Voyager Technologies' Space Defense IPO: What To Expect

Table of Contents

Voyager Technologies' Competitive Advantage in the Space Defense Market

Voyager Technologies' success in the competitive space defense market hinges on several key factors. Their competitive edge stems from a combination of technological innovation, strategic government partnerships, and strong market positioning.

Technological Innovation

Voyager Technologies boasts a portfolio of cutting-edge technologies that set them apart from competitors. This technological leadership is a crucial element of their success in securing contracts and establishing themselves as a key player in the space defense sector.

- Advanced Satellite Tracking: Voyager's proprietary algorithms provide unparalleled accuracy and speed in tracking satellites, enabling proactive threat assessment.

- AI-Powered Threat Detection: Their AI systems analyze vast amounts of data to identify potential threats with minimal human intervention, significantly improving response times.

- Innovative Defense Systems: Voyager is developing and deploying next-generation defense systems designed to counter emerging threats in space. This includes advanced countermeasures and defensive technologies.

These advancements are protected by several patents, further solidifying their intellectual property and competitive advantage. Furthermore, Voyager actively collaborates with leading universities and research institutions, ensuring they remain at the forefront of technological innovation in space defense. Their commitment to R&D has been recognized with several industry awards, highlighting their technological superiority.

Government Contracts and Partnerships

Voyager Technologies' strong relationships with government agencies are a cornerstone of their business model. These strategic partnerships provide crucial revenue streams and long-term stability.

- NASA Collaboration: Voyager has secured several contracts with NASA, contributing to critical space exploration and defense initiatives.

- Department of Defense Contracts: Significant contracts with the Department of Defense solidify their position as a trusted provider of space defense solutions.

These partnerships not only guarantee a steady flow of revenue but also provide Voyager with access to valuable resources and expertise, enhancing their ability to develop and deploy advanced technologies. The long-term nature of these government contracts offers investors increased confidence in the company's future growth trajectory.

Market Position and Growth Potential

Voyager Technologies is strategically positioned within a rapidly expanding space defense market. Industry analysts project significant growth in the coming years, presenting a substantial opportunity for Voyager.

- Market Share Growth: Voyager's market share is expected to increase significantly due to their technological advancements and strong government partnerships.

- Market Size Expansion: The overall space defense market is anticipated to expand exponentially as nations invest heavily in space-based capabilities.

- Competitive Advantage: Voyager's superior technology and strategic partnerships give it a significant advantage over its competitors.

Compared to its competitors, Voyager's growth trajectory appears particularly robust, driven by both organic growth and strategic acquisitions. The company is well-placed to capitalize on the increasing demand for advanced space defense systems.

Analyzing the Voyager Technologies' IPO Prospectus

The Voyager Technologies' IPO prospectus contains crucial information that potential investors must carefully analyze. This includes key financial metrics, potential risks, and the valuation and pricing of the IPO.

Understanding Key Financial Metrics

The prospectus will detail Voyager's financial performance, including revenue, profit margins, and debt levels. Understanding these metrics is crucial for assessing the company's financial health and growth potential.

- Revenue Growth: Investors should analyze historical revenue growth and projected future revenue to assess the company's growth trajectory.

- Profit Margins: Examining profit margins helps determine the company's profitability and efficiency.

- Debt Levels: Assessing the company's debt levels is essential to understanding its financial risk profile.

It's important to compare these metrics to industry averages to gain a comprehensive understanding of Voyager's financial performance relative to its competitors.

Identifying Potential Risks and Challenges

While Voyager Technologies presents a compelling investment opportunity, potential investors should carefully consider the associated risks.

- Competition: Increased competition from established players and new entrants could impact Voyager's market share.

- Regulatory Hurdles: Navigating complex regulatory environments can pose challenges and delays.

- Technological Challenges: The rapid pace of technological advancements requires continuous investment in R&D to maintain a competitive edge.

- Market Volatility: The overall stock market's volatility can influence the performance of newly listed companies.

Voyager’s prospectus will outline its strategies for mitigating these risks. Investors should carefully evaluate these strategies to assess the company's preparedness to overcome potential challenges.

Valuation and Pricing of the IPO

The IPO valuation will be a key consideration for investors. Understanding the valuation methodology and pricing strategy is crucial to determining whether the IPO is attractively priced.

- Valuation Methodology: The prospectus will explain the methods used to determine the company's valuation.

- Pricing Strategy: The pricing strategy should be analyzed to assess its fairness to investors.

- Comparable Companies: Comparing Voyager's valuation to similar companies in the space defense sector will help gauge its relative attractiveness.

Investment Strategies for the Voyager Technologies' Space Defense IPO

Investing in the Voyager Technologies' Space Defense IPO requires a well-defined strategy that aligns with your risk tolerance and investment goals.

Allocating Investment Capital

Determining how much capital to allocate to this IPO is crucial.

- Risk Tolerance: Investors with a higher risk tolerance may allocate a larger percentage of their portfolio to the IPO.

- Investment Goals: The investment should align with your long-term financial objectives.

- Diversification: Diversifying your investment portfolio is essential to mitigate risk.

A long-term investment perspective is highly recommended for this type of investment.

Monitoring Post-IPO Performance

After the IPO, continuous monitoring of Voyager's performance is essential.

- Stock Price: Tracking the stock price provides insights into market sentiment and investor confidence.

- Revenue Growth: Monitoring revenue growth helps assess the company's ability to deliver on its projections.

- Market Share: Tracking market share indicates Voyager's competitive strength.

Regularly review the company’s financial statements and news to make informed decisions about holding or selling your investment.

Conclusion

The Voyager Technologies' Space Defense IPO presents a significant opportunity for investors interested in the rapidly growing space defense market. By carefully analyzing the company’s competitive advantage, understanding the IPO prospectus, and developing a sound investment strategy, you can make informed decisions about participating in this exciting venture. Remember to conduct your own thorough research and consult with a financial advisor before investing in the Voyager Technologies' Space Defense IPO or any other IPO. Don't miss out on this chance to be part of the future of space defense; research the Voyager Technologies' Space Defense IPO today!

Featured Posts

-

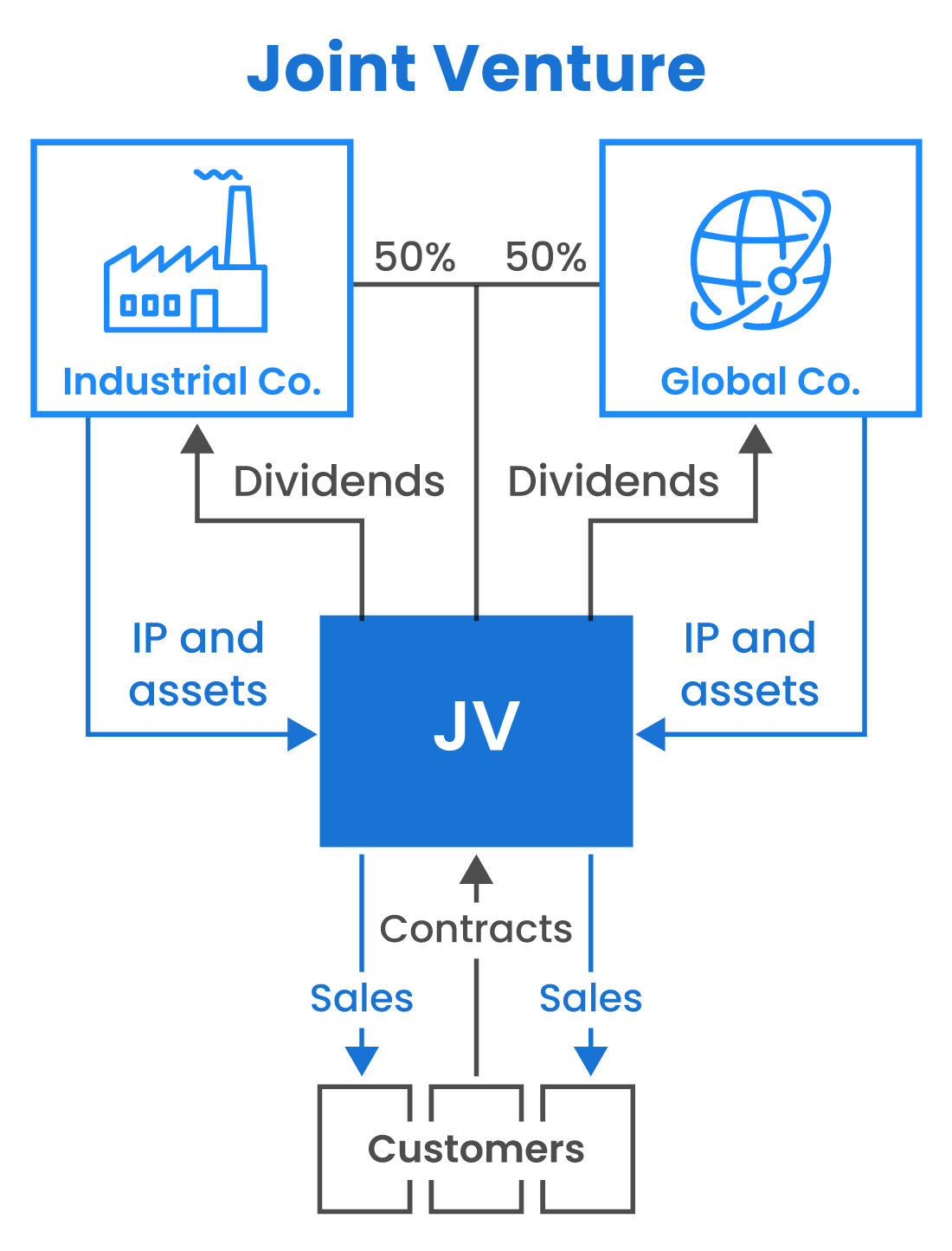

Destino Ranchs Next Gen Omnichannel Media Infrastructure A Joint Venture By Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025

Destino Ranchs Next Gen Omnichannel Media Infrastructure A Joint Venture By Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025 -

Taylor Swift Eras Tour Wardrobe A Close Up Look At Her Stunning Outfits

May 18, 2025

Taylor Swift Eras Tour Wardrobe A Close Up Look At Her Stunning Outfits

May 18, 2025 -

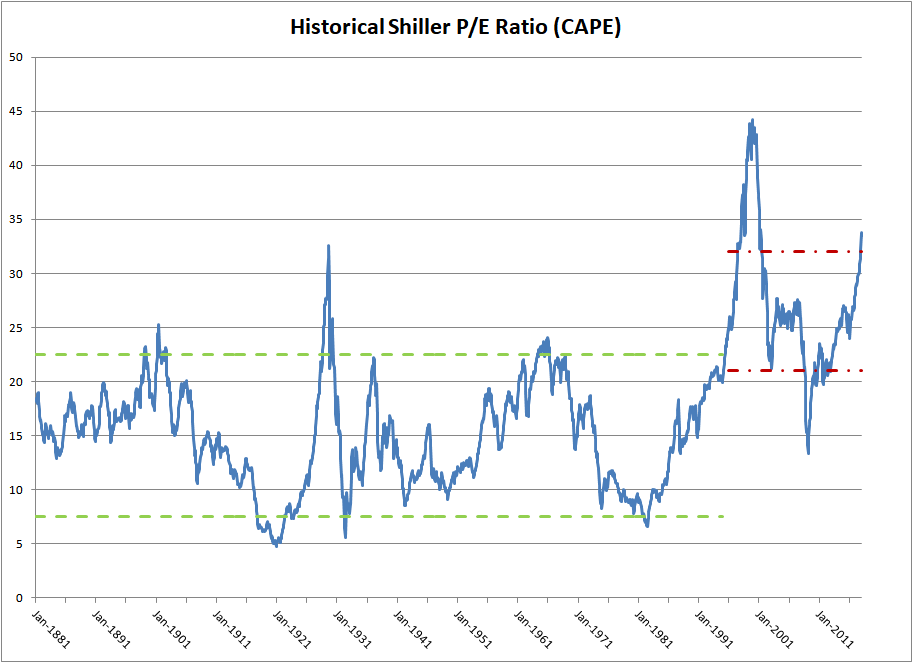

Ignoring High Stock Market Valuations Bof As Rationale

May 18, 2025

Ignoring High Stock Market Valuations Bof As Rationale

May 18, 2025 -

7 Bit Casino Vs The Best Canadian Online Casinos Of 2025

May 18, 2025

7 Bit Casino Vs The Best Canadian Online Casinos Of 2025

May 18, 2025 -

Inmate Escape Caught On Camera New Orleans Jail

May 18, 2025

Inmate Escape Caught On Camera New Orleans Jail

May 18, 2025