Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Essentially, it's the per-share value of what the ETF owns. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this reflects the collective value of its global holdings, adjusted for the USD hedge.

Monitoring NAV fluctuations is critical because it directly reflects the performance of your investment. While the market price of an ETF can deviate slightly from its NAV due to supply and demand, the NAV provides a truer picture of the intrinsic worth of your holdings. Understanding this difference is key to avoiding emotional investment decisions based solely on short-term market price swings.

- NAV represents the underlying asset value per share. This is the core value of your investment.

- Fluctuations in NAV reflect changes in the ETF's holdings. Positive changes indicate growth in the value of the underlying assets.

- Tracking NAV helps assess investment performance. It provides a clear measure of how your investment is performing over time.

- Understanding NAV aids in buy/sell decisions. Informed investors use NAV trends to support their investment strategies.

How to Track the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward using several methods:

Using the ETF Provider's Website

The most reliable source is usually the official Amundi website. Navigate to their ETF section, search for "Amundi MSCI World II UCITS ETF USD Hedged Dist," and locate the historical and current NAV data. Keep in mind that there might be a slight delay in updating the NAV, usually a few hours after market close.

- Step 1: Visit the Amundi website.

- Step 2: Locate their ETF listings.

- Step 3: Search for the specific ETF ticker (if available).

- Step 4: Access the historical and current NAV data.

Utilizing Financial Data Providers

Reputable financial data providers like Bloomberg, Yahoo Finance, and Google Finance offer real-time or delayed NAV data for various ETFs, including the Amundi MSCI World II UCITS ETF USD Hedged Dist. Simply search for the ETF's ticker symbol to find its current and historical NAV.

- Step 1: Choose a financial data provider.

- Step 2: Use the ETF's ticker symbol in the search bar.

- Step 3: Access the NAV information.

Through Your Brokerage Account

Most brokerage accounts display real-time or delayed NAV data for the ETFs you hold. Check your account statements or portfolio overview for the current NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist.

- Step 1: Log in to your brokerage account.

- Step 2: Find your portfolio overview or holdings.

- Step 3: Locate the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings.

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Global market trends: Positive global economic news and strong corporate earnings generally lead to higher NAVs, while negative news can cause declines.

- Currency fluctuations: The "USD Hedged" aspect means the ETF aims to minimize the impact of currency fluctuations between the underlying assets' currencies and the US dollar. However, some currency risk may remain, impacting the NAV.

- MSCI World index performance: The ETF tracks the MSCI World index, so its performance directly affects the NAV. Strong index performance translates to higher NAVs.

- Dividend distributions: When the underlying companies in the index pay dividends, the ETF receives these dividends, which are either reinvested or distributed to shareholders, affecting the NAV.

Interpreting NAV Changes and Making Informed Investment Decisions

Analyzing NAV trends over time is crucial. Compare the current NAV to historical data to identify patterns and trends. Remember to consider other key factors besides NAV, including:

- Expense ratio: A higher expense ratio reduces your overall returns.

- Trading volume: High trading volume typically ensures better liquidity.

Short-term NAV fluctuations can be noisy, so focus on longer-term trends (months or years) for a more reliable assessment of your investment's performance. Compare the ETF’s performance against relevant benchmarks to gauge its effectiveness.

- Compare NAV to historical data for trend analysis. Identify upward or downward trends.

- Consider the ETF's overall performance relative to benchmarks. Assess its success against comparable investments.

- Factor in the total expense ratio when assessing returns. This directly impacts your profitability.

- Long-term NAV trends provide better insight than short-term fluctuations. Patience is key when investing.

Conclusion: Mastering NAV Tracking for the Amundi MSCI World II UCITS ETF USD Hedged Dist

Regularly tracking the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist, using the methods described above, is essential for successful investment management. Understanding NAV allows you to monitor your investment's performance, make informed buy/sell decisions, and ultimately achieve your financial goals. Start tracking the NAV today and make informed investment decisions. For further resources on ETF investing and NAV analysis, consult reputable financial websites and investment guides.

Featured Posts

-

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025 -

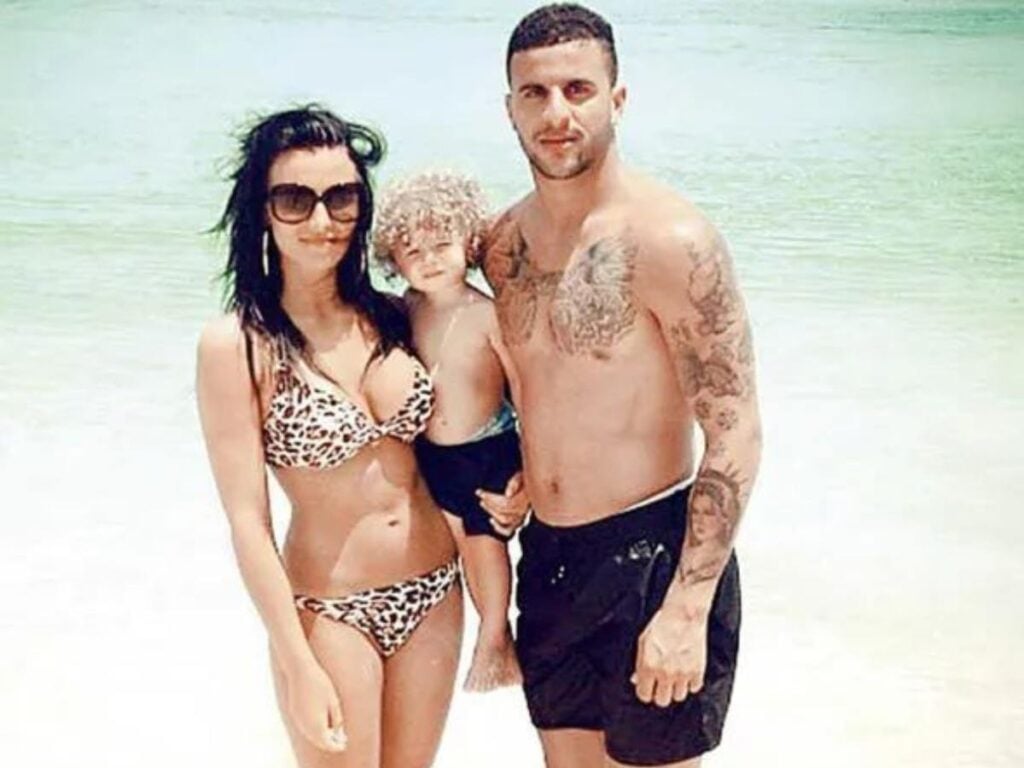

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025 -

Frankfurt Dax Closes Lower Than 24 000 Points

May 24, 2025

Frankfurt Dax Closes Lower Than 24 000 Points

May 24, 2025 -

Avrupa Borsalarinda Duesues Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalarinda Duesues Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Planning Your Memorial Day 2025 Trip Flight Booking Tips

May 24, 2025

Planning Your Memorial Day 2025 Trip Flight Booking Tips

May 24, 2025

Latest Posts

-

The Kyle And Teddi Dog Walker Incident A Detailed Look

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Detailed Look

May 24, 2025 -

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025 -

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025 -

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025