The Dark Side Of Disaster: Examining The Market For Los Angeles Wildfire Bets

Table of Contents

The Growing Market for Wildfire Bets

While openly advertised markets for betting on Los Angeles wildfires may not currently exist, the potential for their emergence is a concerning reality. The mechanics of such a market would likely involve predicting various aspects of a wildfire: its severity (acres burned), its location (specific neighborhoods or geographical areas), or its duration. These bets could be placed on platforms, potentially utilizing dark web or offshore avenues, if they existed. The lack of transparent, regulated markets doesn't negate the potential risk.

- Types of Wildfire Bets: Potential bets could include over/under on the number of acres burned, whether a specific neighborhood will be affected, or even the length of time a fire will rage.

- Potential Profit Margins and Risks: The profit margins would depend heavily on the accuracy of predictions and the stakes involved. The inherent risk is substantial, as wildfire behavior is unpredictable, and losses could be significant.

- Data and Predictive Modeling: Sophisticated data analysis, incorporating weather patterns, historical fire data, fuel conditions (vegetation density and dryness), and even real-time satellite imagery, could be used to inform wildfire betting strategies. This creates a complex and potentially manipulative environment.

The Ethical Concerns of Profiteering from Disaster

The ethical implications of profiting from the suffering caused by wildfires are profound. The very idea of betting on the scale of destruction and the human cost is deeply insensitive and morally reprehensible. This type of market potentially exacerbates the crisis by:

- Insensitive Nature of Disaster Betting: The act of placing bets on wildfires trivializes the immense suffering experienced by victims, ignoring the loss of homes, livelihoods, and lives.

- Potential for Manipulation and Misinformation: The market could be vulnerable to manipulation, with false information spread to influence betting outcomes, further undermining public safety and trust.

- Lack of Empathy and Disregard for Victims: Participants in such a market demonstrate a callous disregard for the victims and the broader community affected by the wildfires.

The Role of Insurance and Reinsurance in Wildfire Risk

Insurance companies play a crucial role in managing wildfire risk in Los Angeles. They assess the risk based on factors like location, vegetation, and building materials, setting premiums accordingly. While direct wildfire betting markets may not exist, the potential for indirect influence is considerable. The perception of increased risk, even if fueled by speculation rather than concrete data, could:

- Increase the Cost of Wildfire Insurance: Higher perceived risk leads to increased premiums, making insurance unaffordable for many residents in high-risk areas.

- Impact Reinsurance Markets: Reinsurance companies, who cover insurance companies' losses, would need to factor in increased wildfire risk, potentially impacting their pricing strategies and profitability.

- Fuel a Cycle of Increased Premiums: A combination of rising claims and perceived increased risk creates a feedback loop, pushing insurance premiums even higher.

Regulation and Legal Ramifications

The legal landscape surrounding gambling on natural disasters is complex. The legality of wildfire bets would vary greatly depending on the jurisdiction, with many jurisdictions having strict laws against gambling and betting on events that are not specifically regulated.

- Legality of Wildfire Bets: In most places, betting on wildfires would likely be considered illegal gambling, falling under existing gambling laws.

- Penalties for Illegal Betting Markets: Operating an illegal betting market carries substantial legal and financial penalties, including hefty fines and even imprisonment.

- Regulatory Complexities: Regulating such a niche and ethically questionable market presents significant challenges for lawmakers.

Conclusion

The potential market for Los Angeles wildfire bets highlights a deeply unsettling aspect of disaster capitalism: profiting from human suffering. The ethical implications are far-reaching, and the potential for market manipulation and increased insurance costs pose serious risks to communities already vulnerable to wildfires. Understanding the ethical considerations surrounding Los Angeles wildfire bets is crucial. We must advocate for responsible behavior, focusing on wildfire prevention and mitigation efforts, rather than speculating on the devastation they cause. Further research into this complex and sensitive topic is urgently needed to address the potential for such markets and protect vulnerable communities.

Featured Posts

-

Generating Podcasts From Repetitive Documents An Ai Based Method For Scatological Data

Apr 29, 2025

Generating Podcasts From Repetitive Documents An Ai Based Method For Scatological Data

Apr 29, 2025 -

Tgi Ag Feiert In Kitzbuehel Blick In Die Zukunft

Apr 29, 2025

Tgi Ag Feiert In Kitzbuehel Blick In Die Zukunft

Apr 29, 2025 -

Your Guide To Purchasing Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Purchasing Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Addressing Driving Safety Concerns For People With Adhd

Apr 29, 2025

Addressing Driving Safety Concerns For People With Adhd

Apr 29, 2025 -

Solve Nyt Strands Game 393 March 31 Hints And Solutions

Apr 29, 2025

Solve Nyt Strands Game 393 March 31 Hints And Solutions

Apr 29, 2025

Latest Posts

-

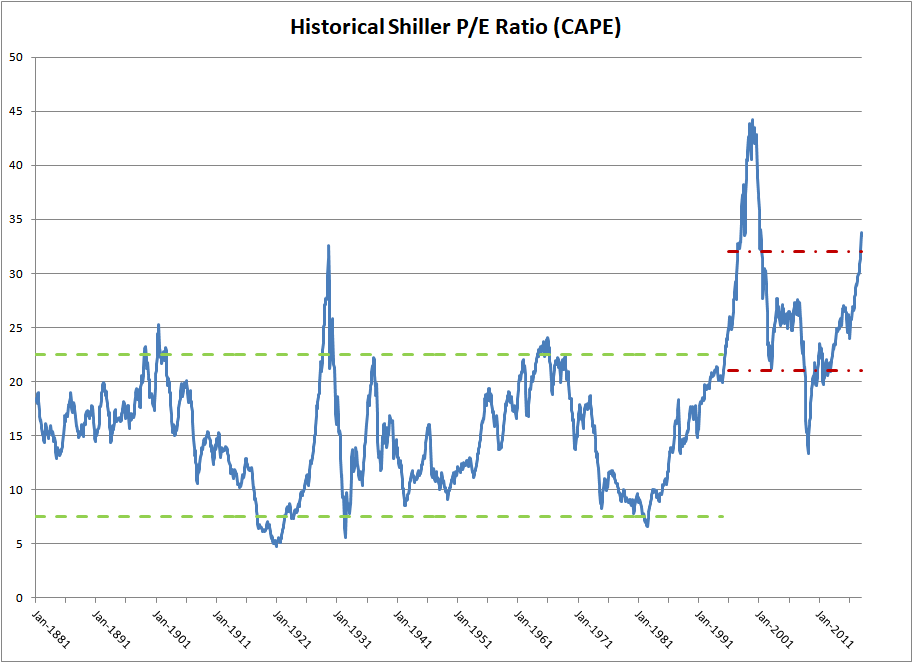

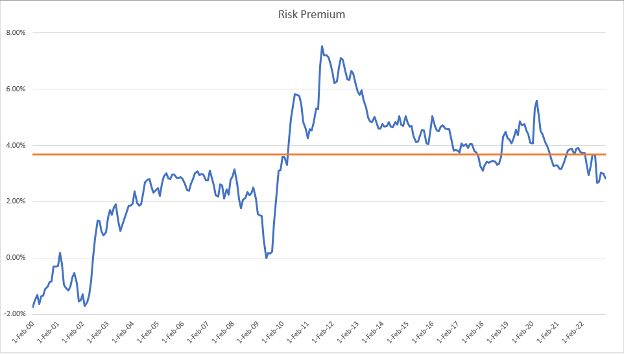

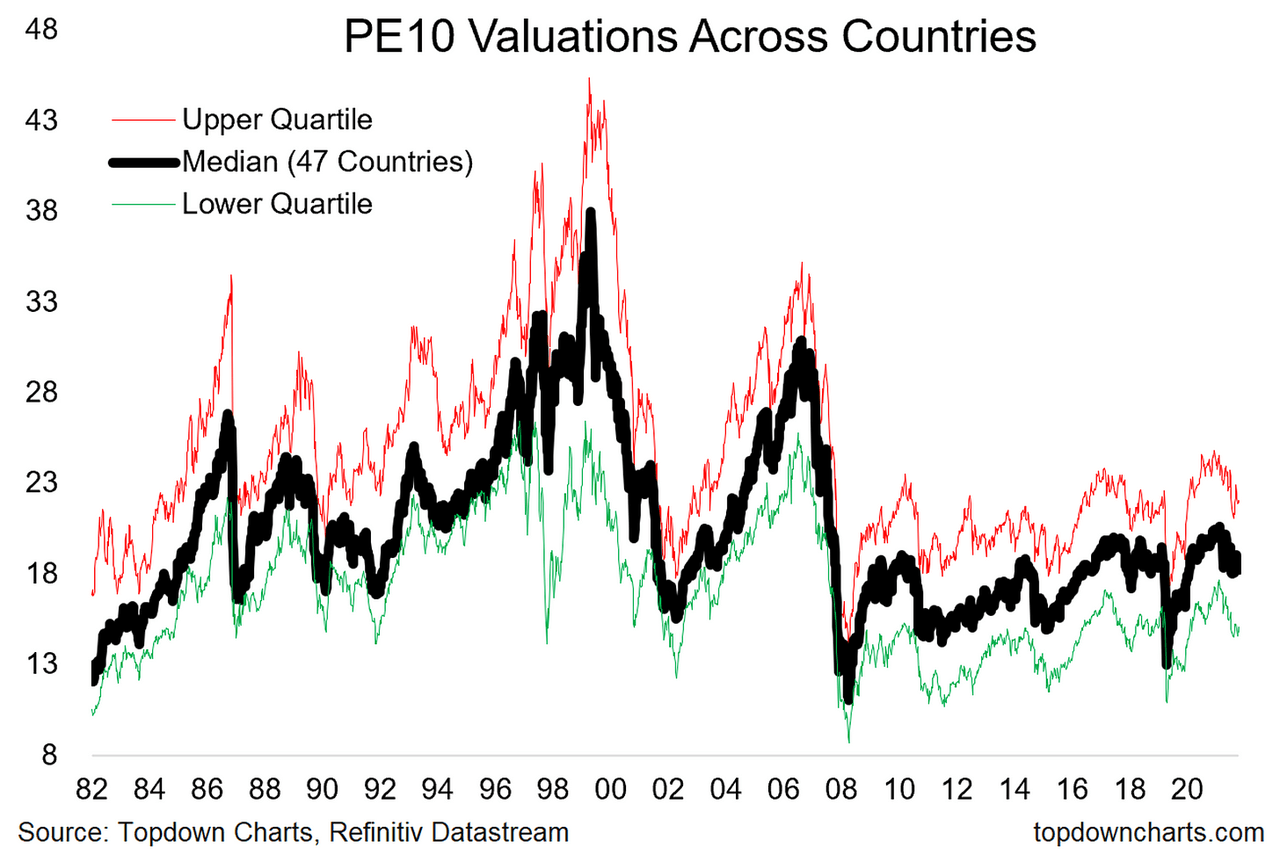

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025 -

High Stock Valuations Bof As View And Investor Implications

May 12, 2025

High Stock Valuations Bof As View And Investor Implications

May 12, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

May 12, 2025 -

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025 -

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025