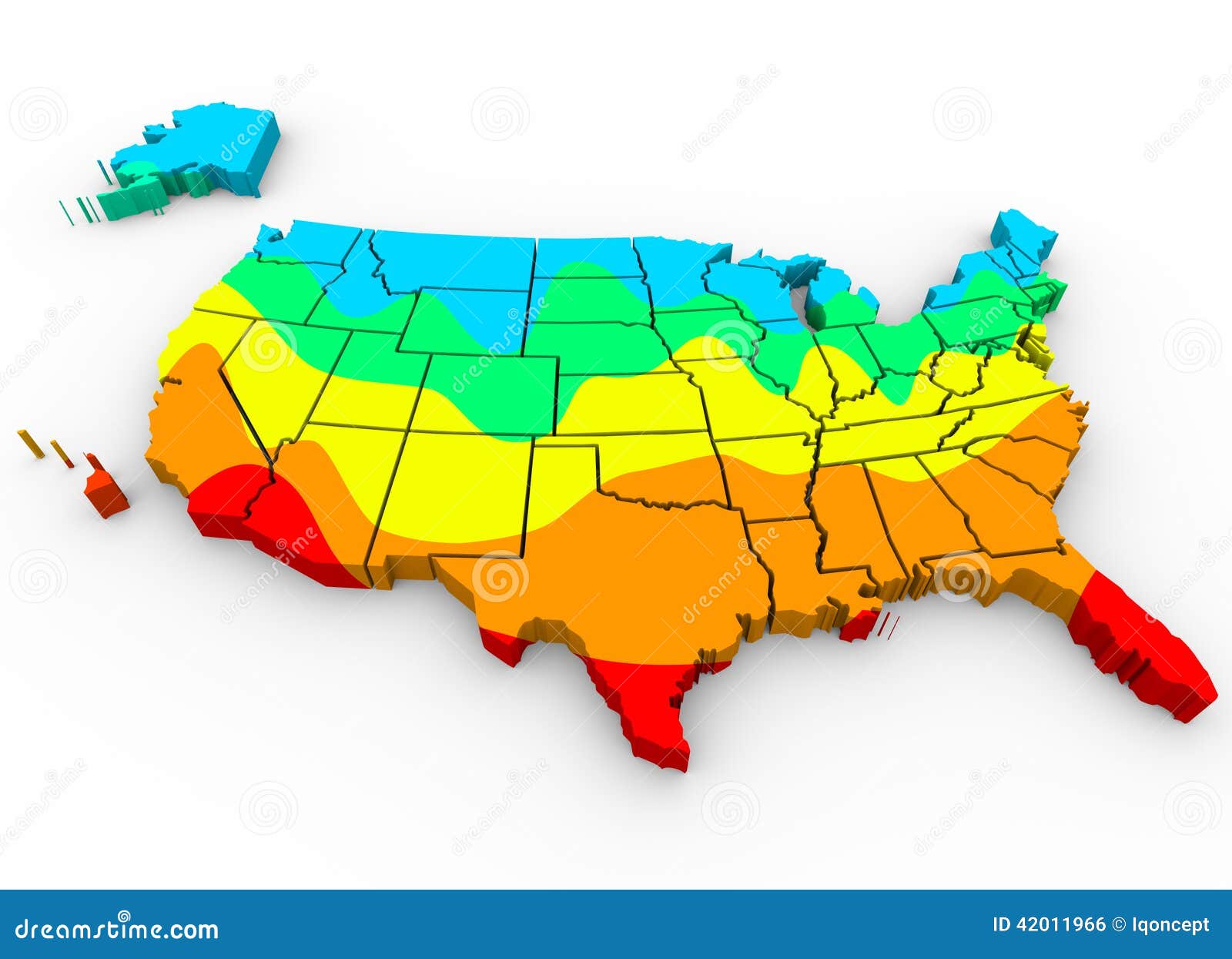

Growth Opportunities Mapping The Countrys Evolving Business Hot Spots

May 21, 2025

Growth Opportunities Mapping The Countrys Evolving Business Hot Spots

May 21, 2025 -

Understanding The Countrys Shifting Business Landscape

May 21, 2025

Understanding The Countrys Shifting Business Landscape

May 21, 2025 -

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

May 21, 2025

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

May 21, 2025 -

The Countrys Top Business Hot Spots Where To Invest Now

May 21, 2025

The Countrys Top Business Hot Spots Where To Invest Now

May 21, 2025 -

The Challenge Of Bringing Factory Jobs Back To The Us Workforce And Reality

May 21, 2025

The Challenge Of Bringing Factory Jobs Back To The Us Workforce And Reality

May 21, 2025