Uber's April Surge: A Double-Digit Rally Explained

Table of Contents

April saw Uber's stock price experience a significant double-digit rally, leaving many investors surprised. This unexpected surge in Uber's stock performance requires closer examination. This article delves into the key factors contributing to this impressive growth, analyzing the contributing market forces and potential implications for the future of the Uber stock price. We'll dissect the financial results, strategic moves, and broader market conditions that fueled this remarkable rally.

Strong Q1 Earnings Beat Expectations

Uber's impressive April surge was significantly fueled by its strong Q1 2024 earnings report, which handily beat analyst expectations. This exceeded performance signaled a positive shift in the company's financial trajectory and significantly boosted investor confidence. Key financial metrics showcased robust growth across several key areas.

- Revenue Growth: Uber reported a [Insert Specific Percentage]% increase in revenue compared to the same period last year, surpassing forecasts by a considerable margin. This strong top-line growth demonstrated the increasing demand for Uber's services.

- Adjusted EBITDA: The adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) also showed significant improvement, indicating improved operational efficiency and profitability. [Insert Specific Data/Percentage Increase] exceeding expectations. This is a crucial metric for investors assessing the financial health and sustainability of the company.

- Ride Volume and User Growth: The number of trips booked through the Uber platform experienced substantial growth, with [Insert Specific Percentage or Number] increase in active users and a corresponding rise in ride volume. This demonstrates increased market penetration and user engagement.

- Improved Driver Engagement: Uber's strategies to improve driver retention and acquisition also yielded positive results, leading to a more stable and efficient driver network. This directly impacts service availability and customer satisfaction.

The market reacted positively to these results, sending a clear signal that Uber’s operational improvements are translating into tangible financial gains. This positive sentiment directly contributed to the double-digit rally in the Uber stock price.

Increased Investor Confidence in Uber's Growth Strategy

Beyond the strong Q1 earnings, the April surge reflects a growing confidence in Uber's overall growth strategy. Several strategic initiatives contributed to this positive investor sentiment.

- Cost-Cutting Measures: Uber has implemented several successful cost-cutting measures, improving operational efficiencies and boosting profitability. [Give specific examples of these measures, e.g., streamlining operations, reducing marketing expenses]. These efforts have demonstrated the company's commitment to fiscal responsibility and long-term sustainability.

- Expansion into New Markets and Services: Uber's continued expansion into new geographical areas and diversification into new service offerings (e.g., Uber Eats, Uber Freight) have broadened its revenue streams and reduced reliance on a single source of income. [Provide specific examples of recent expansions].

- Strategic Partnerships: Strategic partnerships with other companies in related industries further enhance Uber's market position and open new opportunities for growth. [Mention specific partnerships and their contributions].

- Improved Brand Perception: Positive shifts in brand perception and public relations, possibly resulting from improved customer service or successful marketing campaigns, have contributed to increased investor confidence in the long-term prospects of the company.

These strategic initiatives have collectively reinforced investor belief in Uber's ability to sustain its growth trajectory and deliver consistent returns.

Overall Positive Market Sentiment and Sector Performance

The Uber stock price surge wasn't solely driven by internal factors. The broader market environment played a significant role.

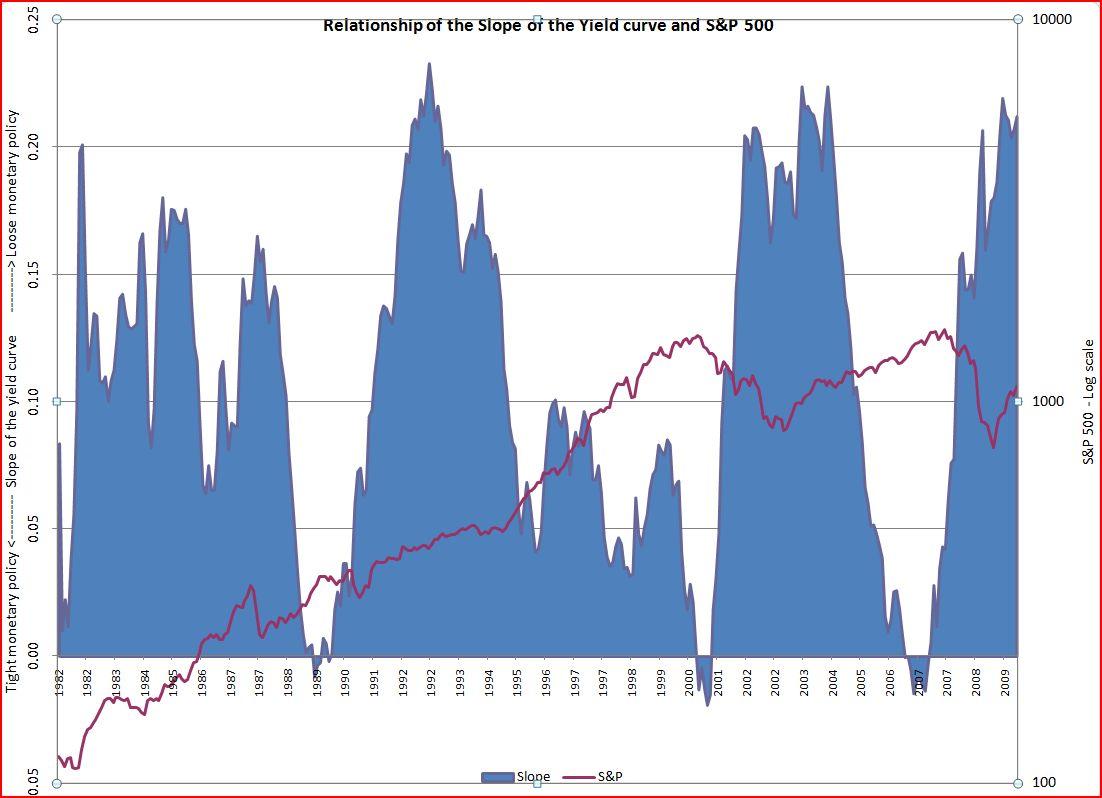

- Positive Market Indices: The overall positive market sentiment, reflected in the performance of major indices such as the S&P 500 and Nasdaq during April, contributed to a favorable investment climate. [Mention specific index performance data]. This general optimism spilled over into the technology sector, benefiting companies like Uber.

- Ride-Sharing Sector Performance: The performance of other companies within the ride-sharing and transportation network industry also contributed to the positive sentiment surrounding Uber. [Mention any positive performances of competitors and explain the impact].

- Macroeconomic Factors: While inflation and interest rates remain factors, the market's risk appetite seemed to increase during this period, contributing to a more favorable investment environment for growth stocks like Uber.

The Role of Short Squeeze in the Uber Stock Price Increase

The April rally in Uber stock may have also been partially influenced by a short squeeze. A short squeeze occurs when investors who bet against a stock (short sellers) are forced to buy it back to cover their positions, driving the price up even further.

- Short Squeeze Mechanics: A short squeeze happens when positive news or unexpected growth prompts short sellers to buy back the stock to limit their losses. This surge in buying pressure further pushes the price upwards in a self-reinforcing cycle.

- Short Interest in Uber: While precise numbers require specialized financial data, [mention any available information about short interest in Uber stock before and after the surge]. A significant level of short interest before the Q1 earnings announcement could have contributed to the intensity of the rally.

- Short Covering: As the Uber stock price climbed following the positive earnings report, short sellers likely engaged in significant short covering, amplifying the upward momentum.

Conclusion

Uber's April double-digit rally resulted from a confluence of factors: exceptionally strong Q1 earnings exceeding expectations, increased investor confidence in Uber's long-term growth strategy, a generally positive market sentiment, and potentially a short squeeze. The company's improved financial performance, strategic initiatives, and the supportive wider market context all played critical roles in fueling this significant stock price increase. Understanding these dynamics is crucial for investors.

Call to Action: Navigating the dynamic ride-sharing market requires a keen understanding of factors affecting Uber's stock price. Stay informed about future Uber developments and market trends to make sound investment decisions regarding Uber stock and other transportation network companies. Deepen your knowledge of Uber's financial performance analysis to better predict future Uber stock rallies.

Featured Posts

-

Predicting Tonights Mlb Matchup Yankees Vs Mariners Odds And Picks

May 17, 2025

Predicting Tonights Mlb Matchup Yankees Vs Mariners Odds And Picks

May 17, 2025 -

Knicks Win Over Pistons Nba Referees Admit To Crucial Missed Foul Call

May 17, 2025

Knicks Win Over Pistons Nba Referees Admit To Crucial Missed Foul Call

May 17, 2025 -

Modular Construction A Viable Solution For Canadas Housing Crisis

May 17, 2025

Modular Construction A Viable Solution For Canadas Housing Crisis

May 17, 2025 -

Japans Steep Yield Curve A Growing Concern For Investors And The Economy

May 17, 2025

Japans Steep Yield Curve A Growing Concern For Investors And The Economy

May 17, 2025 -

Melania Trump Current Status And Relationship With Donald Trump

May 17, 2025

Melania Trump Current Status And Relationship With Donald Trump

May 17, 2025

Latest Posts

-

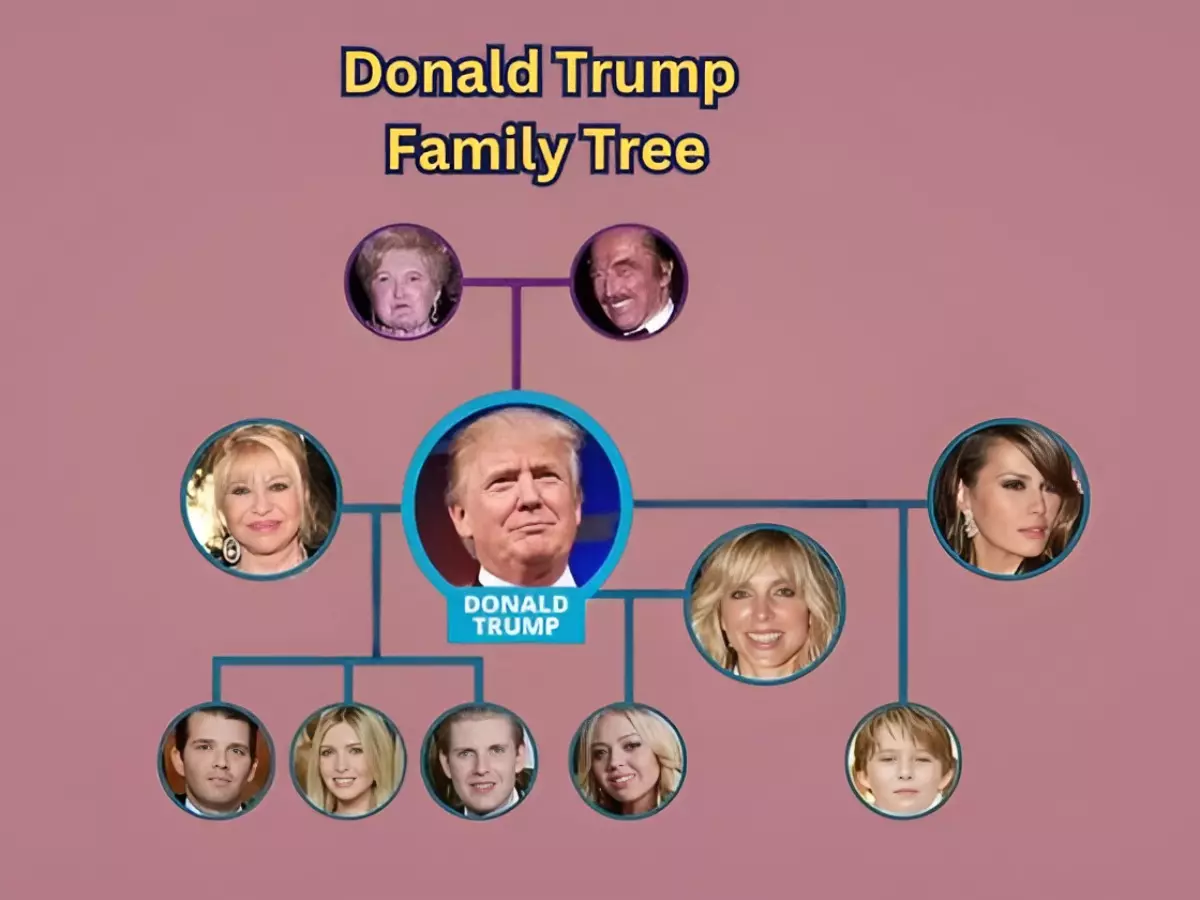

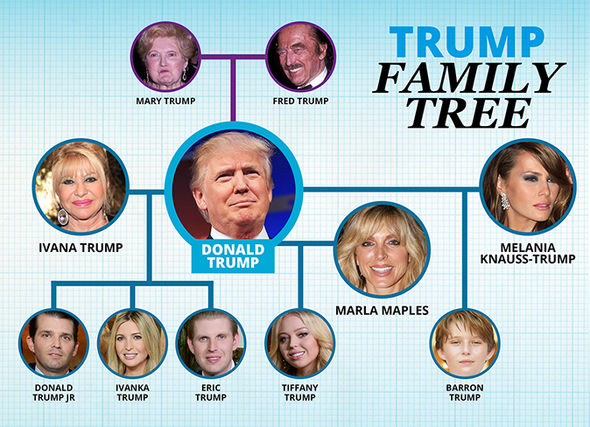

The Trump Family Tree A Detailed Guide To The Presidents Family

May 17, 2025

The Trump Family Tree A Detailed Guide To The Presidents Family

May 17, 2025 -

Understanding The Trump Familys Genealogy And Relationships

May 17, 2025

Understanding The Trump Familys Genealogy And Relationships

May 17, 2025 -

The Trump Family A Comprehensive Genealogy

May 17, 2025

The Trump Family A Comprehensive Genealogy

May 17, 2025 -

Jalen Brunsons Reported Frustration Impact On Wwe Raws Cm Punk Seth Rollins Match

May 17, 2025

Jalen Brunsons Reported Frustration Impact On Wwe Raws Cm Punk Seth Rollins Match

May 17, 2025 -

Will Jalen Brunsons Absence Affect Next Weeks Cm Punk Vs Seth Rollins Raw Bout

May 17, 2025

Will Jalen Brunsons Absence Affect Next Weeks Cm Punk Vs Seth Rollins Raw Bout

May 17, 2025