U.S. Economic Slowdown: 0.2% Contraction Driven By Reduced Spending And Tariffs

Table of Contents

Reduced Consumer Spending: A Major Contributor to the Slowdown

The decrease in consumer spending is a key driver of the current U.S. economic slowdown. Weakening consumer confidence plays a significant role, impacting purchasing decisions across various sectors. This decline in confidence stems from several factors:

-

Rising inflation and interest rates impacting purchasing power: Persistently high inflation has eroded the purchasing power of consumers, leaving less disposable income for non-essential goods and services. Simultaneously, rising interest rates increase borrowing costs, impacting everything from mortgages to auto loans, further reducing spending capacity.

-

Concerns about job security and future economic prospects: Uncertainty about future job security and the overall economic outlook is causing consumers to become more cautious with their spending. This hesitancy is particularly noticeable in discretionary purchases, such as travel and entertainment.

-

Shift in consumer priorities towards essential goods and services: Facing economic pressures, many consumers are prioritizing essential goods and services like groceries and healthcare, leaving less room for discretionary spending. This shift is clearly reflected in retail sales data.

-

Data points illustrating the decline in retail sales and consumer durables: Recent data from the U.S. Census Bureau shows a significant decline in retail sales, particularly in sectors like furniture, automobiles, and electronics. Sales of consumer durables – long-lasting goods – have also fallen sharply, indicating a slowdown in consumer investment. (Keywords: Consumer spending, consumer confidence, inflation, interest rates, retail sales).

The Lingering Impact of Tariffs on Economic Growth

The lingering effects of past tariffs continue to stifle economic growth. These trade barriers have created ripple effects throughout the economy, impacting both businesses and consumers:

-

Increased import costs leading to higher prices for consumers: Tariffs increase the cost of imported goods, directly translating to higher prices for consumers. This inflationary pressure further erodes purchasing power and contributes to the overall economic slowdown.

-

Negative impact on businesses reliant on imported goods and materials: Many U.S. businesses rely on imported goods and materials for production. Tariffs increase these input costs, making it more expensive to manufacture and sell goods, impacting profitability and potentially leading to job losses.

-

Retaliatory tariffs from other countries hindering export growth: The imposition of tariffs often triggers retaliatory measures from other countries, hindering U.S. export growth and further dampening economic activity. This creates a negative feedback loop that exacerbates the economic slowdown.

-

Examples of specific industries significantly impacted by tariffs: Industries heavily reliant on imports, such as manufacturing and agriculture, have been disproportionately affected by tariffs. For example, the steel and aluminum industries faced significant challenges due to tariffs imposed on imported metals. (Keywords: Tariffs, trade war, import costs, export growth, supply chain disruptions).

Other Contributing Factors to the U.S. Economic Slowdown

Beyond reduced consumer spending and tariffs, other factors contribute to the current economic slowdown:

-

Ongoing global supply chain disruptions affecting production and availability: Lingering supply chain disruptions continue to impact production and the availability of goods, contributing to inflationary pressures and slowing economic growth.

-

Geopolitical uncertainties and their influence on investment and trade: Geopolitical instability and uncertainty create a climate of risk aversion, discouraging investment and hindering international trade. This uncertainty further contributes to the economic slowdown.

-

Analysis of the effects of recent governmental fiscal and monetary policies: The effectiveness and impact of recent government fiscal and monetary policies on the economy are subject to ongoing debate and analysis. These policies can either stimulate or further restrain economic growth, depending on their design and implementation. (Keywords: Supply chain, geopolitical risks, fiscal policy, monetary policy, economic uncertainty).

Potential Implications and Future Outlook for the U.S. Economy

The current economic slowdown raises concerns about the possibility of a recession and necessitates a careful analysis of potential implications and future outlook:

-

Analysis of economic indicators and forecasts: Key economic indicators, such as GDP growth, inflation rates, and unemployment figures, are closely monitored to assess the severity of the slowdown and predict future trends. Economic forecasts provide various scenarios, ranging from a mild contraction to a more severe recession.

-

Discussion of potential government interventions and their effectiveness: Government interventions, such as fiscal stimulus packages or monetary policy adjustments, could be implemented to mitigate the slowdown and stimulate economic growth. The effectiveness of these interventions depends on their design and the overall economic context.

-

Expert opinions on the likelihood of a recession: Economists and financial experts offer diverse opinions on the likelihood of a recession, with some predicting a mild downturn while others express concerns about a more prolonged and severe contraction.

-

Possible strategies for stimulating economic growth: Strategies to stimulate economic growth include measures to boost consumer confidence, address supply chain bottlenecks, and promote investment. These strategies require careful consideration and coordination among various stakeholders. (Keywords: Recession, economic recovery, economic indicators, government intervention, economic forecast).

Conclusion:

The 0.2% contraction in the U.S. economy highlights a concerning slowdown fueled by reduced consumer spending and the enduring effects of tariffs. While other factors also contribute to this economic slump, understanding the interplay of consumer confidence, trade policies, and global uncertainties is crucial for navigating this challenging period. The future trajectory of the U.S. economy remains uncertain; however, addressing these fundamental issues through proactive policy measures and bolstering consumer confidence will be vital in fostering a robust economic recovery. To stay informed about the ongoing developments and impacts of this U.S. economic slowdown, continue to monitor credible economic news sources and analyses. (Keyword variations: U.S. Economic Slowdown, Economic Contraction, Economic Recovery).

Featured Posts

-

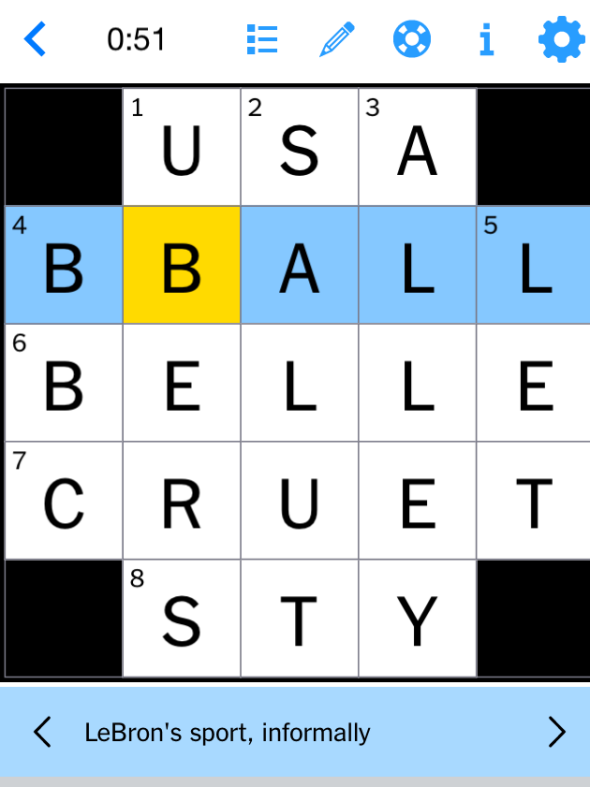

Nyt Mini Crossword Clues And Answers Tuesday April 8

May 31, 2025

Nyt Mini Crossword Clues And Answers Tuesday April 8

May 31, 2025 -

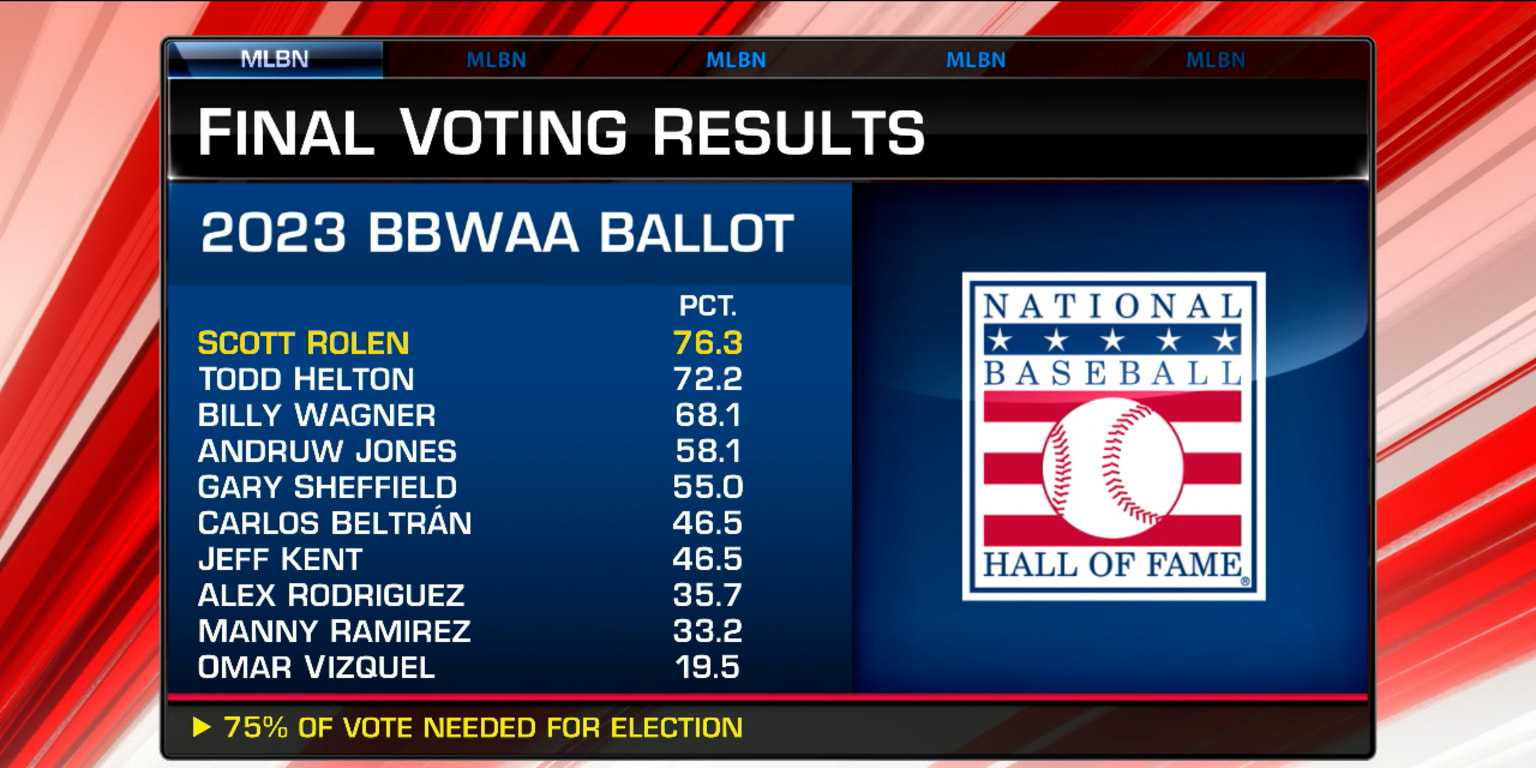

Jack Whites Tigers Broadcast Appearance Insights On Baseball And The Hall Of Fame

May 31, 2025

Jack Whites Tigers Broadcast Appearance Insights On Baseball And The Hall Of Fame

May 31, 2025 -

Horoscope For May 27 2025 Christine Haas Predictions

May 31, 2025

Horoscope For May 27 2025 Christine Haas Predictions

May 31, 2025 -

Understanding The Good Life Values Goals And Action

May 31, 2025

Understanding The Good Life Values Goals And Action

May 31, 2025 -

Finding Glastonbury Resale Tickets Everything You Need To Know

May 31, 2025

Finding Glastonbury Resale Tickets Everything You Need To Know

May 31, 2025