Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Increased Liquidity Needs Driving the Secondary Market

A primary driver of the Venture Capital Secondary Market's expansion is the increasing demand for liquidity among early-stage investors. Limited partners (LPs), angel investors, and venture capital (VC) firms often require early exits from their investments for various reasons. This need isn't always driven by distress; it's frequently a strategic move to optimize portfolios and capitalize on new opportunities.

The reasons behind this liquidity need are multifaceted:

- Portfolio Diversification: Investors may seek to diversify their holdings, reducing their concentration in a single asset or sector. A secondary sale allows them to rebalance their portfolio and reduce risk.

- Capital for New Investments: The proceeds from a secondary sale can provide capital for new, promising ventures, allowing investors to maintain a consistent investment pace.

- Personal Financial Needs: Investors may have personal circumstances requiring immediate liquidity, such as retirement planning or unforeseen expenses. The secondary market offers a mechanism to access capital without liquidating other assets.

- Strategic Rebalancing: VC firms may need to sell stakes in some portfolio companies to free up capital for investments in more promising companies or to address underperforming assets.

Examples of Beneficial Secondary Sales:

- An angel investor who needs funds for a new business venture.

- A VC firm looking to rebalance its portfolio after a period of over-investment in a specific sector.

- Founders utilizing secondary sales to unlock equity for company expansion or acquisitions.

The Role of Technology and Platforms in Facilitating Secondary Transactions

The rise of the Venture Capital Secondary Market is inextricably linked to technological advancements. Online platforms and sophisticated technology are revolutionizing how secondary transactions are conducted, improving efficiency, transparency, and accessibility. These platforms streamline the often-complex process of finding buyers and sellers, negotiating terms, and executing deals.

- Rise of online marketplaces for private equity and venture capital assets: These platforms aggregate listings, providing increased visibility and attracting a broader pool of potential buyers. Examples include platforms specializing in secondary transactions.

- Use of data analytics to improve pricing and valuation: Advanced analytics help determine fair market values, reducing uncertainty and improving the efficiency of the negotiation process.

- Increased speed and efficiency in deal execution: Automated processes and streamlined workflows significantly reduce the time required to complete a transaction, minimizing delays and costs.

Impact of Macroeconomic Factors on the Venture Capital Secondary Market

Macroeconomic conditions exert a significant influence on the Venture Capital Secondary Market. Interest rate changes, inflation levels, and overall economic uncertainty directly impact investor behavior and transaction volume.

- Interest rate hikes and their impact on valuations: Higher interest rates typically lead to lower valuations, making secondary sales less attractive for sellers.

- Inflation and its effect on investor risk appetite: High inflation increases uncertainty and can reduce investor risk tolerance, potentially dampening activity in the secondary market.

- Economic downturns and their influence on liquidity needs: During economic downturns, the need for liquidity may increase, driving up transaction volume in the secondary market. Conversely, during periods of economic growth, less pressure to sell may exist.

Emerging Trends and Future Outlook for the Venture Capital Secondary Market

The Venture Capital Secondary Market is a dynamic sector poised for continued growth. Several emerging trends suggest a bright future, albeit with potential challenges.

- Growth of secondary market funds: Specialized funds dedicated to investing in secondary transactions are emerging, providing increased capital and expertise to this market.

- Increased institutional participation: Larger institutional investors are increasingly participating in the secondary market, further fueling its growth.

- Development of new pricing models and valuation techniques: Innovative methods for valuing private company equity are improving accuracy and efficiency.

Conclusion: Navigating the Dynamic Venture Capital Secondary Market

The Venture Capital Secondary Market is evolving rapidly, driven by increased liquidity needs, technological advancements, and macroeconomic factors. Understanding this dynamic market is crucial for both investors and entrepreneurs. The opportunities for increased liquidity and strategic portfolio management are substantial. However, navigating this market requires awareness of macroeconomic influences and the evolving regulatory landscape. To learn more about optimizing your investment strategies within this exciting sector, explore resources dedicated to private equity and venture capital secondary market transactions. This will equip you with the knowledge to effectively participate in this increasingly important aspect of the investment world.

Featured Posts

-

Full Pardon For Rose Trumps Decision And Its Impact

Apr 29, 2025

Full Pardon For Rose Trumps Decision And Its Impact

Apr 29, 2025 -

Klagenfurts Abstiegskampf Investor Will Trainer Nach Jancker Aera Austauschen

Apr 29, 2025

Klagenfurts Abstiegskampf Investor Will Trainer Nach Jancker Aera Austauschen

Apr 29, 2025 -

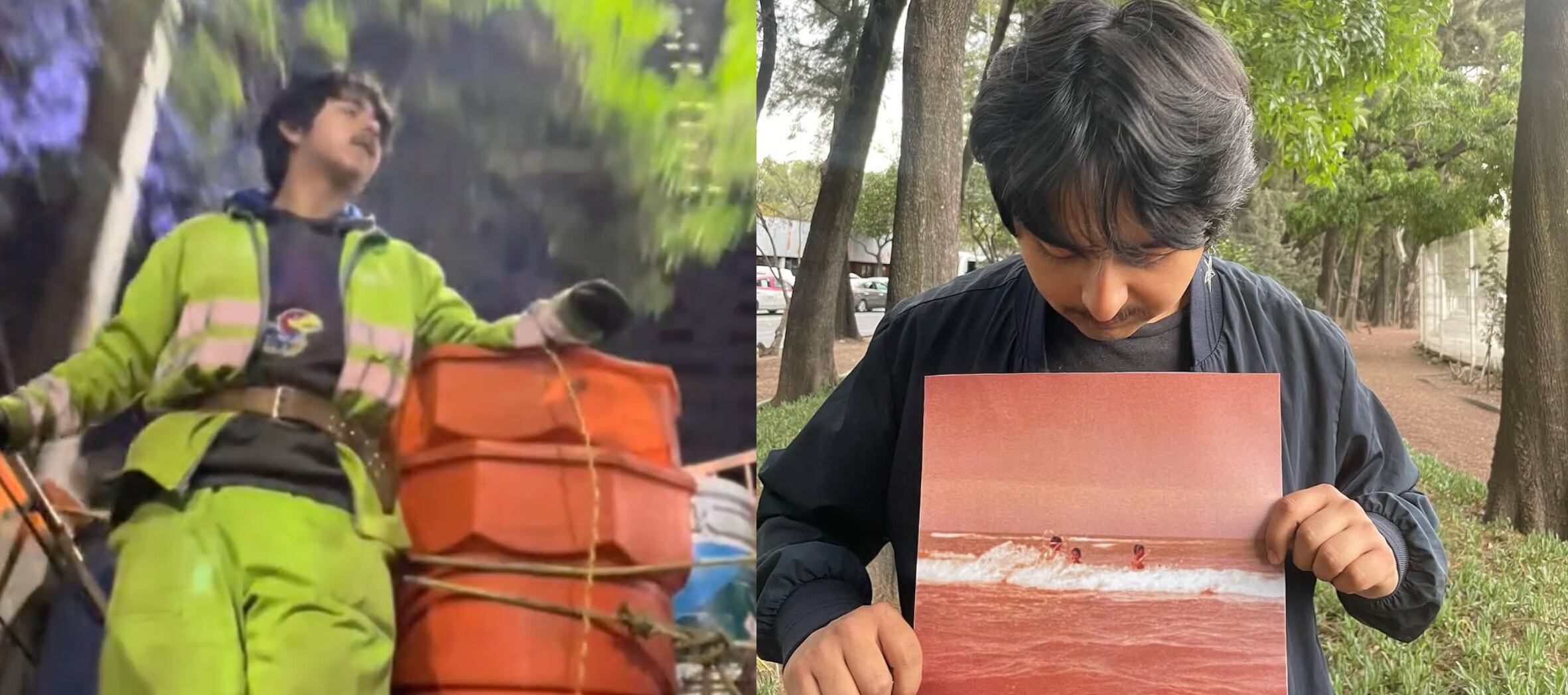

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025 -

The China Market Conundrum Bmw Porsche And The Future Of Luxury Auto Sales

Apr 29, 2025

The China Market Conundrum Bmw Porsche And The Future Of Luxury Auto Sales

Apr 29, 2025 -

Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 29, 2025

Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 29, 2025

Latest Posts

-

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere

May 12, 2025

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere

May 12, 2025 -

Eric Antoine Et Sa Compagne Apparition Remarquee A La Premiere Parisienne

May 12, 2025

Eric Antoine Et Sa Compagne Apparition Remarquee A La Premiere Parisienne

May 12, 2025 -

Eric Antoine Vie Privee Divorce Et Nouvelle Relation Avec Une Presentatrice M6

May 12, 2025

Eric Antoine Vie Privee Divorce Et Nouvelle Relation Avec Une Presentatrice M6

May 12, 2025 -

The Next Papal Election Key Cardinals To Watch

May 12, 2025

The Next Papal Election Key Cardinals To Watch

May 12, 2025 -

Nine Cardinals In The Running To Become The Next Pope

May 12, 2025

Nine Cardinals In The Running To Become The Next Pope

May 12, 2025