Trade War Intensifies: Another Day Of Losses For Dutch Stocks

Table of Contents

Impact of Trade War on Dutch Exports

The intensifying trade conflict has significantly impacted Dutch exports, leading to a decline in key sectors and increasing volatility in the Dutch stock market. Understanding this impact is crucial for investors looking to navigate these turbulent times.

Decline in Key Sectors

Several key sectors of the Dutch economy have experienced a sharp decline due to the trade war. This is largely due to the Netherlands' strong reliance on international trade.

-

Agricultural Exports: Agricultural exports, a cornerstone of the Dutch economy, saw a 5% decrease in Q3 2023, according to the CBS (Statistics Netherlands). Tariffs imposed on Dutch agricultural products have reduced their competitiveness in key export markets, particularly within the EU. This decline affects major players in the sector, impacting their stock prices and overall market performance of Dutch Stocks.

-

Technology and Semiconductors: The technology sector, a significant contributor to Dutch economic growth, also felt the impact. Disruptions in global supply chains and increased tariffs on electronic components have led to a 3% drop in exports, impacting companies heavily reliant on global trade. This slowdown ripples through the economy, impacting related industries and ultimately affecting Dutch Stocks.

-

Manufacturing: The manufacturing sector, closely linked to global supply chains, has experienced reduced orders and increased costs due to trade tensions. This has resulted in a 2% decrease in exports, impacting Dutch manufacturing companies and their corresponding stock performance within the Dutch Stocks market.

These sectors are intricately linked with global trade, and the imposition of tariffs and trade restrictions directly impacts their profitability and ability to compete internationally, directly impacting the performance of Dutch Stocks.

Weakening Euro and its Effect on Dutch Stocks

The weakening Euro further exacerbates the challenges faced by Dutch businesses. A weaker Euro makes Dutch exports more expensive in international markets, reducing their competitiveness and impacting revenue.

Recent fluctuations in the Euro's exchange rate show a clear downward trend against major currencies like the US dollar and the Chinese Yuan. This trend directly contributes to reduced profitability for Dutch exporters and negatively affects the value of Dutch Stocks denominated in Euros. The resulting uncertainty adds to market volatility and discourages investment in Dutch Stocks.

A weaker Euro, coupled with the impact of trade tariffs, creates a double whammy for Dutch businesses and their stock performance.

Investor Sentiment and Market Volatility

Negative investor sentiment is a significant factor contributing to the downturn in Dutch Stocks. Uncertainty surrounding future trade policies and the escalating trade war creates a climate of fear and uncertainty, prompting investors to divest from riskier assets, including Dutch Stocks.

Indicators of market volatility are clearly present: increased trading volume, sharp price swings, and a decline in investor confidence are all evident. This volatility makes it challenging for investors to make informed decisions and contributes to the overall downward trend in Dutch Stocks. The uncertainty regarding future trade policies further fuels this volatility, making it difficult to predict the future performance of Dutch Stocks.

Government Response and Potential Mitigation Strategies

The Dutch government has recognized the severity of the situation and is actively exploring strategies to mitigate the negative impact of the trade war on the Dutch economy and the Dutch Stocks market.

Government Actions to Support Businesses

Several measures have been announced by the Dutch government to provide support to affected businesses. These include:

- Tax breaks and subsidies: Incentives aimed at boosting exports and supporting businesses facing difficulties due to trade tensions.

- Investment in research and development: Funding aimed at enhancing the competitiveness of Dutch businesses and fostering innovation.

- Facilitating access to credit: Measures to ensure that businesses have access to the necessary funding to weather the storm.

While these initiatives are steps in the right direction, their long-term effectiveness remains to be seen. The scale of the problem may require more substantial government intervention in the coming months to truly support the struggling sectors and the Dutch Stocks market.

Long-Term Economic Implications for the Netherlands

The long-term economic impact of this trade war on the Netherlands is a subject of considerable debate. Several scenarios are possible:

- Best-case scenario: A negotiated resolution to trade disputes leading to a gradual recovery in exports and economic growth.

- Worst-case scenario: A prolonged trade war leading to significant job losses and a prolonged recession.

The potential implications for employment and economic growth are substantial, making it crucial for the government and businesses to take proactive steps to mitigate the risks and ensure a resilient and diversified Dutch economy. The future performance of Dutch Stocks hinges on the outcome of these trade tensions and the effectiveness of government policy.

Conclusion

The intensifying trade war has dealt a significant blow to Dutch Stocks, causing substantial losses across various sectors. The weakening Euro and negative investor sentiment have further exacerbated the situation. While the Dutch government has implemented some support measures, the long-term economic implications remain uncertain. The escalating trade war continues to negatively affect Dutch Stocks. Stay informed about the latest developments and adjust your investment strategies accordingly. Monitor leading indicators like the Euro's exchange rate and government policies impacting Dutch Stocks to make informed decisions. Consider diversifying your portfolio to mitigate risks associated with ongoing trade tensions. Understanding the intricacies of the impact on Dutch Stocks is crucial for investors seeking to navigate the current climate and protect their investments.

Featured Posts

-

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025 -

Smart Travel Tips Navigating Memorial Day Flights In 2025

May 24, 2025

Smart Travel Tips Navigating Memorial Day Flights In 2025

May 24, 2025 -

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc A Comprehensive Guide To Net Asset Value

May 24, 2025

Latest Posts

-

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

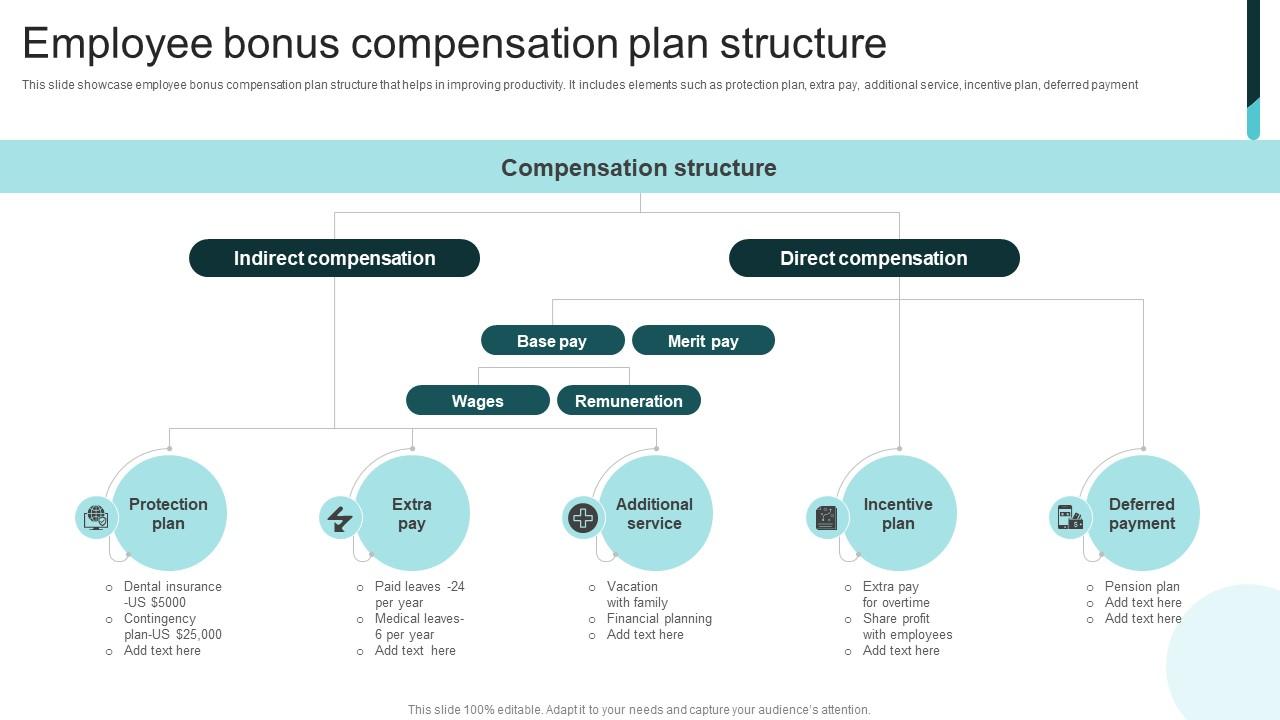

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025