Uber's Self-Driving Gamble: ETF Investment Opportunities

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's commitment to autonomous vehicles goes beyond a simple experiment; it's a core element of their long-term strategy aimed at disrupting the transportation industry. They envision a future dominated by robotaxis, a vision requiring substantial investment in research, development, and deployment. This ambitious plan involves significant expenditures in AI, sensor technology, and the complex software necessary to navigate the complexities of self-driving. Their aim is to drastically reduce operational costs, improve efficiency, and ultimately redefine personal and public transportation.

- Timeline of key milestones: Uber's self-driving program has seen several key milestones, from initial research and development to pilot programs in select cities. Specific dates and achievements should be researched and included here.

- Geographic areas of testing: Uber is actively testing its autonomous vehicles in various locations globally, adapting its technology to diverse road conditions and traffic patterns. This data is critical to refining its self-driving capabilities. These test locations should be listed.

- Technological challenges: The path to fully autonomous vehicles is fraught with technological obstacles. Uber faces challenges related to software reliability, sensor limitations in adverse weather conditions, and ensuring the safety of passengers and pedestrians. These challenges should be explored in detail.

Uber's approach involves strategic partnerships and collaborations with key players in the tech and automotive sectors. These alliances accelerate development and provide access to crucial resources and expertise. Examples of key partnerships should be named.

Assessing the Risks and Rewards of Investing in Self-Driving Technology

Investing in the autonomous vehicle sector promises substantial returns, fueled by the potential for a massive market disruption. The projected market capitalization of the autonomous vehicle market is enormous, offering considerable upside for early investors. However, alongside the potential for high returns comes significant risk.

- Potential market capitalization: Research and include projections for the future market size of the autonomous vehicle industry.

- Regulatory hurdles: Autonomous vehicle deployment faces significant regulatory hurdles, varying considerably between countries and even regions. These regulatory challenges represent a key risk factor.

- Successes and failures: Examining the successes and failures of other companies in the autonomous vehicle space is crucial to assessing the risks involved. Examples of successful and unsuccessful ventures should be cited.

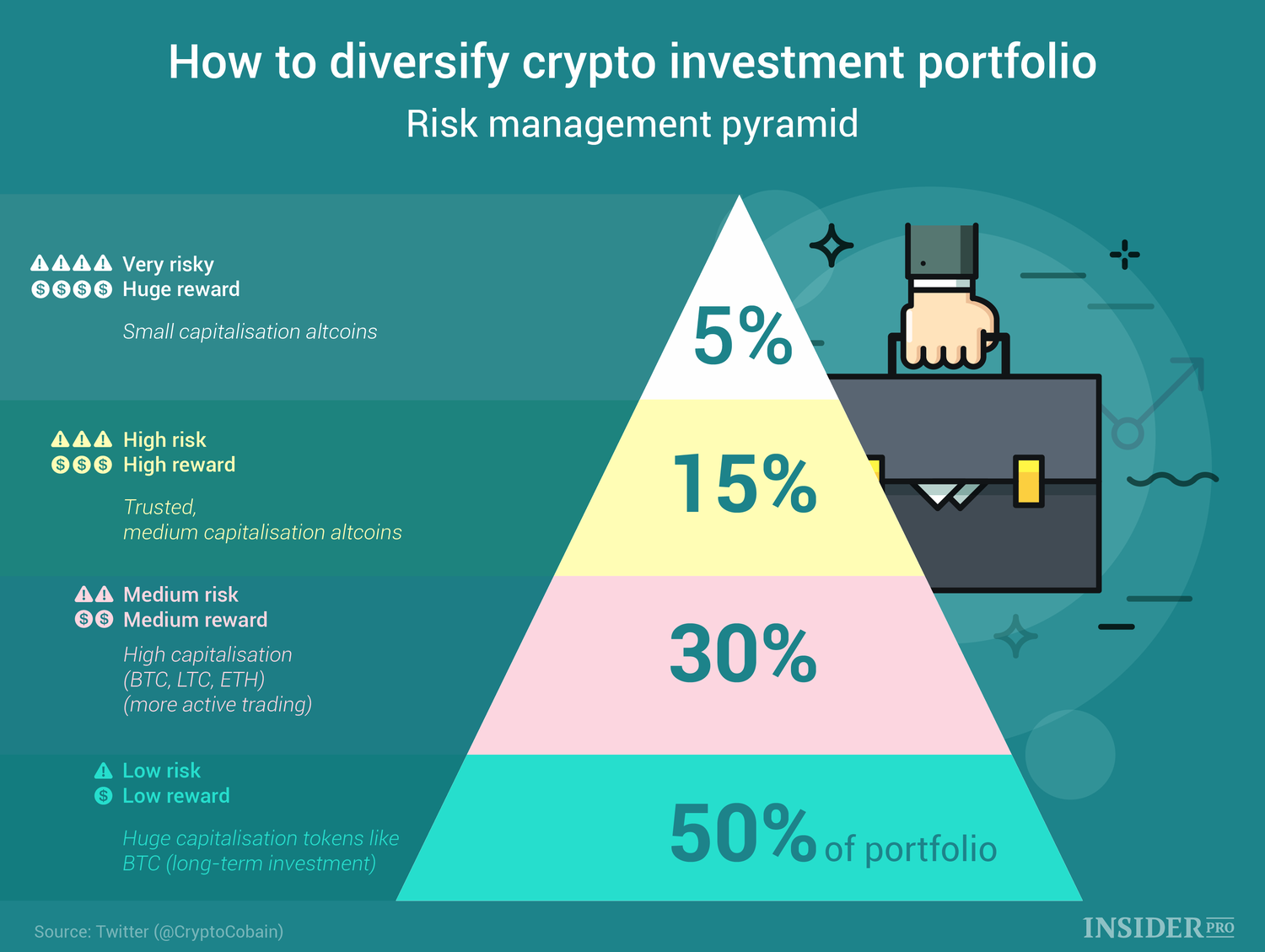

Technological setbacks, safety concerns, and intense competition from established automotive players and new entrants all contribute to the inherent volatility of the sector. Therefore, a diversified investment strategy is crucial to mitigate risk.

Identifying Relevant ETFs for Exposure to Uber's Self-Driving Gamble

Several ETFs offer exposure to the autonomous vehicle sector, providing investors with a diversified approach to participating in this high-growth market. These ETFs often hold shares of companies involved in various aspects of the AV industry, from software development to sensor technology and automotive manufacturing.

- Tech ETFs with AV exposure: Identify and list specific tech ETFs (with their ticker symbols) that have significant holdings in companies involved in autonomous vehicle technologies. Include information on their holdings and weighting.

- Thematic ETFs: List thematic ETFs focusing on disruptive technologies, including autonomous vehicles. Again, include their ticker symbols and a summary of their investment strategies.

- ETF expense ratios: Compare the expense ratios and management fees of different ETFs to help investors make informed decisions. This aspect is important for long-term investment success.

Investing in ETFs provides a convenient and cost-effective way to gain diversified exposure to this rapidly evolving sector, reducing the risk associated with individual stock selection.

Developing a Diversified Investment Strategy

Given the high-risk, high-reward nature of the autonomous vehicle sector, diversification is paramount. A well-diversified portfolio includes ETFs alongside other asset classes, such as bonds or real estate, to mitigate the overall portfolio risk. This reduces the impact of potential losses in one sector on the overall investment performance.

- Diversification strategies: Discuss specific strategies to combine autonomous vehicle ETFs with other asset classes for balanced portfolio construction.

- Investment time horizon: Emphasize the importance of considering one's investment time horizon when selecting ETFs. Longer time horizons generally allow for greater risk tolerance.

- Risk tolerance: Stress the importance of aligning ETF selection with individual risk tolerance levels.

Thorough due diligence is crucial before investing in any ETF. Understanding the fund's investment strategy, holdings, expense ratio, and past performance is essential for making informed investment decisions.

Conclusion: Capitalizing on Uber's Self-Driving Gamble through ETFs

Uber's self-driving initiative presents a compelling investment opportunity, but it’s crucial to remember the inherent risks. By utilizing ETFs, investors can gain diversified exposure to this rapidly developing sector while mitigating some of the inherent volatility. Remember to carefully research the ETFs mentioned, consider your investment time horizon and risk tolerance, and always conduct thorough due diligence before making any investment decisions. Capitalizing on "Uber's self-driving gamble" requires a strategic and informed approach, and ETFs offer a powerful tool to participate in this transformative technological shift. For further research on ETFs and investment strategies, explore resources like [link to reputable financial resource] and [link to another resource].

Featured Posts

-

Retirement Portfolio Diversification Should You Avoid This New Investment

May 18, 2025

Retirement Portfolio Diversification Should You Avoid This New Investment

May 18, 2025 -

7 Bit Casino Best Online Casino Canada For Canadian Players

May 18, 2025

7 Bit Casino Best Online Casino Canada For Canadian Players

May 18, 2025 -

Find Shrek On Bbc Three The Ultimate Tv Guide

May 18, 2025

Find Shrek On Bbc Three The Ultimate Tv Guide

May 18, 2025 -

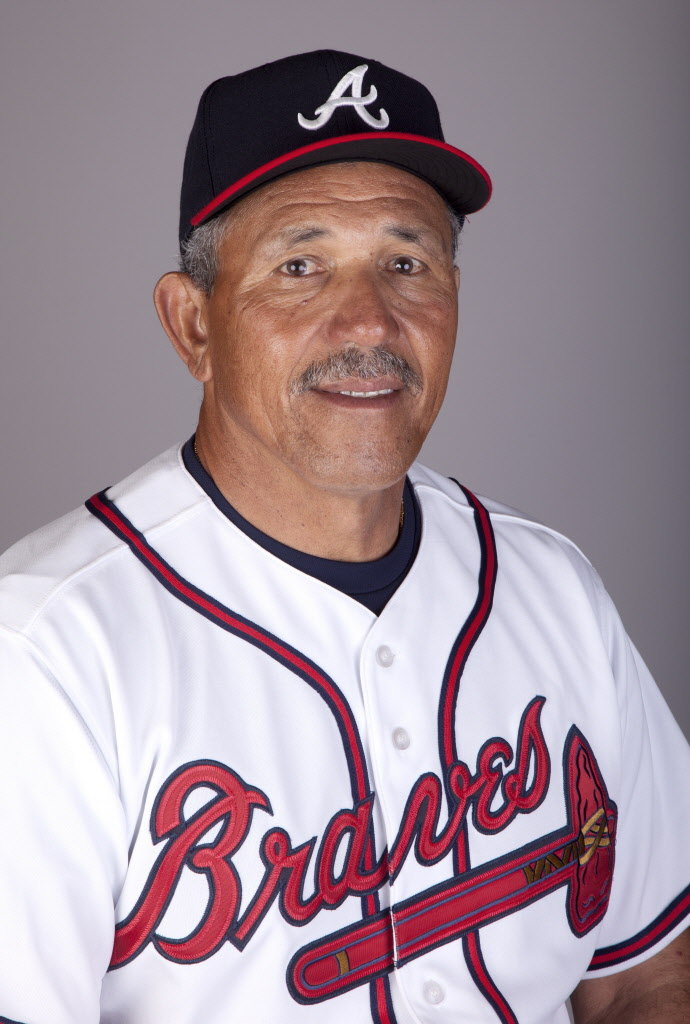

Kimbrels Return To Atlanta A Minor League Opportunity

May 18, 2025

Kimbrels Return To Atlanta A Minor League Opportunity

May 18, 2025 -

The Allure Of Hollywood In Casino Marketing And Advertising

May 18, 2025

The Allure Of Hollywood In Casino Marketing And Advertising

May 18, 2025