When To Refinance Federal Student Loans And When Not To

Table of Contents

When Refinancing Federal Student Loans Makes Sense

Refinancing your federal student loans can be a smart move under certain conditions. Let's explore scenarios where refinancing could significantly benefit your financial situation.

Lower Interest Rates

One of the most compelling reasons to refinance is to secure a lower interest rate. Lower interest rates translate to substantial savings over the life of your loan. A seemingly small difference in interest rates can accumulate to thousands of dollars less paid over the loan's duration. It’s crucial to compare rates from multiple lenders to find the most favorable offer.

- Improved Credit Score: A higher credit score significantly improves your chances of obtaining a lower interest rate.

- Increased Income: Demonstrating a stable, higher income can make you a less risky borrower, leading to better interest rate offers.

- Stronger Financial History: A history of consistent on-time payments on other loans and credit accounts boosts your credibility and negotiating power.

Streamlining Multiple Loans

Juggling multiple federal student loans with varying interest rates and repayment plans can be a logistical nightmare. Refinancing allows you to consolidate these loans into a single, manageable loan. This simplifies your repayment process, reducing the stress of tracking multiple payments and deadlines.

- Simplified Repayment: One monthly payment streamlines budgeting and reduces the risk of missed payments.

- Single Loan Servicer: Dealing with a single lender simplifies communication and makes managing your loan much easier.

- Different Repayment Plans: If you have loans with various repayment schedules, refinancing can unify them under a single, consistent plan.

Switching to a Shorter Repayment Term

A shorter repayment term means you'll pay off your loan faster. While this results in higher monthly payments, it also significantly reduces the total interest you pay over the loan's lifetime.

- Faster Debt Payoff: A shorter repayment term accelerates your journey to becoming debt-free.

- Reduced Total Interest Paid: This is a major advantage, potentially saving you thousands of dollars.

- Budgetary Considerations: Carefully evaluate your budget to ensure you can comfortably afford the higher monthly payments associated with a shorter repayment term.

When Refinancing Federal Student Loans is NOT Advisable

While refinancing can be advantageous, it's crucial to understand the potential drawbacks. In some situations, refinancing your federal student loans could be detrimental to your financial well-being.

Loss of Federal Student Loan Benefits

Refinancing federal student loans into private loans means losing crucial federal protections. This can have significant consequences if your financial circumstances change unexpectedly.

- Public Service Loan Forgiveness (PSLF): Refinancing eliminates eligibility for PSLF, a program that forgives remaining balances after 10 years of qualifying public service.

- Income-Driven Repayment (IDR) Plans: These plans tie your monthly payments to your income, offering flexibility during financial hardship. Refinancing forfeits access to these plans.

- Deferment and Forbearance: These options temporarily suspend or reduce your payments during periods of financial difficulty. Private loans often lack these protective measures.

Higher Interest Rates

Before refinancing, meticulously compare interest rates offered by private lenders to your current federal loan rates. Refinancing could result in paying a higher interest rate, ultimately increasing the total cost of your loan.

- Poor Credit Score: A low credit score dramatically increases the likelihood of receiving a less favorable interest rate.

- Limited Income: Insufficient income can negatively impact your eligibility for competitive interest rates.

- Market Conditions: Fluctuations in the lending market can influence interest rates, potentially making refinancing less advantageous at certain times.

Uncertain Financial Future

Refinancing is a significant financial commitment. Avoid refinancing if you anticipate potential financial instability or uncertainty in the near future.

- Job Loss: Refinancing during periods of job insecurity could place an undue burden on your finances.

- Unexpected Expenses: Unforeseen medical bills or home repairs can significantly strain your budget if you've committed to higher monthly loan payments.

- General Economic Uncertainty: Times of economic downturn can make managing increased loan payments more challenging.

Making the Right Decision on Federal Student Loan Refinancing

Refinancing federal student loans presents both advantages and disadvantages. Carefully consider lower interest rates and streamlined payments, but weigh them against the potential loss of federal benefits and the risk of higher interest rates or financial instability. Consider your credit score, income, and future financial outlook. Compare interest rates from multiple lenders. Most importantly, carefully consider refinancing your federal student loans and make an informed decision about federal student loan refinancing. If you are unsure, seek professional financial advice to explore your options for federal student loan refinancing.

Featured Posts

-

The Changing Landscape Of College Funding A Survey Of Parental Attitudes And Loan Usage

May 17, 2025

The Changing Landscape Of College Funding A Survey Of Parental Attitudes And Loan Usage

May 17, 2025 -

How Josh Cavallo Is Changing Football With His Story

May 17, 2025

How Josh Cavallo Is Changing Football With His Story

May 17, 2025 -

Tam Krwz Ke Jwte Pr Mdah Ka Chrhna Swshl Mydya Pr Rdeml Ky Lhr

May 17, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Chrhna Swshl Mydya Pr Rdeml Ky Lhr

May 17, 2025 -

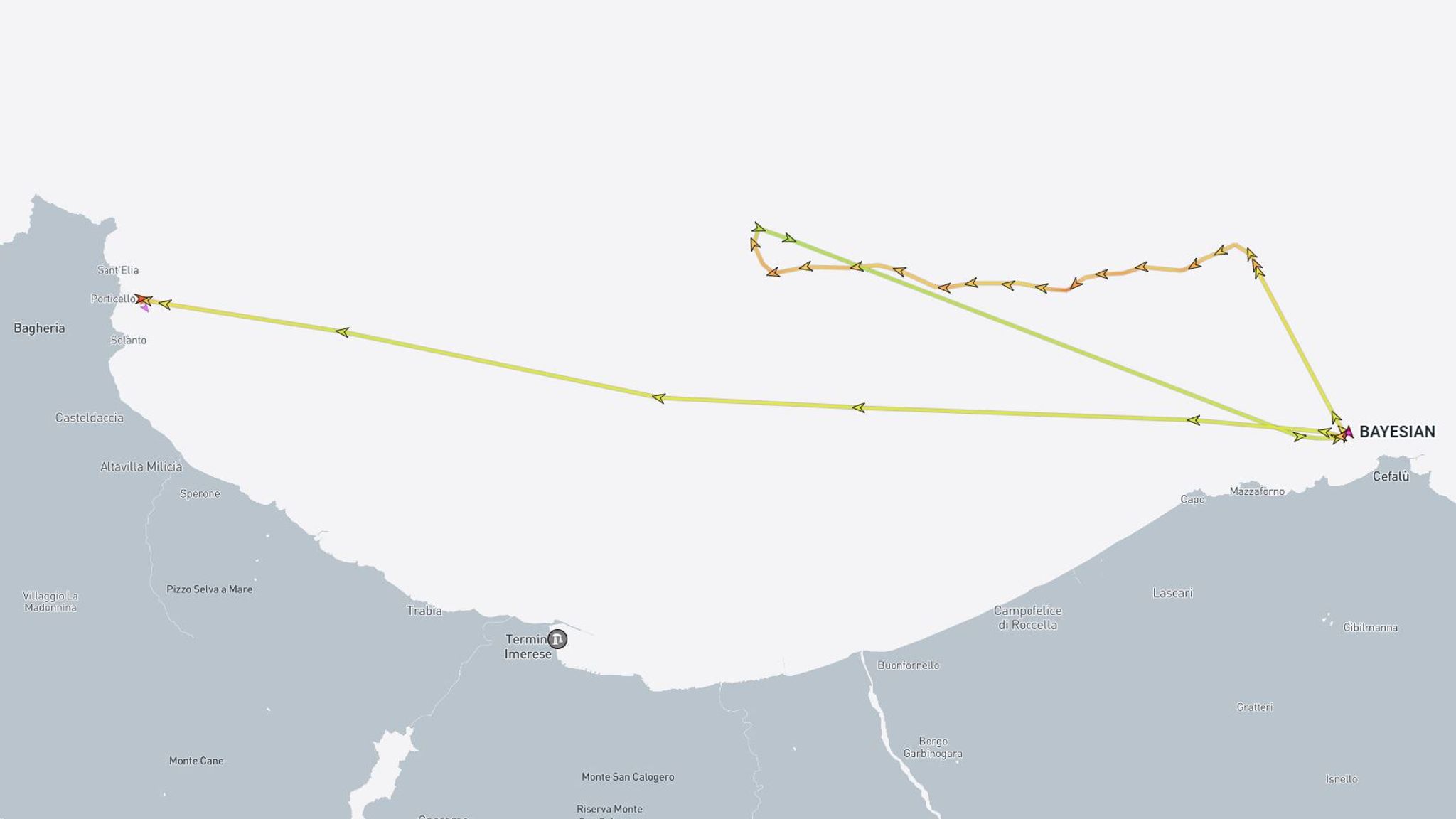

Tragedy At Sea Unraveling The Events Leading To The Loss Of The Bayesian Superyacht

May 17, 2025

Tragedy At Sea Unraveling The Events Leading To The Loss Of The Bayesian Superyacht

May 17, 2025 -

1 050 Price Hike At And T Highlights Broadcoms Impact On V Mware Costs

May 17, 2025

1 050 Price Hike At And T Highlights Broadcoms Impact On V Mware Costs

May 17, 2025

Latest Posts

-

Jackbit The Best Crypto Casino For 2025

May 17, 2025

Jackbit The Best Crypto Casino For 2025

May 17, 2025 -

Exclusive Bonuses Discover The Best Crypto Casinos For 2025 And Easy Withdrawals

May 17, 2025

Exclusive Bonuses Discover The Best Crypto Casinos For 2025 And Easy Withdrawals

May 17, 2025 -

Best Bitcoin Casinos 2025 Find The Top Crypto Casinos With Fast Payouts

May 17, 2025

Best Bitcoin Casinos 2025 Find The Top Crypto Casinos With Fast Payouts

May 17, 2025 -

Top Online Bitcoin Casinos 2025 Easy Withdrawals And Exclusive Bonus Offers

May 17, 2025

Top Online Bitcoin Casinos 2025 Easy Withdrawals And Exclusive Bonus Offers

May 17, 2025 -

Best Bitcoin Casino For Instant Withdrawals Jack Bit

May 17, 2025

Best Bitcoin Casino For Instant Withdrawals Jack Bit

May 17, 2025