Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the per-share value of an ETF's assets minus its liabilities. In simpler terms, it's the total value of everything the ETF owns, less any debts it owes, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, this means calculating the total value of its holdings in the 30 companies that make up the Dow Jones Industrial Average, subtracting any expenses or liabilities, and then dividing by the number of ETF shares. This calculation provides a snapshot of the ETF's intrinsic value.

The importance of understanding NAV cannot be overstated:

- NAV reflects the true value of the ETF's holdings: Unlike the market price, which can fluctuate throughout the trading day based on supply and demand, the NAV provides a more accurate representation of the underlying assets' worth.

- Daily NAV calculations provide transparency to investors: Regular NAV calculations offer investors a clear picture of their investment's performance based on the actual value of the underlying assets.

- Understanding NAV helps in making informed investment decisions: By comparing the NAV to the market price, investors can identify potential discrepancies that might indicate undervalued or overvalued opportunities.

- Discrepancies between NAV and market price can indicate arbitrage opportunities (for advanced investors): Significant differences between the NAV and market price can sometimes present short-term trading opportunities for sophisticated investors.

How to Track the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Tracking the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is relatively straightforward, thanks to several readily available resources. You can typically find this information updated daily:

- Check the Amundi website for official NAV data: The fund manager, Amundi, usually publishes the daily NAV on their official website. This is the most reliable source for accurate information.

- Use financial data providers like Bloomberg, Refinitiv, or Yahoo Finance: These reputable financial data providers usually include NAV data for major ETFs, allowing for easy tracking and comparison with market prices.

- Many brokerage platforms will display the NAV alongside the market price: If you hold the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, the platform likely displays the NAV alongside the real-time market price.

- Understand the potential lag between the market price and the published NAV: Keep in mind that there might be a slight delay between the closing market price and the official publication of the end-of-day NAV.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the daily NAV calculation of the Amundi Dow Jones Industrial Average UCITS ETF:

- The performance of the Dow Jones Industrial Average is the primary driver of NAV: Since the ETF tracks the Dow Jones Industrial Average, the performance of this index is the most significant factor affecting the ETF's NAV. A rising index generally leads to a higher NAV, and vice versa.

- Currency exchange rates can impact the NAV if the ETF holds assets in multiple currencies: While this ETF primarily tracks a US-dollar denominated index, any underlying currency exposure could influence the NAV.

- Expense ratios reduce the NAV over time: The ETF's expense ratio, which covers management and administrative fees, gradually reduces the NAV over time.

- Dividend distributions typically affect the NAV on the ex-dividend date: When the companies within the Dow Jones Industrial Average pay dividends, the ETF's NAV will usually reflect this distribution on the ex-dividend date.

Interpreting NAV Data for Investment Decisions

Using NAV data effectively involves considering both short-term fluctuations and the long-term performance trend.

- Consistent monitoring of NAV helps in assessing long-term investment performance: Regularly reviewing the NAV allows investors to track the overall growth or decline of their investment over time.

- Compare NAV to market price to identify potential undervaluation or overvaluation: While short-term deviations are common, persistent discrepancies between NAV and market price might indicate investment opportunities.

- Consider NAV in conjunction with other relevant factors before making investment decisions: Don't base investment decisions solely on NAV. Consider broader market trends, your risk tolerance, and your overall investment strategy.

- Don't solely rely on short-term NAV fluctuations for investment decisions: Focus on the long-term trend and avoid making impulsive decisions based on daily NAV changes.

Conclusion

Understanding and tracking the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decisions. By actively monitoring the NAV and considering its relationship to the market price, alongside other market factors, investors can gain a clearer picture of their investment's performance and make more strategic choices. Remember to regularly check the official Amundi website and utilize reputable financial data sources for the most accurate NAV data. Actively track the Net Asset Value (NAV) of your Amundi Dow Jones Industrial Average UCITS ETF investments to make better investment choices. Further research into ETF investing and the specifics of the Amundi Dow Jones Industrial Average UCITS ETF will further enhance your understanding and investment strategies.

Featured Posts

-

Frankfurt Stock Exchange Dax Remains Unchanged Following Recent Gains

May 24, 2025

Frankfurt Stock Exchange Dax Remains Unchanged Following Recent Gains

May 24, 2025 -

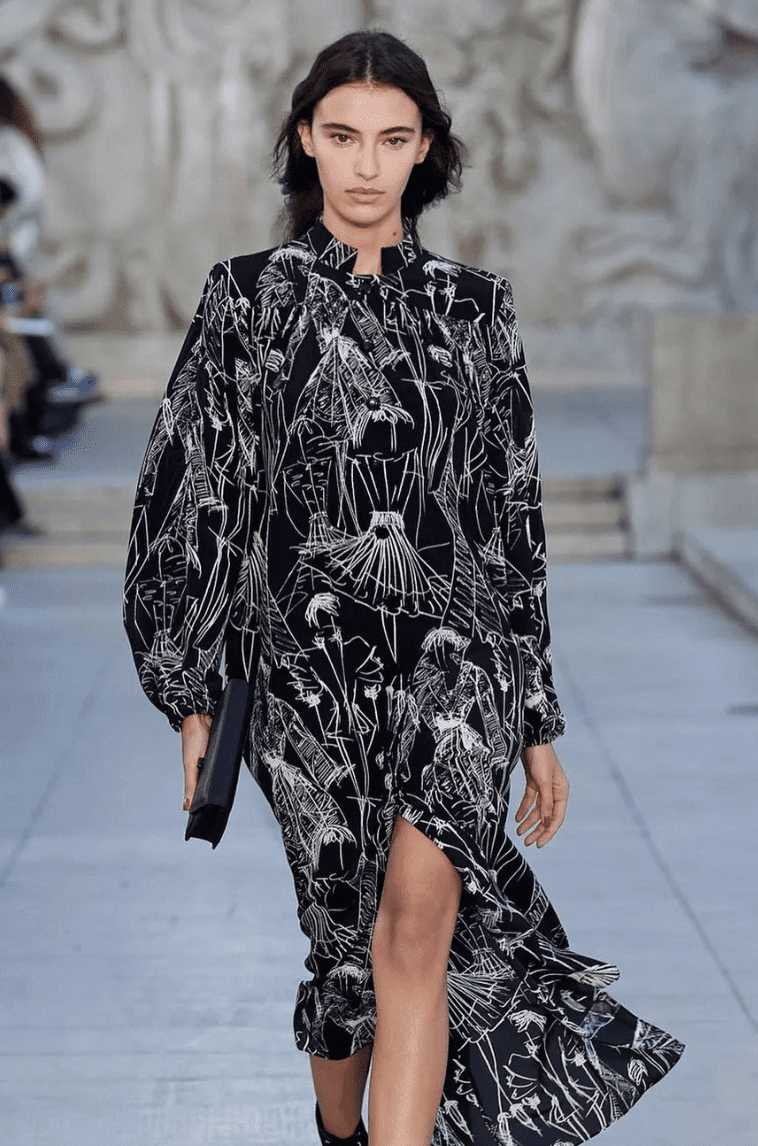

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025 -

New York Times Connections Hints And Answers For Puzzle 646 March 18 2025

May 24, 2025

New York Times Connections Hints And Answers For Puzzle 646 March 18 2025

May 24, 2025 -

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025 -

Classifica Forbes 2025 I 10 Uomini Piu Ricchi Del Mondo

May 24, 2025

Classifica Forbes 2025 I 10 Uomini Piu Ricchi Del Mondo

May 24, 2025

Latest Posts

-

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025 -

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025 -

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025

Best Of Bangladesh In Europe Strengthening Partnerships For Future Success 2nd Edition

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 24, 2025