Understanding The Factors Behind D-Wave Quantum (QBTS) Stock's Thursday Drop

Table of Contents

Main Points: Deconstructing the QBTS Stock Decline

2.1 Market Sentiment and Overall Tech Sector Performance

The performance of QBTS stock is intrinsically linked to the overall health and sentiment of the technology sector and the broader market. Market volatility significantly impacts even established companies, and D-Wave Quantum is no exception. A negative market sentiment, often characterized by a tech sector downturn, can trigger a sell-off, affecting even fundamentally strong performers like QBTS. This is especially true given the inherent risk associated with investing in a relatively nascent technology like quantum computing.

- Negative sentiment in the broader tech sector dragging down even strong performers: A general bearish trend in the tech indices often leads to investors liquidating positions across the board, regardless of individual company performance.

- Potential investor flight from riskier assets, including quantum computing stocks: During periods of uncertainty, investors tend to move towards safer, more established assets, often selling off riskier investments like quantum computing stocks.

- Comparison to performance of other quantum computing companies: Analyzing the performance of other publicly traded quantum computing companies can provide context for QBTS's drop. Were they similarly affected, suggesting a sector-wide issue, or was QBTS uniquely impacted?

The correlation between QBTS stock price and major tech indices (like the NASDAQ Composite) should be examined to gauge the impact of broader market movements. Analyzing metrics like risk aversion indicators can further illuminate the role of market sentiment in the QBTS stock price drop.

2.2 News and Announcements (or Lack Thereof)

The absence of positive news or significant announcements regarding D-Wave Quantum can easily lead to sell-offs. Conversely, negative news – whether substantiated or merely rumor – can severely impact investor confidence and drive down the stock price. Social media sentiment analysis can also offer valuable insights into the narrative surrounding QBTS.

- Absence of positive news or updates could lead to sell-offs: Without positive catalysts, investors might interpret the lack of news as a negative sign, triggering profit-taking or even panic selling.

- Potential negative news (rumors, competitor announcements) influencing investor decisions: Negative press, competitor breakthroughs, or even unsubstantiated rumors can create uncertainty and prompt investors to sell their QBTS shares.

- Analysis of recent press releases and their market impact: A thorough review of recent D-Wave press releases is crucial to assess whether any announcements, or the lack thereof, might have contributed to the stock price decline.

A comprehensive analysis of QBTS news and social media sentiment can help determine the extent to which information flow impacted investor decisions.

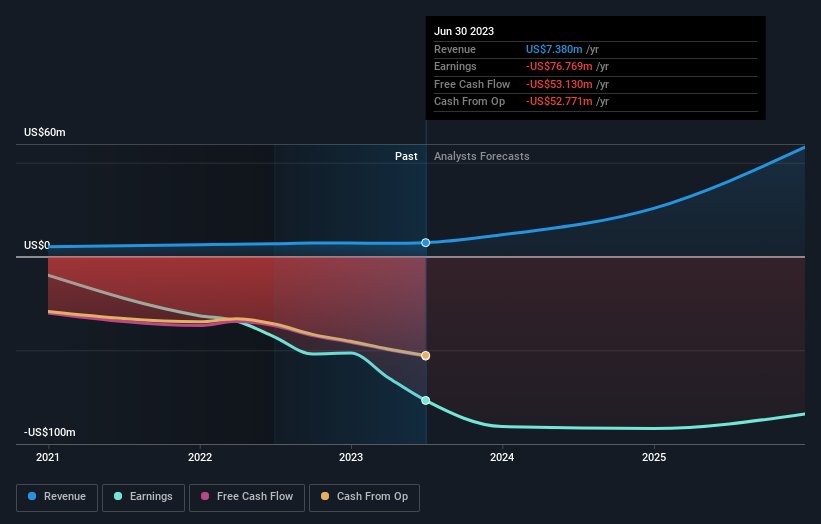

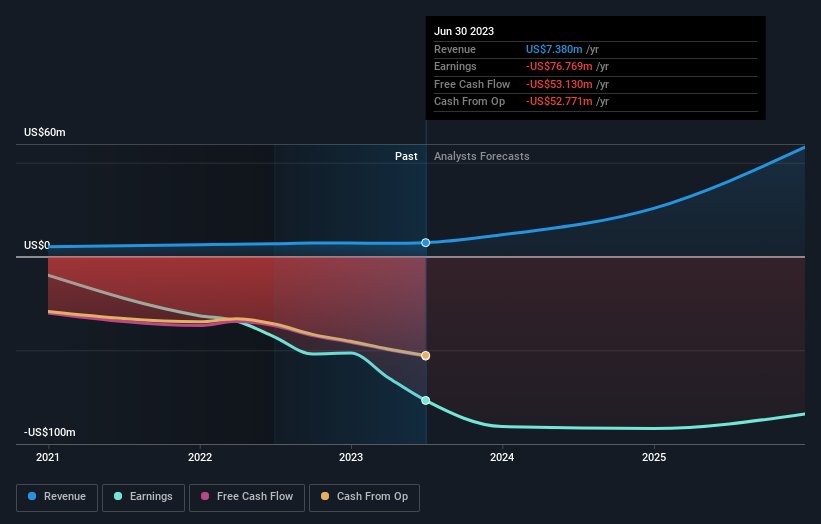

2.3 Financial Performance and Earnings Reports (if applicable)

If D-Wave Quantum recently released financial reports, or if an earnings announcement is imminent, these factors could significantly contribute to the stock price fluctuation. Investors closely scrutinize revenue growth, profit margins, and other key financial metrics. Disappointment relative to analyst expectations can trigger a sharp decline.

- Discussion of quarterly or annual earnings (if released recently): An analysis of the latest earnings report is vital to assess whether the financial results met or exceeded expectations.

- Analysis of revenue, profit margins, and other key financial metrics: Examining key performance indicators can reveal underlying issues contributing to the stock price drop.

- Comparison to analyst expectations and potential disappointment: Falling short of analyst projections can significantly dampen investor enthusiasm and lead to selling pressure.

Analyzing financial data alongside market sentiment provides a comprehensive understanding of the influence of financial performance on QBTS stock price.

2.4 Speculative Trading and Investor Behavior

Speculative trading and short-selling play a crucial role in driving short-term stock price volatility. Algorithmic and high-frequency trading can amplify market reactions, contributing to both sharp rises and falls. The level of short interest in QBTS shares can also indicate the potential for a short squeeze or covering of short positions, impacting price movements.

- Impact of algorithmic trading and high-frequency trading on QBTS stock: These automated trading strategies can exacerbate price fluctuations, making the market more susceptible to sudden changes.

- Analysis of short interest in QBTS shares: High short interest suggests a significant number of investors betting against the stock, potentially increasing the likelihood of downward pressure.

- Discussion of potential short squeezes or covering of short positions: A short squeeze, where short sellers rush to cover their positions, can cause a rapid price increase, though the opposite can also occur.

Understanding investor psychology and the dynamics of speculative trading is vital for comprehending the complex factors influencing QBTS stock price.

Conclusion: Understanding and Navigating Future QBTS Stock Fluctuations

The Thursday drop in D-Wave Quantum (QBTS) stock price resulted from a confluence of factors, including broader market sentiment affecting the tech sector, the absence of positive news, and potentially the impact of speculative trading. Analyzing macroeconomic factors, company-specific announcements, and investor behavior is crucial for understanding stock performance. Continued monitoring of QBTS stock and the quantum computing sector is essential for investors. Conduct thorough QBTS stock analysis, paying close attention to future developments in the quantum computing industry to make informed investment decisions regarding QBTS and other quantum computing stocks. Stay informed about QBTS news and financial reports to navigate future fluctuations effectively. Understanding the complexities of quantum computing investment is key to successfully navigating this evolving market.

Featured Posts

-

Nyt Mini Crossword Solution May 9

May 20, 2025

Nyt Mini Crossword Solution May 9

May 20, 2025 -

Savings Account Surprise Potential Hmrc Repayments

May 20, 2025

Savings Account Surprise Potential Hmrc Repayments

May 20, 2025 -

Todays Nyt Mini Crossword Answers For March 15

May 20, 2025

Todays Nyt Mini Crossword Answers For March 15

May 20, 2025 -

Le Bo Cafe De Biarritz Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025

Le Bo Cafe De Biarritz Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025 -

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Latest Posts

-

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025 -

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025