Tongling Metals: US Tariffs Dim Copper Outlook

Table of Contents

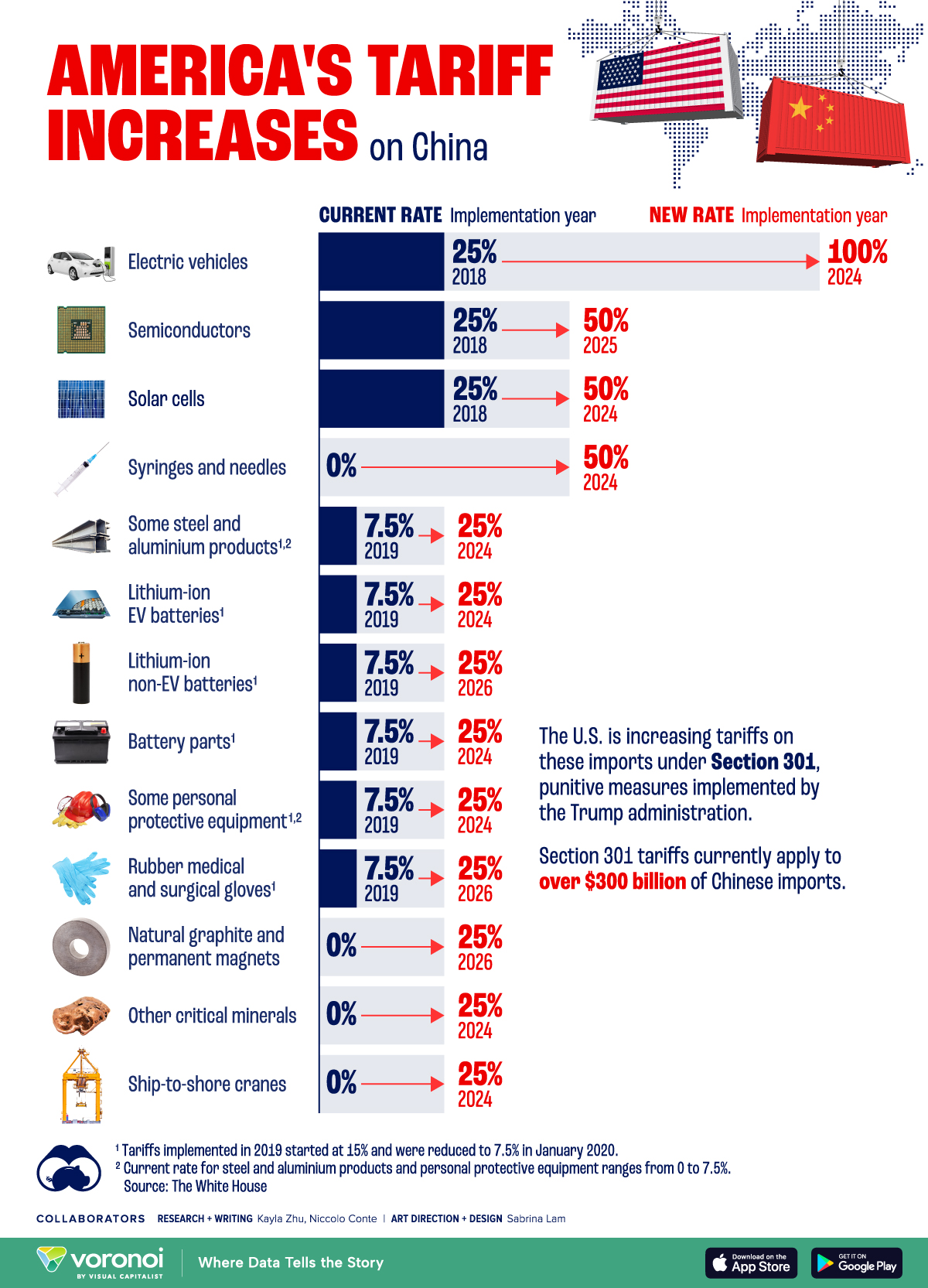

The Impact of US Tariffs on Tongling Metals' Exports

US import tariffs on Chinese goods, including copper, have significantly impacted Tongling Metals' exports. These tariffs, implemented as part of the ongoing trade war between the US and China, have increased the cost of Tongling's copper entering the US market, making it less competitive against other copper producers. While precise figures on Tongling's pre- and post-tariff export volumes to the US are not publicly available due to the company's reporting practices and the complexities of global trade data, industry analysts suggest a considerable decline. This has directly affected Tongling's revenue streams and overall profitability.

- Decreased export volume to the US market: The higher prices resulting from tariffs have reduced the demand for Tongling's copper in the US, leading to a substantial drop in export volume.

- Increased production costs due to tariffs: To maintain competitiveness, Tongling may absorb some of the tariff costs, resulting in lower profit margins.

- Potential shift in export focus to other markets: Tongling has likely sought to mitigate losses by diverting its exports to other countries less affected by US tariffs, such as those in Europe or Asia.

- Loss of market share in the US: The increased price point has allowed US-based and other international copper producers to gain market share in the American market, impacting Tongling's position.

- Negotiation strategies employed by Tongling to mitigate tariff impacts: This may involve lobbying efforts, seeking exemptions, or exploring alternative supply chain routes to minimize the impact of tariffs.

Wider Implications for the Global Copper Market

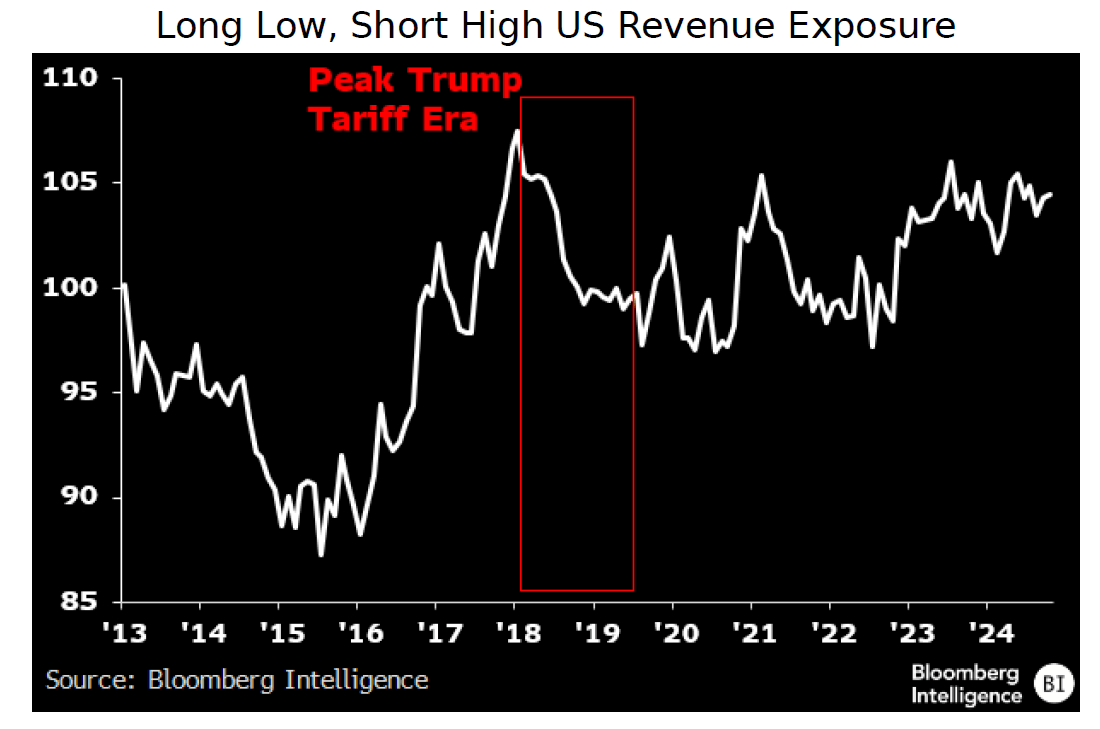

The US tariffs on Chinese copper have had ripple effects across the global copper market. Reduced supply from China, a major global copper producer, has contributed to increased copper price volatility. This uncertainty impacts not only commodity trading and metal futures but also downstream industries heavily reliant on copper, such as construction, electronics, and transportation.

- Increased copper prices globally due to reduced supply from China: The disruption in supply from China has tightened the global copper market, driving up prices.

- Impact on downstream industries relying on copper: Increased copper prices translate to higher production costs for these industries, potentially leading to price increases for consumers or reduced profitability.

- Increased competition from other copper producers: Other copper-producing nations, such as Chile and Peru, have benefited from increased demand, leading to intensified competition.

- Uncertainty and volatility in the copper futures market: The uncertainty surrounding trade policy and future supply has led to increased volatility in the copper futures market, making it a riskier investment.

- Potential for long-term shifts in global copper trade patterns: The tariffs may prompt long-term adjustments in global copper trade, with countries seeking alternative sources of supply and reducing reliance on China.

Tongling Metals' Response and Adaptation Strategies

Faced with these challenges, Tongling Metals is actively implementing adaptation strategies to navigate the difficult market environment. These strategies are crucial for the company's long-term survival and profitability.

- Investment in domestic markets and new technologies: Tongling is likely focusing on strengthening its domestic market presence in China, reducing reliance on exports. This could include investment in new technologies to improve efficiency and reduce costs.

- Diversification into other metals or related industries: To reduce risk, Tongling might be exploring opportunities in other metal markets or related industries to diversify its revenue streams.

- Exploration of new export markets outside the US: The company is actively searching for alternative export markets less impacted by the US tariffs.

- Lobbying efforts to influence trade policy: Tongling may be involved in lobbying efforts to influence trade policy and seek relief from tariffs.

- Cost-cutting measures to maintain profitability: To offset the impact of tariffs and maintain profitability, the company is likely implementing cost-cutting measures across its operations.

The Future of Copper Prices and Tongling Metals

Predicting the future of copper prices is inherently challenging, given the multitude of factors at play. However, the ongoing impact of US tariffs on supply chains, along with global economic growth and environmental regulations (which impact copper demand for green technologies), will continue to influence copper price volatility. Tongling's long-term prospects depend heavily on its ability to adapt and execute its strategic responses effectively.

- Predictions for future copper prices based on current market trends: Analysts offer varied predictions, with some forecasting continued price volatility while others suggest a gradual stabilization.

- Potential for further price volatility: The ongoing trade tensions and global economic uncertainties suggest that copper prices will likely remain volatile in the near term.

- Long-term prospects for Tongling Metals considering its adaptation strategies: Tongling's success hinges on the effectiveness of its diversification and cost-cutting measures.

- Potential investment opportunities and risks associated with Tongling Metals: The current situation presents both opportunities and risks for investors. Careful analysis of the company's performance and adaptation strategies is crucial before making any investment decisions.

Conclusion

US tariffs are significantly impacting Tongling Metals' exports and the global copper market, leading to price volatility and supply chain disruptions. Tongling is actively adapting through diversification and other strategies to mitigate these challenges. However, the future outlook remains uncertain, influenced by ongoing trade tensions and global economic conditions. Stay informed about the evolving situation with Tongling Metals and the broader impact of US tariffs on the copper outlook. Regularly check for updates on commodity prices and trade policies to make informed decisions regarding your investment or business related to Tongling Metals and copper.

Featured Posts

-

Swq Alktakyt Fy Msr Asear Alywm Alathnyn 14 Abryl 2025

Apr 23, 2025

Swq Alktakyt Fy Msr Asear Alywm Alathnyn 14 Abryl 2025

Apr 23, 2025 -

Us Tariffs And The Copper Industry Tonglings Perspective

Apr 23, 2025

Us Tariffs And The Copper Industry Tonglings Perspective

Apr 23, 2025 -

Ontarios Plan To Remove Barriers To Internal Trade Focus On Alcohol And Labour

Apr 23, 2025

Ontarios Plan To Remove Barriers To Internal Trade Focus On Alcohol And Labour

Apr 23, 2025 -

Umpire Controversy Tigers Manager Challenges Overturned Plate Call

Apr 23, 2025

Umpire Controversy Tigers Manager Challenges Overturned Plate Call

Apr 23, 2025 -

Le Sans Alcool Opportunites Economiques Et Impacts Positifs Sur La Sante Dry January And Tournee Minerale

Apr 23, 2025

Le Sans Alcool Opportunites Economiques Et Impacts Positifs Sur La Sante Dry January And Tournee Minerale

Apr 23, 2025

Latest Posts

-

Nyt Strands Hints And Answers Game 403 Thursday April 10

May 10, 2025

Nyt Strands Hints And Answers Game 403 Thursday April 10

May 10, 2025 -

Solve Nyt Strands Game 403 Hints For Thursday April 10th

May 10, 2025

Solve Nyt Strands Game 403 Hints For Thursday April 10th

May 10, 2025 -

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025 -

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025 -

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025