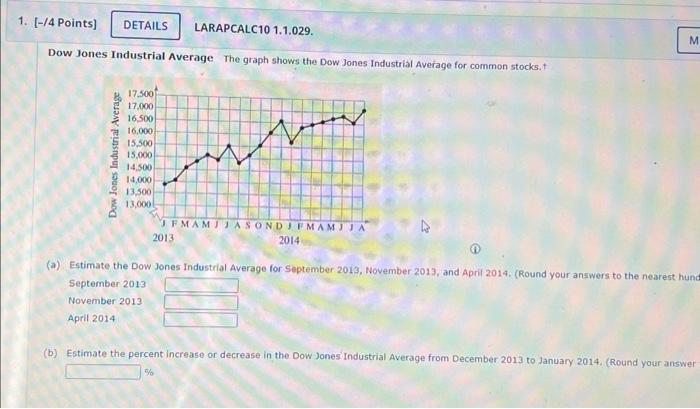

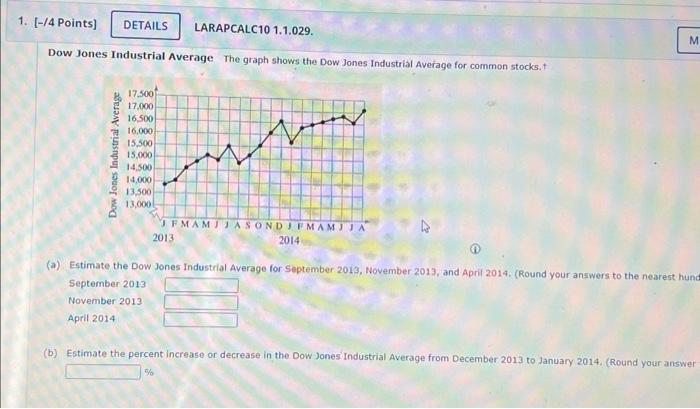

Understanding The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the theoretical price per share of an ETF. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the total value of the underlying assets—the 30 companies comprising the Dow Jones Industrial Average—minus any liabilities, all divided by the number of outstanding shares. This calculation provides a snapshot of the intrinsic value of the ETF at a specific point in time.

The crucial difference between NAV and market price lies in their representation. The market price reflects the price at which the ETF is currently trading on the exchange, influenced by supply and demand. The NAV, however, represents the actual value of the underlying assets. While they often correlate closely, discrepancies can occur due to market forces.

- NAV represents the theoretical value of an ETF's underlying assets. It aims to reflect the true worth of the investment based on its holdings.

- It's calculated daily by summing the value of the holdings, deducting liabilities, and dividing by the number of outstanding shares. This is a standardized process for all ETFs, ensuring transparency.

- NAV fluctuates based on changes in the value of the underlying assets. If the Dow Jones Industrial Average rises, so too will the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (generally speaking).

How to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accessing the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information:

- Amundi's official website: The fund manager, Amundi, will typically publish the daily NAV on their investor relations section.

- Major financial news websites (e.g., Bloomberg, Yahoo Finance): Reputable financial news sources usually display ETF NAV information alongside market price data. Search for the ETF ticker symbol.

- Your brokerage account's platform: Most brokerage platforms provide real-time or near real-time pricing data for your investments, including the NAV.

The NAV is typically updated at the end of each trading day, reflecting the closing prices of the underlying assets. This allows investors to assess the daily performance of their investment.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors significantly influence the Amundi Dow Jones Industrial Average UCITS ETF NAV:

- Performance of the Dow Jones Industrial Average constituent companies: The primary driver of the NAV is the collective performance of the 30 companies within the Dow Jones Industrial Average. Strong performance by these companies leads to a higher NAV, and vice-versa.

- Currency fluctuations (if applicable): If the ETF holds assets denominated in currencies other than your base currency, exchange rate fluctuations can impact the NAV.

- Dividend payments from underlying companies: Dividend distributions from the underlying companies will generally cause a slight decrease in the NAV, reflecting the distribution of assets.

- Changes in the composition of the Dow Jones Industrial Average: The Dow Jones Industrial Average undergoes periodic reconstitution. Changes in the constituent companies will affect the ETF's holdings and therefore its NAV.

Impact of Market Volatility on NAV

Market volatility directly impacts the Amundi Dow Jones Industrial Average UCITS ETF NAV. During market downturns, the NAV will typically decline as the values of the underlying assets decrease. Conversely, market upturns usually lead to increases in the NAV. Understanding this correlation is critical. While short-term fluctuations can be unsettling, investors should focus on a long-term investment strategy, acknowledging the inherent volatility of the market. This ETF tracks a major market index, so volatility should be expected.

Using NAV to Evaluate Investment Performance

The NAV is a vital tool for tracking your investment's performance. By comparing the current NAV to your initial purchase price, you can calculate your profit or loss. This is a simple yet effective method to gauge the success of your investment. Furthermore, comparing the ETF's NAV performance to the Dow Jones Industrial Average itself will help you assess how well the ETF is tracking its benchmark index. This comparison reveals the ETF's tracking efficiency.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for making informed investment decisions. Regularly monitoring your ETF's NAV, alongside understanding the factors that influence it, empowers you to effectively manage your investment. Remember to utilize the reliable sources mentioned above to stay updated on your ETF's performance. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV and consult with a financial advisor if you have any questions. Learn more about effectively using NAV to manage your Amundi Dow Jones Industrial Average UCITS ETF investments.

Featured Posts

-

Maryland Softball Rallies From Deficit Edges Delaware 5 4

May 24, 2025

Maryland Softball Rallies From Deficit Edges Delaware 5 4

May 24, 2025 -

Escape To The Country Budget Friendly Options And Ideas

May 24, 2025

Escape To The Country Budget Friendly Options And Ideas

May 24, 2025 -

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Nav Calculation And Analysis

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Nav Calculation And Analysis

May 24, 2025

Latest Posts

-

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025 -

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025 -

Portrait Des Acteurs Du Brest Urban Trail De L Artiste Au Partenaire

May 24, 2025

Portrait Des Acteurs Du Brest Urban Trail De L Artiste Au Partenaire

May 24, 2025