The Changing Landscape Of College Funding: A Survey Of Parental Attitudes And Loan Usage

Table of Contents

Parental Attitudes Towards College Funding

The traditional model of parental funding for college is undergoing a significant transformation. The rising cost of college tuition is forcing families to reassess their strategies and expectations.

The Decreasing Reliance on Parental Savings

The dream of easily funding a child's college education through parental savings is becoming increasingly elusive. Many parents find the escalating cost of college exceeding their savings capacity, even with diligent saving and investment strategies.

- Reduced parental contribution percentage: Surveys indicate a noticeable decrease in the percentage of college costs covered by parents.

- Increased pressure on students to secure scholarships and grants: Students are facing greater pressure to secure external funding to supplement parental contributions.

- Greater emphasis on part-time jobs during college: More students are working part-time jobs during their studies to help offset the cost of higher education.

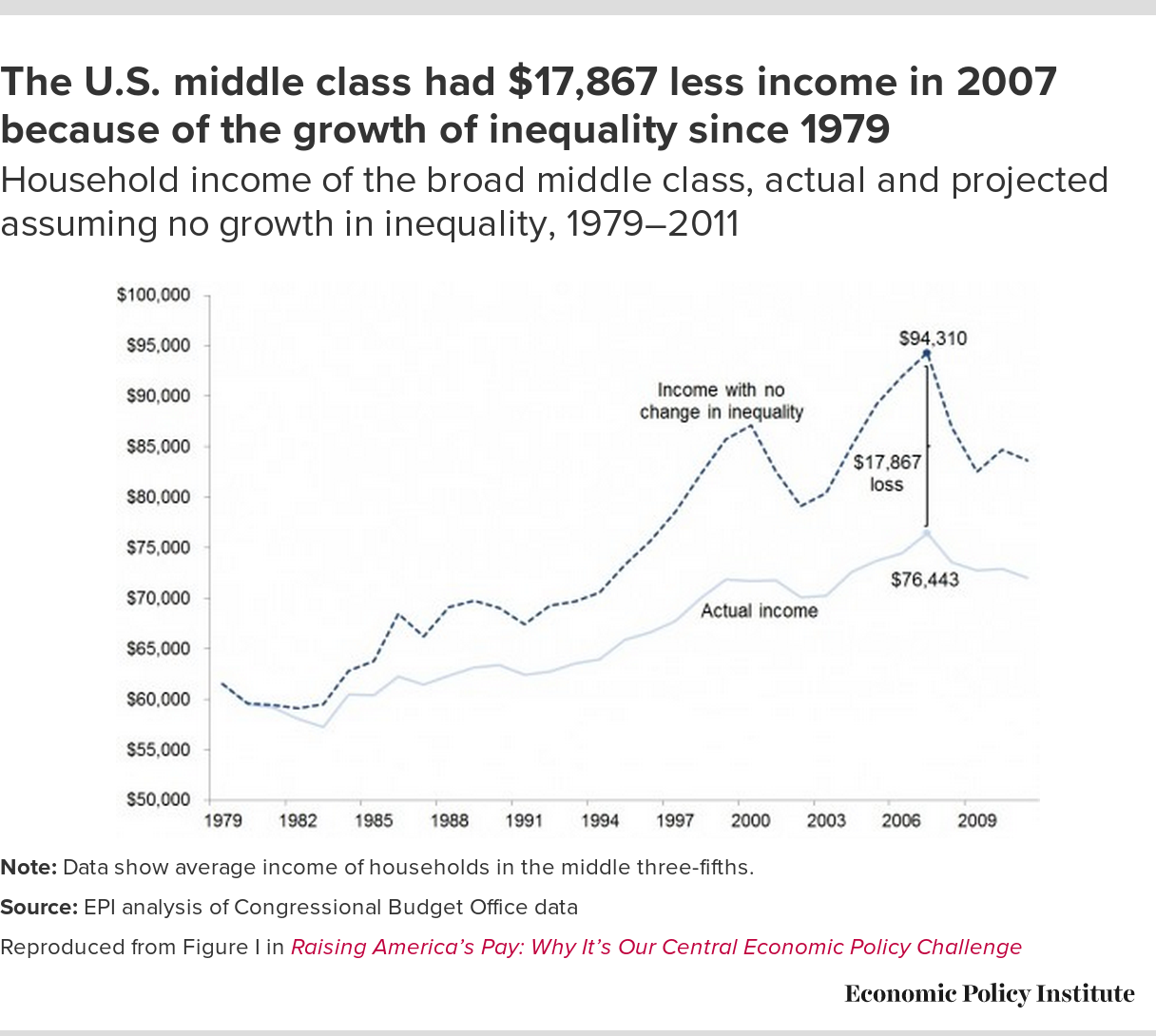

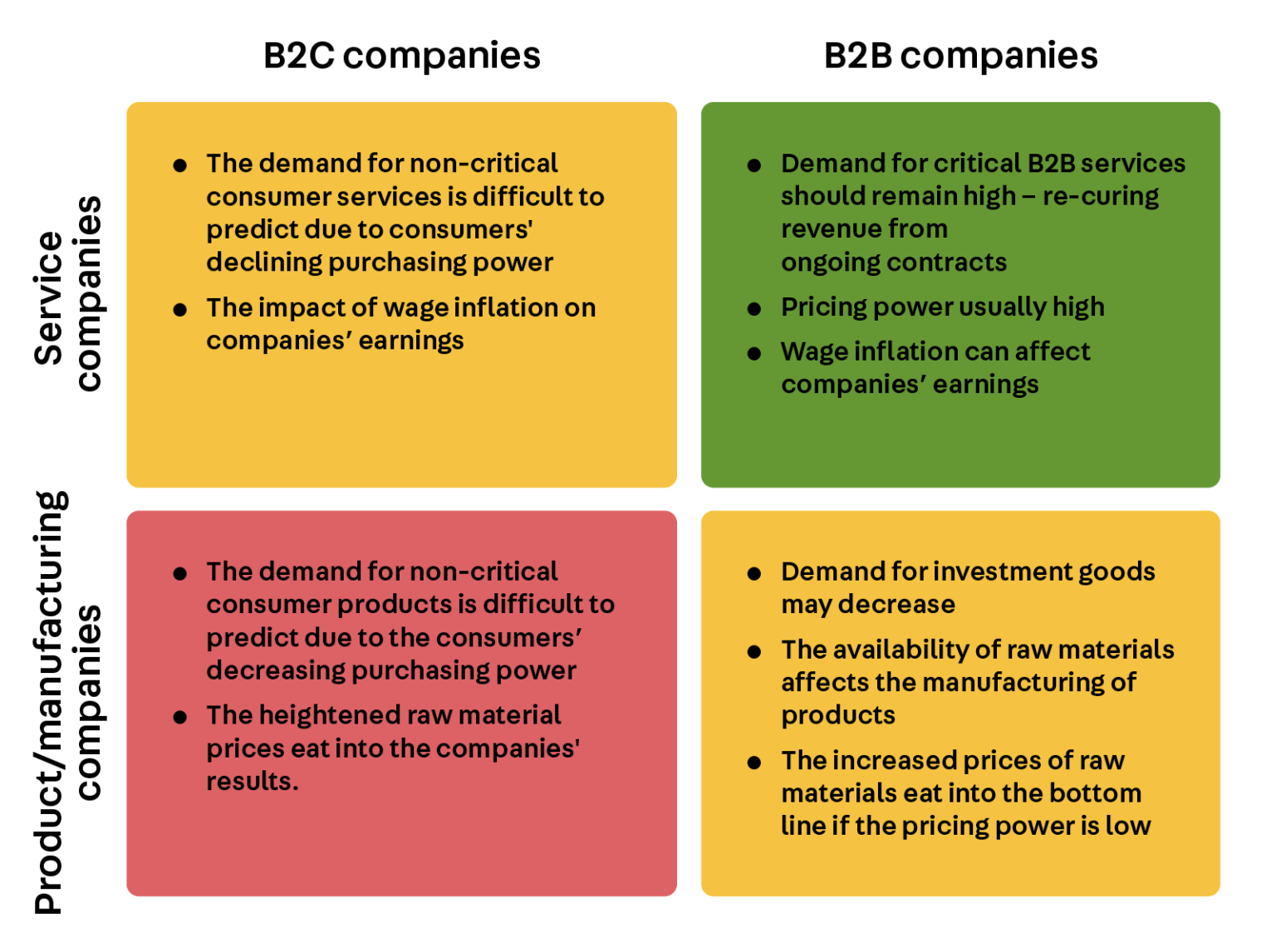

Economic downturns and persistent inflation significantly impact college savings plans. The unpredictability of the economy makes long-term financial planning for college even more challenging. Furthermore, a shift in parental expectations is occurring, with some parents expecting a greater contribution from their children towards their education expenses.

Exploring Alternative Funding Sources

With parental savings often falling short, families are actively seeking alternative funding sources.

- Growth in 529 plan usage: 529 plans, tax-advantaged college savings plans, are experiencing a surge in popularity as families seek ways to maximize their savings.

- Effectiveness of various scholarship search strategies: The importance of proactive scholarship searching cannot be overstated. Many scholarships go unclaimed, so dedicated effort in this area can significantly reduce the financial burden.

- Advantages and disadvantages of crowdfunding for college: Crowdfunding platforms provide a novel approach, but success varies and careful consideration is needed.

The Growing Reliance on Student Loans

The gap between the rising cost of college and available funding sources is increasingly being filled by student loans.

The Increase in Student Loan Debt

The statistics paint a stark picture: student loan debt is soaring. This trend has profound implications for post-graduate life, delaying major life milestones for many young adults.

- Average student loan debt per borrower: The average amount of student loan debt per borrower continues to climb, impacting financial stability for years to come.

- Impact of student loan debt on homeownership and family formation: High student loan debt often delays major life decisions such as buying a home and starting a family.

- Risks associated with private student loans: Private student loans, while sometimes necessary, can come with higher interest rates and less flexible repayment options than federal loans.

Strategies for Managing Student Loan Debt

Effective management of student loan debt requires careful planning and proactive strategies.

- Importance of creating a realistic budget: Students and families need to create a realistic budget to manage loan payments alongside living expenses.

- Comparison of different student loan repayment plans: Understanding the different repayment plans available (e.g., standard, extended, income-driven) is critical for long-term financial health.

- Benefits and drawbacks of loan refinancing: Loan refinancing can potentially lower monthly payments, but it's crucial to weigh the pros and cons carefully before making a decision.

The Future of College Funding

Predicting the future of college funding requires considering several interconnected factors.

Predicting Future Trends

The trajectory of higher education costs, coupled with evolving government policies and technological advancements, will significantly shape the college funding landscape in the coming years.

- Potential changes in federal financial aid programs: Changes in government policies regarding financial aid could profoundly impact the accessibility of higher education.

- Impact of online learning on college costs: The rise of online learning may offer potential cost savings, but its long-term impact on the overall cost structure is still unfolding.

- Predictions for the future of college savings plans: The future may see more innovative college savings vehicles and increased emphasis on financial literacy programs.

Advice for Families Planning for College

Proactive planning and financial literacy are paramount for families navigating the complex world of college funding.

- Importance of starting college savings early: Starting early, even with small contributions, can make a significant difference in the long run.

- Strategies for maximizing financial aid eligibility: Understanding the criteria for financial aid eligibility and actively pursuing available aid is crucial.

- Importance of open communication between families and students about college costs: Open communication and realistic expectations are essential for managing the financial aspects of higher education.

Conclusion

The changing landscape of college funding presents significant challenges for families, requiring careful planning and a comprehensive understanding of available resources. Understanding parental attitudes, the increasing reliance on student loans, and emerging trends in college savings is crucial for navigating this complex financial journey. By proactively exploring diverse funding options, developing a robust savings strategy, and utilizing available resources effectively, families can better prepare for the significant financial commitment of higher education. Begin planning for your child's college education today and take control of your future by researching effective strategies for college funding.

Featured Posts

-

Easing College Costs Survey Highlights Shifting Parental Attitudes And Loan Dependence

May 17, 2025

Easing College Costs Survey Highlights Shifting Parental Attitudes And Loan Dependence

May 17, 2025 -

Gwendoline Christie From Game Of Thrones To Severances Complex Challenges

May 17, 2025

Gwendoline Christie From Game Of Thrones To Severances Complex Challenges

May 17, 2025 -

Budget Friendly Buys Quality Products Without The Premium Price

May 17, 2025

Budget Friendly Buys Quality Products Without The Premium Price

May 17, 2025 -

Grocery Inflation And Wage Stagnation Rep Crocketts Critique Of Trumps Presidency

May 17, 2025

Grocery Inflation And Wage Stagnation Rep Crocketts Critique Of Trumps Presidency

May 17, 2025 -

New York Knicks How To Handle The Landry Shamet Question

May 17, 2025

New York Knicks How To Handle The Landry Shamet Question

May 17, 2025

Latest Posts

-

Uber Stock A Recession Resistant Investment Expert Analysis

May 17, 2025

Uber Stock A Recession Resistant Investment Expert Analysis

May 17, 2025 -

Is Uber Recession Proof Analyzing The Stocks Resilience

May 17, 2025

Is Uber Recession Proof Analyzing The Stocks Resilience

May 17, 2025 -

Uber Stock And Recession Why Analysts Remain Bullish

May 17, 2025

Uber Stock And Recession Why Analysts Remain Bullish

May 17, 2025 -

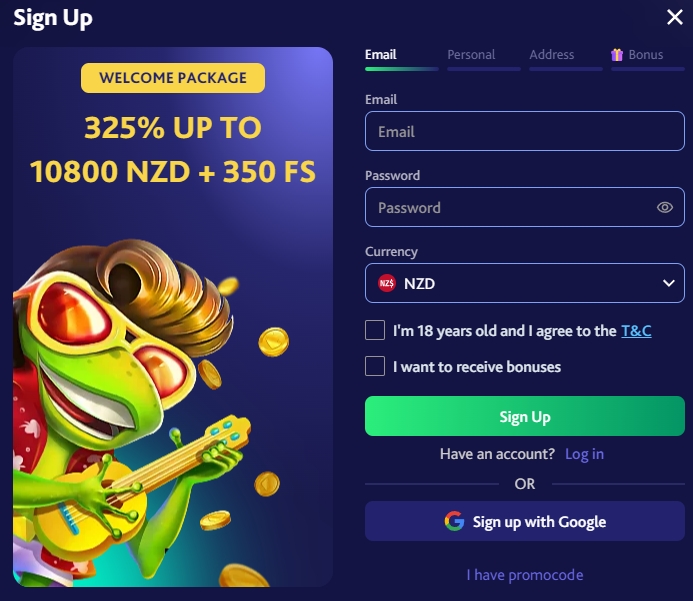

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025 -

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025