Thursday's CoreWeave (CRWV) Stock Decline: Factors Contributing To The Drop

Table of Contents

Broad Market Downturn and its Impact on CRWV

The CoreWeave (CRWV) stock decline wasn't an isolated event. Thursday saw a broader market downturn, significantly impacting tech stocks, particularly those in the rapidly growing cloud computing sector. The Nasdaq Composite, a key indicator of tech performance, experienced a considerable fall, reflecting a general negative investor sentiment. This overall market weakness played a significant role in the CRWV price drop.

- Correlation between CRWV and broader market trends: CRWV, being a high-growth tech stock, is highly sensitive to overall market sentiment. When the broader market falls, investors often sell off high-growth stocks first, leading to amplified declines.

- Impact of investor sentiment on high-growth tech stocks: High-growth stocks, like CRWV, are often valued based on future expectations. Negative market sentiment can quickly erode investor confidence, leading to price corrections.

- Market-moving events: While specific triggers vary daily, potential factors influencing the broader market downturn could include concerns about inflation, interest rate hikes by the Federal Reserve, or negative economic news impacting future growth projections.

Sector-Specific Headwinds Affecting Cloud Computing Stocks

Beyond the general market slump, the cloud computing sector itself faces specific headwinds. Increased competition, pricing pressures, and potential economic slowdowns impacting cloud adoption rates all contributed to the CoreWeave (CRWV) stock decline.

- Analysis of competitor performance: CRWV operates in a competitive market with established players and emerging startups. The performance of competitors, their pricing strategies, and market share gains can influence investor perception of CRWV's future prospects.

- Pricing strategies and profitability: The cloud computing market is becoming increasingly price-competitive. Pressure to lower prices to secure and retain customers can impact profitability, a factor investors carefully consider.

- Future growth concerns: Concerns about a potential slowdown in cloud adoption due to economic uncertainty can negatively impact the valuations of cloud computing companies, including CRWV.

Speculation and Investor Sentiment Regarding CoreWeave's Financials

The CoreWeave (CRWV) stock decline may also be attributed to speculation and shifting investor sentiment concerning the company's financial performance. While no specific negative news was released on Thursday, rumors and anxieties about future financial results can significantly impact stock prices.

- Analysis of CRWV's recent financial reports: Investors constantly scrutinize a company's financial health. Any perceived weakness or unmet expectations in recent reports could trigger selling pressure.

- Unmet investor expectations: If CRWV's recent performance fell short of investor expectations, it could lead to a reassessment of its valuation, contributing to the stock price drop.

- Analyst ratings and their impact: Changes in analyst ratings, reflecting their updated assessment of CRWV's prospects, can significantly influence investor sentiment and trading activity.

Technical Analysis of CRWV Stock Chart

A technical analysis of the CRWV stock chart on Thursday reveals potential contributing factors to the decline. While a deep dive into technical indicators isn't necessary here, we can observe some significant price actions.

- Key technical indicators: Indicators like moving averages, Relative Strength Index (RSI), and trading volume can show shifts in momentum and potential support/resistance breaches.

- Support and resistance levels: If key support levels were breached, it could trigger further selling pressure as investors react to the broken support.

- Unusual trading volume spikes: A sudden increase in trading volume can often indicate a significant shift in investor sentiment and contribute to price volatility.

Understanding and Navigating the CoreWeave (CRWV) Stock Decline

The CoreWeave (CRWV) stock decline resulted from a confluence of factors: a broader market downturn, sector-specific challenges within the cloud computing industry, speculation regarding CRWV's financials, and technical indicators suggesting a shift in momentum. While the drop is concerning, it's essential to maintain a balanced perspective. The cloud computing sector still holds significant long-term potential.

Stay informed about future developments affecting CoreWeave (CRWV) stock and make well-informed investment decisions. Continue to monitor the CoreWeave (CRWV) stock decline and its underlying causes for a comprehensive understanding of market dynamics. Thorough research and careful consideration are key to navigating the complexities of the stock market.

Featured Posts

-

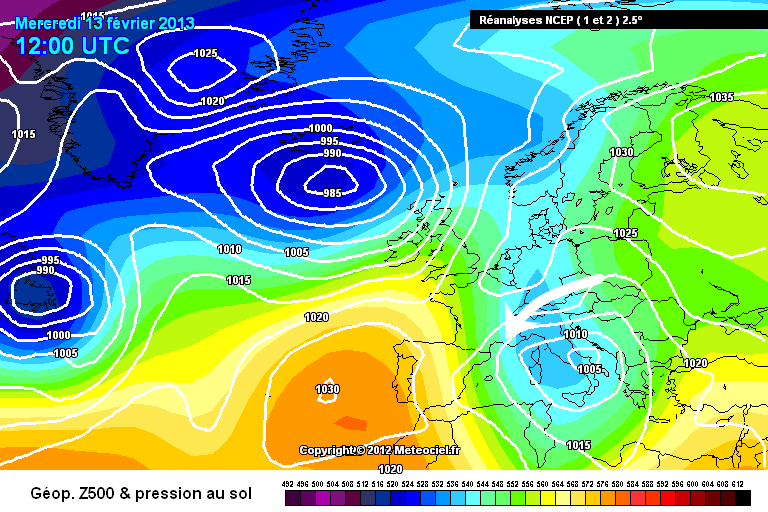

Late Snowfall Impacts Southern French Alps Weather Update

May 22, 2025

Late Snowfall Impacts Southern French Alps Weather Update

May 22, 2025 -

Bolidul De Lux Al Fratilor Tate Cum Au Fost Intampinati La Revenirea In Romania

May 22, 2025

Bolidul De Lux Al Fratilor Tate Cum Au Fost Intampinati La Revenirea In Romania

May 22, 2025 -

Peppa Pig Family Grows Mummy Pig Announces New Piglets Gender

May 22, 2025

Peppa Pig Family Grows Mummy Pig Announces New Piglets Gender

May 22, 2025 -

Revised Core Weave Ipo Price 40 Per Share

May 22, 2025

Revised Core Weave Ipo Price 40 Per Share

May 22, 2025 -

Klopp Replacement For Ancelotti At Real Madrid Agents Statement

May 22, 2025

Klopp Replacement For Ancelotti At Real Madrid Agents Statement

May 22, 2025

Latest Posts

-

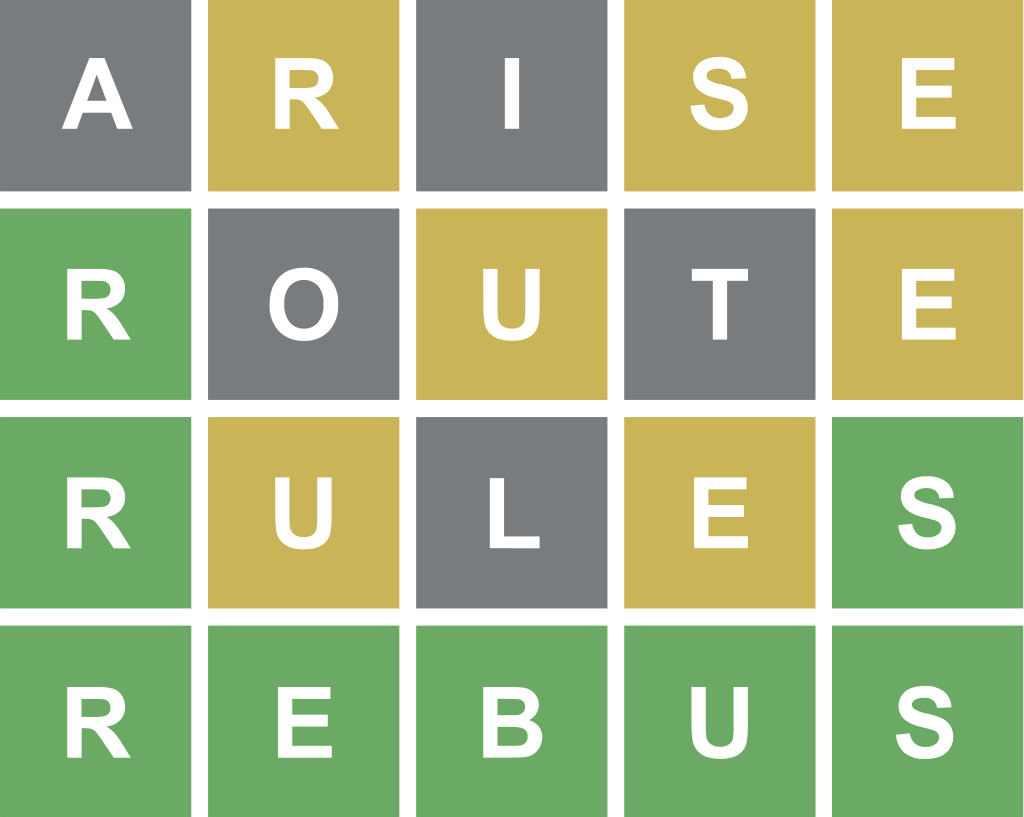

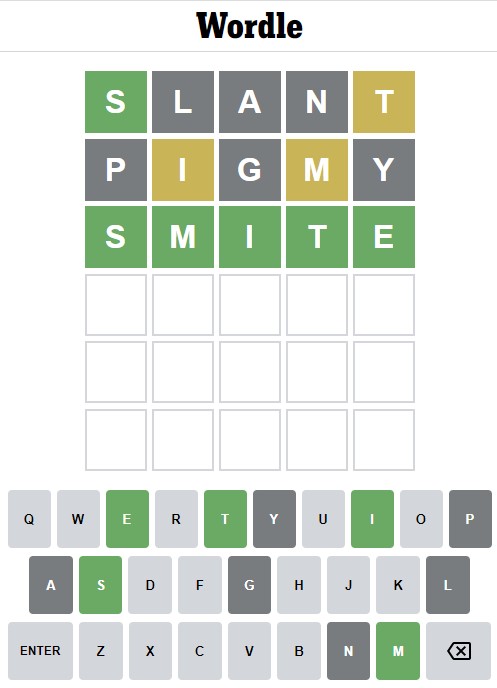

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025 -

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025 -

Wordle Hints And Answer March 20th 370

May 22, 2025

Wordle Hints And Answer March 20th 370

May 22, 2025 -

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025