Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

Bank of America's stance on current stock market valuations is generally cautious, though not overtly bearish. While acknowledging the robust performance and elevated price-to-earnings ratios (P/E ratios), BofA analysts highlight the persistent influence of factors like low interest rates and strong corporate earnings, which continue to support market levels. They are not predicting an immediate crash but suggest a period of consolidation or even modest correction might be likely. Specific data points from BofA reports (if available, should be inserted here, citing the source).

- Key Indicators: BofA uses a range of indicators to assess valuations, including:

- Price-to-Earnings Ratio (P/E): A comparison of a company's stock price to its earnings per share. High P/E ratios often suggest higher valuations.

- Shiller PE Ratio (CAPE): A cyclically adjusted price-to-earnings ratio that smooths out earnings fluctuations over a longer period (typically 10 years). This provides a more stable measure of valuation.

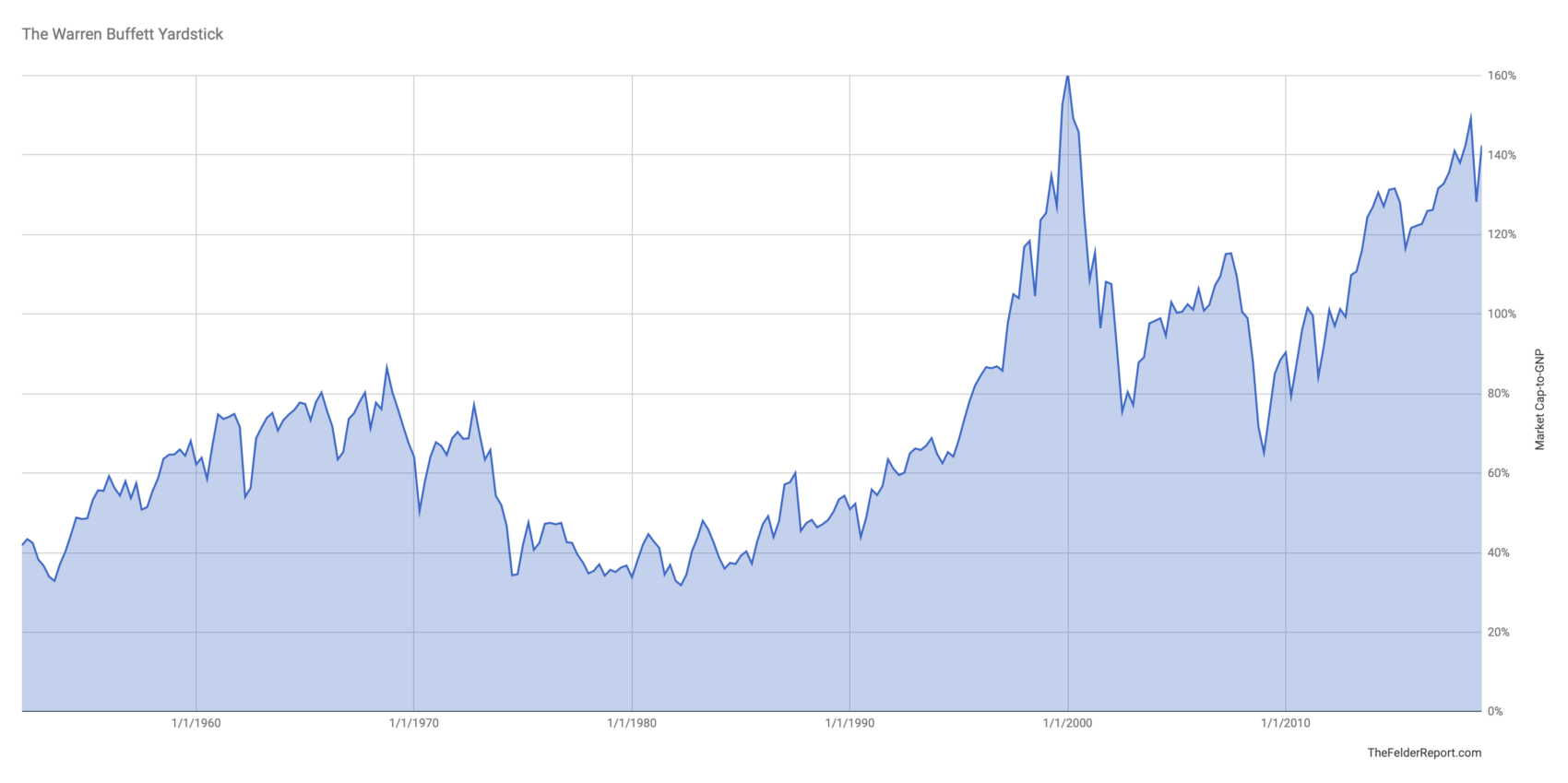

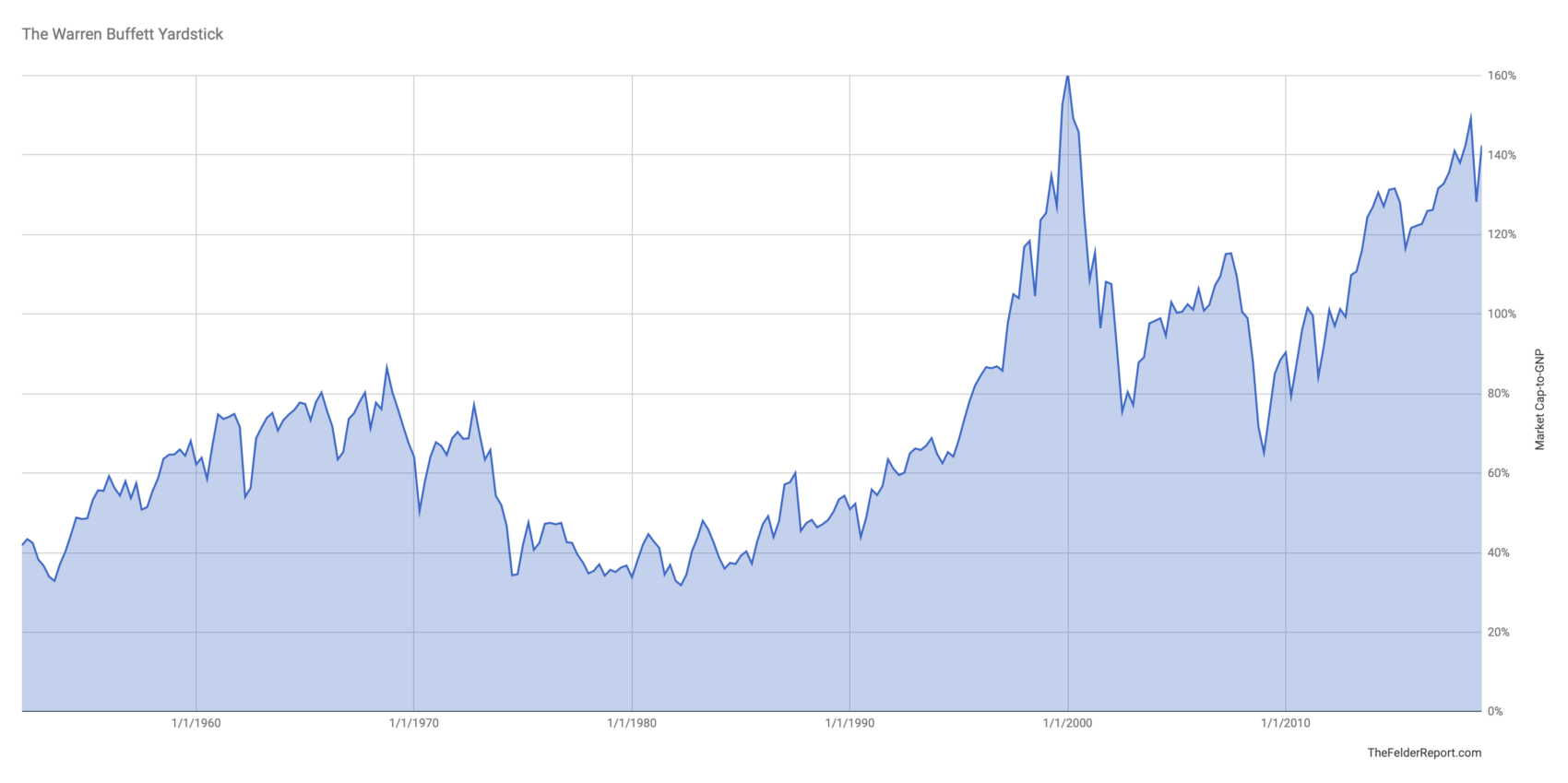

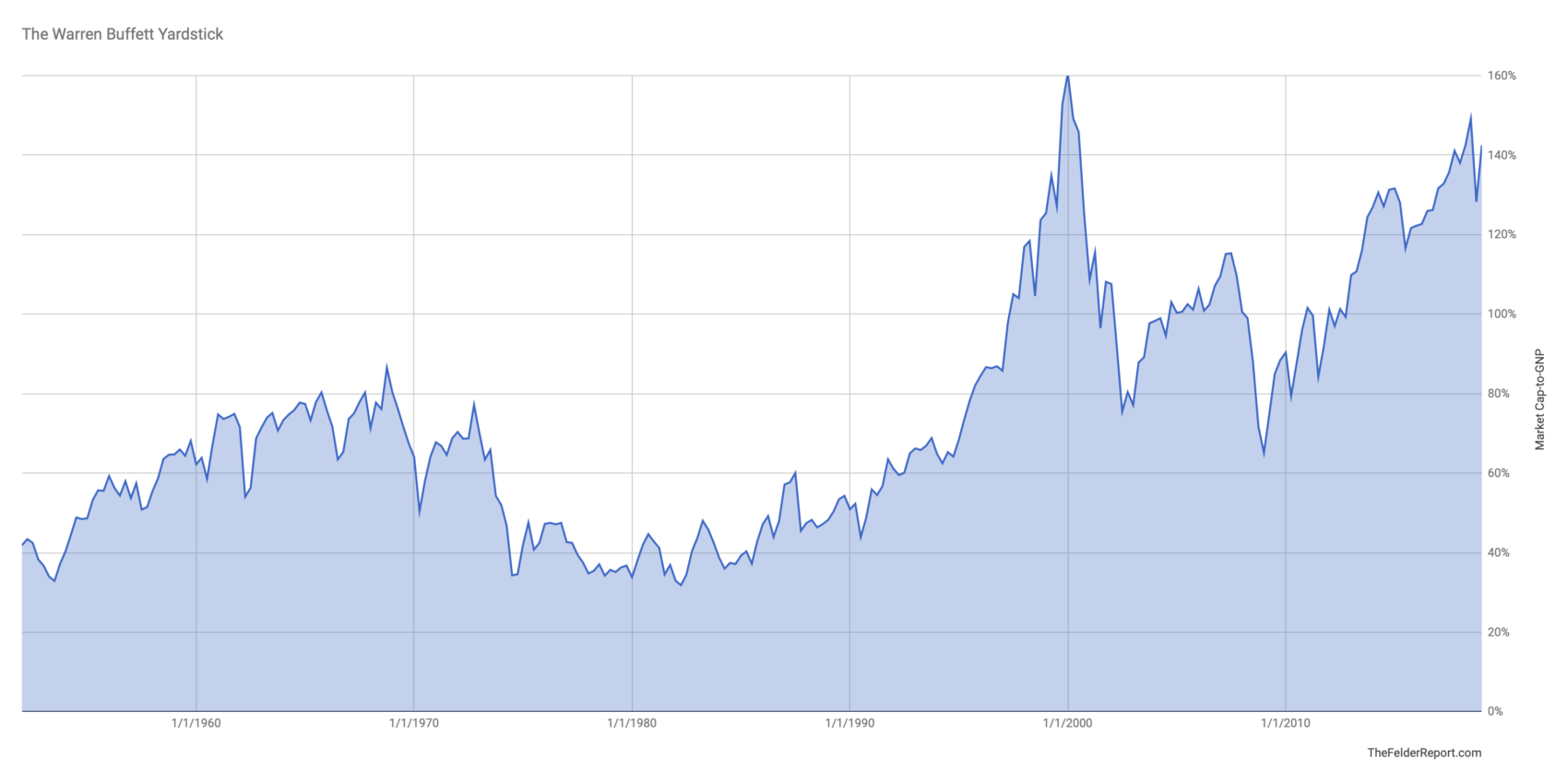

- Market Cap to GDP: This metric compares the total market capitalization of all publicly traded companies to a nation's gross domestic product (GDP). A high ratio suggests potentially overvalued markets.

- Sector Analysis: BofA often identifies specific sectors, such as technology or consumer discretionary, as potentially overvalued, while others, like energy or financials, might be viewed as relatively undervalued depending on the specific report. (Again, specific sectors should be named here, if available from BofA reports).

- Market Predictions: BofA's predictions for future market performance are usually presented as a range of possibilities, considering various economic scenarios. They typically emphasize the importance of monitoring key economic indicators and geopolitical events.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the currently elevated stock market valuations, according to BofA's research:

- Low Interest Rates: Low interest rates make borrowing cheaper for companies and incentivize investors to seek higher returns in the stock market. This increases demand for equities, thus driving up prices and valuations. The relationship between low interest rates and high stock valuations is a key driver of current market conditions.

- Quantitative Easing (QE): QE programs, involving central banks injecting liquidity into the market by purchasing assets, increase the money supply and can inflate asset prices, including stocks. This contributes to higher valuations across the board.

- Strong Corporate Earnings: Robust corporate earnings, or the expectation of strong future earnings, provide a strong foundation for high valuations. Companies demonstrating strong growth and profitability justify higher stock prices.

- Technological Advancements: Technological innovation fuels growth expectations in certain sectors, driving higher valuations for companies perceived to be at the forefront of these advancements. This is particularly true within the tech sector.

- Investor Sentiment: Positive investor sentiment, fueled by confidence in the economy or specific sectors, can push stock prices higher, even if fundamental valuations appear stretched. This psychological factor significantly impacts market pricing.

Potential Risks and Opportunities Associated with High Valuations

While high stock market valuations offer the potential for further gains, they also present significant risks:

- Market Correction or Crash: High valuations make the market more susceptible to corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic downturn could trigger a significant decline in prices.

- Opportunities for Selective Stock Picking: Within a high valuation market, opportunities exist to identify and invest in undervalued sectors or individual companies. Careful stock picking and due diligence can yield strong returns even in a generally expensive market.

- Diversification: Diversifying your portfolio across different asset classes and sectors is crucial to mitigate risk in a high valuation environment. This reduces exposure to any single sector or company experiencing a downturn.

- Continued Growth Potential: Despite high valuations, continued economic growth and strong corporate earnings can still support further market gains. This scenario necessitates a long-term perspective.

- Investment Strategies: Several strategies can help navigate a high valuation market. Value investing focuses on finding undervalued companies, while growth investing concentrates on companies with high growth potential. Careful consideration of your risk tolerance is key to strategy selection.

BofA's Recommendations for Investors

(This section should include specific recommendations from BofA reports if available, including asset allocation suggestions, sector selections, and risk management advice, presented as bullet points.) For example:

- Asset Allocation: Consider a balanced portfolio with exposure to both equities and fixed-income assets.

- Sector Selection: Focus on sectors with strong fundamentals and growth potential, even if valuations are somewhat elevated.

- Risk Management: Employ strategies to manage risk, such as stop-loss orders and diversification.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's analysis provides valuable context, highlighting both the contributing factors and potential risks. While elevated valuations present challenges, they also offer opportunities for shrewd investors. By carefully considering BofA's insights and employing a diversified, risk-managed approach, you can better navigate the complexities of this market. Continue your research into high stock market valuations and consult with a financial advisor to tailor a strategy that aligns with your individual risk tolerance and financial goals. Don't hesitate to further explore the implications of high stock market valuations and how they impact your investment strategy.

Featured Posts

-

Edmonton Oilers Los Angeles Kings Series Betting Odds And Expert Picks

May 10, 2025

Edmonton Oilers Los Angeles Kings Series Betting Odds And Expert Picks

May 10, 2025 -

Imf Review Of Pakistans 1 3 Billion Package Tensions With India And Latest News

May 10, 2025

Imf Review Of Pakistans 1 3 Billion Package Tensions With India And Latest News

May 10, 2025 -

Watch Pam Bondis Statements On Killing American Citizens Explained

May 10, 2025

Watch Pam Bondis Statements On Killing American Citizens Explained

May 10, 2025 -

Understanding High Stock Market Valuations Insights From Bof A

May 10, 2025

Understanding High Stock Market Valuations Insights From Bof A

May 10, 2025 -

Omada Health Ipo Details On The Andreessen Horowitz Investment

May 10, 2025

Omada Health Ipo Details On The Andreessen Horowitz Investment

May 10, 2025