To Buy Or Not To Buy Palantir Stock Before May 5th: A Wall Street Perspective

Table of Contents

Palantir's Recent Performance and Market Sentiment

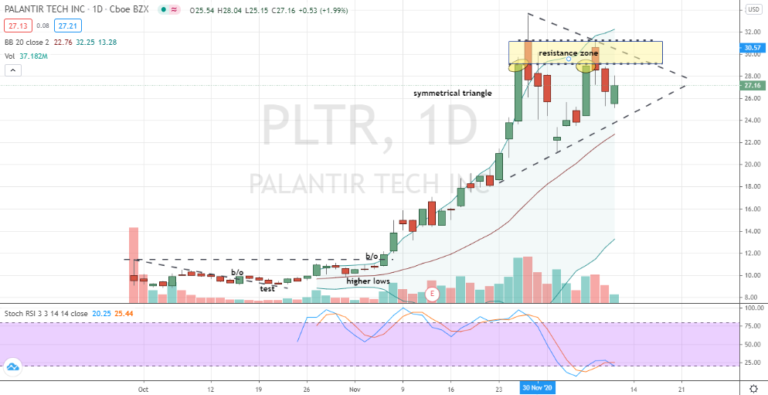

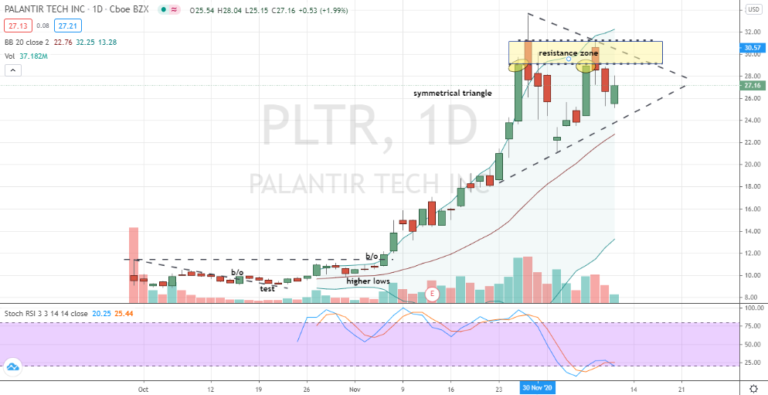

Palantir stock has experienced considerable volatility in recent months. Understanding these fluctuations is crucial for any investor considering buying, selling, or holding PLTR. Recent price movements have been influenced by several factors, including the company's performance, overall market sentiment, and news related to contracts and partnerships.

- Recent stock price fluctuations (with data): While specific numbers require real-time data (which changes constantly), you can readily find this information on financial news websites. Look for charts showing PLTR's performance over the last few months. Note any significant highs and lows.

- Key partnerships or contract wins: Palantir's success hinges on securing large government and commercial contracts. Keep an eye out for announcements of new partnerships or significant contract wins, as these can significantly impact the Palantir stock price. Recent partnerships with major players in various industries can signal strong future growth.

- Summary of recent analyst ratings (buy, hold, sell): Check reputable financial news sources for a summary of analyst ratings for PLTR. Note the distribution of buy, hold, and sell recommendations – a high percentage of "buy" ratings generally suggests a positive outlook.

- Overall market sentiment (bullish, bearish, neutral): Market sentiment towards Palantir can be gauged by looking at news articles, social media discussions, and analyst commentary. Is the overall feeling positive (bullish), negative (bearish), or somewhere in between (neutral)?

Analyzing Palantir's Upcoming Earnings Report (May 5th)

The May 5th earnings report is a pivotal event for Palantir investors. This report will provide crucial insights into the company's financial health and future prospects, directly impacting the Palantir stock price. Careful analysis of the report is essential for making informed investment decisions.

- Key metrics to watch in the earnings report (revenue, EPS, guidance): Pay close attention to revenue growth, earnings per share (EPS), and future guidance. Strong revenue growth and positive EPS are generally positive signs. The guidance offered by management for the coming quarters is particularly important.

- Potential impact of positive vs. negative surprises: If Palantir exceeds expectations, the stock price is likely to rise. Conversely, falling short of expectations could lead to a decline in the Palantir stock price. The magnitude of the surprise will determine the impact.

- Historical performance compared to analyst expectations: Compare Palantir's past earnings reports to analyst expectations. This historical data can provide valuable context for interpreting the upcoming results.

- Risks associated with reliance on government contracts: Palantir’s revenue is significantly tied to government contracts. Changes in government policy or budget cuts could negatively impact future growth. Understanding this risk is essential.

Long-Term Growth Potential and Risks Associated with Palantir Stock

Palantir operates in the rapidly expanding big data analytics market, offering significant long-term growth potential. However, this potential is accompanied by inherent risks.

- Market size and growth potential for big data analytics: The big data analytics market is booming, presenting a substantial opportunity for Palantir to capture significant market share. Research the overall market size and projected growth rates to assess Palantir's potential.

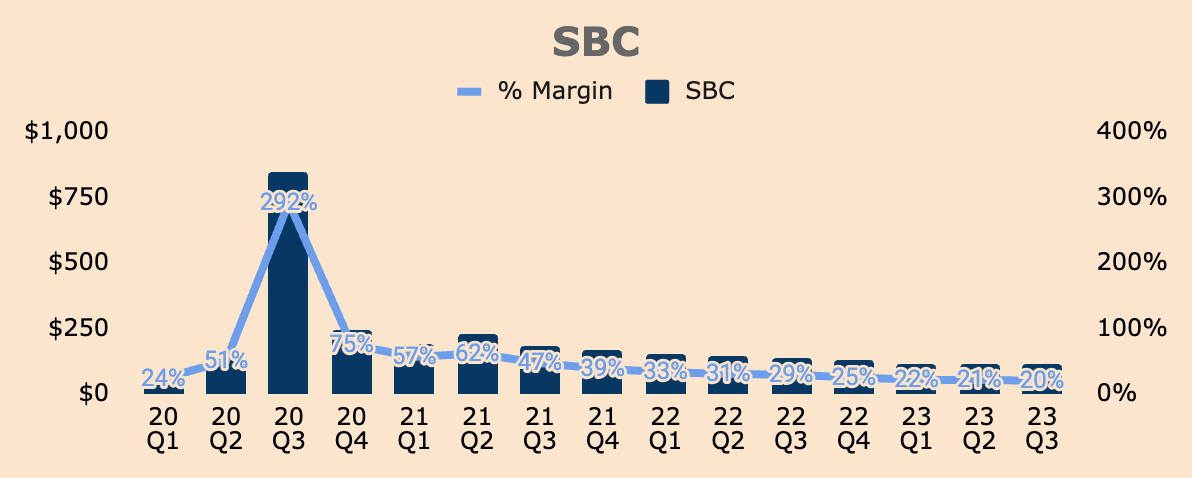

- Palantir's competitive advantages and disadvantages: Analyze Palantir's competitive position within the big data analytics market. What are its strengths (e.g., proprietary technology, strong government relationships)? What are its weaknesses (e.g., high pricing, competition from established players)?

- Potential risks to Palantir's long-term growth: These include increased competition, economic downturns affecting government spending, dependence on a limited number of key clients, and the potential for technological disruption.

- Factors that could significantly impact future performance: These could include changes in government regulations, successful product launches, strategic acquisitions, or unforeseen economic events.

Alternative Investment Strategies: Holding, Buying, or Selling Palantir Stock

The optimal investment strategy – buy, sell, or hold – depends entirely on your individual circumstances and risk tolerance.

- Strategies for investors with high-risk tolerance: High-risk investors might consider buying more Palantir stock before the May 5th earnings report, betting on potential upside.

- Strategies for investors with low-risk tolerance: Low-risk investors might prefer to hold their current Palantir stock or even consider selling, depending on their overall portfolio diversification.

- Importance of diversification in a portfolio: Diversifying your investments across different asset classes is crucial to mitigate risk. Don't put all your eggs in one basket.

- Practical examples of different investment strategies: A high-risk investor might allocate a larger percentage of their portfolio to Palantir stock, whereas a low-risk investor might only allocate a small percentage or even none.

Conclusion

The decision to buy, sell, or hold Palantir stock before May 5th is complex, influenced by Palantir's recent performance, the upcoming earnings report, long-term growth potential, and associated risks. Thoroughly analyze the information presented here and conduct your own due diligence. The upcoming earnings report is crucial, and understanding the company's long-term prospects is paramount.

Ultimately, the decision of whether to buy, sell, or hold Palantir stock before May 5th depends on your individual risk tolerance and investment goals. Carefully consider the information presented in this article and conduct thorough research before making any investment decisions regarding Palantir stock. Remember to consult a financial advisor before making any significant investment choices related to Palantir stock or any other investment.

Featured Posts

-

Viktig Informasjon Om Vintervaer Og Kjoring I Sor Norges Fjell

May 09, 2025

Viktig Informasjon Om Vintervaer Og Kjoring I Sor Norges Fjell

May 09, 2025 -

Jeanine Pirros Appointment As Dc Prosecutor Trumps Decision And Fox News Influence

May 09, 2025

Jeanine Pirros Appointment As Dc Prosecutor Trumps Decision And Fox News Influence

May 09, 2025 -

Fanatics Your Source For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025

Fanatics Your Source For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025 -

Should You Buy Palantir Technologies Stock In 2024

May 09, 2025

Should You Buy Palantir Technologies Stock In 2024

May 09, 2025 -

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Paaiskinimas

May 09, 2025

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Paaiskinimas

May 09, 2025