Weihong Liu's $650 Million Hudson's Bay Deal: A Deep Dive

Table of Contents

The retail world watched with bated breath as Weihong Liu, a prominent investor, orchestrated a significant shift in the landscape with his $650 million investment in Hudson's Bay Company (HBC). This substantial injection of capital represents a pivotal moment for both Liu and HBC, raising crucial questions about the future direction of the iconic Canadian retailer. This article delves into the intricacies of Weihong Liu's Hudson's Bay deal, examining its structure, implications, and potential long-term effects. We will explore the strategic motivations behind the investment, analyze its impact on HBC, and assess the market's response to this monumental transaction.

Weihong Liu, a seasoned investor with a history of high-profile deals, and Hudson's Bay Company, a retail giant with a rich history in Canada and beyond, present a compelling case study in strategic investment. Understanding the nuances of this $650 million deal is crucial to comprehending the future trajectory of both entities and the broader retail sector.

This article aims to provide a comprehensive analysis of Weihong Liu's Hudson's Bay deal, examining its structure, the motivations behind it, its impact on HBC, and the overall market reaction, offering insights into its potential long-term consequences.

The Deal's Structure and Key Terms

Investment Amount and Ownership Stake

Weihong Liu's investment in HBC totaled $650 million, representing a significant equity investment. The exact percentage of ownership stake acquired remains undisclosed, though reports suggest a substantial minority position. This strategic investment demonstrates a strong vote of confidence in HBC’s potential for future growth and profitability. Keywords like "equity investment," "strategic investment," and "ownership stake" are crucial in understanding the deal's nature. The investment is considered a crucial step towards financial restructuring for HBC and solidifies Liu's presence in the North American retail sector.

Transaction Details and Closing Date

The transaction involved a complex series of agreements, including the acquisition of equity shares, the terms of which are largely confidential. Regulatory approvals from relevant authorities were necessary for deal closing. The exact closing date is public information and can be referenced from financial news reports. Keywords such as "transaction completion," "regulatory approvals," and "deal closing" are vital when discussing the procedural aspects of the deal. The success of the transaction hinged on multiple factors including due diligence, legal compliance, and the overall market conditions.

- Specific details about the payment structure: While the precise structure is not fully public, it likely involved a combination of upfront payment and potentially contingent payments linked to HBC's future performance.

- Contingent payments or performance-based incentives: These mechanisms would incentivize Liu to actively participate in the company's strategic planning and management for long-term growth.

- Stipulations or clauses within the agreement: Standard clauses related to confidentiality, non-compete agreements, and other legal protections would be part of such a substantial transaction.

Weihong Liu's Investment Strategy and Motivation

Liu's Business Background and Portfolio

Weihong Liu's extensive experience in real estate and investments makes him a formidable player in the global financial market. His investment portfolio spans various sectors, though his successes in real estate and retail demonstrate a clear interest in tangible assets with long-term value appreciation. Understanding his past investments and acquisitions provides valuable context for interpreting his motives behind the HBC deal. Keywords such as "investment portfolio," "real estate tycoon," and "retail investment" aptly describe his business profile.

Potential Benefits for Liu

The potential return on investment (ROI) for Liu is likely a primary driver. Apart from potential financial gains, the strategic advantage of acquiring a significant stake in a major retail chain like HBC offers substantial long-term benefits. Access to prime real estate assets owned by HBC and the potential for synergistic opportunities with Liu's existing businesses are further motivating factors. Keywords like "ROI," "strategic advantage," and "long-term investment strategy" highlight the multifaceted benefits.

- Interest in HBC's real estate assets: HBC owns significant prime real estate holdings in key North American cities; these could be valuable assets for Liu's portfolio.

- Synergies with existing business interests: The acquisition could create synergies with other retail ventures or provide opportunities for expanding into new markets.

- Vision for HBC's future direction: Liu's involvement could bring a fresh perspective, influencing HBC's strategic direction and driving innovation within the company.

Impact on Hudson's Bay Company

Financial Implications for HBC

The $650 million investment provides HBC with a much-needed infusion of capital, improving its liquidity position and reducing its debt burden. This financial restructuring is crucial for stabilizing the company and paving the way for future growth initiatives. Keywords such as "financial restructuring," "debt reduction," and "liquidity improvement" highlight the immediate benefits. The enhanced financial health allows HBC to pursue strategic investments, modernize operations, and navigate challenging market conditions effectively.

Strategic Implications for HBC

This investment may profoundly impact HBC's strategic direction. Liu's involvement could lead to significant changes in HBC's business strategy, potentially focusing on operational improvements, expansion into new markets, or a refined approach to customer engagement. Keywords like "business strategy," "growth strategy," and "retail transformation" are critical in discussing the long-term implications.

- Changes in HBC's management or board structure: Liu's investment could potentially lead to changes in leadership to align with his vision.

- Impact on HBC's brand and customer base: The investment could influence branding strategies and customer outreach initiatives.

- Effect on HBC's competition in the retail market: The infusion of capital can enhance HBC's competitiveness by enabling upgrades to its infrastructure and technology.

Market Reaction and Future Outlook

Stock Market Response

The announcement of Weihong Liu's investment elicited a positive response from the stock market, with HBC's stock price experiencing a noticeable increase. Investor sentiment was largely optimistic, reflecting confidence in the deal's potential to revitalize HBC and improve its long-term prospects. Tracking the stock price fluctuations and analyzing investor sentiment provide valuable insights into the market's perception of the deal. Keywords such as "stock price," "market reaction," and "investor sentiment" are important for understanding the market's response.

Industry Analysis and Predictions

The Weihong Liu – HBC deal is not just an isolated event; it reflects broader trends in the retail industry. Industry analysts anticipate increased consolidation and strategic investments within the sector as companies adapt to evolving consumer behavior and technological advancements. Predicting the long-term impacts requires careful analysis of various factors including market trends and competitive pressures. Keywords such as "retail industry," "market trends," and "future outlook" are crucial for the analysis of the broader impact.

- Expert opinions and market analyses from financial publications: These analyses will provide valuable insights into potential future scenarios.

- Predictions on the future performance of HBC: Analysts will be closely monitoring HBC's performance to gauge the success of the investment.

- Potential future developments related to this investment: The deal may pave the way for other strategic alliances or acquisitions within the retail sector.

Conclusion:

Weihong Liu's $650 million investment in Hudson's Bay Company is a significant event with far-reaching implications for both companies and the broader retail landscape. The deal's structure, Liu's investment strategy, and its impact on HBC's financial and strategic direction are key takeaways. The positive market reaction suggests confidence in the deal's potential to revitalize HBC and enhance its long-term competitiveness. Staying informed about further developments related to Weihong Liu's Hudson's Bay deal and the strategic moves of both parties is crucial for understanding the future of the retail industry. Continue to follow reputable financial news sources for updates and in-depth analysis of this transformative investment.

Featured Posts

-

Bts 2025 Quand Auront Lieu Les Epreuves Et La Publication Des Resultats

May 30, 2025

Bts 2025 Quand Auront Lieu Les Epreuves Et La Publication Des Resultats

May 30, 2025 -

Situatsiya S Koryu V Mongolii Rost Zabolevaemosti I Nekhvatka Resursov

May 30, 2025

Situatsiya S Koryu V Mongolii Rost Zabolevaemosti I Nekhvatka Resursov

May 30, 2025 -

Anisimova Upsets Andreeva In Miami Open

May 30, 2025

Anisimova Upsets Andreeva In Miami Open

May 30, 2025 -

Ticketmaster Y Setlist Fm Tu Asesor Para Conciertos Inolvidables

May 30, 2025

Ticketmaster Y Setlist Fm Tu Asesor Para Conciertos Inolvidables

May 30, 2025 -

Sncf En Pagaille Le Ministre Et La Greve Imminente

May 30, 2025

Sncf En Pagaille Le Ministre Et La Greve Imminente

May 30, 2025

Latest Posts

-

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025 -

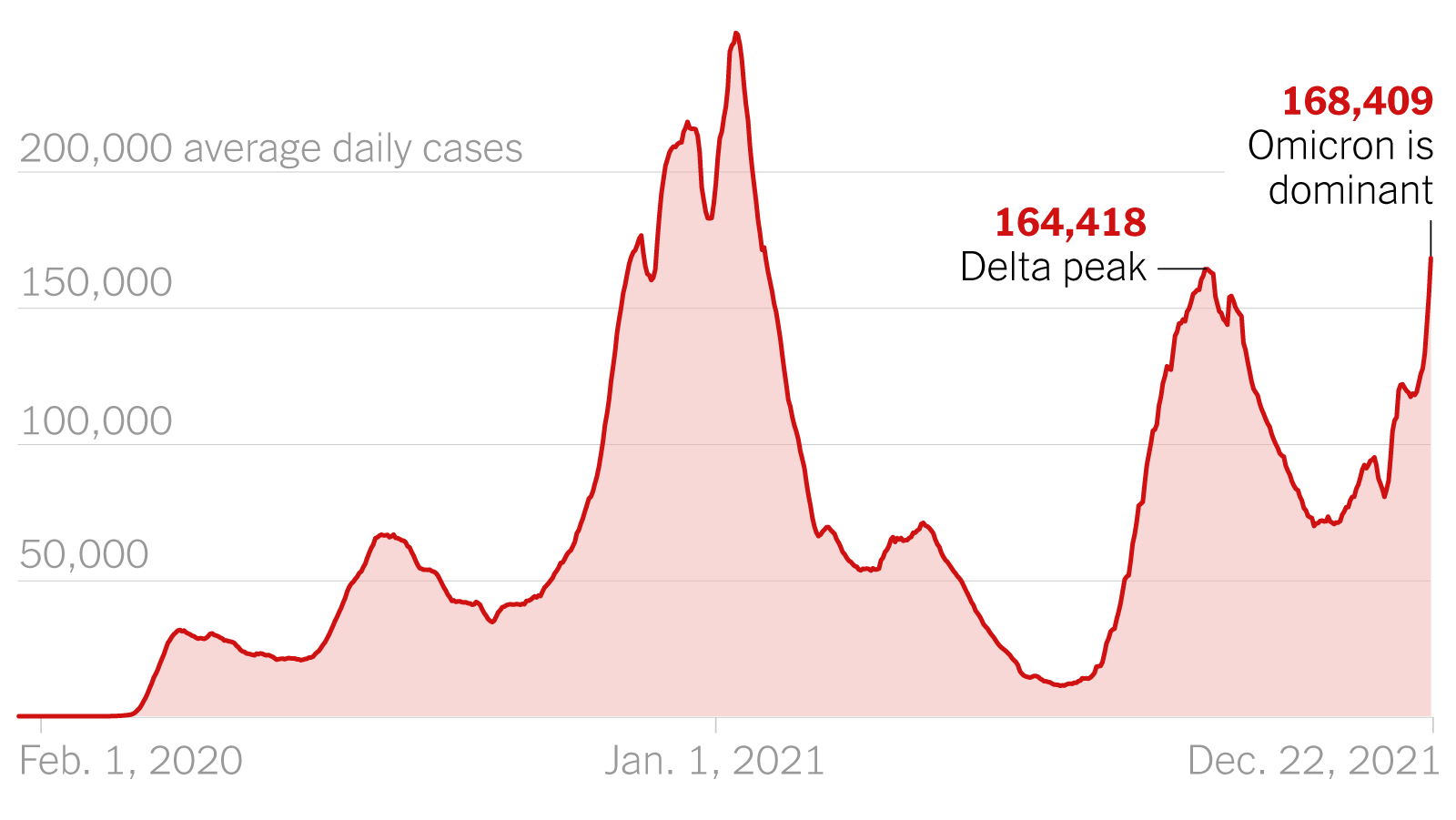

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025 -

A Look At Thompsons Losses In Monte Carlo

May 31, 2025

A Look At Thompsons Losses In Monte Carlo

May 31, 2025 -

Analysis The Link Between A New Covid 19 Variant And Increased Infections

May 31, 2025

Analysis The Link Between A New Covid 19 Variant And Increased Infections

May 31, 2025 -

Thompsons Monte Carlo Challenges A Comprehensive Review

May 31, 2025

Thompsons Monte Carlo Challenges A Comprehensive Review

May 31, 2025