Trump's Absence In Key Economic Indicators

Table of Contents

GDP Growth and the Trump Legacy

Analyzing GDP growth rates provides a crucial lens through which to view the economic impact of Trump's absence. We need to compare his administration's performance with the current economic climate.

Comparing GDP Growth Rates

Let's examine the GDP growth rates under Trump's administration versus the current administration. While precise figures fluctuate based on methodologies and data revisions, a general comparison can be made.

- Pre-pandemic GDP growth under Trump: Generally experienced moderate growth, although not consistently exceeding the historical average.

- Post-pandemic GDP growth under the current administration: Showed significant volatility, influenced heavily by the pandemic's economic fallout and subsequent recovery efforts.

- Comparison of annual growth rates: Requires a detailed year-by-year analysis to reveal accurate trends and account for seasonal adjustments.

- Factors influencing the differences: The COVID-19 pandemic is a significant factor. Global economic conditions, such as supply chain disruptions and international trade policies, also play a vital role. Additionally, differing fiscal and monetary policies enacted by the subsequent administrations have contributed to contrasting growth trajectories.

Investment and Business Confidence

Examining business investment and consumer confidence reveals further insights into the impact of Trump's absence.

- Impact of policy changes on business sentiment: Shifts in tax policies, regulatory environments, and trade agreements under the current administration have affected business confidence levels.

- Analysis of investment trends in key sectors: Investment patterns have varied across sectors, reflecting changes in market demand, technological advancements, and government priorities.

- Data on consumer spending and confidence levels: Consumer spending is a crucial driver of GDP growth, and consumer confidence indices offer valuable insights into spending behavior. Changes in these indicators reflect the overall economic sentiment after Trump left office.

Inflation and its Impact

Inflation is a critical economic indicator, offering significant insight into the effects of Trump's absence.

Inflation Rates Under Trump vs. Post-Trump

A direct comparison of inflation rates during and after the Trump presidency is essential.

- Inflation rates under Trump's administration: Remained relatively low initially, but increased towards the end of his term.

- Current inflation rates and contributing factors: Currently, inflation is a major concern, driven by factors like supply chain issues, increased demand, and expansionary monetary policies.

- Analysis of the impact of inflation on various economic sectors: Different sectors experience inflation's effects differently; some are more price-sensitive than others.

- Comparison of inflation control measures employed by both administrations: Analyzing the differences in fiscal and monetary policy responses sheds light on the varying approaches to inflation management.

The Role of Fiscal and Monetary Policy

Fiscal and monetary policies enacted post-Trump have significantly influenced inflation.

- Impact of government spending and taxation: Government spending programs and tax policies have direct impacts on aggregate demand and inflation.

- Federal Reserve's interest rate policies and their effects: The Federal Reserve's actions to control inflation through interest rate adjustments have significant consequences for borrowing costs, investment, and overall economic activity.

- Relationship between inflation and unemployment (Phillips Curve): Understanding the trade-off between inflation and unemployment, as illustrated by the Phillips Curve, helps assess the effectiveness of economic policies implemented after Trump's departure.

Job Market Performance and Unemployment Rates

Analyzing job creation and unemployment rates helps gauge the impact of Trump's absence on the labor market.

Job Creation and Unemployment Trends

The job market has undergone significant shifts since Trump left office.

- Job growth under Trump’s administration: Experienced moderate job growth, although the distribution across sectors varied.

- Current job market trends: The current job market is dynamic, with certain sectors experiencing robust growth while others face challenges.

- Analysis of sector-specific job growth: Specific industries, such as technology and healthcare, have exhibited strong job growth, while others have lagged behind.

- Impact of automation and technological advancements: Automation and technological progress continue to reshape the job market, creating new opportunities while displacing others.

Wage Growth and Income Inequality

Examining wage growth and income inequality provides a complete picture of the labor market.

- Wage stagnation or growth in different income brackets: Wage growth has varied across income levels, with some groups experiencing faster wage increases than others.

- Analysis of the Gini coefficient (income inequality measure): The Gini coefficient provides a quantitative assessment of income inequality.

- Impact of minimum wage changes: Changes in minimum wage laws have affected low-wage earners and influenced overall income distribution.

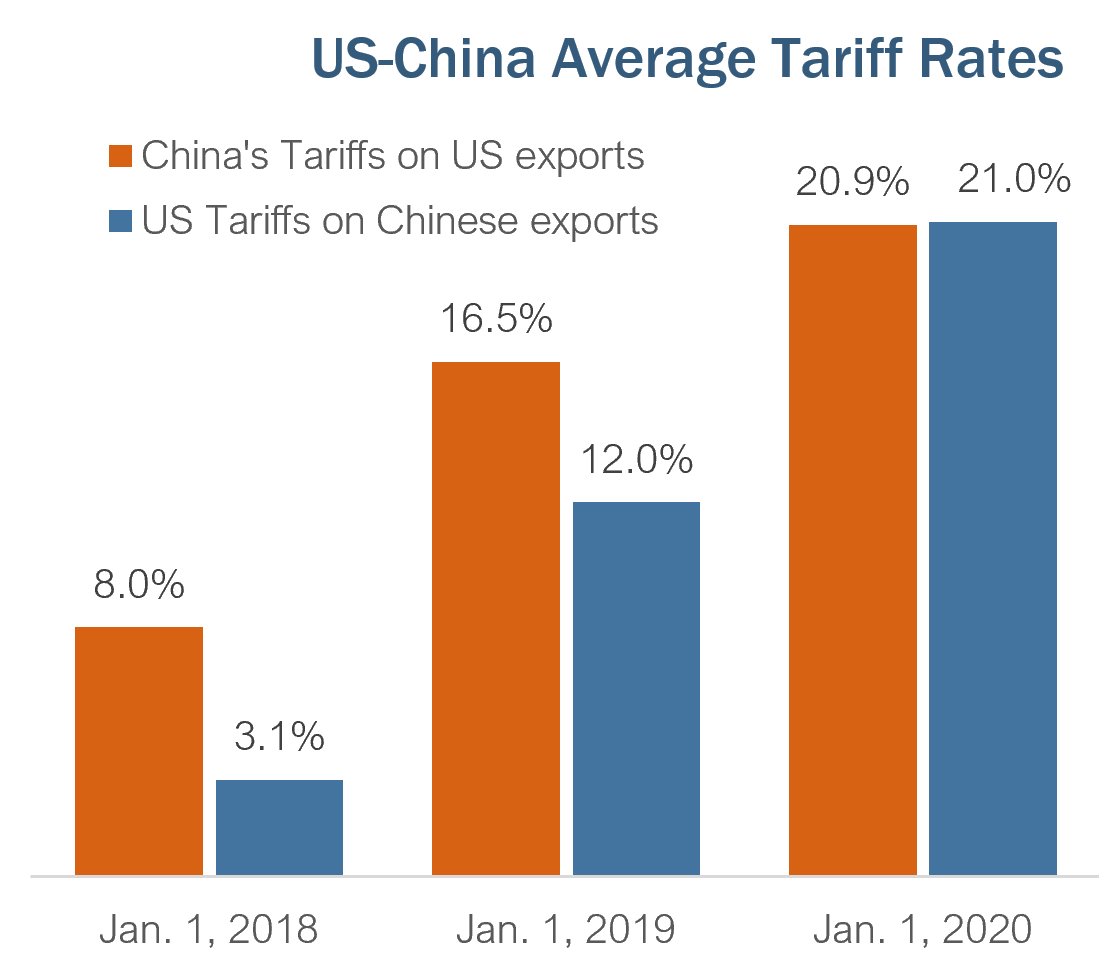

The US Dollar and Global Trade

The value of the US dollar and the nation's trade relationships are further key indicators affected by Trump's absence.

Exchange Rate Fluctuations

The value of the US dollar has fluctuated since Trump left office.

- Impact of global economic conditions on the dollar: Global economic factors, such as interest rate differentials and investor sentiment, significantly influence the dollar's value.

- Analysis of trade balances with key trading partners: Trade balances with major trading partners indicate the competitiveness of US exports and imports.

- The role of US trade policy in affecting the dollar's value: Trade policies and agreements influence international trade flows and the demand for the US dollar.

Impact on International Trade Agreements

Policy changes have affected US trade relationships.

- Assessment of changes to existing trade agreements: The renegotiation or withdrawal from existing trade agreements has impacted trade flows and relationships.

- Impact on import and export volumes: Changes in trade policies have directly influenced the volume of imports and exports.

- Analysis of potential trade wars and their economic consequences: The potential for trade conflicts and their economic consequences are significant considerations.

Conclusion

This analysis of key economic indicators reveals significant shifts in the US economy since the end of the Trump presidency. While the pandemic undeniably played a crucial role, we've identified areas where his policies continue to have lingering impacts, positive and negative, on GDP growth, inflation, job creation, and international trade. Understanding these trends is critical for making informed economic decisions moving forward. Further research should delve deeper into specific policy impacts and their long-term consequences. Continue your economic analysis by exploring the implications of Trump's absence in key economic indicators and how these changes may shape future economic policy.

Featured Posts

-

Lumina Gold Sold To Chinas Cmoc For 581 Million Analysis Of The Deal

Apr 23, 2025

Lumina Gold Sold To Chinas Cmoc For 581 Million Analysis Of The Deal

Apr 23, 2025 -

Calendario Laboral 2024 El Puente Del 21 De Abril

Apr 23, 2025

Calendario Laboral 2024 El Puente Del 21 De Abril

Apr 23, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime

Apr 23, 2025

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime

Apr 23, 2025 -

Skubal Silences Brewers 7 Inning Shutout Leads Tigers To Victory

Apr 23, 2025

Skubal Silences Brewers 7 Inning Shutout Leads Tigers To Victory

Apr 23, 2025 -

The Destruction Of Pope Franciss Ring A Papal Tradition

Apr 23, 2025

The Destruction Of Pope Franciss Ring A Papal Tradition

Apr 23, 2025

Latest Posts

-

Mstwa Markw Fyraty Me Alerby Alqtry Bed Andmamh Mn Alahly

May 10, 2025

Mstwa Markw Fyraty Me Alerby Alqtry Bed Andmamh Mn Alahly

May 10, 2025 -

Us Eu Trade Dispute French Minister Advocates For Increased Retaliation

May 10, 2025

Us Eu Trade Dispute French Minister Advocates For Increased Retaliation

May 10, 2025 -

Trade Tensions French Minister Seeks Tougher Eu Stance On Us Tariffs

May 10, 2025

Trade Tensions French Minister Seeks Tougher Eu Stance On Us Tariffs

May 10, 2025 -

French Minister Eu Must Do More To Counter Us Tariffs

May 10, 2025

French Minister Eu Must Do More To Counter Us Tariffs

May 10, 2025 -

Stronger Eu Response To Us Tariffs Demanded By French Minister

May 10, 2025

Stronger Eu Response To Us Tariffs Demanded By French Minister

May 10, 2025