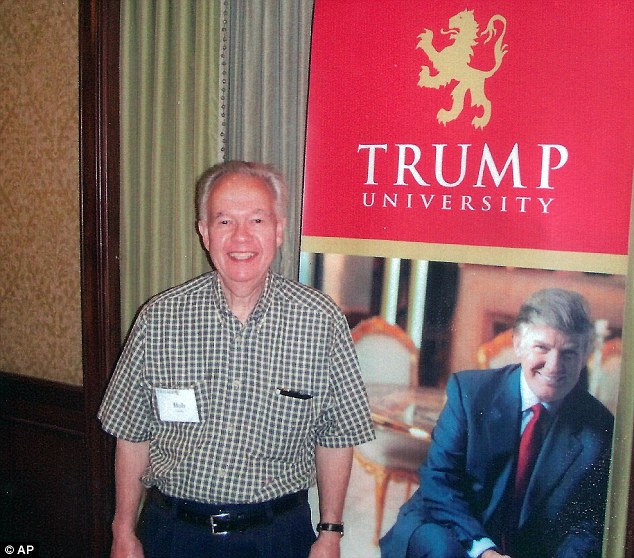

Trump's China Tariffs: Higher Prices And Empty Shelves? A US Economic Impact Analysis

Table of Contents

The Impact of Tariffs on Consumer Prices

Trump's China Tariffs directly impacted consumer prices in several ways.

Increased Costs for Imported Goods

Tariffs are essentially taxes on imported goods. When the Trump administration imposed tariffs on Chinese imports, the cost of those goods immediately increased for American consumers. This directly affected a wide range of products, including:

- Electronics: Smartphones, laptops, and televisions saw price increases.

- Clothing and Footwear: The cost of apparel and shoes rose, impacting consumers across all income levels.

- Furniture and Home Goods: Prices for furniture, home décor, and other household items climbed.

Studies showed price increases ranging from a few percentage points to over 20% for certain goods, depending on the tariff rate and the product category. This contributed to a rise in inflation and impacted the Consumer Price Index (CPI), affecting purchasing power for many American households.

Ripple Effect on Domestic Prices

The impact wasn't limited to imported goods. Tariffs also increased input costs for US businesses reliant on Chinese imports. These businesses, in turn, passed these increased costs onto consumers through higher prices for domestically produced goods. This "ripple effect" impacted various sectors, including:

- Manufacturing: Companies utilizing Chinese-made components in their products experienced higher production costs.

- Agriculture: Farmers faced increased costs for machinery and supplies sourced from China.

This phenomenon led to a broader inflationary pressure across the US economy, further impacting consumer spending and economic growth.

The Role of Supply Chain Disruptions

Trump's China Tariffs introduced significant uncertainty and disruption to global supply chains. This uncertainty made it harder for businesses to predict costs and manage inventory, resulting in:

- Delays: Shipping delays and logistical bottlenecks increased lead times and reduced the availability of goods.

- Increased Costs: The added complexity and uncertainty drove up transportation and logistics expenses, further contributing to higher prices.

- Shortages: In some cases, the tariffs led to shortages of certain goods, impacting consumers' ability to find products they needed. Examples include specific electronics components and certain agricultural products.

The Effect of Tariffs on US Businesses and Employment

The impact of Trump's China Tariffs on US businesses and employment was complex and multifaceted.

Job Losses and Gains

While some argued that the tariffs protected American jobs by encouraging domestic production, the reality was more nuanced. While some job creation likely occurred in certain sectors, it's difficult to quantify precisely. Studies have shown that job losses in industries heavily reliant on cheap Chinese imports may have outweighed any job gains created in other sectors. Accurately measuring the net effect of the tariffs on employment is challenging, due to several confounding factors influencing job creation and destruction concurrently.

Impact on Specific Industries

The impact varied significantly across different sectors:

- Agriculture: Farmers, particularly soybean producers, experienced significant losses due to retaliatory tariffs imposed by China.

- Manufacturing: Some manufacturers benefited from increased domestic demand, while others struggled with higher input costs.

- Technology: The tech sector faced challenges due to increased costs for components and supply chain disruptions.

Businesses adapted in various ways, including:

- Relocating Production: Some companies shifted production to other countries to avoid tariffs.

- Sourcing Alternatives: Others sought alternative suppliers outside of China.

Increased Business Costs and Reduced Competitiveness

The tariffs increased operational costs for many businesses. This reduced their competitiveness in both domestic and international markets, particularly as China retaliated with its own tariffs on US goods. This created a trade war, escalating the overall economic damage.

Long-Term Economic Consequences of Trump's China Tariffs

The long-term consequences of Trump's China Tariffs are still unfolding, but some key trends are evident.

Trade War and Global Economic Slowdown

The trade war initiated by the tariffs contributed to a slowdown in global economic growth. International organizations like the World Bank and IMF warned of the negative repercussions of escalating trade tensions on global trade and economic activity.

Restructuring of Global Supply Chains

Businesses responded to the tariffs by diversifying their supply chains, moving away from a heavy reliance on China. This involved:

- Nearshoring: Shifting production to nearby countries like Mexico or Canada.

- Friend-shoring: Prioritizing trade with countries considered allies or partners.

This restructuring of global supply chains has long-term implications for trade patterns and manufacturing locations worldwide.

Impact on US-China Relations

The trade war significantly damaged US-China relations, creating increased tension and distrust between the two economic superpowers. This strained relationship has implications for future trade negotiations and broader collaborations on global issues.

Conclusion: Understanding the Lasting Legacy of Trump's China Tariffs

Trump's China Tariffs had a profound and multifaceted impact on the US economy. They led to higher consumer prices, disrupted supply chains, and created complexities in the labor market. While some businesses adapted and found alternative solutions, the overall economic consequences were significant, contributing to increased inflation, reduced competitiveness, and a strained relationship with China. The long-term effects are still being felt as global supply chains continue to readjust and the economic fallout of the trade war unfolds. To delve deeper into the complexities of the economic fallout from these tariffs, explore resources from the Congressional Research Service or the Peterson Institute for International Economics.

Featured Posts

-

Where Could White Lotus Film Next Top Contender Locations

Apr 29, 2025

Where Could White Lotus Film Next Top Contender Locations

Apr 29, 2025 -

Exclusive University Group Challenges Trump Administration Policies

Apr 29, 2025

Exclusive University Group Challenges Trump Administration Policies

Apr 29, 2025 -

Skoleprestasjoner Og Adhd Medisin Hva Sier Fhi

Apr 29, 2025

Skoleprestasjoner Og Adhd Medisin Hva Sier Fhi

Apr 29, 2025 -

Monte Carlo Masters 2025 Djokovic Suffers Straight Sets Loss Against Tabilo

Apr 29, 2025

Monte Carlo Masters 2025 Djokovic Suffers Straight Sets Loss Against Tabilo

Apr 29, 2025 -

The Dark Side Of Disaster Examining The Market For Los Angeles Wildfire Bets

Apr 29, 2025

The Dark Side Of Disaster Examining The Market For Los Angeles Wildfire Bets

Apr 29, 2025

Latest Posts

-

Exploring The World Of Luxury Homes On Mtv Cribs

May 12, 2025

Exploring The World Of Luxury Homes On Mtv Cribs

May 12, 2025 -

Discovering The Mansions Featured On Mtv Cribs

May 12, 2025

Discovering The Mansions Featured On Mtv Cribs

May 12, 2025 -

Mtv Cribs A Tour Of Celebrity Real Estate

May 12, 2025

Mtv Cribs A Tour Of Celebrity Real Estate

May 12, 2025 -

Ormsperma Och Jessica Simpson En Djupdykning I Kontroversen

May 12, 2025

Ormsperma Och Jessica Simpson En Djupdykning I Kontroversen

May 12, 2025 -

The Ultimate Guide To Mtv Cribs Mansions

May 12, 2025

The Ultimate Guide To Mtv Cribs Mansions

May 12, 2025